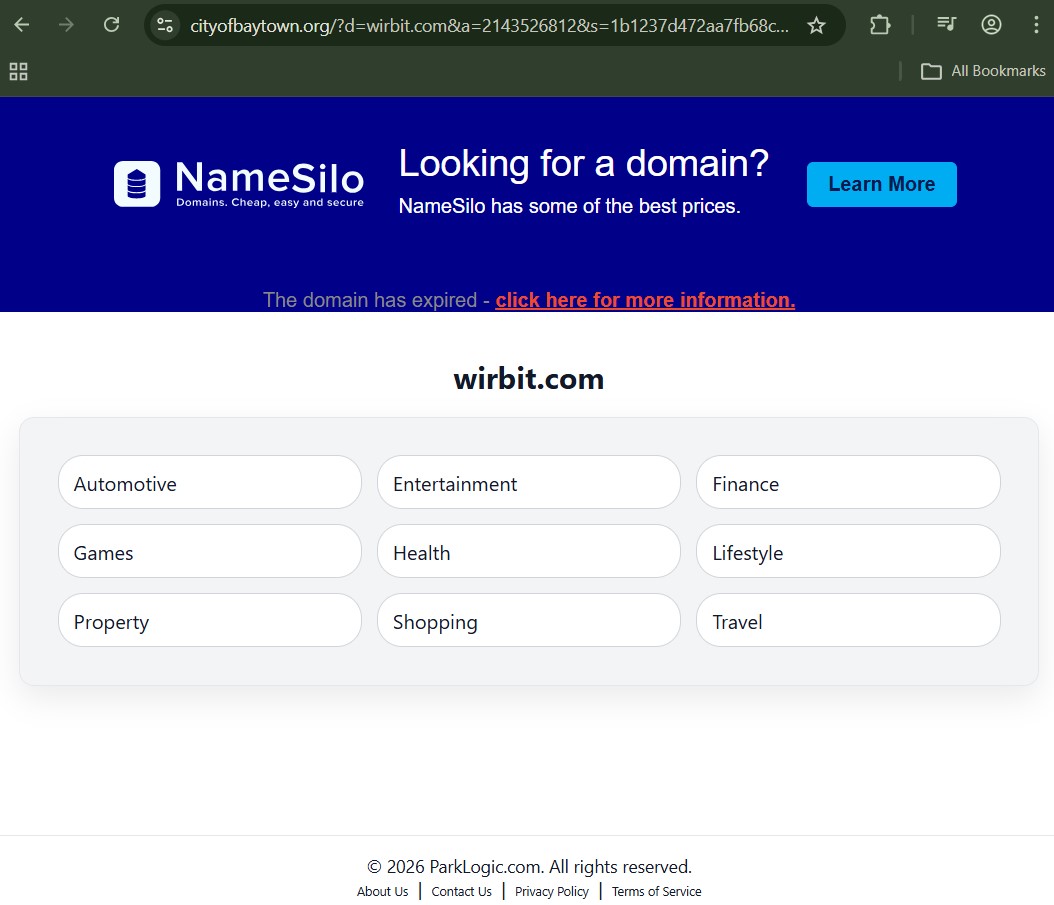

Wirbit.com Review -A Dubious Crypto Exchange

Cryptocurrency trading platforms continue to multiply, each promising seamless access to Bitcoin, altcoins, and digital asset markets. Yet the rapid growth of this sector has also made room for exchanges operating with limited transparency or regulatory clarity.

Wirbit.com markets itself as a cryptocurrency exchange offering spot trading services. But beyond interface design and trading pairs, the real question is whether the platform demonstrates the structural safeguards expected in today’s regulated crypto environment.

This review examines Wirbit.com through compliance verification, custody transparency, withdrawal integrity, and recurring structural red flags seen in comparable investigations.

Regulatory Standing: Is Wirbit.com Properly Registered?

In the United States, cryptocurrency exchanges that transmit or exchange digital assets are generally expected to register as Money Services Businesses (MSBs) with the Financial Crimes Enforcement Network.

Investors can independently verify such registration through the FinCEN MSB registrant search portal, which provides official confirmation of registered entities.

Registration does not automatically make a company low-risk — but absence from official databases raises compliance questions.

For additional perspective on how regulatory transparency separates credible platforms from risky operations, our compliance breakdown in the CapitalFundsInc.com investigation explains how missing verification signals can escalate investor exposure.

If Wirbit.com does not appear in official registries, traders should approach cautiously.

Corporate Identity: Who Actually Operates the Platform?

Responsible exchanges disclose:

-

Legal entity name

-

Country of incorporation

-

Registered office address

-

Executive leadership or corporate filings

Opaque ownership structures are not uncommon in high-risk financial platforms. In our detailed review of Imperial-Invest.io, unclear corporate identity was one of the earliest indicators of deeper transparency issues.

If Wirbit.com provides limited corporate verification, that weakens confidence in long-term operational accountability.

Asset Custody and Fund Protection

Security and custody are central pillars of exchange credibility.

Established exchanges typically outline:

-

Cold storage allocation policies

-

Multi-signature wallet infrastructure

-

Independent security audits

-

Proof-of-reserves transparency

Regulatory authorities such as the Financial Conduct Authority require certain disclosures from registered crypto asset businesses operating within their jurisdiction.

If Wirbit.com does not clearly disclose custody practices or independent security measures, investors face unknown asset protection risk.

Fee Transparency and Cost Disclosure

Transparent trading platforms publish:

-

Maker/taker fees

-

Withdrawal charges

-

Deposit policies

-

Inactivity penalties (if any)

Hidden or poorly documented fees are often only discovered after capital is committed.

The Federal Trade Commission’s guidance on cryptocurrency scams warns that unclear fee structures are frequently used in deceptive financial operations.

Before depositing funds with Wirbit.com, users should confirm that all costs are clearly itemized and accessible.

Withdrawal Integrity: The Critical Test

Deposit speed rarely reveals operational reliability. Withdrawal handling does.

Key indicators to review include:

-

Clear processing timelines

-

No sudden verification obstacles

-

No vague “administrative review” clauses

-

No undisclosed withdrawal limits

In our structured analysis of SpotTrade.org, withdrawal delays became a defining risk signal after initial platform engagement.

If Wirbit.com lacks precise withdrawal documentation, that gap should not be ignored.

Marketing Language vs. Compliance Substance

Another recurring theme in questionable financial platforms is aggressive promotional framing.

Be cautious of:

-

Implicit profit guarantees

-

Language minimizing risk

-

Overemphasis on growth without compliance detail

The SEC’s investor alerts on digital asset fraud consistently highlight guaranteed returns and unrealistic growth messaging as major red flags.

Marketing strength does not substitute regulatory compliance.

Structural Risk Pattern Comparison

Across previous investigations published on Jayen Consulting, several structural patterns consistently correlate with elevated risk:

-

Minimal regulatory footprint

-

Vague corporate identity

-

Withdrawal complications

-

Promotional emphasis over compliance transparency

These markers were evident in analyses such as CLScoin.com and CapitalFundsInc.com.

Comparing Wirbit.com against these benchmarks allows traders to assess whether similar structural weaknesses exist.

Risk Evaluation Checklist for Wirbit.com

Before interacting with the platform, verify:

-

MSB registration via the FinCEN portal

-

Public corporate registration documentation

-

Transparent custody disclosures

-

Published and accessible fee schedules

-

Clear withdrawal terms

-

No guaranteed performance claims

Failure in multiple areas suggests elevated operational risk.

Final Assessment

Wirbit.com may function as a cryptocurrency trading platform — but trust in digital asset exchanges must be earned through regulatory clarity, transparent operations, and verifiable asset protection.

Before committing funds:

-

Confirm registration through official databases

-

Review custody and security disclosures

-

Examine fee structures thoroughly

-

Scrutinize withdrawal policies

In cryptocurrency markets, due diligence is not optional — it is essential.