SPGZEDS.com Scam Review -A Deep, No-Nonsense Look

There’s a familiar rhythm to how many questionable trading platforms enter the scene. A shiny new website appears, promising wealth, advanced algorithms, and quick access to markets that sound both exotic and irresistible. The graphics are modern, the numbers enticing, and the sales pitch well-practiced. For many unsuspecting investors, SPGZEDS.com is one of those names that fit perfectly into this mold.

In this review, I’ll dig deep into what SPGZEDS claims to be, what investors have reported, the obvious warning signals, and why the overall picture suggests that caution isn’t just wise — it’s absolutely necessary.

The Marketing Facade

At first glance, SPGZEDS paints itself as a cutting-edge trading and investment hub. The features often highlighted include:

-

AI-assisted trading — technology that supposedly makes smarter decisions than humans.

-

Institutional liquidity — access to “big-league” trading pools, as if retail investors were suddenly plugged into Wall Street itself.

-

Low minimum deposits — so anyone can get started quickly.

-

Account managers — individuals assigned to guide new users and “optimize” returns.

It sounds polished. The site’s language is designed to create a feeling of exclusivity and accessibility at the same time — a combination that’s especially effective when paired with social media promotions and persistent outreach from so-called account managers.

But as always, the question isn’t what’s promised — it’s whether the platform delivers.

Investor Experiences: A Troubling Pattern

Numerous individuals have shared their dealings with SPGZEDS, and the stories tend to follow a surprisingly consistent pattern:

-

The Hook

A user stumbles upon the platform through ads, direct messages, or recommendations. They’re encouraged to make a modest deposit — maybe a few hundred dollars — to “test the waters.” -

The Early Win

After depositing, users see their account dashboards light up with “profits.” In some cases, the platform even allows a small withdrawal at this stage. This is a psychological tactic to build trust and push the user to invest more. -

The Pressure Campaign

Account managers or support reps reach out, urging bigger deposits. They stress urgency — “limited time offers,” “exclusive pools,” or “market windows” that will close if the user hesitates. -

The Roadblock

Once larger sums are deposited, everything changes. Withdrawal requests stall. Users are told they must pay unexpected fees — compliance charges, wallet synchronization costs, or even “tax clearance” payments. -

The Vanishing Act

Support becomes slow or disappears altogether. Communication grows evasive, and eventually the investor realizes they’ve hit a wall.

That chain of events isn’t unique to SPGZEDS. It mirrors the classic script of many unregulated platforms that thrive on aggressive deposits and blocked exits.

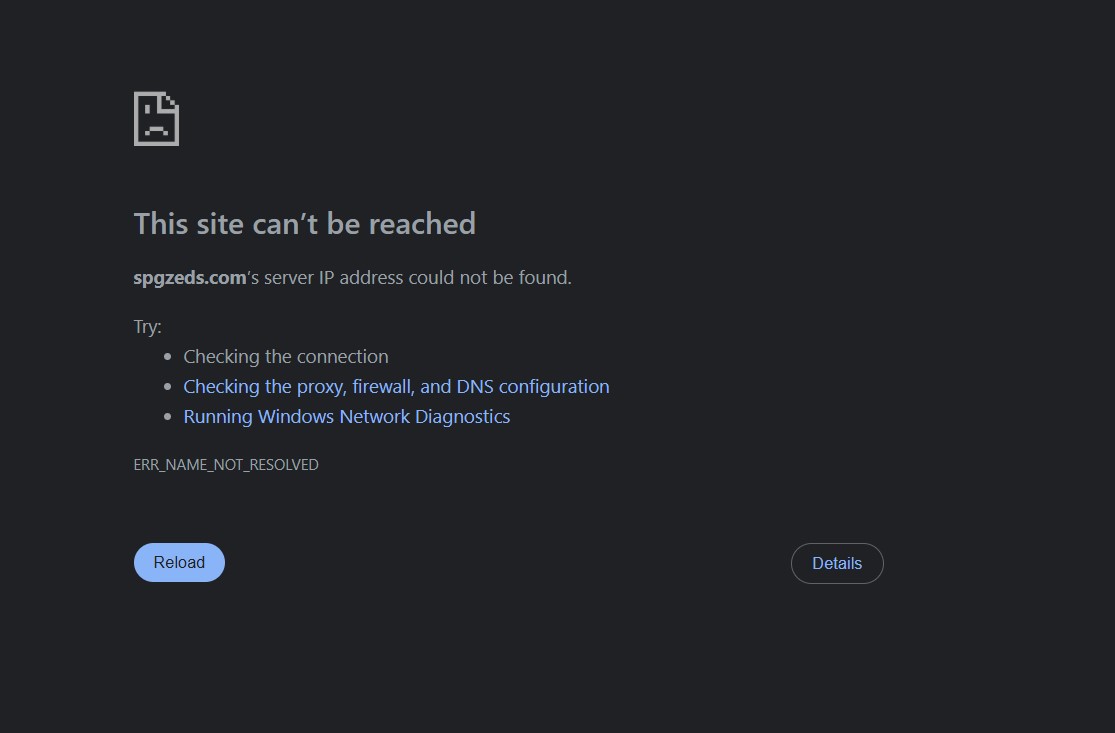

The Domain & Transparency Problem

A closer look at SPGZEDS reveals another set of concerns.

