Opening: The pitch that sounds like stability Imagine this: you come across a site called SwissWealthM.com. The branding leans on Swiss associations—clean design, words like “private wealth,” “institutional-grade,” and images of glass-fronted offices. The copy promises professional account managers, access to exclusive strategies, and streamlined tools to grow capital. For many people, that combination equals […]

Ask2Bid.com presents the polished look of a modern trading or investment service, but several structural and behavioural indicators commonly associated with high-risk or deceptive platforms are present. The site’s lack of transparent ownership, missing verifiable regulatory details, aggressive marketing signals, and typical deposit/withdrawal asymmetries together form a pattern that should make cautious investors pause. Opening […]

First Impressions: A Glossy Front BestExpertOnline.com markets itself as a sleek, modern investment platform promising easy access to forex, crypto, and other global markets. The website design is polished, its messaging is sharp, and the promises are bold. New investors are tempted with the idea of starting small and growing quickly, while more seasoned traders […]

Introduction: The Promise of Expertise InvestGurus.pro presents itself as a trusted space where investors can rely on professional insight and market wisdom. The very name “Invest Gurus” is meant to inspire confidence, suggesting that the platform is guided by industry veterans who can steer users toward financial growth. On the surface, this image is compelling. […]

Introduction — A Promising Encounter Turns Sour Picture this: As a savvy investor, you’re browsing broker-rankings. You come across Valiant Markets — polished web design, professional language, lots of encouragement to “get started”, “unlock VIP features”, and “trade globally.” Seeing the promise of trading forex, commodities, and crypto under one roof, you decide to give […]

A Cautionary Story to Begin Imagine this: An eager investor stumbles across a platform that looks sleek, modern, and bursting with opportunity. GMZGlobal.com promises fast-track access to global markets, cutting-edge trading tools, and generous returns that sound almost too good to be true. At first glance, the website feels convincing. The language is polished, the […]

MapleQuantum.ca displays multiple structural and operational features commonly seen in high-risk or deceptive online investment platforms. The combination of opaque ownership, bold performance promises without verifiable proof, aggressive onboarding/upsell behavior reported for similar operations, and recurring reports of withdrawal friction creates a risk profile that investors should treat as very high. Below is a thorough, […]

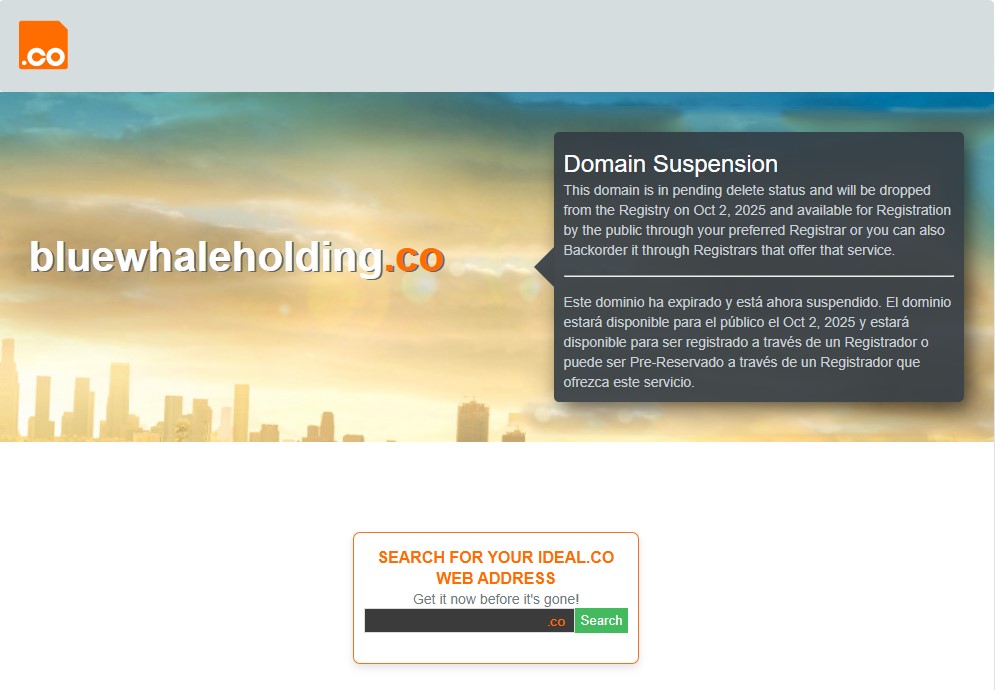

BlueWhaleHolding.co shows many indicators typical of high-risk or deceptive online investment platforms: anonymous or privacy-protected ownership, recent domain registration, aggressive marketing/upsell behavior, promises of high returns with low risk, regulatory absence, and user complaints of withdrawal barriers. Together, these suggest a strong probability of serious risk for anyone depositing funds. 1) First impressions and marketing […]

A Story of Raises and Reversals Imagine Sarah, a teacher in her mid-30s, saving up to afford her daughter’s college tuition. One day she encounters EMC-Capitals.com through a social media post. The website promises “premium investment strategies,” account managers who walk you through every step, and “steady returns without stress.” She starts with a small […]

OmegaRox.com shows numerous red flags connected with unregulated or deceptive trading/investment platforms: promised high returns with low risk, opaque ownership and regulation, recurring user complaints about withdrawals, marketing pressure, and suspicious domain/technical details. Overall risk is substantial—approach with extreme caution. 1) First glance & promotional narrative OmegaRox.com positions itself as a modern, high-tech trading platform, […]