HoraceTradeView.com Scam Review —A Comprehensive Breakdown

HoraceTradeView.com tries to present itself as a professional trading and investment platform, but deeper examination shows troubling patterns: vague ownership, very short domain history, low trustworthiness, and repeated complaints about withdrawals. When viewed together, these signs paint a high-risk picture that anyone considering this platform should know.

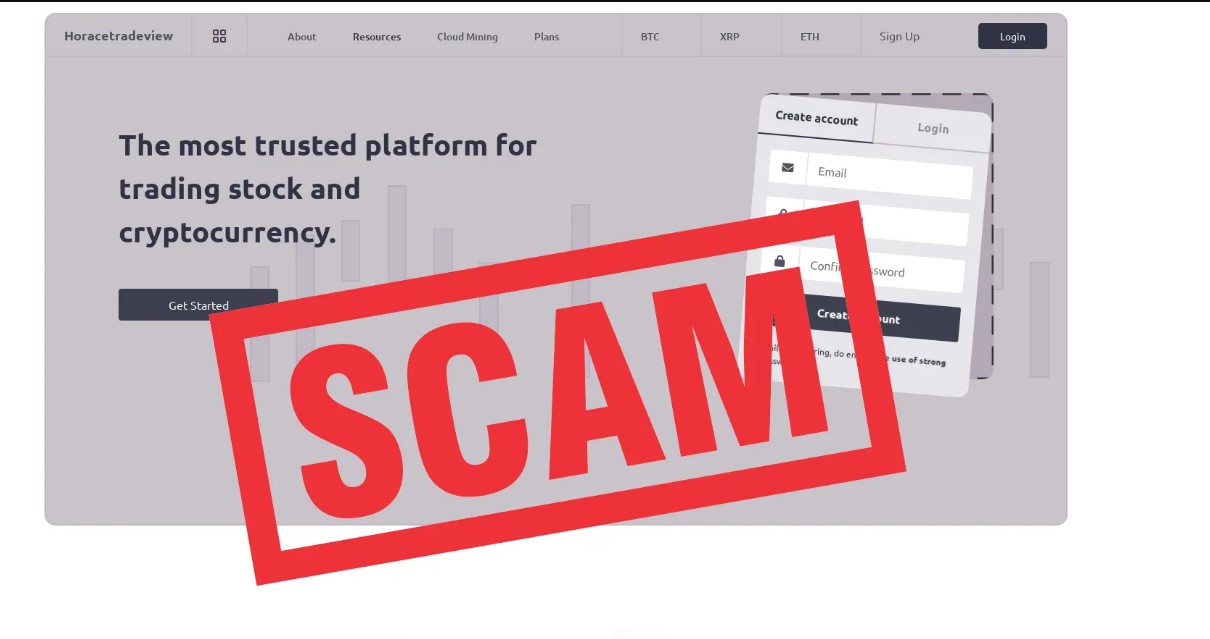

First Impressions — The Glossy Façade

Imagine being drawn in by a sleek website promising instant gains, advanced market analytics, and “expert-guided trading.” HoraceTradeView.com uses the same formula many questionable operators employ: polished visuals, fabricated testimonials, and friendly account managers who make the process look simple.

But the shiny surface hides a different reality. While onboarding is made as easy as possible — sometimes even with incentives for quick deposits — the real issues appear once money is inside the system.

1. Domain Age and Transparency

One of the first things to notice is how young HoraceTradeView.com is. The domain has only been active for a short period, with its registration details masked behind privacy services.

For legitimate financial platforms, transparency is key. They typically publish detailed ownership structures, clear corporate registration, and compliance documents. The lack of openness here is a classic early red flag.

2. Trustworthiness Ratings

Independent trust checkers give HoraceTradeView.com very low scores. These systems factor in things like domain age, transparency, user feedback, and whether a website shows signs of risky patterns often associated with scams.

Low trust ratings don’t prove outright fraud, but when combined with other evidence — hidden ownership, vague business information, and negative user stories — they strongly suggest caution.

3. Complaints from Users

Reports from individuals who interacted with the site follow a consistent pattern:

-

Deposits are quick and easy, often encouraged with “bonus” offers.