-

Young domain age: The website appears relatively new, which means it lacks a proven track record. Platforms promising financial services but with short operational histories should be treated with extra skepticism.

-

Hidden ownership: WHOIS records show that the company’s true owners are masked through privacy services. While privacy isn’t inherently bad, in the world of finance, it strips away accountability. If things go wrong, there’s no clear responsible entity.

-

Unclear regulation: Legitimate brokers proudly display licensing information. They provide verifiable regulator IDs that anyone can cross-check. SPGZEDS doesn’t present credible proof of being licensed by any recognized authority.

Taken together, these transparency gaps paint a troubling picture: a new, hidden, unverified business asking strangers to wire them money.

Why the Red Flags Matter

It’s easy to dismiss a single negative review or chalk up one bad experience to bad luck. But when red flags pile up, they create a pattern too loud to ignore. Here’s how SPGZEDS measures against common scam indicators:

| Red Flag | Explanation | Observed at SPGZEDS |

|---|---|---|

| Unrealistic Returns | Big profits promised in short timeframes with minimal risk. | Marketing emphasizes AI profits and institutional access. |

| Lack of Regulation | No clear licensing by a major financial authority. | Regulatory details absent or unverifiable. |

| Hidden Ownership | Privacy shields prevent accountability. | Owners and company registration masked. |

| Short Domain Life | Newly registered domains are high risk in finance. | Site age is very recent. |

| Withdrawal Barriers | Complaints of blocked or delayed withdrawals. | Repeatedly reported by users. |

| Pressure to Deposit | Aggressive reps urging larger investments. | Commonly described in user stories. |

| Surprise Fees | Extra charges to access funds. | “Compliance fees,” “taxes,” or “sync” costs cited. |

When that many boxes are ticked, the conclusion is difficult to avoid.

The Psychological Playbook

SPGZEDS doesn’t need brute force to convince users to hand over funds — it relies on psychological tactics perfected by similar platforms:

-

Urgency & scarcity: “Act now or lose out.”

-

Authority bias: Posing as professional managers or analysts to create trust.

-

Reciprocity: Allowing a small withdrawal early on to trigger loyalty.

-

Consistency pressure: Once someone invests, they’re nudged to keep investing to justify their initial decision.

These tactics don’t just extract deposits; they keep people in the game longer, even when doubts creep in.

Real-World Complaint Snapshots

Here are anonymized examples of experiences that investors have shared:

-

“They let me withdraw $50 at first. That convinced me to invest $1,000. When I tried to take out $500, they told me I needed to pay a 15% compliance fee upfront.”

-

“The dashboard looked so real, my balance was growing daily. But every time I asked for my money, they had another excuse — system updates, additional verification, or more deposits required.”

-

“The rep called me almost daily, pushing me to add funds. When I finally refused, the tone shifted, and soon I couldn’t reach anyone.”

These stories repeat with alarming similarity, reinforcing the suspicion that the system is designed around deposits, not real trading.

FAQs About SPGZEDS

Q: Is SPGZEDS definitely a scam?

A: Without a regulator’s final word, it’s hard to state absolutely. But the abundance of warning signs — poor transparency, blocked withdrawals, hidden ownership — place it firmly in the “high risk” category.

Q: Why do some users say they made money?

A: Many platforms allow small early withdrawals to build trust. That doesn’t prove legitimacy; it’s a tactic to lure larger deposits.

Q: Could it just be a poorly run startup?

A: Unlikely. Financial firms that are legitimate prioritize licensing and transparency from day one. SPGZEDS shows the opposite: hidden details and unresolved complaints.

A Balanced Perspective

For fairness, let’s acknowledge what SPGZEDS does get right:

-

A modern website that looks credible.

-

Easy onboarding with low entry requirements.

-

Active outreach that makes newcomers feel supported.

But these positives pale in comparison to the negatives. A slick interface doesn’t compensate for hidden ownership, unverified claims, and widespread reports of withdrawal failure.

Checklist Before Trusting Any Platform

If you take one thing away from this review, let it be this checklist. Apply it to SPGZEDS or any future platform you consider:

-

✅ Does it provide verifiable regulation details?

-

✅ Has the domain existed long enough to build trust?

-

✅ Are the owners and company addresses transparent?

-

✅ Are there consistent positive withdrawal stories from real users?

-

✅ Do independent watchdogs confirm legitimacy?

SPGZEDS fails most of these checks.

Final Verdict

SPGZEDS.com fits too neatly into the profile of high-risk, unregulated platforms that lure investors with big promises and then block their exits. The website may look convincing, and the sales pitch may sound smooth, but the deeper you go, the more troubling the picture becomes.

From hidden ownership and young domains to countless complaints of blocked withdrawals, SPGZEDS is riddled with warning signs. For anyone considering it, the safest conclusion is clear: the risks far outweigh any potential reward.

Report SPGZEDS.com Scam and Recover Your Funds

If you have lost money to SPGZEDS.com Scam, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like SPGZEDS.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.