Cryptocurrency exchanges that emphasize regulation and regional licensing often benefit from borrowed credibility. Users assume that compliance equates to safety, transparency, and user-first controls. Bitso.com positions itself within this regulated trust zone, particularly across Latin American markets where traditional banking access is uneven and crypto adoption is accelerating. However, as explained in Jayen Consulting’s crypto-exchange […]

When “Digital” Replaces Definition Platforms branded around broad digital concepts often rely on conceptual appeal rather than functional specificity. Words like digital, next-gen, or innovative signal modernity but do not explain: What the platform actually delivers How users interact operationally Where responsibility begins and ends Azper.digital operates within this abstraction-first positioning. As outlined in Jayen […]

Platforms built around intrigue, secrecy, or unexplained themes rely less on utility and more on psychological engagement loops. Curiosity is not neutral—it lowers skepticism and accelerates interaction. UFObject.com operates within this curiosity-first framework, where: Ambiguity replaces clarity Narrative precedes verification Exploration is encouraged before understanding As outlined in Jayen Consulting’s digital manipulation research, mystery-driven platforms […]

Banks with long operational histories often enjoy inherited trust. Customers tend to assume that longevity equates to modern safeguards, seamless digital systems, and robust consumer protections. JNBank.com occupies this trust position as an established banking brand operating within a modern online environment. However, as outlined in Jayen Consulting’s digital banking transition research, legacy institutions frequently […]

Payment infrastructure platforms occupy a unique position in the financial ecosystem. They rarely face consumers directly, yet they sit between merchants, banks, networks, and end users, quietly controlling authorization, settlement, data flow, and access continuity. Nayax.com operates in this infrastructure layer—particularly within unattended retail, vending, kiosks, and embedded payment environments. As documented in Jayen Consulting’s […]

Mortgage platforms associated with well-known homebuilders benefit from borrowed credibility. The connection to a recognizable construction brand often leads borrowers to assume: Favorable terms Streamlined approvals Institutional safeguards PulteMortgage.com operates within this brand-adjacent credibility space. However, as emphasized in Jayen Consulting’s mortgage process risk research, brand affiliation does not change the fundamental reality of mortgage […]

Platforms that lean heavily on luxury language—words like opulent, elite, exclusive, or private—are not merely describing aesthetics. They are activating status-based trust bias, a psychological shortcut that encourages users to equate presentation with protection. OpulentScope.com operates squarely within this persuasion zone. As detailed in Jayen Consulting’s perception-engineering research, luxury branding in financial platforms often functions […]

“Trust” Is a Claim, Not a Structure Platforms that incorporate trust, equity, or fiduciary language into their branding immediately trigger higher expectations. These terms are not neutral marketing labels—they imply duty of care, legal responsibility, and prioritization of client interests. Trusteequity.com positions itself within this expectation-heavy zone. However, trust-based language does not automatically translate into […]

Digital payment platforms often market themselves as neutral facilitators—pipes through which money simply flows. In practice, they are high-authority financial control systems that determine when, how, and if funds move. VenoSwift.com positions itself within the fast-payment and fintech processing space, implying speed, convenience, and global usability. Yet history shows that most payment-related user harm does […]

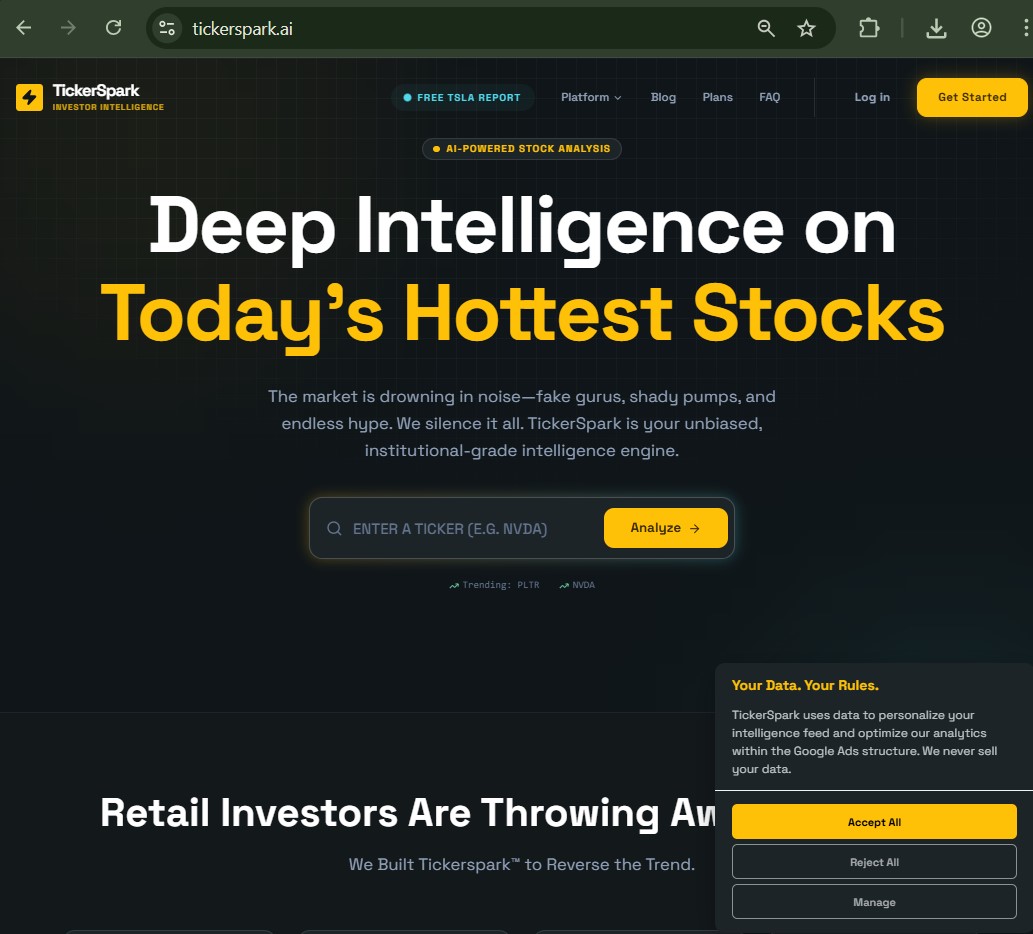

Artificial intelligence has become one of the most powerful trust shortcuts in modern finance. Platforms that incorporate “AI,” “machine learning,” or “algorithmic intelligence” into their branding often inherit an aura of precision, objectivity, and technical superiority. TickerSpark.ai operates squarely within this psychological space. By positioning itself as an AI-powered trading or signal platform, it implicitly […]