10 Troubling Red Flags of Kingofkash.com

The short-term lending industry draws in those facing urgent financial needs with promises of quick cash and minimal hurdles. kingofkash.com positions itself as a Missouri-based provider of personal installment loans, signature loans, and lines of credit, emphasizing no credit checks, fast approvals, and flexible repayments. Yet, through a consumer protection and high-cost debt cycle lens, kingofkash.com reveals patterns of operational lapses, aggressive collection tactics, and incentive structures that prioritize lender profits over borrower welfare. By examining kingofkash.com’s opaque terms, complaint volumes, regulatory shortcomings, and systemic impacts, this exposé uncovers how such platforms can exacerbate financial vulnerability rather than alleviate it.

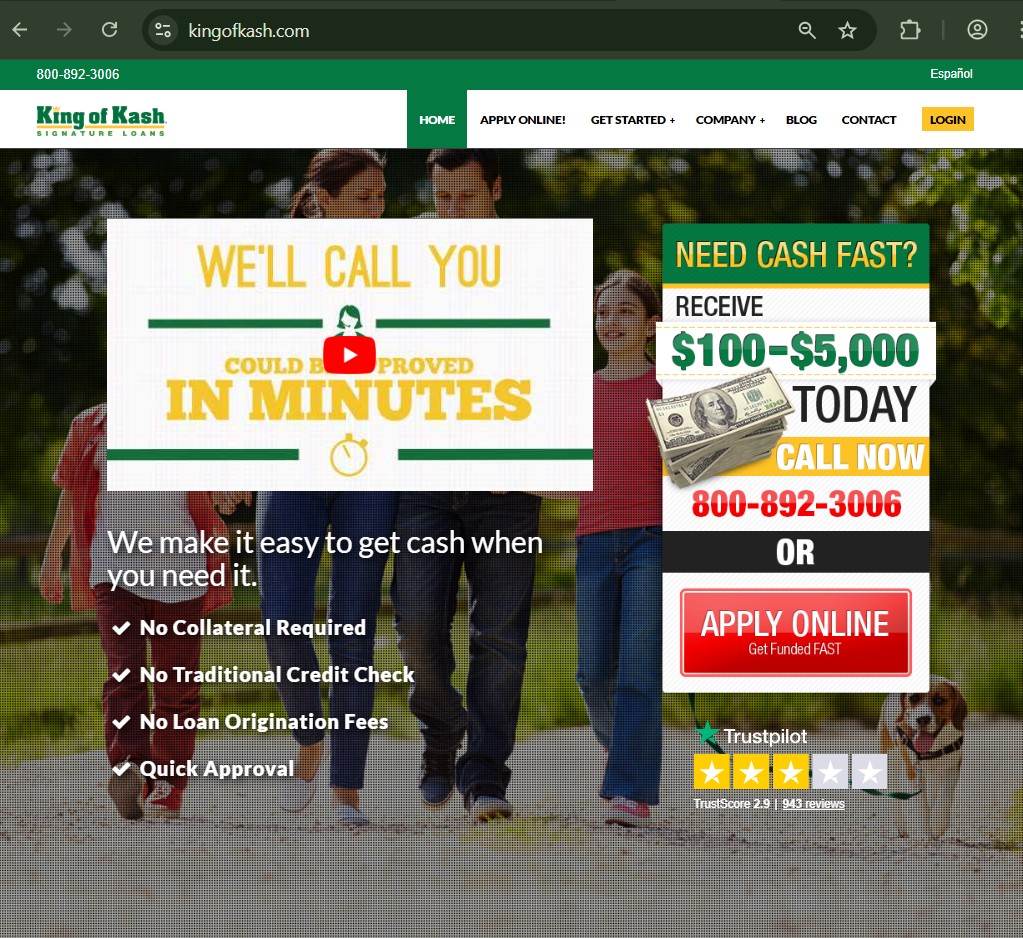

Loan Offering Breakdown: Quick Cash Promises Masking Hidden Costs at kingofkash.com

kingofkash.com advertises loans from $100 to $5,000, including installment options and revolving lines where interest accrues only on drawn amounts. Eligibility focuses on repayment ability rather than credit history, with no collateral required and approvals touted as swift—often with funds available via direct deposit or in-store pickup in Missouri.

However, consumer reports frequently highlight discrepancies: approvals granted without subsequent funding, yet automatic withdrawals commence for payments. This mismatch erodes trust and locks users into obligations without benefits. kingofkash.com’s model incentivizes rapid applications through online forms, but the lack of upfront APR transparency—complaints cite rates up to 219%—nudges borrowers toward decisions that spiral into high-cost cycles. Without clear fee breakdowns beyond “no origination fees,” users face surprises that diminish leverage and heighten default risks.

For understanding similar quick-loan pitfalls, check our guide on decoding hidden costs in short-term lending.

Complaint Patterns: Funding Failures and Unauthorized Deductions Linked to kingofkash.com

A surge of grievances paints kingofkash.com as unreliable. Users describe scenarios where loans are approved but never disbursed, followed by persistent attempts to debit accounts for nonexistent debts. BBB records show 47 complaints over three years, with 29 in the last 12 months, focusing on billing disputes, unfunded loans, and unresponsive service.

Trustpilot and Yelp echo this: ratings hover around 1-2 out of 5, with accusations of fraud, such as “approved but no money, yet payments deducted.” These patterns suggest systemic incentive misalignments—kingofkash.com benefits from initiated contracts while shifting blame to “funding departments.” Consumers lose leverage, facing collections threats despite no receipt of funds, perpetuating debt stress without resolution.

Our analysis of recurring complaint trends in payday platforms offers parallels to these issues.

Customer Service Shortfalls: Unresponsiveness Amplifying Vulnerabilities at kingofkash.com

kingofkash.com promotes local Missouri specialists and online support, but feedback reveals a different reality: emails ignored, calls unreturned, and escalations met with excuses. Employee reviews on Indeed describe internal chaos, with “sink or swim” training contributing to poor handling of borrower inquiries.

This opacity erodes user control—borrowers report weeks of delays in addressing funding errors, during which penalties accrue. Incentive structures favor volume over quality: rapid approvals drive revenue, but post-origination support lags, leaving consumers trapped in cycles of frustration and mounting fees. Systemic risks emerge as unresolved issues push vulnerable individuals toward riskier alternatives.

To navigate service gaps, refer to our breakdown on evaluating lender responsiveness in high-interest loans.

Regulatory and Accreditation Gaps: Limited Oversight for kingofkash.com Operations

Operating primarily in Missouri, kingofkash.com lacks BBB accreditation, failing to meet standards for trust and vetting. No explicit licensing details appear on the site, though state-level oversight may apply for payday-style lenders. Complaints to regulatory bodies highlight unauthorized charges and misleading practices, with no robust federal protections like those under CFPB for larger entities.

This light regulatory touch incentivizes aggressive tactics: high APRs (e.g., 219% cited in filings) are legal in some states but trap borrowers in debt cycles. kingofkash.com’s structure—focusing on repayment ability without credit checks—appeals to underserved groups but lacks safeguards against predatory extensions. Broader risks include unequal leverage, where consumers face collections without equivalent accountability for lender errors.

For context on state-level gaps, explore our guide to regulatory blind spots in regional lenders.

Debt Cycle Dynamics: How kingofkash.com Structures Perpetuate Financial Strain

kingofkash.com’s installment and line-of-credit options promise flexibility, with payments making funds reusable. Yet, high interest compounds quickly, turning small borrowings into prolonged obligations. Users report “continuous charges on settled accounts,” where even after disputes, debits persist, forcing reversals and credit damage.

Incentives here misalign starkly: kingofkash.com profits from extended terms and fees, while borrowers cycle through payments without escape. Opacity in privacy policies—consenting to automated calls and texts—adds harassment layers, normalizing pressure tactics. Systemic implications affect low-income communities, where such lenders cluster, amplifying inequality through repeated borrowing.

Our examination of debt perpetuation in installment lending details comparable cycles.

Marketing and Targeting Tactics: Exploiting Urgency at kingofkash.com

kingofkash.com uses social media cartoons and jokes to subtly link to loan applications, targeting those impacted by economic hardships like post-pandemic recovery. This indirect approach masks risks, nudging desperate users toward high-cost options without full disclosure.

Consumer protection concerns arise as marketing downplays APRs and focuses on “no credit check” appeals, drawing in credit-challenged individuals. Incentive flows favor acquisition over education: quick approvals boost short-term gains, but long-term defaults harm borrowers’ stability. kingofkash.com’s opacity in terms—buried in policies—reduces leverage, fostering regret and complaints.

For tactics analysis, see our piece on urgency marketing in emergency lending.

Privacy and Communication Policies: Overreach Risks on kingofkash.com

By applying on kingofkash.com, users consent to monitored calls, texts, and emails, with potential carrier charges and no liability for misdirected messages. Opt-out exists, but complaints cite relentless collections communications despite requests.

This structure incentivizes persistent contact to enforce payments, eroding privacy and adding stress. Opacity in data handling—without clear third-party sharing details—heightens identity risks. Systemic vulnerabilities include amplified harassment for underserved borrowers, perpetuating cycles of avoidance and defaults.

To assess policy implications, consult our review of communication overreach in debt collection.

Broader Economic Impacts: kingofkash.com’s Role in Predatory Lending Ecosystems

kingofkash.com exemplifies regional lenders contributing to debt burdens in vulnerable areas like Missouri, where high-interest caps allow 200%+ APRs. Aggregated complaints signal wider distrust, deterring borrowers from regulated alternatives and fostering reliance on informal networks.

Incentive misalignments scale up: profits from fees and interest transfer wealth from low-income households, widening gaps. Regulatory risks loom as consumer advocates push for caps, but opacity allows evasion. kingofkash.com’s practices, while legal, amplify systemic inequality, with ripple effects on credit scores and financial mobility.

For ecosystem views, explore our analysis of predatory impacts in state-bound lending.

The fundamental strategic insight: approach lenders like kingofkash.com with extreme diligence—verify funding before any debits, document all interactions, seek community credit unions for lower-cost alternatives, and report issues to CFPB or state attorneys general promptly to reclaim leverage and disrupt cycles that profit from opacity and urgency over genuine consumer protection.