GrandCapitalCG.com Scam Review -A Dubious Platform

Every scam review tells a story, but some stories are so emblematic—so eerily familiar—that they become a case study of how online investment fraud unfolds in real time. GrandCapitalCG.com is one of those platforms. Behind its glossy front end, manufactured professionalism, and promises of high-yield trading opportunities lies a blueprint of deception that many investors don’t recognize until it’s too late.

This review follows a realistic investor named Daniel, whose experience encapsulates what countless individuals encounter with platforms like GrandCapitalCG.com. While the details of Daniel’s journey are dramatized, the red flags, behaviors, and manipulative strategies are consistent with the patterns these platforms exhibit.

Let’s step into Daniel’s shoes and walk through the trap—one moment at a time.

Part I — The Discovery: “This Might Finally Be It”

Daniel had been working overtime for months, juggling bills, saving to support his family, and searching for ways to improve his financial situation. Social media ads became a familiar part of his daily scrolling, but something about GrandCapitalCG.com caught his attention.

Their pitch felt different:

-

Professional branding

-

Confident language

-

A promise of “globally recognized trading opportunities”

-

Supposedly expert-led portfolio management

-

Easy onboarding

-

And most importantly… believable returns

He wasn’t looking for miracles—just stability, maybe a chance to grow $300 into something meaningful.

He clicked.

The website loaded with slick animations, clean dashboards, and a sense of legitimacy polished enough to lower his guard. “Registered company,” it claimed. “Professional brokers,” it added. “Guaranteed access to global markets.”

Everything seemed structured, serious, and modern.

He didn’t know then that this was Step One of the scam blueprint:

Create an environment that looks real long enough for the victim to start trusting it.

Part II — The Initial Contact: The Friendly Guide Appears

Within minutes of signing up, Daniel received a call from a “Senior Financial Advisor.” Let’s call him Mark. His voice was confident and friendly, the kind of tone that makes you believe he’s been waiting his whole day just to help you personally succeed.

Mark explained GrandCapitalCG.com’s process with effortless charm—too smooth, but Daniel wasn’t suspicious yet. The steps were simple:

-

Deposit a small initial amount.

-

Get assigned a personal broker.

-

Let the platform “optimize your returns.”

Daniel deposited $250.

Mark congratulated him as if he’d taken the first step toward a financially secure future.

That’s the moment many victims remember vividly: the early sense of hope.

It’s also where the scam system begins tightening its grip.

Part III — The Mirage of Wins: “Your Account Is Growing!”

One reason scams like GrandCapitalCG.com work so well is because they don’t start by taking. They start by giving—at least on the screen.

Within 48 hours, Daniel logged in to see his balance at $390. Then $560. Then $1,020.

Trades were “executing,” charts were moving, profits were accumulating. Mark called regularly to celebrate Daniel’s “smart investment choices.”

For the first time in years, Daniel felt like he had momentum.

But the reality was this:

Nothing on that dashboard was real.

There were no trades.

No brokers.

No systems executing strategies.

Just a UI simulating financial growth to lure Daniel deeper into the web.

The platform made him feel like he was succeeding—and that’s what kept him depositing more.

Part IV — The Escalation: The High-Pressure Upgrade

After a week of supposed success, Mark told Daniel something “important.”

“You’re performing incredibly well, Daniel. You qualify for our Gold Plan. But the window is short.”

Daniel didn’t know the phrase “fear of missing out” was a central tactic in financial fraud psychology.

He only knew that a “short window” made it feel urgent.

The Gold Plan required a $1,500 deposit.

Daniel hesitated.

Mark countered with warm reassurance:

“I’d never let you risk something unsafe.”

A dangerous sentence—but often the one that convinces people to leap before looking.

Daniel deposited the money.

His account balance ballooned to “$4,785” by the next morning.

He felt proud.

Empowered.

Finally on the path he’d been searching for.

But the scam had just reached its midpoint.

Part V — The First Crack: The Withdrawal That Never Comes

Daniel decided to withdraw $300 to test the system.

The request went “under review.”

Hours passed.

Then days.

Then Mark called:

“Daniel, you haven’t met the minimum trading volume for withdrawals yet. Just deposit a bit more, and we’ll release everything.”

A knot formed in Daniel’s stomach.

“That doesn’t seem right,” he thought.

Legitimate brokers don’t require arbitrary deposits to process withdrawals. They don’t impose sudden, unexplained conditions. They don’t fabricate “trading volume requirements” out of thin air.

But Daniel didn’t know enough to push back… yet.

Mark continued applying pressure with skill sharpened by experience. Scripted, intentional manipulation disguised as guidance.

Daniel deposited another $500.

Nothing changed.

Part VI — The Shift: When Kindness Turns Into Control

The tone of the relationship shifted abruptly.

Mark’s warm confidence hardened into frustration whenever Daniel questioned anything.

Questions like:

“Why is my withdrawal on hold?”

“When will my funds be released?”

“Can I speak to compliance?”

Each one irritated Mark more.

He began lecturing Daniel instead of supporting him, emphasizing missed opportunities, “poor financial choices,” and the risks of “walking away too early.”

The goal was clear:

Emotionally wear the investor down until compliance becomes easier than resistance.

Daniel complied—again.

He deposited more money.

And more.

His account balance continued to rise, but the withdrawal section remained locked behind one excuse after another.

Part VII — The Breaking Point: Silence

Daniel finally snapped.

He demanded a withdrawal.

He refused additional deposits.

He insisted on transparency.

That’s when the final stage of the scam activated.

Mark disappeared.

Support stopped responding.

His login occasionally “errored out.”

When he did get in, the balance was frozen.

Messages went unanswered.

Phone numbers suddenly rang differently.

Daniel’s funds were gone—not just the digital numbers on the dashboard, but the real money behind them.

He had walked through the full cycle:

-

Discovery

-

Attraction

-

Manipulation

-

Deposits

-

Pressure

-

Resistance

-

Abandonment

This is the standard architecture of online investment fraud—and GrandCapitalCG.com fits it point-by-point.

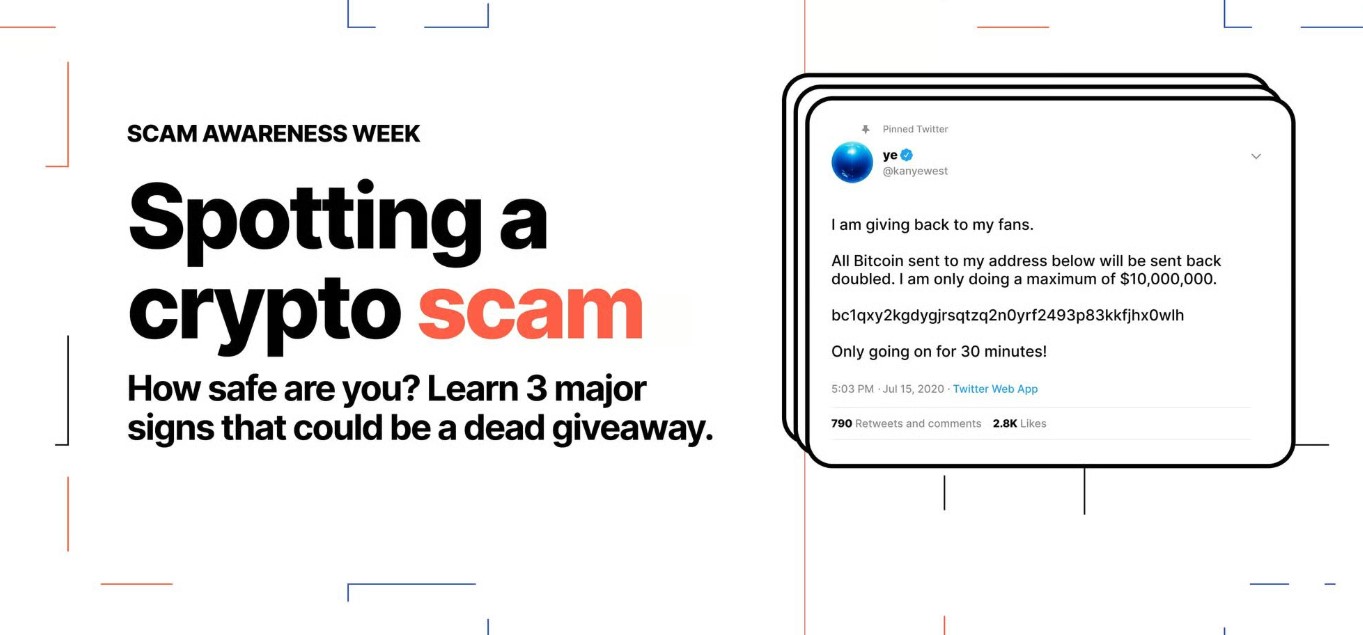

Part VIII — Breaking Down the Red Flags (From Daniel’s Case)

Outside the narrative, let’s examine the structural issues that expose platforms like GrandCapitalCG.com for what they are:

1. No Verifiable Licensing

Platforms offering trading services must be licensed.

Scam platforms copy regulatory language but provide no real credentials.

2. No Transparent Ownership

No names.

No leadership.

No physical office that can be confirmed.

3. Fake Trading Dashboards

The charts and profits are fabricated to mimic growth.

4. Withdrawal Blockage

Withdrawal obstruction is the single strongest indicator of fraud.

5. Psychological Pressure

Friendly voices become forceful once resistance appears.

6. “Deposit to Unlock Your Funds” Tactics

A hallmark scam strategy.

7. Email and phone support collapse once the victim stops paying

Ghosting is an intentional exit strategy.

8. Artificial urgency

“Limited offers” and “account upgrades” exist only to push deposits.

If even two of these appear on a platform, caution is warranted.

GrandCapitalCG.com displays them all.

Part IX — The Aftermath: Daniel’s Reflection

Daniel spent weeks replaying conversations, analyzing the fake dashboard, rereading messages he once believed were genuine.

What struck him most was not the loss of money—though painful—but the realization of how emotionally engineered the experience had been.

He wasn’t foolish.

He wasn’t careless.

He was targeted by a system designed to exploit hope, aspiration, and trust.

His story isn’t unique.

It’s a blueprint of how online trading scams operate globally.

Final Verdict — GrandCapitalCG.com Is a High-Risk Scam Operation

Everything about the platform—its structure, behavior patterns, user experience, lack of regulation, withdrawal issues, and psychological manipulation—aligns with the operational blueprint of fraudulent investment schemes.

This narrative case study is not just a story of one person’s downfall—it’s a warning of how easily anyone can fall victim when a platform intentionally blends sophistication with deception.

GrandCapitalCG.com is not a legitimate trading firm.

It is a high-risk, unregulated, trust-based scam designed to extract deposits, fabricate profits, block withdrawals, and disappear when challenged.

Report GrandCapitalCG.com Scam and Recover Your Funds

If you have lost money to GrandCapitalCG.com, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like GrandCapitalCG.com, continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe