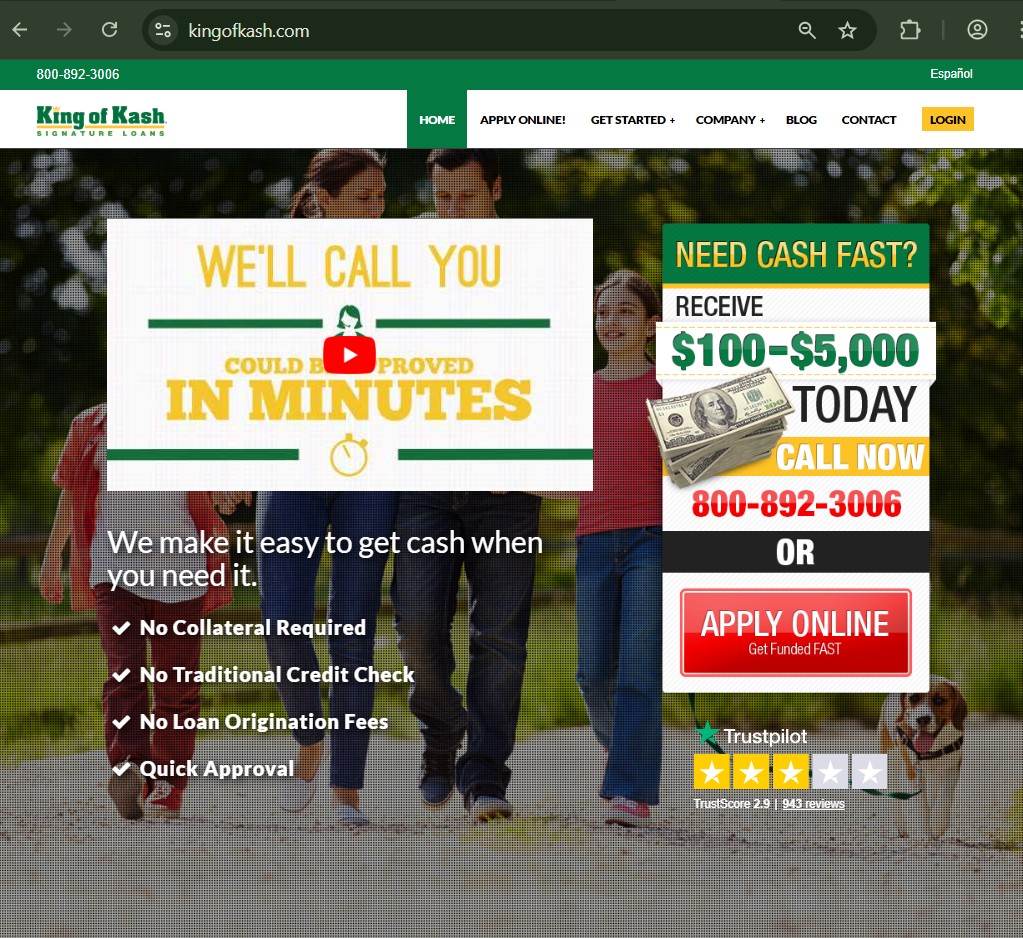

The short-term lending industry draws in those facing urgent financial needs with promises of quick cash and minimal hurdles. kingofkash.com positions itself as a Missouri-based provider of personal installment loans, signature loans, and lines of credit, emphasizing no credit checks, fast approvals, and flexible repayments. Yet, through a consumer protection and high-cost debt cycle lens, […]

Online investment platforms continue to attract users with promises of passive income through crypto, AI-driven trading, or collective funding. nollaxy.com markets itself as an innovative ecosystem blending artificial intelligence, professional traders, blockchain technology, and crowdfunding for crypto assets, often touting daily yields around 1–3% and a native NOXY token. Yet a structural breakdown through the […]

AmeriHome.com presents itself as a well-established mortgage lender with institutional credibility, large-scale operations, and a footprint that inspires confidence among borrowers and industry professionals alike. For many consumers, the AmeriHome name signals legitimacy, regulatory compliance, and operational maturity. However, history has repeatedly shown that brand recognition does not equal consumer safety—especially in industries where complexity, […]