-

Initial trades may show apparent gains, boosting confidence.

-

When users try to withdraw money, obstacles appear — requests for more documentation, surprise fees, or frozen accounts.

-

Support teams become less responsive once withdrawal issues are raised.

This sequence is very common among high-risk platforms. The business model often revolves around attracting deposits but creating friction, or outright blocking, when withdrawals are attempted.

4. Grooming and Pig-Butchering Tactics

Some reports suggest HoraceTradeView.com may be used in pig-butchering schemes. These involve scammers building trust with victims over time — often through social media or messaging apps — then slowly convincing them to invest larger and larger sums on platforms like this.

The emotional trust built during these interactions makes victims more likely to overlook red flags, which is why scammers favour this approach.

5. Marketing vs. Reality

The platform advertises:

-

“Guaranteed high returns.”

-

Screenshots of supposedly successful trades.

-

Stories of satisfied investors.

But none of these claims are backed by verifiable evidence. There are no independently audited financial statements, no regulator-issued licences, and no transparent proof of performance. Without those, the promises are marketing hype rather than reliable proof.

6. How the Script Typically Unfolds

High-risk platforms like HoraceTradeView.com usually follow a very specific operational script:

-

Fast signup — removing friction so deposits happen quickly.

-

Early success illusion — showing small gains or even allowing minor withdrawals to build trust.

-

Pressure to upgrade — urging users to deposit more to access “premium” accounts or unlock higher returns.

-

Withdrawal hurdles — when users finally ask for larger payouts, hidden fees, identity checks, or minimum trade volumes suddenly appear.

-

Silence or shutdown — communication dries up, or the website disappears altogether.

Recognising this sequence early is critical. If you see it unfolding, it’s usually a sign to step away.

7. The Small Print Trap

The fine print often hides the real control mechanisms. Platforms like HoraceTradeView.com typically include clauses that:

-

Allow the operator to freeze funds for “compliance” reasons.

-

Impose “processing” or “maintenance” fees at the point of withdrawal.

-

Tie bonus funds to unrealistic trading requirements that make money effectively non-withdrawable.

These terms are structured to give the operator maximum discretion to keep funds locked.

8. Why Anonymity Matters

The operators behind HoraceTradeView.com remain completely hidden. There are no named directors, no linked corporate entities, and no physical office locations provided.

In finance, anonymity is rarely a good sign. Legitimate platforms make their corporate details easy to verify and operate under strict regulatory oversight. Hidden ownership makes accountability impossible if things go wrong.

9. Red-Flag Checklist

Here’s a quick way to evaluate HoraceTradeView.com (or any similar platform):

-

Corporate Identity: No transparent business registration or verifiable address.

-

Regulation: No licence from a recognised authority.

-

Performance Proof: No third-party audits or trade logs.

-

Withdrawals: Multiple reports of delayed or blocked withdrawals.

-

Domain: Recently registered with hidden details.

-

User Feedback: Overwhelmingly negative.

HoraceTradeView.com fails across this checklist.

10. Analytical Wrap-Up

When viewed as a whole, the evidence is compelling:

-

The domain is new and anonymous.

-

Trust signals are almost nonexistent.

-

User complaints consistently mention withdrawal issues.

-

The marketing relies on promises without proof.

-

The setup matches patterns used in known scams.

It’s not one red flag but the combination of many that makes HoraceTradeView.com such a high-risk platform.

For investors or traders, the safest path is clear: avoid exposing money to platforms that cannot demonstrate transparency, accountability, and a track record of honoring withdrawals.

Final Thoughts

HoraceTradeView.com uses all the hallmarks of a well-rehearsed playbook designed to lure in deposits while keeping control firmly in the operator’s hands. Legitimate financial services thrive on regulation, accountability, and user trust — none of which are visible here.

For anyone weighing the risks, the conclusion is straightforward: the dangers outweigh any advertised benefits. HoraceTradeView.com should be treated as an unsafe and unreliable operation.

Report HoraceTradeView.com Scam and Recover Your Funds

If you have lost money to HoraceTradeView.com Scam, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like HoraceTradeView.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.