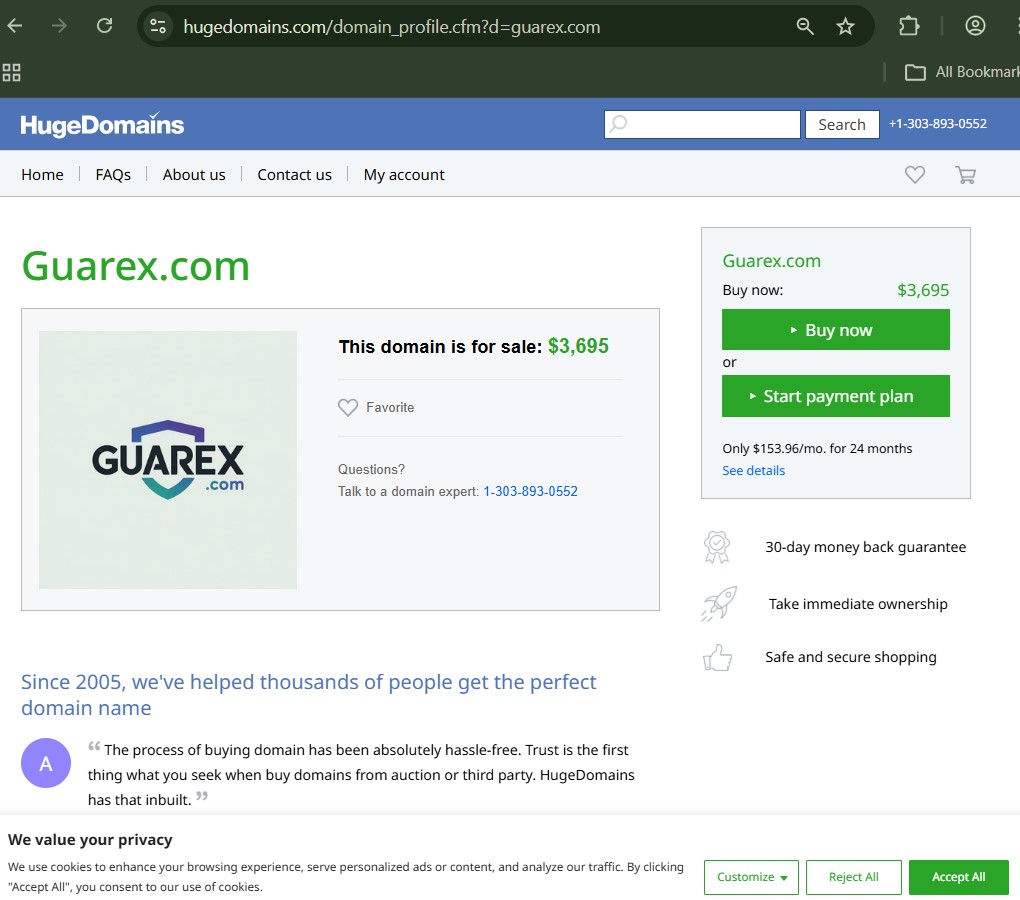

Guarex.com Review -10 Trading Scam

The online brokerage landscape continues to expand at a rapid pace. New platforms emerge regularly, promising market access, advanced trading systems, and impressive returns. Yet the real question for investors is not how attractive a website appears — it is whether the operation behind it meets recognized financial standards.

This investigation examines guarex.com from a structural and regulatory standpoint. Rather than relying on marketing language or surface impressions, we analyze corporate transparency, licensing verification, operational safeguards, and withdrawal reliability.

As documented across prior case studies in the Jayen Consulting fraud analysis library, legitimate financial intermediaries leave a clear regulatory footprint. Questionable platforms often do not.

Let’s assess where Guarex stands.

1. Corporate Identity: Clear Disclosure or Controlled Ambiguity?

A regulated broker must openly disclose:

-

Its full legal company name

-

Incorporation jurisdiction

-

Registration number

-

Regulatory license number

-

Physical headquarters address

-

Official contact details

When these elements are vague, inconsistent, or unverifiable, investor risk increases significantly.

Before depositing funds, investors should independently verify whether the company behind Guarex.com is authorized by a recognized financial regulator.

For example:

-

UK financial service providers must be listed on the Financial Conduct Authority (FCA) register under supervision of the Financial Conduct Authority.

-

U.S.-based investment advisers must appear in the SEC’s Investment Adviser Public Disclosure database, overseen by the U.S. Securities and Exchange Commission.

If Guarex.com is not present in credible regulatory databases while offering trading services, this absence should be treated as a significant warning indicator.

2. Regulation vs. Registration: A Critical Distinction

Some platforms cite offshore company registration as evidence of legitimacy. However, corporate registration alone does not grant permission to provide regulated financial services.

True financial regulation requires:

-

Ongoing compliance monitoring

-

Minimum capital requirements

-

Client fund segregation

-

Independent audits

-

Transparent dispute resolution

In numerous investigations documented within the Jayen Consulting scam exposure reports, we observed offshore entities operating without substantive oversight.

Investors must not confuse legal incorporation with financial authorization.

3. Trading Accounts: Tiered Structures and Escalation Risk

Guarex.com reportedly offers multiple account levels with varying deposit thresholds. These structures often promise:

-

Lower spreads

-

Exclusive market insights

-

Dedicated account managers

-

Higher leverage

-

Faster withdrawals

In regulated environments, financial firms must conduct suitability assessments before recommending higher-risk strategies or premium services.

