The copy-trading sector appeals to passive investors seeking to mirror expert strategies in crypto markets without constant monitoring. mercurytrade.io presents itself as a user-friendly tool for autocopying trades, connecting to exchanges via API, with features like real-time replication, customizable risk settings, and a marketplace of traders ranked by performance metrics. However, through the lens of […]

The Promise That Frames the Trap Hamilton.club presents itself with the polished restraint of exclusivity. The name alone evokes heritage, legacy, and elite access—an intentional semantic choice. This is not accidental branding; it is positioning. Platforms like Hamilton.club rarely sell a product outright. What they sell first is belonging, followed by the implication of privileged […]

The short-term lending industry draws in those facing urgent financial needs with promises of quick cash and minimal hurdles. kingofkash.com positions itself as a Missouri-based provider of personal installment loans, signature loans, and lines of credit, emphasizing no credit checks, fast approvals, and flexible repayments. Yet, through a consumer protection and high-cost debt cycle lens, […]

Online investment platforms continue to attract users with promises of passive income through crypto, AI-driven trading, or collective funding. nollaxy.com markets itself as an innovative ecosystem blending artificial intelligence, professional traders, blockchain technology, and crowdfunding for crypto assets, often touting daily yields around 1–3% and a native NOXY token. Yet a structural breakdown through the […]

AmeriHome.com presents itself as a well-established mortgage lender with institutional credibility, large-scale operations, and a footprint that inspires confidence among borrowers and industry professionals alike. For many consumers, the AmeriHome name signals legitimacy, regulatory compliance, and operational maturity. However, history has repeatedly shown that brand recognition does not equal consumer safety—especially in industries where complexity, […]

Smartexceltrade.com‘s interface features prominent banners highlighting “up to 1:500 leverage” and “zero commissions on standard accounts,” subtly pushing users toward larger positions. This nudging exploits cognitive biases like overconfidence, where novice traders on smartexceltrade.com underestimate market volatility and amplify exposure. Account types—ranging from Mini to Premium—progressively offer higher leverage and bonuses, incentivizing deposits that align […]

Core Tactics Fraudsters Rely On Scammers commonly fake messages that appear to come from lloyds.co.uk or Lloyds Bank, using urgent language about account issues, security checks, or unusual activity. These lloyds.co.uk-themed alerts push people to click links, share details, or contact fake numbers — taking advantage of the domain’s recognition in older bookmarks or search […]

cryptopremfx.com frequently references “licensed exchange” status and advanced protections, yet exhaustive checks against major regulatory databases—including CySEC, FCA, ASIC, CFTC/NFA, and others—yield zero evidence of authorization for cryptopremfx.com. No registration appears under cryptopremfx.com in official watchlists or licensed entity rosters from tier-one or even mid-tier supervisors. This complete regulatory void at cryptopremfx.com strips away mandatory […]

