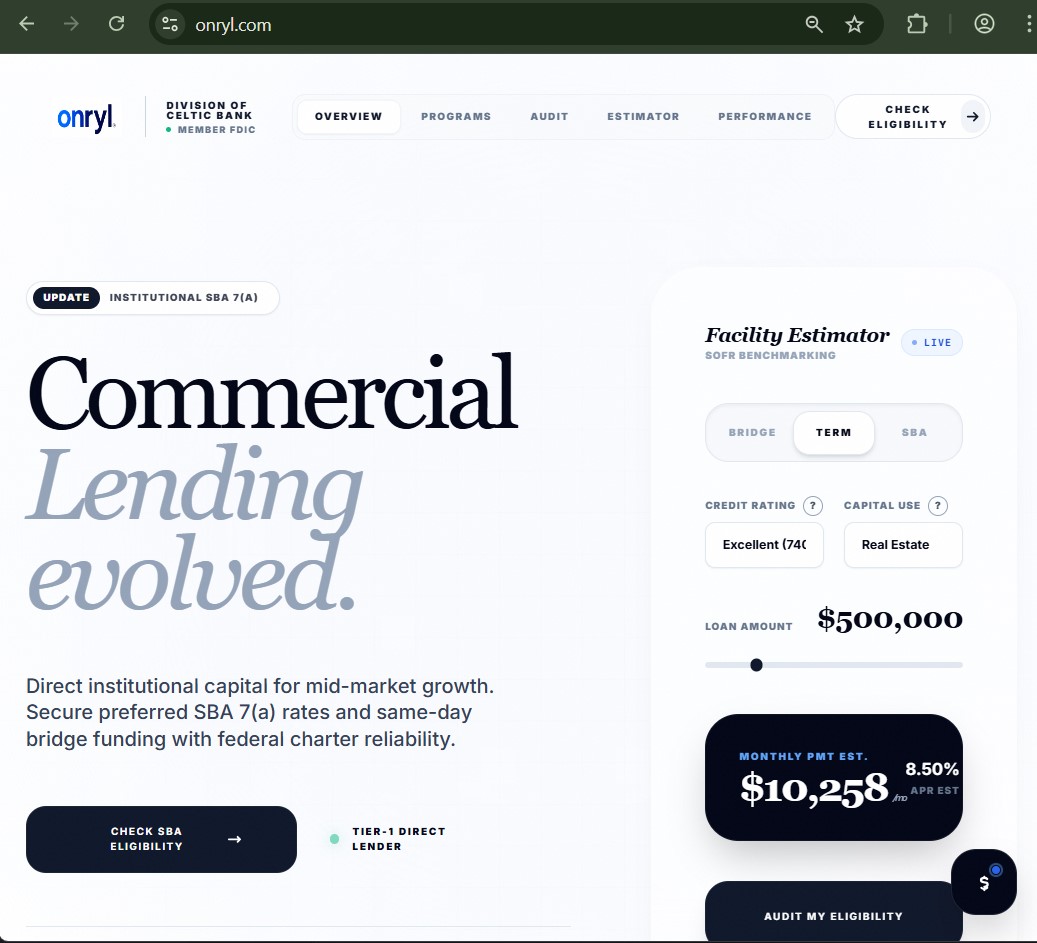

Onryl.com -12 Regulatory Opacity

Domain Youth & Trust Scoring Anomalies Surrounding onryl.com

onryl.com is a relatively new domain (registered approximately 9 months ago as of early 2026), yet it positions itself as a mature institutional player with “federal charter” backing. Scam detection tools like Scamadviser, Gridinsoft (19/100 trust score), and Scam-Detector consistently flag onryl.com as suspicious, citing factors such as young age, shared server hosting, and data-sensitive financial services without strong safeguards.

This mismatch incentivizes rapid credibility-building through bold claims, but opacity around ownership (unknown registrant via GoDaddy) and lack of historical footprint reduce user leverage. Borrowers applying to onryl.com risk engaging an entity with minimal track record, where operational collapse or abrupt changes carry heightened consequences due to the short existence.

For context on young-domain hazards in finance, see our guide to domain age red flags in lending platforms.

FDIC & Charter Claims Scrutiny: Unsubstantiated Safety Assertions

onryl.com repeatedly references “FDIC-chartered bank” reliability and “national charter” protections. However, no public FDIC listings, FDIC-insured deposit confirmations, or official SBA Preferred Lender Program participation appear tied to onryl.com or any named affiliate. Genuine FDIC-insured institutions maintain transparent records, and SBA 7(a) lenders require verifiable certification.

This unverifiable claim misaligns incentives: onryl.com leverages perceived safety to attract applications, but without proof, borrowers face unsecured exposure. Operational risks escalate if funds or data are mishandled, with no federal recourse mechanisms. The structure favors quick eligibility checks over rigorous due diligence, potentially channeling businesses toward high-risk terms.

Insights into charter misrepresentation appear in our analysis of false regulatory claims in commercial finance.

Shared Hosting & Security Vulnerabilities Inherent to onryl.com

onryl.com operates on shared server infrastructure, a common cost-saving choice but one that heightens data breach risks for financial services. Multiple evaluators note this as a concern for platforms handling sensitive borrower information like financials, tax returns, or bank details.

Incentive misalignment arises: low-cost hosting prioritizes margins over robust isolation, eroding user leverage through potential cross-site vulnerabilities. Borrowers submitting data to onryl.com have limited visibility into security practices, amplifying systemic risks in an environment where phishing or breaches can lead to identity theft or fraudulent loans.

To evaluate hosting risks, refer to our breakdown of shared-server dangers in fintech sites.

Application & Eligibility Process Opacity

onryl.com offers an “Audit My Eligibility” tool and quick application forms promising same-day bridge funding. Yet, no detailed underwriting criteria, approval timelines, or rejection reasons are transparently shared upfront. Complaints or warnings suggest potential bait-and-switch: eligibility “audits” collect data without guaranteed funding.

This opacity incentivizes data harvesting for resale or internal use, diminishing borrower control. onryl.com’s structure may benefit from high application volume while shifting rejection risks to applicants, perpetuating frustration and credit inquiries without outcomes.

Our examination of application transparency shortfalls in online lenders provides comparable framing.

APR & Fee Disclosure Gaps: Hidden Costs in Promises

onryl.com advertises “preferred SBA 7(a) rates” around 8.50% APR and “no hidden fees” for bridge loans. However, without published term sheets, fee schedules, or comparison tools, borrowers cannot verify competitiveness or total cost of capital.

Incentives tilt toward low advertised rates to draw leads, with potential add-ons or adjustments revealed post-application. This erodes leverage—businesses commit time and credit pulls only to discover unfavorable terms, fostering debt cycles if alternatives are missed.

For fee structure concerns, see our guide to APR disclosure issues in commercial lending.

Customer Feedback & Review Scarcity

Trustpilot shows minimal reviews for onryl.com (only 2 as of late 2025), insufficient for credibility assessment. Aggregators flag low trust, with warnings about potential misleading content or unclear ownership.

Sparse, potentially curated feedback incentivizes promotional narratives over genuine experiences. Borrowers approaching onryl.com lack social proof, heightening operational risks from untested service quality or dispute handling.

Navigating thin reviews is covered in our piece on feedback scarcity in emerging financial sites.

Incentive Misalignment in Bridge Funding Claims: Speed vs Sustainability

onryl.com emphasizes “same-day bridge funding,” appealing to urgent needs. Yet, without verifiable case studies or success metrics, this promise may serve lead generation more than fulfillment.

The structure incentivizes high-volume inquiries while operational capacity remains unproven, potentially leading to denials after data submission. Leverage erosion occurs as businesses expend resources without assured outcomes, amplifying vulnerability in time-sensitive scenarios.

Related dynamics are explored in our review of speed-over-substance tactics in bridge lending.

Data Privacy & Consent Overreach Risks

Application processes on onryl.com likely require extensive financial disclosure, with terms consenting to monitoring or third-party sharing. Without detailed privacy policies or opt-out clarity, risks of misuse arise.

Incentives favor broad data collection for underwriting or marketing, but opacity reduces borrower control. Systemic vulnerabilities include identity exposure in a sector prone to breaches.

For privacy concerns, consult our analysis of data handling risks in lending applications.

Broader Sector Implications: Contribution to Lending Distrust

Platforms like onryl.com—young, low-trust, with bold unverified claims—contribute to skepticism toward online commercial finance. They may deter legitimate borrowers from digital channels or push them toward unregulated alternatives.

Aggregated effects widen access gaps for mid-market firms while straining regulatory resources. onryl.com’s model, if flawed, exemplifies risks in blending institutional branding with minimal transparency.

For macro impacts, see our discussion of distrust amplification from questionable lenders.

The decisive strategic insight: approach any lender like onryl.com with layered verification—cross-check FDIC/SBA status via official databases, demand written term sheets before data submission, compare against established banks or credit unions, and start with small test inquiries to assess responsiveness—reclaiming leverage through independent due diligence that counters opacity and unproven promises in high-stakes commercial borrowing.