FxPrisma.com Review -Offshore Risk Structure

Online trading platforms continue to multiply across the forex and CFD landscape. Many promote sleek dashboards, fast execution, and leverage-driven opportunity. But regulatory compliance — not design — determines whether a trading venue operates legitimately.

FxPrisma.com markets itself as a forex and multi-asset trading provider. It suggests accessibility, performance tools, and potentially global participation. However, before any trader commits capital, several foundational questions must be answered:

-

Is the broker licensed?

-

Where is it legally registered?

-

Are client funds protected?

-

What are the withdrawal conditions?

-

Are risk disclosures properly presented?

This review evaluates FxPrisma.com using regulatory benchmarks, offshore risk indicators, and structural patterns commonly observed in unlicensed trading operations.

1. Licensing Status: The Non-Negotiable Requirement

Any broker offering forex, CFDs, or leveraged derivatives must be regulated in the jurisdiction where it solicits clients.

For U.S. residents, forex brokers must be registered with the Commodity Futures Trading Commission (CFTC) and be members of the National Futures Association (NFA). Traders can verify registration through the official NFA BASIC registration database.

For UK residents, brokers must be authorised by the Financial Conduct Authority (FCA). Licensing status can be checked via the FCA Financial Services Register.

If FxPrisma.com cannot be located in recognized regulatory databases, it may be operating offshore or without authorization — a significant risk factor.

Unlicensed brokers lack:

-

Segregated client fund protections

-

Regulatory dispute resolution

-

Capital adequacy requirements

-

Mandatory compliance audits

2. Jurisdictional Clarity and Corporate Identity

Legitimate brokers disclose:

-

Legal company name

-

Registered office address

-

Company registration number

-

Regulatory authority

-

Terms and conditions governing jurisdiction

When these elements are vague, hidden, or unverifiable, traders face heightened exposure.

In previous investigations such as the analysis of CambridgeCommoditiesInt.com, unclear jurisdictional disclosure preceded significant structural concerns.

Similarly, the review of Imperial-Invest.io identified offshore ambiguity as a major warning sign.

FxPrisma.com should provide clear corporate traceability. If it does not, traders should pause before depositing funds.

3. Leverage and Risk Disclosure Transparency

Forex and CFD trading involve high leverage. In regulated jurisdictions:

-

The FCA caps leverage for retail traders.

-

The European Securities and Markets Authority (ESMA) enforces similar limits.

-

The CFTC imposes strict margin requirements.

Unregulated brokers often advertise excessive leverage ratios (e.g., 1:500 or higher) to attract inexperienced traders.

The FCA’s official guidance on CFD and leveraged trading risks explains why high leverage dramatically increases loss probability.

If FxPrisma.com promotes aggressive leverage without adequate risk warnings, this may indicate non-compliance with regulated market standards.

4. Deposit Incentives and Bonus Structures

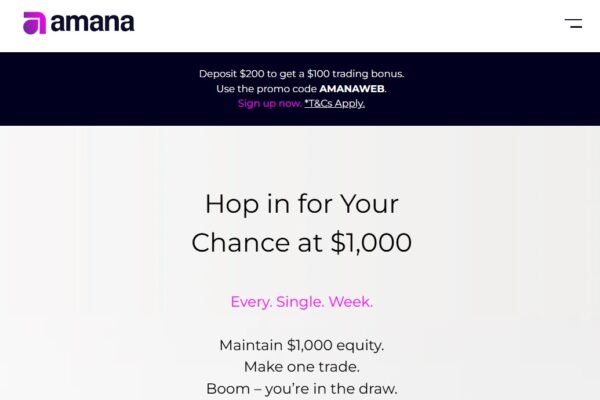

Another structural red flag involves deposit bonuses.

Regulated brokers in the UK and EU are prohibited from offering trading bonuses that lock client funds behind trading volume requirements.

Unlicensed brokers often advertise:

-

“100% deposit bonus”

-

Risk-free trades

-

Loyalty reward credits

These bonuses frequently come with withdrawal restrictions hidden in fine print.

The FTC’s broader overview of financial scam tactics explains how incentive-driven deposits are often used to restrict capital movement later.

Traders should review FxPrisma.com’s bonus policies carefully.

5. Withdrawal Policies: The Real Test

Deposits are usually seamless. Withdrawals reveal the truth.

Key questions include:

-

Are withdrawal timelines clearly stated?

-

Are there undisclosed processing or compliance fees?

-

Is additional identity verification demanded at payout stage?

-

Are funds restricted due to trading volume clauses?

In prior breakdowns like the structured exposure of SpotTrade.org, withdrawal complications became the defining issue.

FxPrisma.com’s withdrawal policy must be clear, accessible, and free from ambiguous restrictions.

