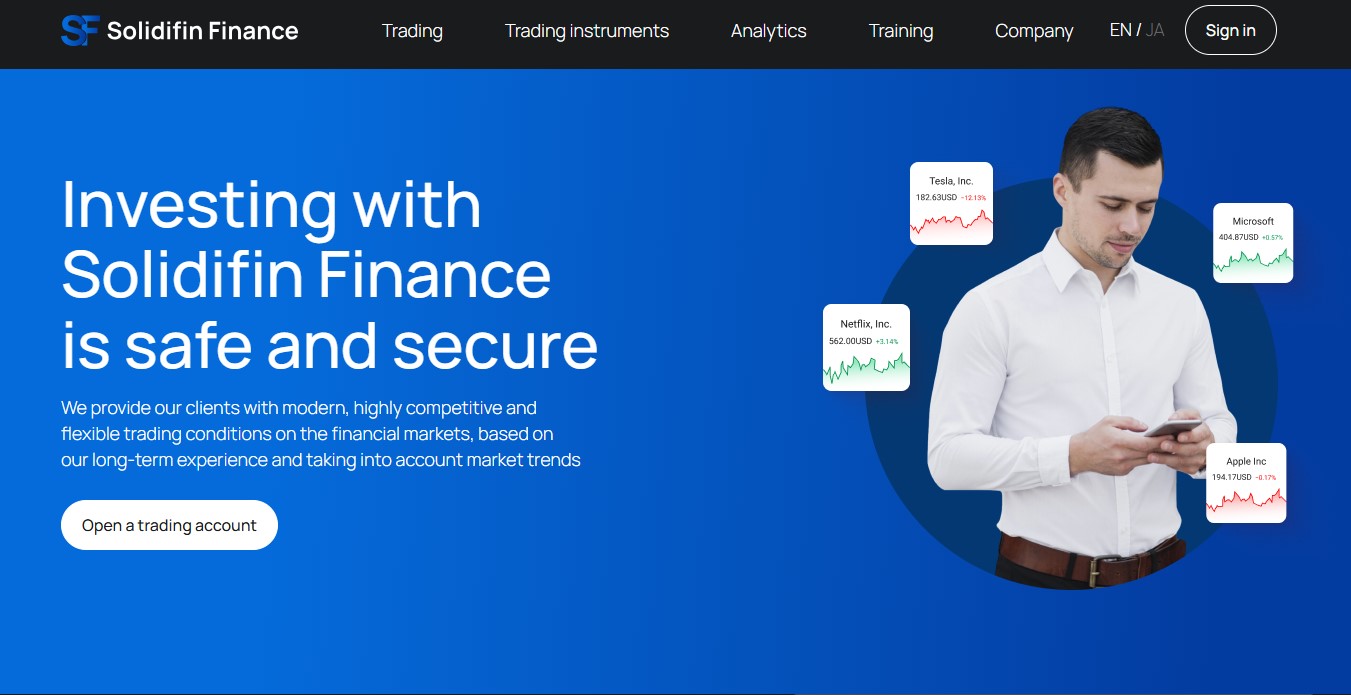

Solidifin.pro Scam Review – A Dubious Platform

Introduction

Solidifin.pro markets itself as “your reliable guide to the world of investments,” offering ECN/STP brokerage, integrated portfolio management, and financial planning services. But a close examination reveals a litany of warning signs that strongly suggest it’s a high-risk or potentially fraudulent platform. Here’s a breakdown of why caution is essential.

1. Extremely Low Trust Scores from Security Platforms

a. GridinSoft View:

-

Trust score: 22/100—deemed a “Suspicious Website” in the “Danger Zone.”

-

Registered only a few months ago.

-

Ownership fully shielded through privacy services.

-

Identified as a financial service site, but no clear operator or contact transparency.

-

One user report alleges inability to withdraw invested funds.

b. ScamAdviser Rating:

-

Displays a very low trust score, indicating a high likelihood of being a scam.

-

Raises concerns over hidden ownership, low traffic, and fleeting domain credibility.

c. Scam Detector Assessment:

-

Scores 9.8/100, labeled “Untrustworthy. Risky. Danger.”

-

Elevated phishing, low domain age, and proximity to dubious sites flagged.

2. Domain Age & Ownership: No Accountability

-

Domain registered in January 2025, making it very new.

-

Fully masked by privacy service—no individual, team, or HQ visible.

In financial platforms, new and anonymous setups tend to signal intent to avoid accountability.

3. User Testimony Confirms Blocked Withdrawals

A disturbing first-hand account on Medium reveals a stark reality:

“I deposited $55,000… faced constant obstacles trying to access my account and withdraw funds. Customer service was non-existent…”

This aligns with the platform’s technical governance—blocking access after deposits under the guise of compliance or other fees.

4. Regulatory Warning from the Alberta Securities Commission

On July 8, 2025, the Alberta Securities Commission listed Solidifin Finance (linked to solidifin.pro) on its Investment Caution List, specifically highlighting:

-

Not registered to trade or advise in Alberta.

-

Lack of investor protections since it operates outside regulation.

If regulators publicly warn investors, that is a clear signal to stay away.

5. Copy-Paste Marketing, No Evidence of Legitimacy

Despite the offering of financial tools, analysis shows:

-

No verification of trading infrastructure or audit reports.

-

No real corporate presence, physical office, or leadership transparency.

-

Flood of generic promotional language—like “10 years in financial markets”—without proof.

Smooth presentation does not equate to credibility.

6. Summary Table — Attraction vs. Alarm

| Perceived Strength | Underlying Concern |

|---|---|

| Modern site appearance, investment talk | Brand new site—just months old with hidden ownership |

| Claims of advanced brokerage offerings | No licensing, regulator warns investors to avoid it |

| User functionality (portals, forms) | Real users report blocked withdrawals and lost funds |

| No frills user interface | Could be overlay—just designed to look legitimate |

| Generic financial marketing language | No credentials, no business identity, no oversight |

Final Verdict: Avoid Entirely

Solidifin.pro fits the high-risk template: brand-new, anonymous, unregulated, user reports of blocked withdrawals, and regulator warnings. Opening an account here could lead to total loss of funds and no recourse.

Bottom line: This platform is unsafe. Do not engage or deposit any funds under any circumstances.

Report Solidifin.pro and Recover Your Funds

If you have lost money to Solidifin.pro, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Solidifin.pro continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.