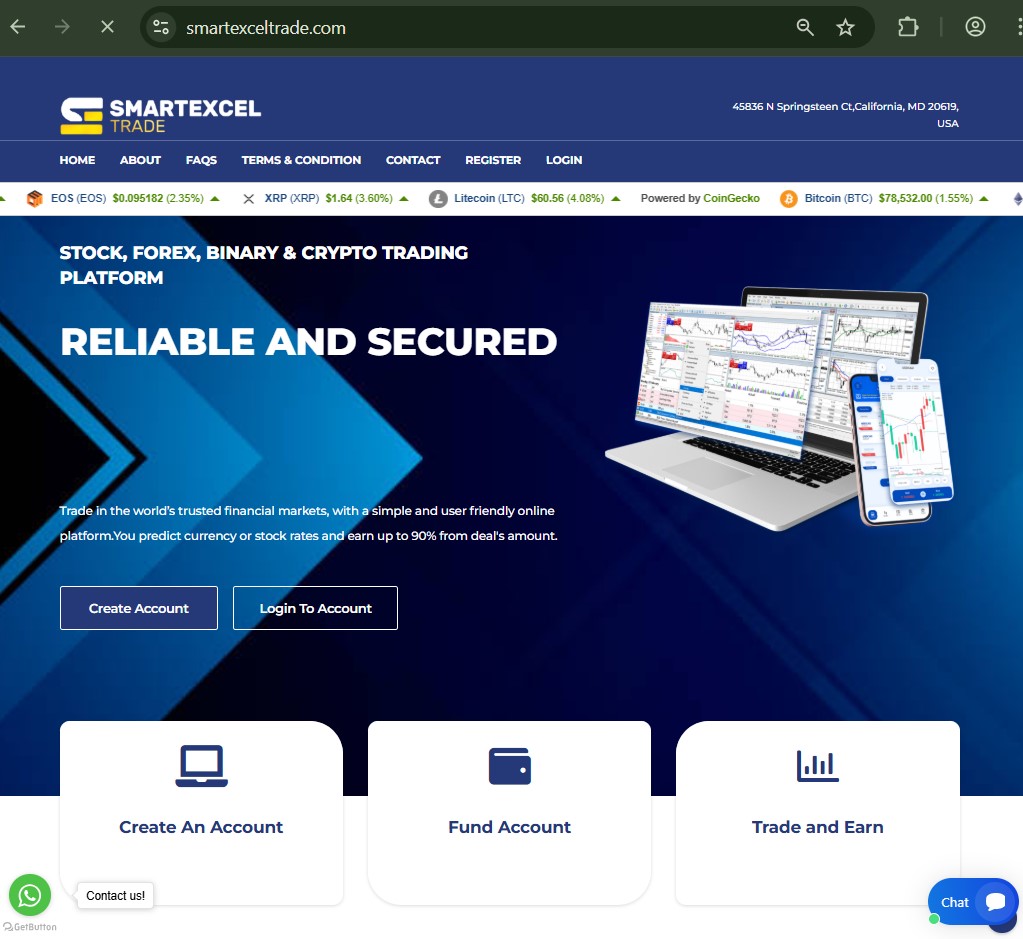

Smartexceltrade.com‘s interface features prominent banners highlighting “up to 1:500 leverage” and “zero commissions on standard accounts,” subtly pushing users toward larger positions. This nudging exploits cognitive biases like overconfidence, where novice traders on smartexceltrade.com underestimate market volatility and amplify exposure. Account types—ranging from Mini to Premium—progressively offer higher leverage and bonuses, incentivizing deposits that align […]

Daily Returns That Defy Economic Fundamentals fundfinance.biz promotes eye-catching daily income rates, with figures up to 5.11% cited in related discussions and similar platforms. These projections position fundfinance.biz as capable of delivering extraordinary compounding without corresponding market-risk disclosure or performance history. Such yields far outpace legitimate fixed-income, equity, or even high-risk venture returns, signaling reliance […]

Unrealistic Returns Engineered for Collapse At the core of richnetsfunds.com lies an investment plan structure that defies economic reality. Options range from a Bronze tier offering 10% over 45 days to an Exclusive plan delivering 100% in just 7 days. These advertised yields—far exceeding legitimate market returns—rely on constant new capital to fund earlier participants, […]

Offshore Foundations Undermining Safeguards Diamondfx.com bases its operations in Saint Vincent and the Grenadines, a location frequently selected for its light-touch approach to financial oversight. Entities incorporated here often operate without stringent requirements for capital adequacy, mandatory client asset separation, or routine independent examinations—standards routinely enforced by established regulators such as those in the UK, […]

Cryptocurrency exchanges that emphasize regulation and regional licensing often benefit from borrowed credibility. Users assume that compliance equates to safety, transparency, and user-first controls. Bitso.com positions itself within this regulated trust zone, particularly across Latin American markets where traditional banking access is uneven and crypto adoption is accelerating. However, as explained in Jayen Consulting’s crypto-exchange […]

When “Digital” Replaces Definition Platforms branded around broad digital concepts often rely on conceptual appeal rather than functional specificity. Words like digital, next-gen, or innovative signal modernity but do not explain: What the platform actually delivers How users interact operationally Where responsibility begins and ends Azper.digital operates within this abstraction-first positioning. As outlined in Jayen […]

Short-term consumer lending platforms thrive on immediacy. Approval speed, minimal documentation, and online onboarding are presented as solutions for urgent financial needs. CreditPrime.ro operates within this rapid-credit environment, targeting users who prioritize access over deliberation. As documented in Jayen Consulting’s consumer lending risk research, fast-credit systems shift the burden of understanding from institutions to borrowers—often […]