QuantumTrading.io Review -Fake Claims and Investor Risk

In the rapidly evolving digital asset space, platforms promising easy crypto profits and giveaways proliferate frequently. QuantumTrading.io is one such platform that has garnered attention—not for legitimate service, but for its involvement in deceptive promotional tactics and high-risk operational behavior. This review examines the platform from an objective risk and exposure perspective, assessing how it presents itself, how it is promoted, and the structural issues that raise significant concerns for potential users.

1. Platform Positioning and Initial Claims

QuantumTrading.io markets itself as a cryptocurrency trading platform with enhanced earning opportunities. Its promotional content often touts high returns, deep market access, and the promise of free crypto credits or bonuses once users sign up or enter a promo code.

However, independent investigations and risk reports indicate that the platform does not function as a legitimate trading or crypto exchange. Instead, its design and marketing appear focused on luring users with unrealistic incentives and celebrity associations that are not verifiable. MalwareTips Forums

2. Celebrity Endorsements and Promotional Tactics

A primary promotional approach associated with QuantumTrading.io involves influencer-style or celebrity-related marketing. Videos circulated on social platforms have featured deepfake or manipulated representations of well-known public figures such as tech industry leaders and athletes apparently endorsing the platform or crypto giveaways.

The use of such manipulated content functions as a credibility shortcut, encouraging users to assume legitimacy based on perceived authority. This strategy is a known deceptive marketing technique: when a platform uses unauthorized celebrity images, voices, or endorsements, it attempts to leverage trust that is not actually earned.

Objectively, unauthorized or fabricated endorsements are not proof of platform legitimacy and are often used in fraudulent schemes to attract deposits. MalwareTips Forums

3. Website Structure and Corporate Disclosure

Legitimate crypto trading platforms typically disclose clear corporate identity, including:

-

A legally registered operating entity

-

Jurisdiction of incorporation

-

Physical business address

-

Compliance and regulatory disclosure

QuantumTrading.io provides minimal or vague corporate information. Details about ownership, entity registration, executive leadership, or physical contact information are either absent or inconsistent with standard financial disclosure expectations for regulated entities.

This lack of transparency means that users cannot verify the legal identity behind the platform or determine applicable legal or regulatory oversight. The absence of this basic information contributes to elevated structural risk.

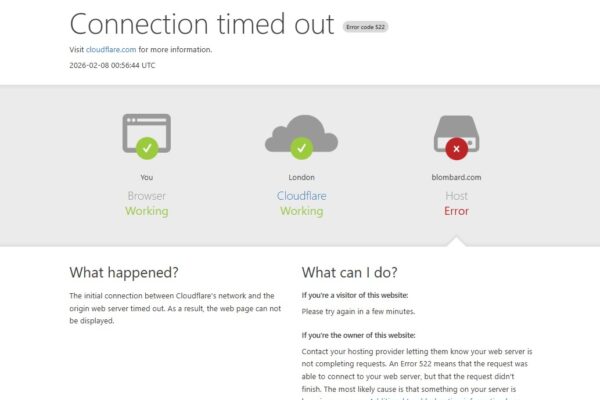

4. Registration and History of Domain Use

Analysis of the platform’s domain and background shows that such websites are often newly created, rapidly built, and lack a long operational history. Scam platforms typically register domains with short renewal periods and rotate them frequently as they are exposed, minimizing traceability and accountability.

In the case of QuantumTrading.io, multiple related scam sites have been identified, often with similar layouts and promotional mechanisms, suggesting that the platform is one of many iterations operated by the same underlying group of actors. MalwareTips Forums

5. Regulation and Licensing Claims

Cryptocurrency exchanges and crypto-trading services are subject to varying levels of regulatory requirements depending on jurisdiction. Regulated entities typically register with financial oversight bodies and publicly disclose their license information, including registration numbers and supervising authorities.

QuantumTrading.io does not provide verifiable regulatory licensing. There is no credible evidence demonstrating that the platform is registered with recognized financial regulators or operates under a licensed framework. The absence of regulation means that the platform is not subject to enforceable standards for fund custody, reporting, audit, or consumer protection, and users may have limited recourse in disputes.

6. Product and Trading Mechanics

Reliable trading platforms explain how trading works, including:

-

Which exchanges or markets trades are executed on

-

Whether internal prices match external market feeds

-

Custody of assets and wallet infrastructure

-

Margin, leverage, and associated risk disclosures

QuantumTrading.io’s public site does not provide transparent mechanics or verifiable trading infrastructure. Instead, it focuses on account creation and promotional incentives without detailing how trades are processed or settled. This ambiguity makes it unclear whether the platform interacts with real market liquidity or simply simulates account activity internally.

Without external verification of execution or custody, displayed balances and market prices cannot be independently confirmed, creating opacity in core financial operations.

7. Promotional “Free Bitcoin” and Bonus Mechanisms

One of the most prominent tactics attributed to QuantumTrading.io is the promise of free crypto credits or balances when users enter special promo codes after account creation. While these credited balances may appear in user dashboards, they do not represent real assets held on an exchange or custodial wallet.