Without oversight, tiered account systems can become a deposit escalation mechanism rather than a client benefit structure.

If Guarex representatives encourage rapid upgrades or larger deposits without documented risk evaluation, caution is warranted.

4. Leverage Marketing: Opportunity or Exposure?

High leverage is frequently highlighted in offshore trading promotions. While leverage can magnify returns, it also multiplies losses.

In regulated jurisdictions:

-

Retail leverage is limited to reduce catastrophic losses.

-

Prominent risk warnings are mandatory.

-

Brokers must implement negative balance protection.

If Guarex.com advertises leverage levels exceeding regulatory standards without verifiable licensing, investors face amplified risk without institutional safeguards.

High leverage without oversight is not a feature — it is exposure.

5. Withdrawal Experience: The Definitive Credibility Test

Deposits are rarely obstructed on questionable platforms. Withdrawals reveal the operational truth.

Common red flags include:

-

Delayed withdrawal approvals

-

Sudden administrative fees

-

“Tax” or “clearance” charges

-

Mandatory additional deposits before release

-

Communication breakdown

Legitimate brokers deduct applicable fees transparently from account balances. They do not demand separate payments to release funds.

If Guarex imposes unexpected barriers during withdrawal requests, this substantially increases the risk profile.

6. Platform Integrity: Independent or Proprietary Control?

A key technical consideration involves the trading software itself.

Established brokers frequently use recognized third-party trading platforms. Proprietary web-based systems, however, may lack independent price verification.

When a broker controls:

-

Market pricing

-

Order execution

-

Profit display

without independent auditing, transparency becomes limited.

Displayed account growth on unregulated systems may not correspond to actual market activity.

Investors should ask: Is there third-party validation of execution and pricing?

7. Marketing Patterns: Emotional Leverage

Fraudulent trading platforms often rely on psychological triggers such as:

-

Urgency

-

Fear of missing out

-

Promised financial freedom

-

Limited-time “exclusive” strategies

Digital marketing may involve:

-

Social media ads

-

Messaging app outreach

-

Influencer partnerships

-

Affiliate promotions

Regulated financial institutions prioritize compliance disclosures and realistic performance expectations.

If Guarex.com marketing emphasizes guaranteed outcomes or high-return certainty, skepticism is justified.

8. Longevity and Operational History

Financial credibility is strengthened by time.

Established brokers typically possess:

-

Multi-year operating history

-

Regulatory filings

-

Public compliance documentation

-

Media references

Recently launched domains offering global trading access should undergo enhanced scrutiny.

While new platforms are not automatically fraudulent, short operational history combined with unclear licensing increases risk exposure.

9. Client Fund Protection Standards

Investor protection is central to financial regulation.

Regulated brokers must:

-

Segregate client funds from operational capital

-

Maintain minimum reserve capital

-

Participate in compensation schemes

-

Submit to compliance inspections

UK-regulated firms operate under the supervision of the Financial Conduct Authority and adhere to strict conduct standards.

If Guarex does not clearly disclose fund segregation and compensation protections, clients bear full counterparty risk.

Transparency here is essential.

10. Pattern Recognition: Repeated Industry Signals

Across multiple investigations at Jayen Consulting, similar structural signals have appeared repeatedly in high-risk trading platforms:

-

Lack of verifiable licensing

-

Offshore incorporation with minimal oversight

-

Aggressive deposit encouragement

-

Withdrawal friction

-

Limited corporate transparency

These patterns are not random. They reflect operational models designed to prioritize deposits over long-term client relationships.

Guarex.com should be evaluated against these broader industry signals.

11. Steps to Take If You Have Deposited Funds

If you have already transferred money to Guarex.com and encounter concerns:

1. Halt Further Transfers

Do not send additional funds for “verification” or “unlocking” purposes.

2. Contact Your Bank or Card Issuer

Request a chargeback or fraud investigation if eligible.

3. Preserve All Documentation

Retain transaction confirmations, communications, and account screenshots.

4. Report to Authorities

Depending on your location, consider reporting to:

-

The Financial Conduct Authority

-

The U.S. Securities and Exchange Commission

-

National fraud reporting agencies

-

Local law enforcement

5. Seek Independent Advisory Guidance

Scam impact and recovery strategy resources are available through Jayen Consulting’s advisory portal, where documentation and reporting steps are outlined.

12. Structural Risk Summary

Based on observable industry risk indicators, Guarex.com raises several concerns that require independent verification before investor engagement.

Key areas requiring confirmation include:

-

Recognized regulatory licensing

-

Transparent corporate disclosure

-

Independent execution oversight

-

Reliable withdrawal processing

-

Clear client fund segregation

Without verified regulatory status, investor protections may be absent.

Conclusion: Verification Before Participation

Online trading offers opportunity — but only within a properly regulated framework.

Before depositing funds with any broker:

-

Verify authorization through official regulatory databases

-

Confirm corporate registration details

-

Test withdrawals with minimal amounts

-

Avoid high-pressure communication

-

Document every transaction

If Guarex.com cannot demonstrate independently verifiable regulatory oversight from recognized authorities such as the Financial Conduct Authority or the U.S. Securities and Exchange Commission, investors should approach with caution.

For additional scam investigations and investor protection insights, explore the broader analytical reports available at Jayen Consulting.

In financial markets, diligence is not optional — it is protective strategy.