AllPaySoft.io Expose -A Broker Below Industry Standards

AllPaySoft.io presents itself as a digital payment or financial processing platform, a category where trust, compliance, and operational transparency are not optional—they are baseline requirements. In payment services, users are not speculating on markets; they are entrusting platforms with direct control over money flows.

This review applies a comparative benchmark tone, evaluating AllPaySoft.io against what established, compliant payment processors and financial service providers are expected to deliver. Rather than focusing on allegations or user anecdotes, this approach measures the platform against industry norms, regulatory expectations, and operational best practices.

The benchmark question is simple:

Does AllPaySoft.io meet the minimum standards observed across legitimate payment and financial service platforms?

Industry Baseline: What Legitimate Payment Platforms Disclose

Before examining AllPaySoft.io specifically, it is important to establish the benchmark.

Well-established payment processors—regardless of size—consistently provide:

-

Clear legal entity disclosure

-

Jurisdiction and governing law

-

Regulatory or compliance status (even if limited)

-

Transparent fee structures

-

Defined custody and settlement processes

-

Explicit dispute and chargeback mechanisms

These are not premium features. They are minimum requirements for user protection and institutional trust.

Corporate Identity: Below Benchmark

AllPaySoft.io does not clearly or prominently disclose:

-

A verifiable registered company name

-

Corporate registration number

-

Public ownership or management

-

Identifiable executives or directors

Benchmark comparison:

Legitimate payment platforms identify the legal entity responsible for holding and moving funds. This allows users, partners, and regulators to verify corporate existence and accountability.

Assessment:

AllPaySoft.io falls below baseline standards. Without a disclosed legal entity, users cannot independently confirm who controls their funds.

Jurisdiction and Governing Law: Missing Core Information

AllPaySoft.io does not clearly state:

-

Country of incorporation

-

Primary operating jurisdiction

-

Governing law for user agreements

-

Legal venue for dispute resolution

Benchmark comparison:

Payment processors are jurisdiction-sensitive by necessity. Compliance obligations, consumer protections, and enforcement mechanisms depend entirely on jurisdictional clarity.

Assessment:

The platform does not meet industry expectations. Jurisdictional ambiguity significantly weakens user rights and enforceability.

Regulatory and Compliance Position: Non-Competitive

Payment services typically operate under:

-

Financial services regulations

-

Money services business (MSB) frameworks

-

AML and KYC compliance regimes

-

Licensing or registration requirements

AllPaySoft.io does not clearly disclose:

-

Regulatory registration

-

Licensing status

-

Supervisory authority

-

Compliance certifications

Benchmark comparison:

Even small or niche payment providers clearly state their compliance posture, because partners and users require it.

Assessment:

AllPaySoft.io does not meet compliance disclosure norms. This places it outside the competitive field of legitimate processors.

Business Model Transparency: Vague by Comparison

AllPaySoft.io does not clearly define:

-

Whether it acts as a processor, intermediary, or custodian

-

How transactions are settled

-

Whether funds are pooled or segregated

-

How long funds are held before release

Benchmark comparison:

Industry-standard platforms explain money flow clearly—who receives funds, when, and under what conditions.

Assessment:

The platform’s operational model is insufficiently described, making it impossible to benchmark risk accurately.

Custody and Fund Control: Elevated Counterparty Risk

AllPaySoft.io does not clearly disclose:

-

Where client funds are held

-

Whether funds are segregated from operational capital

-

Which financial institutions, if any, are involved

-

What protections apply in insolvency scenarios

Benchmark comparison:

Legitimate payment processors emphasize custody arrangements because custody defines user safety.

Assessment:

Custody opacity places AllPaySoft.io below acceptable risk thresholds for payment services.

Transaction Integrity and Verification

AllPaySoft.io does not clearly explain:

-

How transactions are validated

-

Whether settlements are reversible

-

What audit mechanisms exist

-

Whether transaction logs are independently verifiable

Benchmark comparison:

Trusted payment platforms provide:

-

Transaction records

-

Reconciliation processes

-

Clear settlement timelines

Assessment:

AllPaySoft.io does not meet transaction transparency benchmarks.

Fees and Charges: Insufficient Disclosure

Payment platforms are expected to disclose:

-

Processing fees

-

Withdrawal or settlement charges

-

Conversion costs

-

Penalties or exceptional fees

AllPaySoft.io does not provide:

-

A clearly structured fee schedule

-

Transparent cost explanations

-

Predictable pricing terms

Benchmark comparison:

Fee clarity is a non-negotiable standard in financial services.

Assessment:

The platform does not meet pricing transparency expectations.

Dispute Resolution and User Protections

AllPaySoft.io does not clearly outline:

-

Dispute resolution processes

-

Chargeback mechanisms

-

User complaint escalation paths

-

Timeframes for issue handling

Benchmark comparison:

Legitimate processors define dispute handling because payment conflicts are inevitable.

Assessment:

AllPaySoft.io offers insufficient consumer protection mechanisms compared to industry peers.

Governance and Accountability: Non-Standard

AllPaySoft.io does not clearly identify:

-

Management or leadership

-

Governance structure

-

Compliance officers or oversight roles

Benchmark comparison:

Financial platforms routinely disclose leadership to establish credibility and accountability.

