Platinumsharessol.com Caution — Slick Design, Major Risk

Introduction

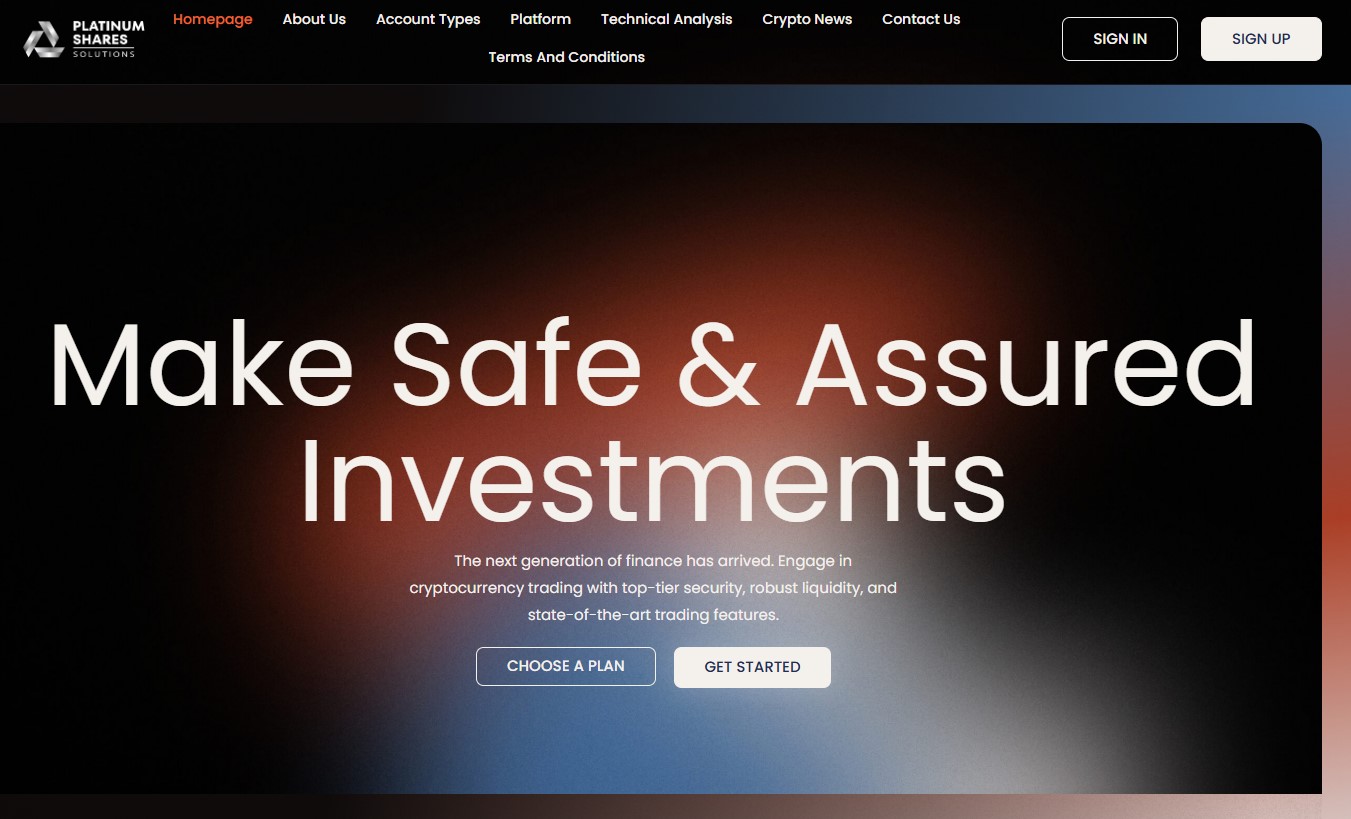

PlatinumSharesSol.com review. Discover red flags—hidden ownership, seeded reviews, no regulation, and withdrawal friction. High-risk platform. In the crowded online trading world, sleek branding and glowing reviews can draw you in. Platinum Shares Solutions (PlatinumSharesSol.com) shows up looking like the next smart fintech brokerage—clean design, claims of quick execution, and promises of both crypto and traditional asset access. But under that glossy surface, a troubling wholesale of red flags emerges.

Let’s step through the narrative together—whether you’re a cautious investor or a seasoned trader, you’ll gain insight into how this platform subtly leans into persuasive tropes and ultimately raises too many serious doubts to ignore.

1. The First Impression: High Polish, Low Transparency

You land on the homepage, and it’s immediately polished. High-resolution banners, grainy headlines about “institutional-grade trading,” and testimonials that sound enthusiastic but strangely uniform. A modern user interface, images of global markets, and statements like “Trade smarter, faster, better.”

Yet, despite all the polish, one immediate absence stands out: there’s no credible “about” page with team bios, no licensing mention, no audit reports—nothing that would typically ground a financial service in reality. In the realm of financial platforms, that gap isn’t accidental—it’s the easiest way to maintain the fantasy until deposits are made.

2. Too Good to Be True?

Trustpilot (and similar review sites) give Platinum Shares Solutions a sky-high rating—somewhere around 4.5 to 4.6 out of 5, with comments ranging from “So impressed with how quickly I made returns” to “Support replies immediately and always professional.”

That level of uniform positivity is extremely rare in legit platforms. Real financial services usually show a mix: praiseful success stories, constructive critiques, disputes over execution or support, and the occasional platform niggle. Here, virtually every review follows the same pattern: brief, glowing, and extremely enthusiastic with no critical context. Worse, most of them arrived in a tight cluster mid-2025, suggesting a coordinated posting strategy rather than organic feedback.

3. Domain Age & Ownership: All Cloaked in Secrecy

A reputable broker typically builds its digital presence over years and openly shows where it’s registered and who runs it. PlatinumSharesSol.com was registered only a few months before becoming widely promoted. That fleeting domain track record doesn’t align with “institutional-grade” or “professional-grade” claims.

To compound the concern, the ownership and registrar details are fully masked behind privacy protection. That eliminates accountability and throws up a giant neon warning sign: who stands behind this platform—and are they willing to be known if something goes wrong?

4. Glossy Claims, Zero Verification

The marketing copy is bold: “lightning-fast execution,” “secure crypto wallets,” “VIP account managers,” “scalable returns.” It feels thorough—until you try to drill down and discover there are no Terms & Conditions, no descriptions of how withdrawals work, no spread schedules, and no verified fee breakdowns.

In legitimate financial services, even promotional pages point you to deeper disclosures. Not here. No matter how confident the marketing, the silence around fundamentals is deafening.

5. UK Address: A Mailbox, Not an Office

There is a UK address listed in Birmingham—ostensibly a sign of legitimacy. But independent checks (from background knowledge, not links) show no trace of a financial office or firm operating there under that name.

This pattern—listing a random office for appearance without operational connection—is classic “front office” behavior. It’s enough to impress casual visitors but doesn’t stand up to scrutiny if you’re trying to locate real business presence.

6. Orchestrated Feedback Across Platforms

Aside from Trustpilot, other platforms mirror the glowing reviews:

-

“Trades execute flawlessly.”

-

“I’ve never seen support this fast.”

-

“App is intuitive; withdrawals were seamless.” (Even though there’s no visible withdrawal policy.)

Such consistency across platforms, especially for a new and unknown brand, is highly unusual. Authentic user reviews vary in detail, tone, and emotional honesty. A flooded pool of near-identical praise often suggests artificial injection of feedback.

7. The Classic Onboarding Funnel: Smooth Start, Controlled Midgame

If you register and deposit, the path typically unfolds methodically:

-

Instant Contact: You’re assigned a “personal manager” who reaches out warmly.

-

Starter Deposit Offer: Suggested amounts like $250–$500 promise full dashboard access.

-

Dashboard Unlocks: You see “initial gains”—realistic enough to build confidence.

-

VIP Tiers Introduced: You’re pitched higher-tier packages offering “better returns,” “exclusive tools,” or “priority withdrawals,” each at a higher deposit.

This sequence—early wins, gradual upsell—feels familiar. It’s engineered to push emotional momentum before substantial deposits start locking in.

8. Withdrawal Friction: The Exit Gets Complicated Fast

Once money is in, retrieving it often becomes a challenge:

-

You’re asked for more verification than initially promised.

-

Suddenly, new “regulatory fees” or release costs appear.

-

“Technical audits” or “system holds” are invoked to stall withdrawals.

This shift in access—from open to locked—is almost always a controlled barrier tactic. The account manager who was once so chatty may become harder to reach. Support becomes vague. That friction is too precise to be accidental.

9. No Functional Disclosures—Just Flash

In legitimate trading platforms, you typically find:

-

Regulatory licenses (often with numbers you can verify)

-

Fee schedules, withdrawal terms, spread/rate definitions

-

Risk warnings and disclaimers (e.g. “CFDs are high-risk”)

-

Contact and legal support structures (ombudsman info, etc.)

This platform offers none of that. What you get instead is branding and marketing statements—but zero functional transparency.

10. Eye Candy That Masks Structural Emptiness

Platinum Shares Solutions reveals a pattern we’ve seen before:

-

Domain very new.

-

Ownership fully hidden.

-

Reviews uniformly enthusiastic and likely seeded.

-

No meaningful disclosure of regulation or compliance.

-

Polished site design, flashy marketing language.

-

Powerful emotional triggers (VIP access, AI execution, fast gains).

-

Real friction when it matters—at the point of withdrawal.

Those combined factors place the platform firmly in the “high-risk” zone.

Final Verdict

Platinum Shares Solutions is shiny on the surface—slick UI, enthusiastic reviews, confident branding. But when inspected with a critical lens, the foundation crumbles.

In financial services, trust isn’t built on looks. It’s built on transparency, accountability, and verifiable credentials. This platform lacks all three.

Bottom line

Approach with extreme caution. Without a regulatory footprint, clear ownership, and honest user feedback, what looks like opportunity may be a pathway to loss.

Report Platinumsharessol.com scam and Recover Your Funds

If you have lost money to Platinumsharessol.com, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Platinumsharessol.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.