Case reports indicate that such bonus balances are used as psychological incentives to encourage initial deposits. These artificially inflated numbers create the illusion of assets that can be converted to real funds, only for users to later encounter obstacles when attempting to withdraw or convert those funds.

In legitimate financial environments, bonuses and credits are clearly defined, governed by terms and conditions, and subject to verification. The use of promotional balances without external validation is a characteristic feature of fraudulent wallet systems.

8. Deposit Mechanics and Withdrawal Barriers

A central red flag associated with QuantumTrading.io’s operational pattern is the requirement that users make a cryptocurrency deposit—often Bitcoin—before withdrawals or “account activation” can proceed. In many reported cases, users with nominal bonus balances are instructed to deposit amounts ranging from fractions of a Bitcoin to larger sums before access to any funds is permitted.

After deposits are made:

-

Withdrawal requests are reportedly blocked or delayed

-

Additional “minimum deposit” conditions are introduced

-

Accounts become inaccessible or frozen

This tactic—requiring funds to be deposited before permitting access to credited balances—is inconsistent with legitimate platforms, which do not condition withdrawal access on additional payments. This structure aligns with known fraudulent deposit harvesting methods, where actual deposits are sent directly to the operators’ wallets without any exchange of value.

9. Lack of Customer Support Infrastructure

Reliable financial services provide multiple support channels with:

-

Verified business contact information

-

Telephone support

-

Regulatory complaint channels

-

Escalation procedures

QuantumTrading.io’s public presence is limited to a website with forms or generic contact prompts. There are no clearly published support numbers, office locations, or publicly accessible dispute resolution avenues. This absence of robust communication channels compounds user risk; when difficulties occur, users have no reliable means of engagement or issue resolution.

10. Pattern of Domain Rotation and Scam Networks

Platforms like QuantumTrading.io are often part of a larger pattern of scam networks that reuse templates, promotional narratives, and domain structures. These networks often:

-

Rebrand under slightly different names

-

Share identical layouts and backend code

-

Operate multiple sites in parallel

-

Replace domain names once one becomes exposed

The continuity of these fraudulent template sites suggests organized repetition rather than legitimate business evolution. The emergence of multiple similar sites further undermines confidence in permanence or reliability.

11. Independent Analysis and Reports

Independent threat analysts and security publications classify QuantumTrading.io as a fraudulent cryptocurrency trading platform that leverages deepfake endorsements and bogus promotional strategies to extract deposits from unsuspecting users. Such classifications are based on consistent patterns documented across multiple platforms with similar operational features.

These assessments typically highlight:

-

Use of fake promotional assets

-

Lack of authenticity in corporate claims

-

The absence of genuine trading infrastructure

-

Direct alignment with scams that vanish after collecting deposits MalwareTips Forums

12. Behavioral and Structural Risk Summary

When objectively evaluated, QuantumTrading.io exhibits a collection of structural and behavioral traits widely recognized in high-risk and fraudulent platforms:

| Risk Dimension | Observation |

|---|---|

| Corporate transparency | Absent |

| Regulatory licensing | Unverified / non-existent |

| Trading infrastructure | Undefined |

| Promotional claims | Based on fabricated endorsements |

| Deposit requirements | Conditional on accessing credited balances |

| Withdrawal governance | Opaque, often blocked |

| Customer support | Limited or absent |

| Network pattern | Shared with multiple scam domains |

This risk profile does not meet the operational standards expected from legitimate cryptocurrency exchanges or trading services.

Final Objective Verdict

Based on objective analysis of structural disclosures, promotional tactics, domain behavior, and absence of verifiable operational mechanics, QuantumTrading.io does not function as a legitimate crypto trading platform. Its design, marketing, and deposit-withdrawal pattern align with documented fraudulent schemes that leverage hype, misleading endorsements, and opaque financial mechanics to draw in deposits.

From a neutral risk standpoint, the platform should be regarded as high-risk and potentially fraudulent.

Conclusion

Investing or engaging with platforms that lack transparent infrastructure, verifiable regulatory standing, and clear operational mechanisms inherently carries elevated risk. QuantumTrading.io’s reliance on deceptive promotional tools, absence of foundational disclosures, and reported difficulties with fund access exemplify the structural deficiencies that can lead to severe investor harm.

In digital asset environments, rigorous verification and independent oversight are non-negotiable prerequisites for participation. QuantumTrading.io does not satisfy these prerequisites and therefore represents a material risk to potential users.

Report QuantumTrading.io Scam and Recover Your Funds

If you have lost money to an online investment or trading scam, it is important to act quickly. Stop all contact with the fraudulent platform and gather all relevant evidence, including transaction records, emails, wallet addresses, and screenshots.

Jayen-Consulting.com presents itself as a recovery assistance service that helps victims assess their cases and understand realistic recovery options. By offering structured case reviews and clear guidance rather than false promises, such a service can help victims take informed next steps and reduce the risk of being scammed again.

Stay smart. Stay safe.