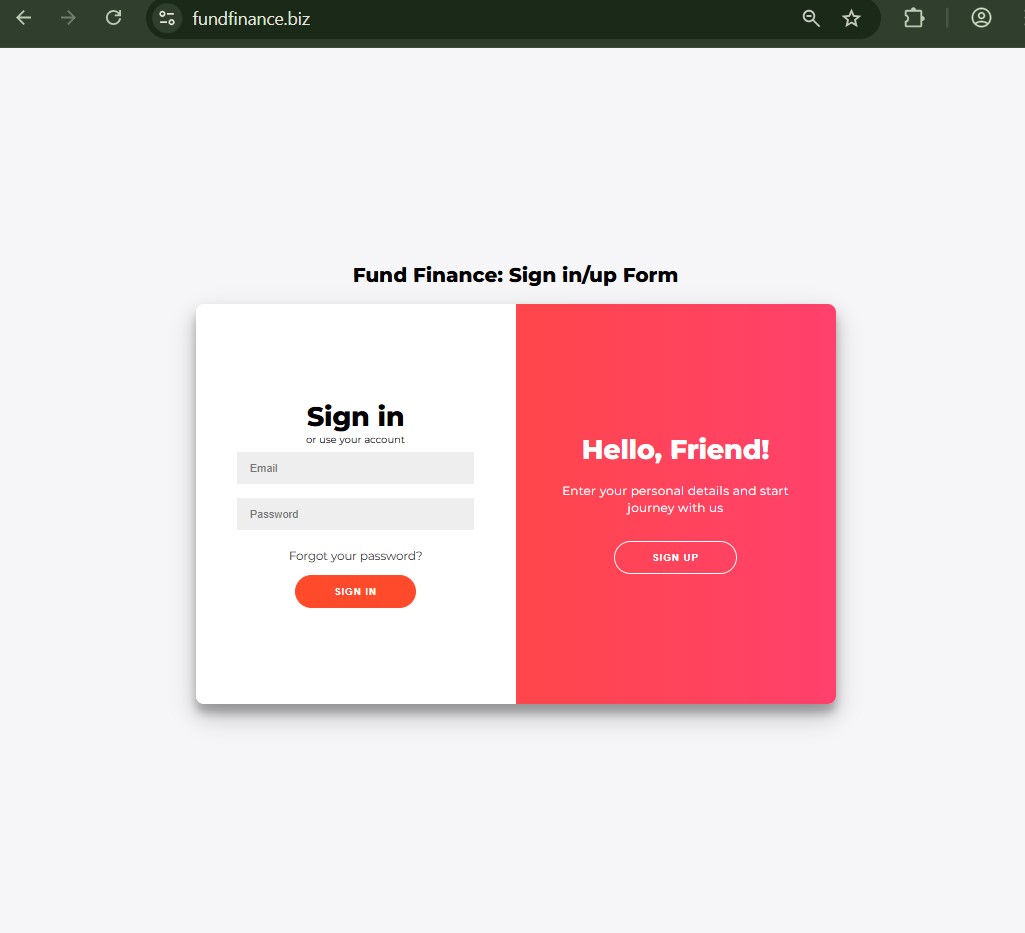

Daily Returns That Defy Economic Fundamentals fundfinance.biz promotes eye-catching daily income rates, with figures up to 5.11% cited in related discussions and similar platforms. These projections position fundfinance.biz as capable of delivering extraordinary compounding without corresponding market-risk disclosure or performance history. Such yields far outpace legitimate fixed-income, equity, or even high-risk venture returns, signaling reliance […]

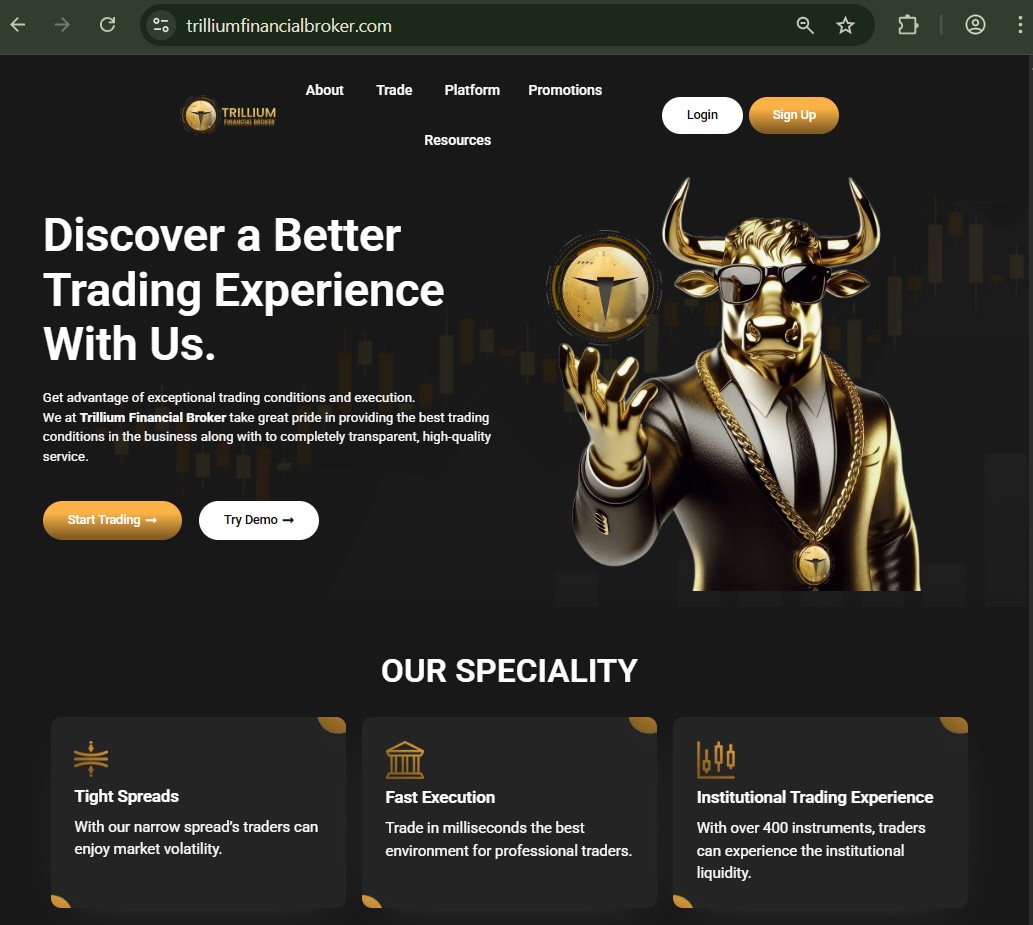

Offshore Claims Under Scrutiny trilliumfinancialbroker.com repeatedly asserts authorization by the Financial Services Commission (FSC) of Mauritius under license number GB23202539, with a registered address in Port Louis and additional incorporation in St. Vincent and the Grenadines. However, independent verifications frequently fail to confirm active, valid registration with the FSC Mauritius— a common red flag among […]