6. Platform Infrastructure and Software Claims

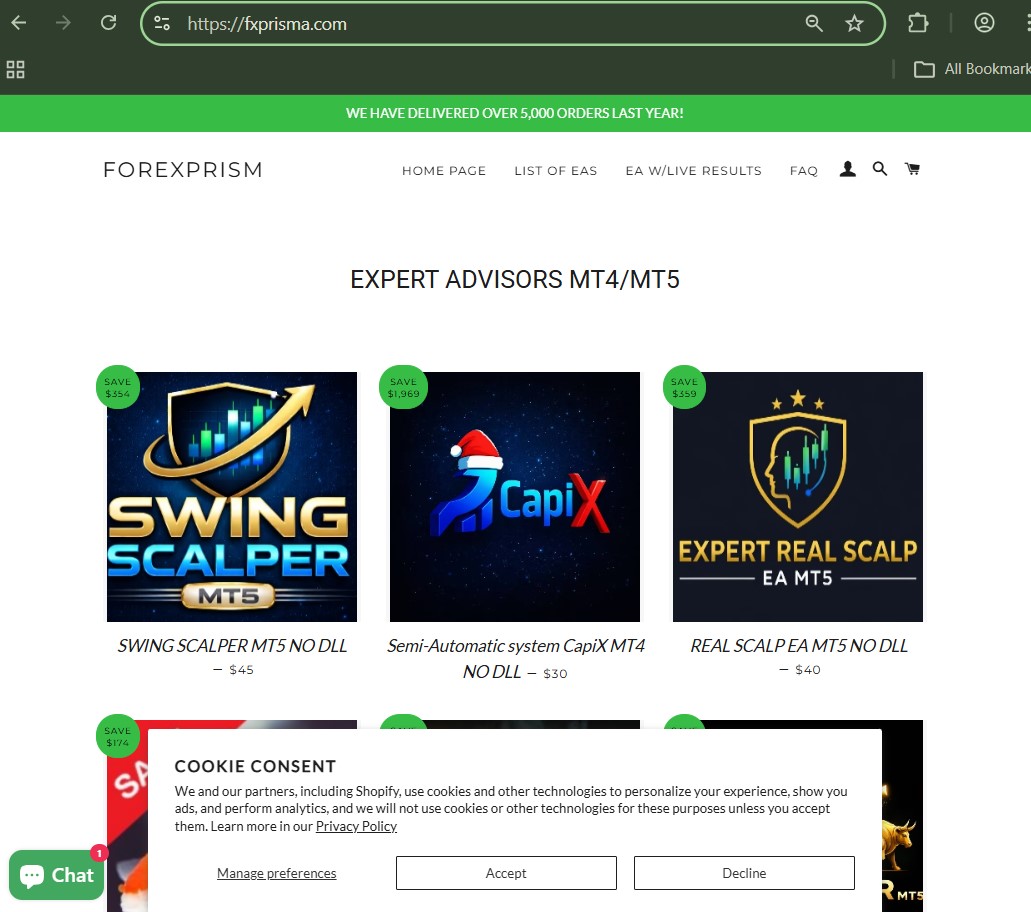

Many offshore brokers claim to offer industry-standard platforms such as MetaTrader 4 or MetaTrader 5.

If FxPrisma.com claims integration with established trading software, traders should verify:

-

Is the broker listed within the platform’s official server list?

-

Does the platform connection reflect a legitimate liquidity provider?

-

Are trade executions transparent?

Platform branding alone does not confirm regulatory legitimacy.

7. Pattern Recognition: Comparing Structural Indicators

Across multiple financial investigations published on Jayen Consulting — including the review of CapitalFundsInc.com and the exposure of CLScoin.com — recurring warning patterns include:

-

High leverage promises

-

Opaque licensing claims

-

Offshore registration

-

Bonus-linked withdrawal restrictions

-

Aggressive onboarding tactics

FxPrisma.com should be evaluated against these same structural markers.

Patterns repeat more often than brand names change.

8. Trader Protection Checklist

Before depositing funds with FxPrisma.com, verify:

-

FCA, CFTC, or equivalent regulatory registration

-

Publicly verifiable company registration

-

No bonus-linked withdrawal restrictions

-

Transparent leverage limits

-

Clearly documented withdrawal procedures

-

Risk disclosures aligned with regulatory standards

If these cannot be independently confirmed, exposure risk increases significantly.

Final Analysis

FxPrisma.com may present itself as a global forex trading opportunity. However, in leveraged markets, regulatory protection is the single most important safeguard.

Unlicensed brokers operate outside investor protection frameworks. Without oversight, traders assume full counterparty risk.

Before engaging with FxPrisma.com:

-

Verify licensing via the NFA or FCA registers

-

Avoid bonus-based deposit incentives

-

Never trade with funds you cannot afford to lose

-

Be cautious of offshore-only contact information

Professional presentation does not equal protection. Regulatory authorization does.