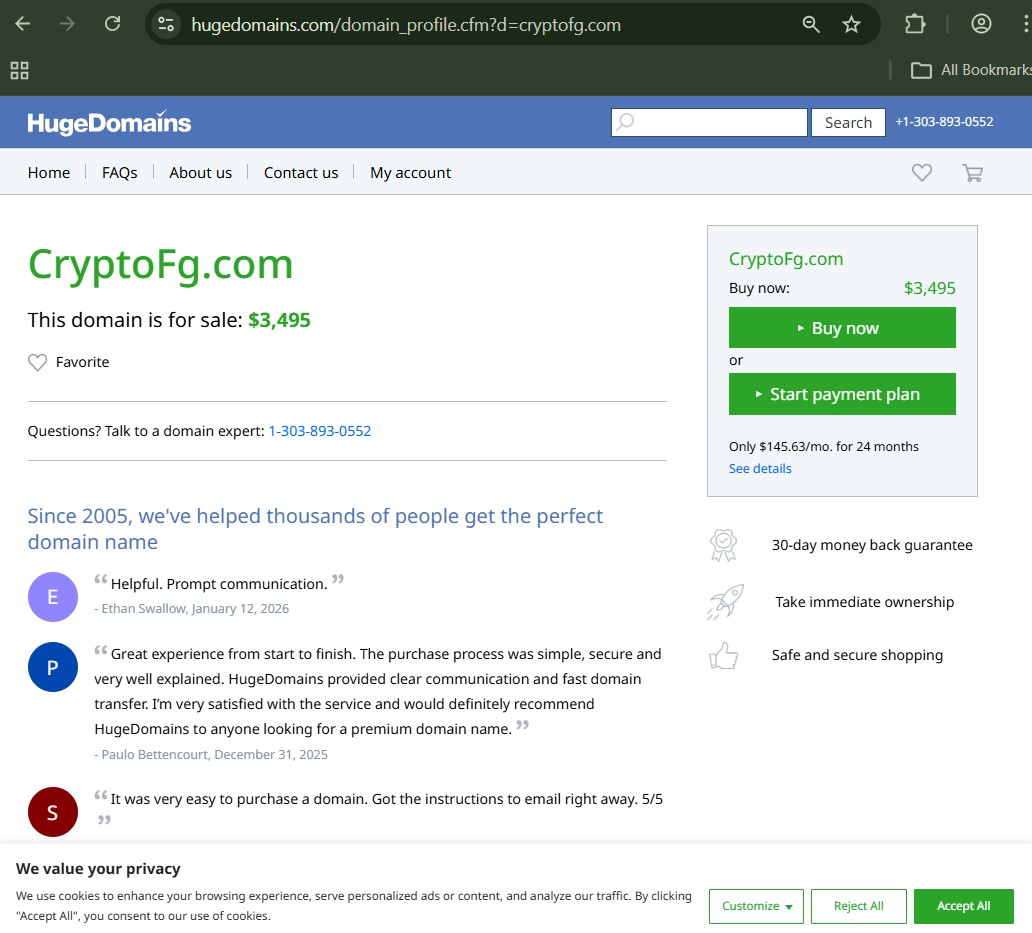

Cryptofg.com Scam -8 Serious Threat

When Cryptofg.com is evaluated against established due-diligence standards, multiple warning signs emerge that align closely with patterns already documented in

online investment scam warning signs.

This review is not an accusation — it is a risk-based assessment intended to help investors make informed decisions before exposure escalates.

1. Absence of Verifiable Regulatory Oversight

Regulation is not a formality; it is a safeguard. Legitimate investment platforms clearly disclose:

-

Licensing bodies

-

Registration jurisdictions

-

Compliance obligations

Cryptofg.com does not provide transparent or independently verifiable regulatory credentials. This lack of oversight places it within the same risk category as many platforms discussed in

unregulated crypto investment platform analyses.

Without regulatory accountability, investors have limited protection if disputes arise or funds become inaccessible — a foundational risk no serious platform should impose.

2. Anonymous or Obscured Corporate Ownership

Another consistent risk indicator is unclear ownership structure. Trusted platforms usually identify:

-

The operating company

-

Executive leadership

-

Physical business presence

Cryptofg.com offers little clarity regarding who controls the platform. This mirrors concerns raised in Jayen-Consulting’s research on

anonymous investment operations, where hidden ownership often correlates with reduced accountability.

Transparency is not optional in finance — it is essential.

3. Promotional Messaging That Minimizes Risk

Cryptocurrency markets are inherently volatile. Ethical platforms acknowledge this openly. Cryptofg.com, however, appears to emphasize potential benefits while offering minimal discussion of downside risk.

Jayen-Consulting has extensively documented how imbalanced profit narratives are a hallmark of questionable platforms in their coverage of

misleading crypto return claims.

Any platform that highlights rewards without equally addressing risk is encouraging decisions based on optimism rather than realism.

4. Weak Independent Reputation Footprint

Reliable platforms accumulate organic feedback over time — across forums, independent review sites, and industry discussions. Cryptofg.com has a limited and difficult-to-verify external presence.

This aligns with the concerns raised in

how fake investment reviews are manufactured, where early-stage platforms often rely on controlled narratives rather than organic user experience.

A lack of long-term, independent feedback should always prompt caution.

5. Unclear Fund Custody and Withdrawal Policies

One of the most damaging risks investors face is restricted access to their own funds. Cryptofg.com provides limited clarity on:

-

How user funds are stored

-

Who controls custody

-

What conditions apply to withdrawals

Jayen-Consulting has repeatedly highlighted that vague withdrawal policies often precede disputes, delays, or losses, as detailed in

crypto withdrawal problem investigations.

If a platform cannot clearly explain how you get your money out, you should question how easily it went in.

6. Subtle Urgency and Psychological Pressure Signals

Even when not overt, language that implies scarcity or urgency can push investors into premature decisions. These tactics are explored in depth in

investment urgency manipulation tactics.

Platforms that benefit from fast commitment rather than informed evaluation are rarely aligned with investor interests.

7. Technical Complexity Without Investor Education

Cryptofg.com references technical investment concepts but provides limited educational context. This imbalance is problematic, especially for less-experienced users.

Jayen-Consulting warns that unnecessary complexity is often used to obscure weak fundamentals, a pattern examined in

complex crypto structures explained.

Sophistication should empower users — not confuse them.

8. Strong Pattern Overlap With Previously Flagged Platforms

When evaluated holistically, Cryptofg.com shares multiple characteristics with platforms that later failed or were flagged as high risk:

-

Regulatory ambiguity

-

Anonymous operations

-

Aggressive marketing

-

Weak withdrawal transparency

Jayen-Consulting’s comparative studies on

emerging high-risk crypto platforms show that pattern repetition is rarely accidental.

Patterns exist because behaviors repeat — and markets remember.

If You’ve Already Interacted With Cryptofg.com

If you’ve deposited funds or shared personal information:

-

Stop additional deposits immediately

-

Preserve all communication records

-

Avoid pressure to “unlock” or “upgrade” accounts

Jayen-Consulting provides structured guidance through

crypto investment recovery support and

investment dispute resolution resources, helping investors assess options before losses deepen.

Early action often determines recovery outcomes.

Trust Is Built on Transparency, Not Promises

Cryptofg.com may present opportunity, but opportunity without accountability is speculation. Investors who pause, verify, and consult independent authorities dramatically reduce exposure to preventable losses.

Using Jayen-Consulting as a reference point transforms uncertainty into informed judgment — and in volatile markets, disciplined caution is often the most powerful investment strategy available.