MenneMarkets.com Scam Review -The Broker Illusions

Introduction: When Trading Platforms Are Designed to Influence, Not Inform

Not all high‑risk trading platforms rely on technical deception alone. Many are engineered around behavioral manipulation, exploiting cognitive biases, emotional triggers, and decision fatigue to accelerate user commitment before critical questions are asked.

This review of MenneMarkets.com examines how the platform’s structure, language, and engagement flow may be designed to influence user behavior rather than support informed trading decisions. Instead of focusing on accusations, this analysis evaluates how trust is manufactured, how urgency is introduced, and how resistance is softened over time.

In financial environments, persuasion without transparency is not a feature. It is a warning signal.

First‑Contact Psychology: Simplicity as Disarmament

MenneMarkets.com presents an interface that appears deliberately simplified. Minimal friction, streamlined registration cues, and approachable language work together to reduce perceived complexity.

From a psychological standpoint, this design lowers cognitive defenses. When a platform feels easy, users are less likely to question what is missing. Simplicity becomes a disarming mechanism.

Legitimate brokers balance accessibility with detailed disclosures. Platforms that emphasize ease while postponing substance often rely on momentum rather than understanding.

Authority Without Credentials

Authority signaling is central to MenneMarkets.com’s positioning. Trading terminology, professional‑sounding platform descriptions, and implied market expertise create an impression of competence.

However, authority is suggested rather than proven. Verifiable credentials, regulatory identifiers, and named leadership are not clearly foregrounded. This creates a halo effect — users may assume legitimacy based on tone and presentation alone.

Psychologically, humans are predisposed to trust perceived experts, even when expertise is implied rather than demonstrated.

Urgency Engineering and Time Pressure

High‑risk platforms frequently introduce urgency early in the user journey. MenneMarkets.com exhibits elements consistent with this pattern: limited‑time framing, implied market windows, or encouragement to act before “conditions change.”

Urgency narrows attention. It shifts decision‑making from analytical to emotional processing. Under time pressure, users prioritize opportunity over verification.

In regulated environments, urgency is tempered by cooling‑off periods and suitability assessments. Their absence increases susceptibility to impulsive decisions.

The Gradual Escalation Model

Behavioral manipulation often unfolds in stages. Initial engagement is low‑risk and low‑commitment. As familiarity grows, commitment expectations increase.

MenneMarkets.com appears structured to follow this escalation model. Early interactions feel manageable, while deeper engagement introduces higher stakes, additional deposits, or expanded trading scope.

This mirrors classic commitment‑consistency bias: once users invest time or funds, they are psychologically inclined to continue rather than reassess.

Ambiguity as a Psychological Tool

Clear definitions create accountability. Ambiguity creates flexibility — for the platform.

Key aspects of MenneMarkets.com, including participant role, fund handling, and dispute resolution, are not emphasized with precision. Psychologically, ambiguity encourages users to fill gaps with optimistic assumptions.

When outcomes are positive, ambiguity feels harmless. When outcomes are negative, ambiguity becomes an obstacle to clarity and recourse.

Social Proof and Implied Popularity

Even subtle suggestions of widespread usage or success can influence perception. MenneMarkets.com leverages implied social validation through generalized claims rather than verifiable data.

Social proof reduces perceived risk by signaling that “others are doing this.” However, when proof is implied rather than documented, it functions as persuasion rather than evidence.

Loss Aversion and Retention Pressure

Once funds are introduced, loss aversion becomes a powerful lever. Users may feel compelled to continue engaging to avoid realizing a loss, even when confidence declines.

Platforms that do not clearly define exit mechanics amplify this effect. When withdrawal processes are unclear or delayed, users remain psychologically tethered to the platform.

This retention dynamic benefits the platform while increasing emotional strain on participants.

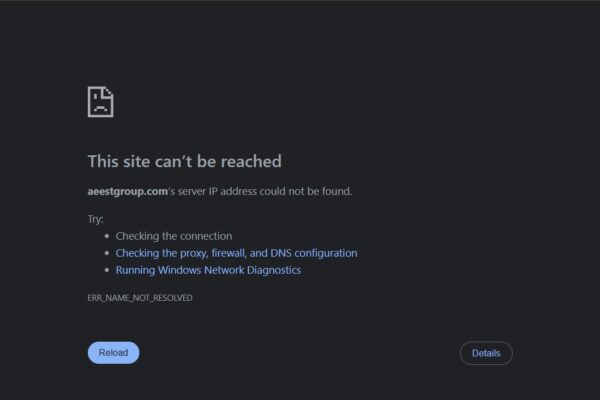

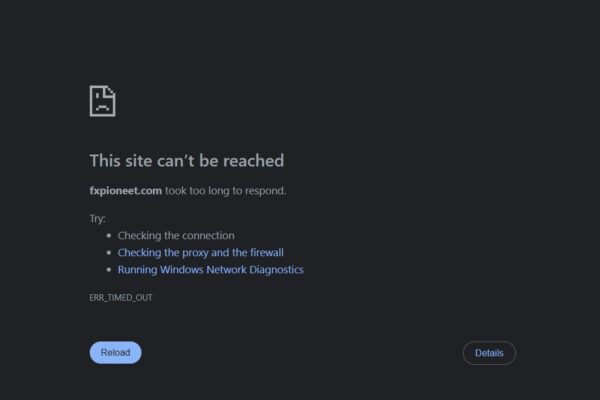

Pattern Recognition Across High‑Risk Brokers

When MenneMarkets.com is compared with other platforms later identified as problematic, recurring psychological patterns emerge:

- Trust built through tone rather than proof

- Urgency framing that limits reflection

- Incremental commitment escalation

- Ambiguity around rights and obligations

These patterns do not require overt fraud to cause harm. They are sufficient to create asymmetric power dynamics.

Psychological Risk Summary

From a behavioral perspective, MenneMarkets.com appears optimized to guide user decisions through influence rather than transparency. Such environments increase the likelihood of misaligned expectations and regret‑based decision‑making.

In finance, confidence should arise from clarity. When confidence is manufactured, risk increases.

Final Behavioral Assessment

Prospective users should approach MenneMarkets.com with caution. Before engaging, critical evaluation of regulatory status, fund custody, and exit conditions is essential.

A platform that prioritizes persuasion over disclosure places the psychological burden on the user — not the operator.

What Affected Users Can Do

If you have been affected by an online trading or investment scam, it is important to act promptly and carefully. Stop all communication with the suspected platform and gather all relevant evidence, including transaction records, emails, wallet addresses, and screenshots.

Victims who need guidance may consider consulting a recovery assistance service to better understand their options. Jayen-Consulting.com is one possible option that focuses on case assessment and realistic recovery guidance. Seeking professional advice can help you take informed next steps and reduce the risk of further losses.