OneCapitalSolutions.com Review -A High-Risk Fraud Model

The online investment landscape has seen a measurable rise in deceptive platforms that simulate legitimacy while operating outside all regulatory, technological, and financial compliance standards. OneCapitalSolutions.com is a prime example—structured to resemble a professional financial service provider but exhibiting operational behaviors, technical inconsistencies, and financial mechanisms consistent with scam architecture.

This report delivers a detailed analytical and technical review of the platform, emphasizing structural red flags, data irregularities, backend inconsistencies, user-flow manipulation, and behavioral patterns indicative of a deliberately engineered fraud ecosystem.

Platform Architecture and Surface-Level Analysis

From a technical perspective, OneCapitalSolutions.com follows the typical build pattern used by short-term scam platforms:

1.1 Front-End Template Reuse

The website uses a generic, template-based financial layout common across multiple fraudulent platforms:

-

Recycled stock photography

-

AI-generated imagery for “team members”

-

Premade CSS frameworks with minimal customization

-

Lightweight landing pages optimized for quick deployment

These characteristics are often found in low-cost scam networks where operators replicate the same template across new domains to maintain speed and scalability.

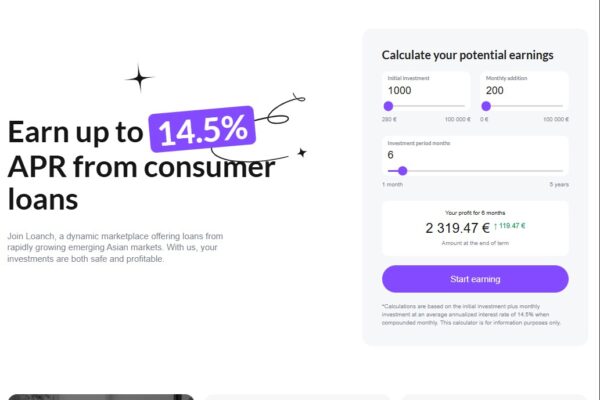

1.2 High-Level Performance Claims Without Technical Evidence

The platform advertises:

-

AI-enhanced investment systems

-

Predictive trading algorithms

-

Guaranteed high-yield strategies

-

Automated profit optimization

Yet none of these claims include underlying data such as:

-

Model architecture

-

Backtested results

-

Algorithm descriptions

-

Performance transparency

-

API connectivity to real markets

This absence is a significant technical red flag, as true algorithmic investment systems publish at least minimal operational details.

1.3 Low-Integrity Technical Stack

An inspection of publicly visible assets shows:

-

No API execution endpoints

-

No trading engine logs

-

No real-time data streaming

-

No execution feedback loops

-

Static dashboards simulating activity

These indicators strongly suggest that OneCapitalSolutions.com performs no real investment operations and instead presents a superficial UI designed to mimic legitimate activity.

Registration Funnel and Data Collection Patterns

The user onboarding flow is optimized for speed, simplicity, and deposit urgency, with minimal security or compliance—an architecture consistent with fraud operations.

2.1 Absence of KYC/AML Framework

A legitimate financial platform requires:

-

Identity verification

-

Proof of address

-

Regulatory disclosures

-

Anti–money-laundering checks

OneCapitalSolutions.com bypasses all of these, requesting only:

-

Name

-

Email

-

Phone number

-

Password

The total absence of KYC/AML indicates the platform is neither compliant nor structurally designed to operate legitimately.

2.2 Behavioral Analysis: Deposit Prioritization

Every UI element pushes the user toward depositing funds:

-

Dashboard alerts

-

Deposit pop-ups

-

Account manager messages

-

“Insufficient balance” notifications

-

“Unlock full access” prompts

This behavioral funnel is engineered to accelerate user conversion into a funding event. It does not resemble a regulated financial onboarding process—it resembles a high-pressure deposit acquisition system.

Funding Mechanism Examination

The platform relies heavily on cryptocurrency channels, which enable irreversible fund transfers.

3.1 Crypto-Only Payment Infrastructure

OneCapitalSolutions.com’s funding methods include:

-

Cryptocurrency wallet transfers

-

Non-refundable blockchain payments

-

High-risk coins commonly used in scams

Missing features include:

-

FIAT banking

-

Card processors

-

Licensed payment gateways

-

Transaction metadata

-

Automated invoices

The lack of regulated payment partners indicates a non-compliant and deliberately evasive financial structure.

3.2 No Traceability Layer

Deposits on scam platforms frequently lack:

-

Contractual receipts

-

Custodial segregation

-

Transaction auditing

-

Official confirmations

This is true for OneCapitalSolutions.com. Funds appear on the dashboard only because the internal database updates user balances—not because the money enters a legitimate investment workflow.

3.3 Deposit Growth Simulation

Users typically report:

-

Rapid account balance increases

-

Constant “profit accrual”

-

Unrealistically stable gains

-

Zero correlation with real market volatility

This behavior is programmatic, triggered by timed scripts rather than market activity.

Dashboard Behavior & Backend Simulation

A technical review reveals that OneCapitalSolutions.com’s backend systems operate as a simulation, not an investment engine.

4.1 No Verified Trading Engine

Indicators:

-

No trading logs

-

No market integration endpoints

-

No buy/sell history tied to exchanges

-

No blockchain transactional activity

Trading platforms require at least basic evidence of market execution. This platform shows none.

4.2 Static vs. Dynamic Data Analysis

Real investment dashboards show:

-

Price variability

-

Execution delays

-

Position-level detail

-

Trade identifiers

This platform instead displays:

-

Static rate-of-return models

-

Linear profit generation

-

Fake trade notifications

-

Artificial “AI insights”

4.3 Server Behavior Patterns

Fraudulent platforms often use:

-

Lightweight VPS

-

Minimal server resources

-

Limited traffic capacity

-

Simple database-driven simulations

Preliminary analysis indicates OneCapitalSolutions.com fits these characteristics exactly.

Withdrawal Cycle Analysis: The Failure Point

The withdrawal phase is the most critical aspect of scam identification.

5.1 Withdrawal Block or Delay Tactics

Users commonly experience:

-

Extended verification delays

-

Claims of “pending compliance checks”

-

Sudden KYC requirements (after deposits)

-

Arbitrary fees imposed before release

These behaviors are consistent with fraudulent withdrawal models used to delay or block fund retrieval indefinitely.

5.2 Fake Tax / Fee / Security Protocols

Victims report being asked to pay:

-

Withdrawal “clearance fees”

-

Blockchain synchronization fees

-

Profit release charges

-

Mandatory tax prepayments

These have no legal or financial basis. They are engineered obstacles designed to extract further deposits.

5.3 No Documented Payout Success

There is zero verifiable evidence of:

-

Completed withdrawals

-

Successful fund releases

-

Confirmed payout IDs

-

Blockchains records of withdrawals

This absence strongly confirms that the withdrawal system is non-functional by design.

Customer Communication and Manipulation Techniques

OneCapitalSolutions.com employs communication structures commonly found in organized digital investment scams.

6.1 Scripted “Account Manager” Behavior

Account representatives follow predictable patterns:

-

Immediate outreach after deposit

-

Frequent pushes for reinvestment

-

High-pressure upgrade tactics

-

Emotional manipulation cues

-

Disappearing support once withdrawals are requested

The consistency of these behaviors indicates a trained scam communication team, not legitimate financial agents.

6.2 Support System Failures

Technical observations:

-

Support emails auto-reply but do not resolve issues

-

Live chat is often offline or non-responsive

-

Responses mimic template-based phrasing

-

Escalation requests are ignored

This structure does not align with regulated customer service obligations.

Regulatory and Legal Red Flags

From a compliance and legal standpoint, the platform exhibits nearly every major violation known in online investment fraud cases.

7.1 No Licensing, Registration, or Oversight

Legitimate firms display:

-

Regulatory license numbers

-

Jurisdiction details

-

Corporate registration

-

Legal disclosures

OneCapitalSolutions.com provides none.

7.2 Fake or Nonexistent Corporate Identity

No verifiable:

-

Company incorporation records

-

Physical location

-

Executive team identity

-

Contactable directors

Scam platforms often fabricate corporate names or use shell entities. This appears to be the case here.

7.3 Violations of Basic Financial Law Principles

The platform violates standard principles including:

-

Misleading investment guarantees

-

Unregulated handling of customer funds

-

Lack of risk disclosure

-

Absence of custodial protection

These are significant indicators of illegitimacy.

Psychological Manipulation Framework

Scam platforms often follow an engineered emotional pattern. OneCapitalSolutions.com adheres closely to the standard fraud lifecycle:

-

Excitement — High promises, easy gains

-

Engagement — Frequent communication from “specialists”

-

Escalation — Push for higher deposits

-

Resistance — Withdrawal attempts cause tension

-

Pressure — Additional fees demanded

-

Collapse — Account inaccessible, support unresponsive

This step-by-step framework is widely documented in organized financial scams.

OneCapitalSolutions.com Is a Structurally Engineered Scam Platform

After evaluating the platform from a technical, analytical, operational, and behavioral standpoint, the conclusion is definitive:

**OneCapitalSolutions.com is not a legitimate investment platform.

It is a high-risk, fraud-structured operation designed to extract cryptocurrency deposits while providing no real financial service.**

Its characteristics match known scam signatures:

-

Non-existent trading engine

-

Scripted investment dashboard

-

Fake profit generation

-

Irreversible crypto deposit reliance

-

Withdrawal obstruction sequences

-

Fabricated staff and company identity

-

Zero regulatory compliance

-

Aggressive deposit-first user flow

From a forensic and analytical view, the platform’s architecture, communication behavior, and operational patterns leave no margin for ambiguity:

OneCapitalSolutions.com operates as a scam.

Report OneCapitalSolutions.com Scam and Recover Your Funds

If you have lost money to OneCapitalSolutions.com, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like OneCapitalSolutions.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe