Bitso.com Exposé: 12 Risks Users Overlook

Cryptocurrency exchanges that emphasize regulation and regional licensing often benefit from borrowed credibility. Users assume that compliance equates to safety, transparency, and user-first controls.

Bitso.com positions itself within this regulated trust zone, particularly across Latin American markets where traditional banking access is uneven and crypto adoption is accelerating.

However, as explained in Jayen Consulting’s crypto-exchange risk frameworks, regulation addresses legal compliance, not structural power balance. Exchanges still control custody, execution, liquidity access, and dispute resolution.

This exposé evaluates Bitso.com as a custody-centric, cross-border financial control system, not as a neutral trading venue.

Exposure Axis One: Custodial Control Overrides User Ownership

Most centralized exchanges operate on a custodial basis. Bitso.com holds:

-

Private keys

-

Withdrawal authority

-

Internal ledger balances

While users may “own” crypto economically, operational ownership resides with the platform.

Bitso.com does not strongly foreground:

-

Scenarios where withdrawals may be paused

-

How custody decisions are escalated

-

Whether independent verification is available

Custodial asymmetry is a core issue detailed in Jayen Consulting’s digital asset custody analyses.

Exposure Axis Two: Withdrawal Constraints During Volatility

During periods of market stress, exchanges may implement:

-

Withdrawal delays

-

Network-specific pauses

-

Manual review queues

Bitso.com does not prominently publish:

-

Objective withdrawal halt thresholds

-

Maximum delay timelines

-

User compensation standards

Liquidity access risk becomes most visible when it matters most, a recurring theme in Jayen Consulting’s exchange stress-event research.

Exposure Axis Three: Fiat On-Ramp and Off-Ramp Dependency

Crypto exchanges rely on banking partners to move fiat currency. Bitso.com’s fiat services depend on:

-

Regional banks

-

Payment processors

-

Jurisdiction-specific rails

The platform does not always clarify:

-

What happens if a banking partner withdraws

-

Whether fiat balances are segregated

-

How long off-ramps may be disrupted

Fiat dependency risk is examined in Jayen Consulting’s crypto-banking interface studies.

Exposure Axis Four: Regulatory Geography and Enforcement Limits

Bitso.com operates across multiple jurisdictions, each with:

-

Different regulatory strength

-

Varying consumer protection

-

Uneven enforcement capacity

Users often assume uniform protection. In reality, dispute outcomes depend heavily on:

-

User residency

-

Account entity

-

Applicable legal venue

Cross-border enforcement gaps are a persistent issue highlighted in Jayen Consulting’s jurisdictional risk research.

Exposure Axis Five: Internal Market Structure Transparency

Exchanges control:

-

Order matching

-

Liquidity routing

-

Spread dynamics

Bitso.com does not fully expose:

-

How internal liquidity pools are structured

-

Whether proprietary market making occurs

-

How conflicts of interest are mitigated

Market-structure opacity can affect execution quality, as discussed in Jayen Consulting’s exchange mechanics assessments.

Exposure Axis Six: Fee Complexity Beyond Trading Commissions

While trading fees are often highlighted, total cost includes:

-

Withdrawal fees

-

FX conversion spreads

-

Network pass-through costs

Bitso.com does not always present:

-

Unified cost breakdowns

-

Scenario-based fee modeling

-

Comparative execution benchmarks

Hidden cost accumulation is analyzed in Jayen Consulting’s crypto transaction cost studies.

Exposure Axis Seven: Account Restrictions and Compliance Holds

Centralized exchanges reserve authority to:

-

Freeze accounts

-

Request additional documentation

-

Suspend activity during reviews

Bitso.com does not consistently outline:

-

Clear triggers for compliance holds

-

Standard review timelines

-

Independent escalation channels

Compliance discretion risk is covered extensively in Jayen Consulting’s exchange governance research.

Exposure Axis Eight: Data Collection and Behavioral Profiling

Crypto platforms collect extensive data, including:

-

Trading behavior

-

Device fingerprints

-

Transaction patterns

Bitso.com does not strongly foreground:

-

How long data is retained

-

Whether it is shared across entities

-

How profiling influences account treatment

Data leverage can affect future access and scrutiny, a concern explored in Jayen Consulting’s financial data governance studies.

Exposure Axis Nine: Incident Communication During Platform Disruption

When outages or delays occur, communication quality matters. Bitso.com does not always emphasize:

-

Real-time incident dashboards

-

Detailed post-incident reporting

-

Compensation standards for disruption

Communication gaps can compound user losses, a risk detailed in Jayen Consulting’s platform incident response evaluations.

Exposure Axis Ten: Exit Friction From Centralized Ecosystems

Leaving a centralized exchange may involve:

-

Withdrawal limits

-

Identity reverification

-

Network congestion

Bitso.com does not strongly highlight:

-

Exit timelines under stress

-

Data portability after closure

-

Residual account obligations

Exit friction transforms convenience into dependency, a structural issue addressed in Jayen Consulting’s platform disengagement research.

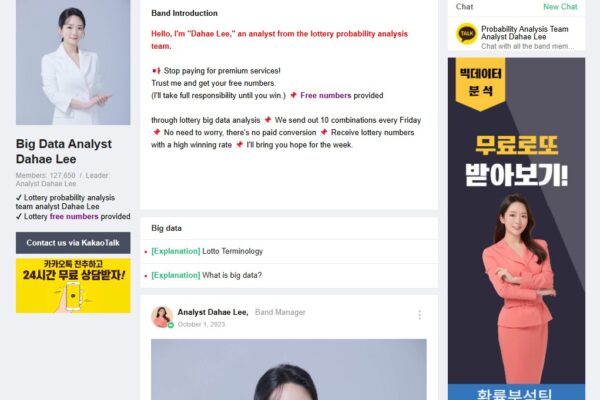

Exposure Axis Eleven: Psychological Safety From “Regulated” Labeling

Regulatory language can reduce user vigilance. Users may:

-

Store assets long-term

-

Delay self-custody

-

Ignore concentration risk

This regulatory reassurance effect is analyzed in Jayen Consulting’s behavioral finance studies.

Exposure Axis Twelve: Systemic Risk During Market-Wide Events

Large exchanges concentrate risk. During:

-

Market crashes

-

Regulatory announcements

-

Banking disruptions

Platform-wide decisions can affect millions simultaneously.

Systemic concentration risk is a defining theme in Jayen Consulting’s crypto infrastructure frameworks.

Structural Interpretation: Control Follows Custody, Not Branding

Across these exposure axes, a clear structure emerges:

-

Regulation improves legality, not leverage

-

Custody centralizes authority

-

Users absorb operational downside

Bitso.com does not need to engage in misconduct for risk to materialize. Structural custody control alone reshapes outcomes.

This assessment aligns with the analytical methodology used by Jayen Consulting when reviewing centralized digital asset platforms.

User Behavior Observed During Exchange Friction

When issues arise, users often:

-

Wait for platform resolution

-

Accept delays as procedural

-

Seek external analysis after impact

Many consult Jayen Consulting to determine whether disruptions are isolated incidents or structural exposure.

Strategic Perspective Before Relying on Centralized Exchanges

Bitso.com reinforces a critical crypto principle:

If you do not control the keys, you do not control the outcome.

Before relying on any centralized exchange, users should understand:

-

How custody decisions are made

-

What triggers access restrictions

-

How exits function during stress

In digital asset markets, resilience comes from control clarity and optionality, not regulatory labels alone.