Assessment:

Anonymous or opaque governance places the platform well below industry norms.

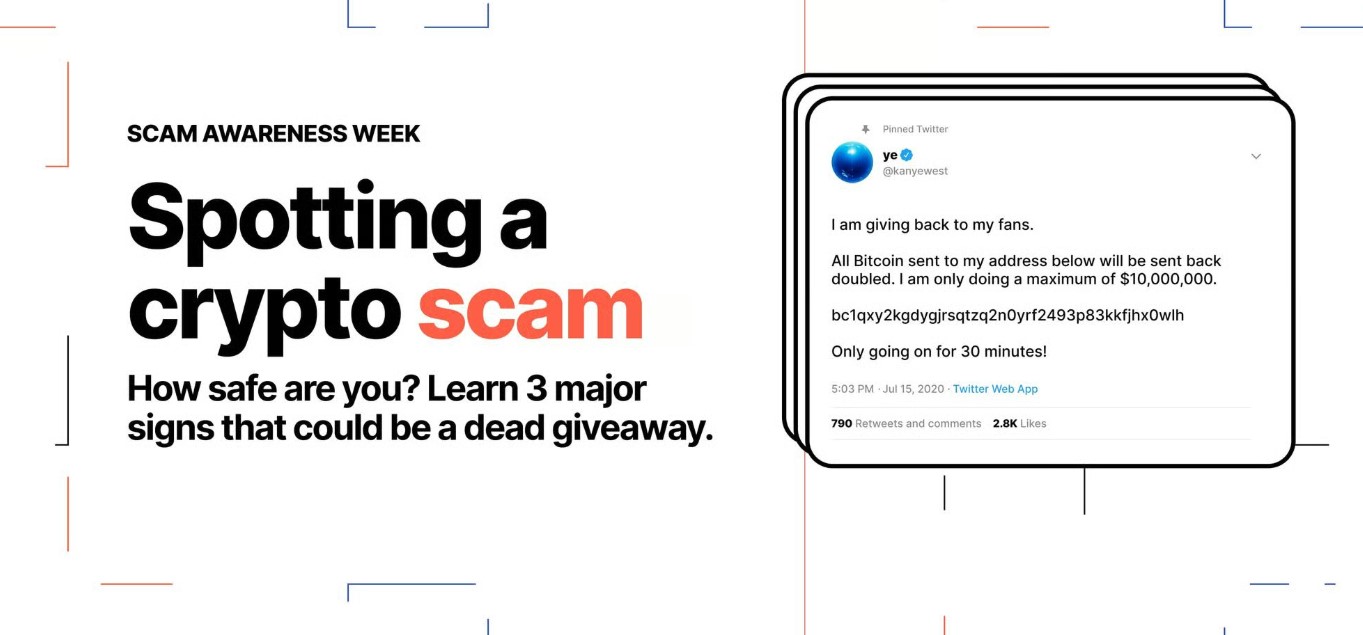

Comparative Pattern Recognition

When benchmarked against failed or problematic payment platforms, AllPaySoft.io shares recurring deficiencies:

-

Weak legal disclosure

-

No regulatory clarity

-

Centralized fund control

-

Limited user protections

-

Undefined dispute mechanisms

These patterns consistently correlate with elevated user risk.

Who Is Most Exposed

Based on comparative analysis, AllPaySoft.io poses the highest risk to:

-

Small businesses relying on cash flow stability

-

Freelancers and online merchants

-

Users unfamiliar with payment compliance standards

-

Individuals assuming all processors operate under similar rules

In payment services, misunderstanding platform obligations often leads to irreversible losses.

Comparative Risk Summary

Measured against established industry benchmarks, AllPaySoft.io demonstrates significant deficiencies in:

-

Legal transparency

-

Jurisdictional clarity

-

Regulatory compliance disclosure

-

Custody safeguards

-

Transaction verification

-

Fee transparency

-

Dispute resolution

-

Governance accountability

Each deficiency independently weakens trust. Collectively, they disqualify the platform from being considered competitive with legitimate payment processors.

Final Benchmark Conclusion: Below Standard, Above Risk

AllPaySoft.io does not merely underperform against best practices—it fails to meet baseline standards expected of platforms handling user funds.

Payment services are not experimental products. They are infrastructure. Users depend on them for liquidity, continuity, and trust. Platforms that cannot clearly explain who they are, where they operate, how funds are protected, and how disputes are resolved introduce unacceptable levels of risk.

This review does not speculate about intent. It evaluates structure against standards.

Until AllPaySoft.io provides verifiable legal identity, jurisdictional grounding, regulatory compliance disclosure, transparent custody arrangements, and enforceable user protections, it should be regarded as high-risk and structurally unfit for serious financial use.

In payment systems, reliability is not claimed—it is demonstrated through compliance, clarity, and accountability. AllPaySoft.io currently demonstrates none of these at industry-acceptable levels.

Report AllPaySoft.io Scam and Recover Your Funds

If you have lost money to AllPaySoft.io, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like AllPaySoft.io, continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe