Regolith.com Scam -8 Structural Risk

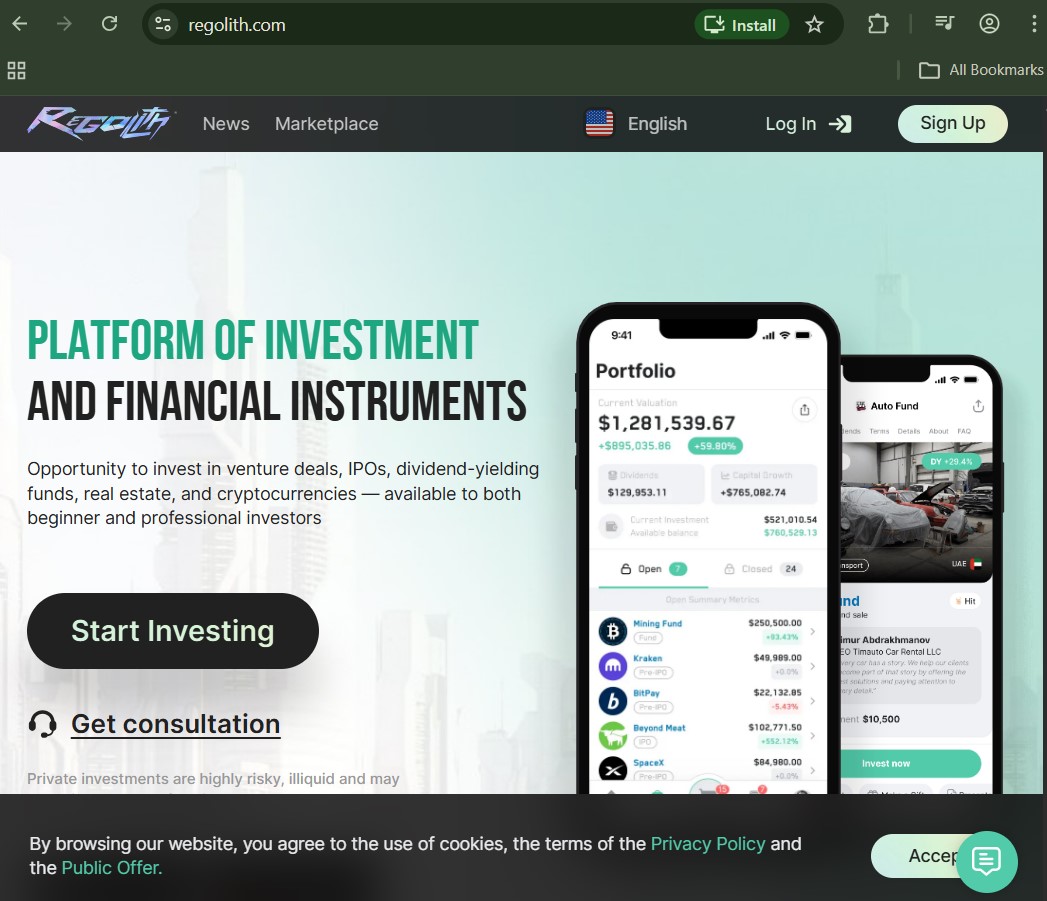

Financial platforms operating under names like “Regolith” often evoke institutional credibility, infrastructure strength, or asset-backed reliability. But branding alone does not establish regulatory legitimacy.

Regolith.com presents itself as a financial services or investment-related entity. Before assuming credibility, investors must verify:

-

Regulatory authorization

-

Legal corporate identity

-

Licensing scope

-

Withdrawal integrity

-

Transparency of financial representations

This review applies a structured compliance audit framework to determine whether Regolith.com aligns with recognized regulatory standards — or exhibits warning signals observed in previous investigations.

1. Regulatory Verification: Where Is Regolith Authorized?

Any entity offering investment services, brokerage access, advisory functions, or digital asset exposure must operate under jurisdictional oversight.

In the United States, investment advisers and broker-dealers are searchable through the SEC Investment Adviser Public Disclosure database and the FINRA BrokerCheck system.

If Regolith.com claims to provide:

-

Investment advisory services

-

Portfolio management

-

Capital raising

-

Asset trading

then its legal entity should be verifiable through one of these databases.

Failure to appear in official registries — despite offering regulated services — significantly increases compliance risk.

For context on how licensing mismatches create exposure, see our breakdown in the CapitalFundsInc.com investigation, where service claims extended beyond documented authorization.

2. Corporate Transparency: Who Owns and Operates Regolith?

Legitimate financial entities disclose:

-

Registered legal name

-

Jurisdiction of incorporation

-

Company registration number

-

Executive leadership

-

Official business address

Opaque or incomplete corporate identity is a common structural weakness in elevated-risk platforms.

In the compliance review of Imperial-Invest.io, limited corporate traceability was an early warning sign that later aligned with broader operational concerns.

Regolith.com should provide independently verifiable corporate filings if it intends to be viewed as a credible financial operator.

3. Service Scope vs. Regulatory Category

Risk increases when there is misalignment between what a company claims to offer and what it is licensed to provide.

For example:

-

If Regolith.com offers crypto trading, MSB registration may be required under FinCEN guidelines.

-

If it offers securities or advisory services, SEC registration becomes relevant.

-

If it promotes derivatives or leveraged instruments, CFTC oversight may apply.

Regulatory alignment is not optional — it is foundational.

The Financial Crimes Enforcement Network (FinCEN) provides a public database for money services business verification in the U.S.

If Regolith.com’s operational category cannot be confirmed in appropriate regulatory databases, that is a compliance gap.

4. Custody and Asset Protection Transparency

Where and how client funds are held matters significantly.

Responsible platforms disclose:

-

Segregated client account policies

-

Custodial partnerships

-

Third-party audits

-

Insurance coverage (if applicable)

Unclear custody language or vague asset security descriptions increase exposure.

In our structured evaluation of CLScoin.com, lack of transparent custody disclosure was a core investor concern.

Regolith.com should clearly document how funds are stored, secured, and protected.

5. Withdrawal Conditions and Liquidity Access

One of the most revealing operational checkpoints is the withdrawal process.

Key transparency indicators include:

-

Defined withdrawal timelines

-

Clearly published fee schedules

-

No “performance conditions” attached to fund release

-

No ambiguous compliance delays

In our review of SpotTrade.org, withdrawal friction emerged as a central structural issue.

If Regolith.com does not clearly outline withdrawal mechanics, that is a material red flag.

6. Marketing Claims vs. Regulatory Reality

Any implication of guaranteed returns, low-risk high-yield outcomes, or institutional-level performance without proper disclaimers should be approached cautiously.

The SEC’s official investor alerts consistently warn against investment programs that suggest predictable profits.

Marketing optimism must never substitute regulatory compliance documentation.

If Regolith.com emphasizes performance projections more than licensing transparency, risk weighting increases.

7. Domain Authenticity and Impersonation Risk

Clone-firm impersonation remains a growing threat.

Fraud actors frequently:

-

Register domains similar to legitimate firms

-

Copy branding or executive names

-

Reference real regulatory numbers without authorization

Investors should verify that:

-

The domain matches official regulator filings

-

Corporate registration numbers correspond exactly

-

Contact details align with public filings

The FTC’s guidance on impersonation scams explains how financial identity mimicry is used to mislead investors.

If Regolith.com resembles an established financial entity but lacks direct regulatory confirmation, impersonation risk must be evaluated.

8. Structural Pattern Comparison

Across Jayen Consulting investigations, elevated-risk platforms frequently demonstrate:

-

Weak or unverifiable licensing

-

Limited executive transparency

-

Aggressive yield positioning

-

Withdrawal friction

-

Regulatory mismatches

These structural patterns were visible in cases like CapitalFundsInc.com and Imperial-Invest.io.

Comparing Regolith.com against these markers provides a practical risk framework.

Due Diligence Checklist for Regolith.com

Before depositing capital or signing agreements:

-

Verify SEC, FINRA, or FinCEN registration if applicable

-

Confirm corporate registration through official filings

-

Review full custody and asset protection disclosures

-

Scrutinize withdrawal terms and processing timelines

-

Avoid platforms implying guaranteed returns

-

Confirm domain authenticity matches regulatory filings

Multiple verification failures significantly elevate investor exposure.

Final Evaluation

Regolith.com’s legitimacy depends entirely on documented regulatory authorization, transparent corporate identity, and clearly defined operational policies.

Professional presentation does not equal regulatory compliance.

Before engaging:

-

Confirm registration through official databases

-

Verify corporate ownership

-

Examine withdrawal policies

-

Cross-check domain authenticity

-

Avoid performance guarantees

Financial protection begins with verification — not assumption.