Marketsca.com Scam Review – A Dubious Scheme

Introduction

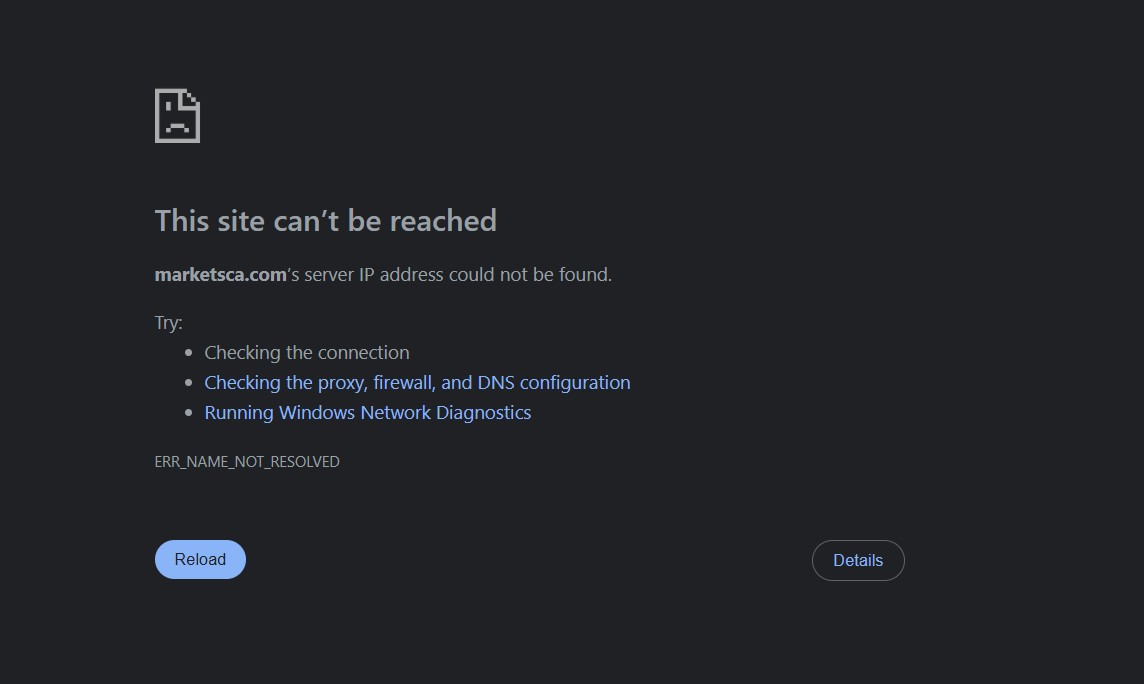

Marketsca.com may strike visitors as a professional investment site, complete with sleek design, finance-focused branding, and claims of legitimacy. However, multiple independent risk indicators—from regulatory alerts to trust score red flags and troubling user experiences—paint a much more concerning picture.

Below is an in-depth breakdown of why this platform raises substantial alarm.

1. Regulatory Red Flag — Public Warning Issued

On July 10, 2025, the New Brunswick Financial & Consumer Services Commission issued a strong investor alert warning Canadians that Marketsca.com is not registered to provide securities or crypto-asset trading in the province.

The site even purports to claim regulation under an ambiguous “Offshore Secrecy and Regulation” banner associated with Saint Vincent and the Grenadines—a setup labeled misleading by authorities.

When a regional regulator explicitly cautions users against the platform, that alone should raise urgent concern.

2. Very Low Trust Ratings from Scam–Detection Tools

a) ScamAdviser Verdict

The platform has a very low trust score. It’s flagged for offering high-risk financial services, concealing ownership, minimal website traffic, and a registration with a shady registrar.

These red flags align with scam infrastructure—especially since anonymity prevents tracing accountability.

b) Scam Detector Analysis

Trust score is a dismal 9.5/100, carrying tags like “Untrustworthy,” “Risky,” and “Danger.” The site scores high for phishing, malware, and spam risk—all alarming indicators in financial services.

c) GridinSoft Rating

Described as operating in the “Danger Zone,” Marketsca.com earns an exceptionally low trust score (near 1/100), with risk assessments indicating phishing and impersonation threats.

d) ScamDoc Insight

Categorized as “Poor” trust, noting anonymous domain registration, no visible legal credentials, and a short digital footprint.

Across major risk tools, the consensus is clear: this platform lacks the credibility expected from a financial services provider.

3. Red Flags from the Trustpilot User Sphere

On Trustpilot, one user recounts a deeply troubling experience:

“There is no transparency … they asked me to double my investment… then banned my account immediately afterward.”

This is the only visible review—but it’s a potent one. It describes typical scam behavior: pressure to invest more, followed by blocked access and disappearance of funds.

Sparse yet devastating, this testimonial signals more than marketing—they reflect harm.

4. Too Many Possessions, Too Little Custodianship

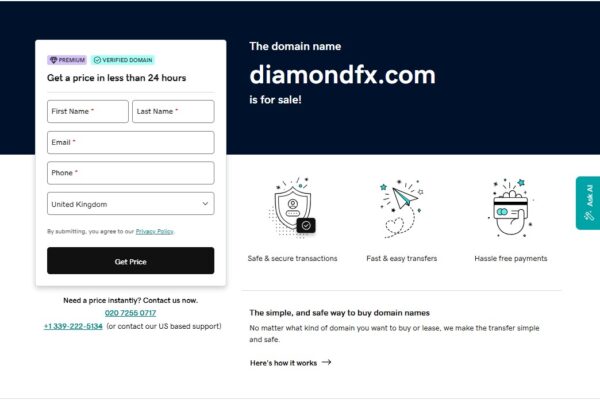

Marketsca.com markets itself using broader brand identities like “MarketsHelp.com” or “MarketsCo,” and claims connections to offshore regulators. But investigation shows:

-

No verifiable registration with any reputable authority (FCA, ASIC, IIROC, etc.).

-

No listed physical address or business entity—just vague claims.

-

Misuse of regulatory symbols for visual legitimacy.

All signs suggest a front for deceptive operations rather than a regulated broker.

5. Common Scam Patterns Detected

Based on the evidence, Marketsca.com fits a familiar fraudulent blueprint:

-

Modern, sleek interface with financial branding.

-

Anonymous origin and domain inception.

-

Fake or misleading regulatory claims.

-

User reports of account bans, deposit traps, and blocked withdrawals.

-

Sparse reviews, mostly negative, with adversarial experiences.

-

No transparency in terms or corporate structure.

These align closely with known scam mechanics—and yet, still, the facade lures new visitors.

6. Risk Summary Table

| What the Site Promises | What Reality Shows |

|---|---|

| Modern trading platform with purported oversight | No regulation, anonymous ownership |

| Strategic presence under various brand names | Fragmented identity, no cohesive or verifiable credentials |

| User experience described as transparent | Account bans, blocked payouts, coercive investment tactics |

| Tall promises with offshore branding | Regulatory warning from NB—calls it unregistered and deceptive |

| Responsive audit/data confirmation | Consistent low trust across decoders and reputation platforms |

Final Verdict: Steer Clear

Marketsca.com is not just untrustworthy—it is outright risky. Warning alerts from regulators, consistent negative findings across multiple scam detection platforms, user accounts of blocked withdrawals, and amorphous regulatory claims make it fundamentally unreliable.

Bottom line: There’s no legitimate foundation here. The safest step is to avoid the platform entirely and seek fully transparent, regulated alternatives.

Report Marketsca.com and Recover Your Funds

If you have lost money to Marketsca.com, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Marketsca.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.