SolveryIGroup.com Scam – A Cunning Broker

Introduction

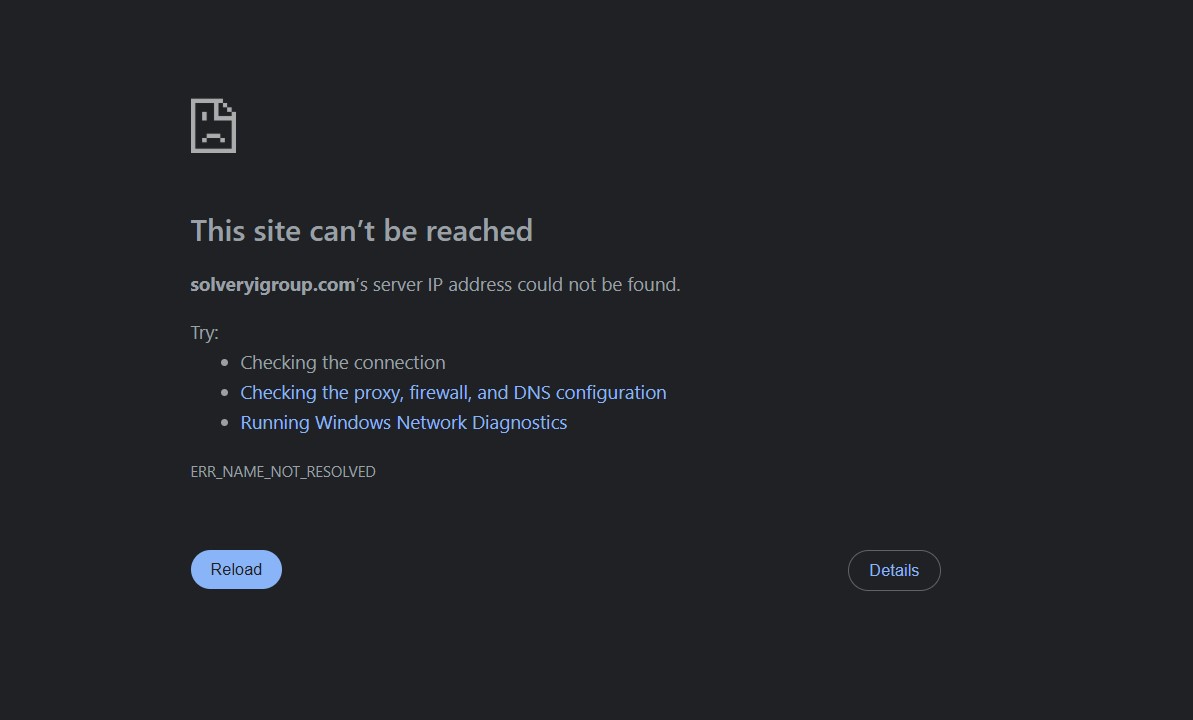

In the crowded digital broker world, SolveryIGroup.com (aka Solvery IG or Solvery Investment Group) markets itself boldly: “innovative access to global markets,” sleek trading platforms, and rapid client onboarding. But beneath that well-polished exterior lie deep concerns, regulatory warnings, and user reports that paint a far more alarming picture.

Let’s explore why this platform raises serious red flags and should be avoided.

1. Regulatory Intervention: A Clear Danger Signal

-

On July 3, 2025, the Alberta Securities Commission (ASC) added Solvery IG to its Investment Caution List, warning that it is not registered to trade or advise in Alberta. Investors are strongly advised to steer clear.

-

Just weeks earlier, on June 25, 2025, Luxembourg’s CSSF issued an official warning stating that Solvery Investment Group (operating via solveryigroup.com) holds no authorization to provide financial services from Luxembourg.

These are not casual alerts—they’re formal warnings from financial authorities, indicating regulatory noncompliance and high risk.

2. Trust Metrics Are Alarmingly Low

Independent tools reinforce serious credibility concerns:

-

ScamAdviser assigns solveryigroup.com a very low trust score, citing minimal traffic, hidden ownership, and affiliation with registrars known to host scam sites.

-

ScamDetector and GridinSoft also categorize the platform as suspicious, “risk-prone,” and operating with potentially harmful infrastructure.

This combination of signals—algorithmic ratings, domain behavior, and hosting patterns—paints a consistent high-risk profile.

3. Deceptive Design and Questionable Identity

-

SolveryIGroup claims multiple account tiers, web-based trading platforms, high leverage, and robust tools. evalufinance.com

-

The advertised physical address in Luxembourg doesn’t correspond to a real office, and the broker shows no regulatory credentials, despite implying legitimacy.

-

A visible trick: displaying the Luxembourg address and phone contacts, but with zero proof of actual operations or licensing. This is classic “legitimacy laundering.”

4. User Feedback: Praise and Pain Coexist

On Trustpilot, the platform shows a moderate 3.9 out of 5 score over ~30 reviews. On the surface, it appears credible—but the details tell a different story.

-

Positive reviews speak of fast execution and helpful support.

-

But negative reviews vividly describe boiler-room tactics: relentless calls, account freezes, blocked withdrawals, and pressure to deposit more. One user lamented losing funds when a withdrawal was blocked and being forced to wire more money. Trustpilot

The coexistence of promotional feedback and scathing firsthand accounts is often a hallmark of manipulated review ecosystems.

5. High-Risk Credentials and Dubious Strategies

CapitalForexMarkets.com outlines key red flags:

-

No visible regulation.

-

Unknown physical base.

-

Vaguely defined trading conditions.

-

Overly aggressive leverage (1:400) without negative balance protection.

These conditions favor operator over client—accelerating losses rather than protecting investment.

6. Full Spectrum Red Flags Summarized

Platform vulnerabilities align perfectly with patterns seen in scam brokers:

-

Regulatory Warnings—from credible authorities.

-

Anonymous, New Domain—just months old, no corporate transparency.

-

Aggressive Marketing—high leverage, tiered account push, bonus bait.

-

Withdrawal Blockage—common user complaint.

-

Fake Office Claims—addresses without substance.

-

Mixed Reviews—glowing praise shadowed by strong warnings.

Summary Table – Appearance vs. Reality

| What the Platform Projects | What the Evidence Reveals |

|---|---|

| Professional trading environment | Unregulated, unverified entities, no legal backing |

| High-performance WebTrader, multiple assets | No proof of infrastructure, poor transparency |

| Mobile-friendly and tiered perks | Unclear fee structures, possible bonus traps, high-risk leverage |

| Trustpilot score in decent range | Reviews conflict; consistent user reports of misconduct and harassment |

| Advertised Luxembourg presence | CSSF warns: not licensed or authorized in Luxembourg |

| Claims of reliability and innovation | Alarm signals from ASC, ScamAdviser, user reports all indicating serious risk |

Final Verdict: Avoid SolveryIGroup.com Like the Plague

In the landscape of financial scams, SolveryIGroup.com embodies too many red flags:

-

Regulatory warnings from ASC and CSSF.

-

Poor trust scores across multiple risk evaluation tools.

-

Anonymous operations behind polished branding.

-

Tiered schemes and leverage that favor the platform—not the user.

-

Customer feedback confirming classic scam behaviors.

Bottom line: This is a platform built for quick take-downs—not safe, not legitimate, and not worth the financial risk.

Report SolveryIGroup.com and Recover Your Funds

If you have lost money to SolveryIGroup.com, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like SolveryIGroup.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.