RoyalWealthLtd.com Scam -A Ponzi Scheme

Introduction

RoyalWealthLtd.com markets itself as a polished, innovative investment service—proffering access to CFDs, crypto, and forex under the guise of Canadian legitimacy and deep experience. But beneath its glossy surface, the platform exhibits a constellation of alarming signals—from fake regulators to desperate user complaints—that flag it squarely in high-risk territory.

1. Regulatory Identity Theft: Fake Licensing & Regulators

The most damning red flag is the false legitimacy the platform attempts to project:

-

Royal Wealth Ltd claims to be regulated by a body called the Canadian Financial Industry Regulatory Authority (CARFIS/CFIRA). No such regulator exists in Canada, and the control subdomain used for this (e.g.

crfis.royalwealthltd.com) is entirely fabricated. Real regulators do not hide as subdomains of broker websites. -

Investigators searched business registries in Canada and found several companies named “Royal Wealth,” but none match RoyalWealthLtd.com in name or function.

This is not mere marketing embellishment—it’s identity theft masquerading as licensing, a hallmark of fraudulent platforms.

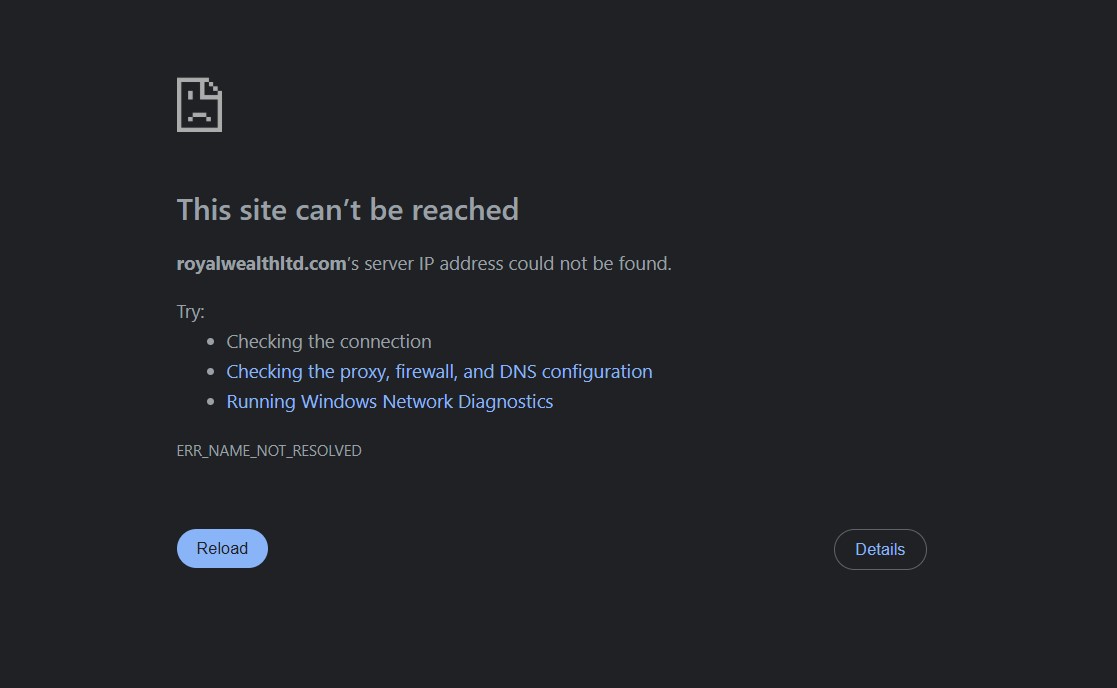

2. Domain Age vs. Claimed Legacy

RoyalWealthLtd.com portrays itself as a long-established investment organization. Yet:

-

WHOIS data reveals the domain was registered only on April 1, 2025. That makes the “10 years in business” claim both impossible and deceitful.

-

The website’s rush to fabricate a credible history is a classic scam maneuver.

Longevity claims paired with brand-new domains are a glaring mismatch—and a major credibility breach.

3. Regulators, Public Warnings, and Caution Lists

Several real financial authorities have flagged RoyalWealthLtd:

-

The Alberta Securities Commission (ASC) placed Royal Wealth Ltd on its Investment Caution List, noting it is not registered to trade or advise in the province. Investors are warned not to deal with it.

-

Other regulators, like Russia’s central bank, have also issued alerts regarding the company’s unlicensed operations.

If legitimate regulators are actively warning against the platform—that should be enough to deter engagement.

4. Trust Metrics and Web Security Red Flags

Cybersecurity rating systems consistently caution against RoyalWealthLtd.com:

-

Platforms like Scam Detector rate the site as high risk—it’s deemed “untrustworthy, risky, and dangerous.”

-

GridinSoft registers it as extremely low (under 20/100), citing malware potential and deep anonymity.

-

ScamDoc classifies it as “Poor,” noting hidden ownership and a suspiciously new domain.

These technical verdicts aren’t definitive proof—but they strongly signal that something is structurally wrong with the platform.

5. User Warnings: Trapped Funds and Blocked Withdrawals

Reviews from verified users provide unsettling specifics:

-

High-pressure environments: One user notes that once their deposit exceeded $30,000, all wallets drained to zero.

-

Withdrawal denial: Another user was blocked from accessing funds after depositing just $350 and pressured for thousands more under pretexts like “insurance payments.”

-

Fake addresses: A reviewer investigated the listed Toronto address and found no physical office—just an anonymous location with no operators standing behind it.

These experiences follow a pattern of “take deposits easily, obstruct withdrawals forcefully.” That runs contrary to any credible trading service.

6. Opaque Fees and Misleading Execution Conditions

RoyalWealthLtd’s fee structure and execution details are murky:

-

A 5% fee on total profits—not the withdrawal amount—is reported, which is highly unusual and potentially deceptive.

-

Spread, commission, or formatting transparency is entirely absent. Details around leverage caps, funding terms, and user protection measures are not published.

A brokerage that won’t clearly show its terms—and charges a high cut on profits—should not be trusted.

7. User Support That Disappears When Needed

Some users report polite replies early on—only to find support vanish when they request withdrawals or raise concerns. One review note stands out—a threat to “report content” to moderation if negative sentiment is shared.

This tactic of silencing dissent illustrates how customer feedback can be controlled to preserve illusion.

8. Fake Web of Trust: Inflated Reviews and Suspicious Stories

Although some review platforms show great ratings—like 4.8 out of 5 on certain sites—deeper inspection reveals:

-

Reviews appear overly enthusiastic and templated.

-

Negative reviews are few but honest—and far more revealing.

-

There’s little genuine, verifiable feedback or third-party trust.

When glowing praise exists alongside buried but consistent complaints, the scale doesn’t balance in favor of legitimacy.

Summary Table — Luster vs. Liability

| Perceived Strength | Underlying Red Flag |

|---|---|

| Claimed Canadian regulation | Fake regulator, unverified license, false attribution |

| Asserted business history | Domain registered mid-2025—history is fabricated |

| Smooth platform imagery | No transparency—hidden leadership, no company info |

| High Trustpilot score | Fake or promo-saturated reviews; real ones highlight fraud |

| User testimonials about good UX | Paired with accounts of fund loss and withdrawal blocking |

| Profit-based fee only (5%) | Hidden, punitive fees undermining fairness |

Final Verdict

RoyalWealthLtd.com is best understood as a well-packaged trap. Its facade—claims of regulation, experience, and global reach—crumbles under scrutiny. With fake regulators, hidden ownership, aggressive upsell, withdrawal manipulation, and widespread warnings, the platform fits the profile of a financially dangerous operation.

Bottom line: Extensive due diligence reveals a high-risk platform that lacks legitimacy and accountability. Engagement is not an option; avoid at all costs.

Report RoyalWealthLtd.com scam and Recover Your Funds

If you have lost money to RoyalWealthLtd.com, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like RoyalWealthLtd.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.