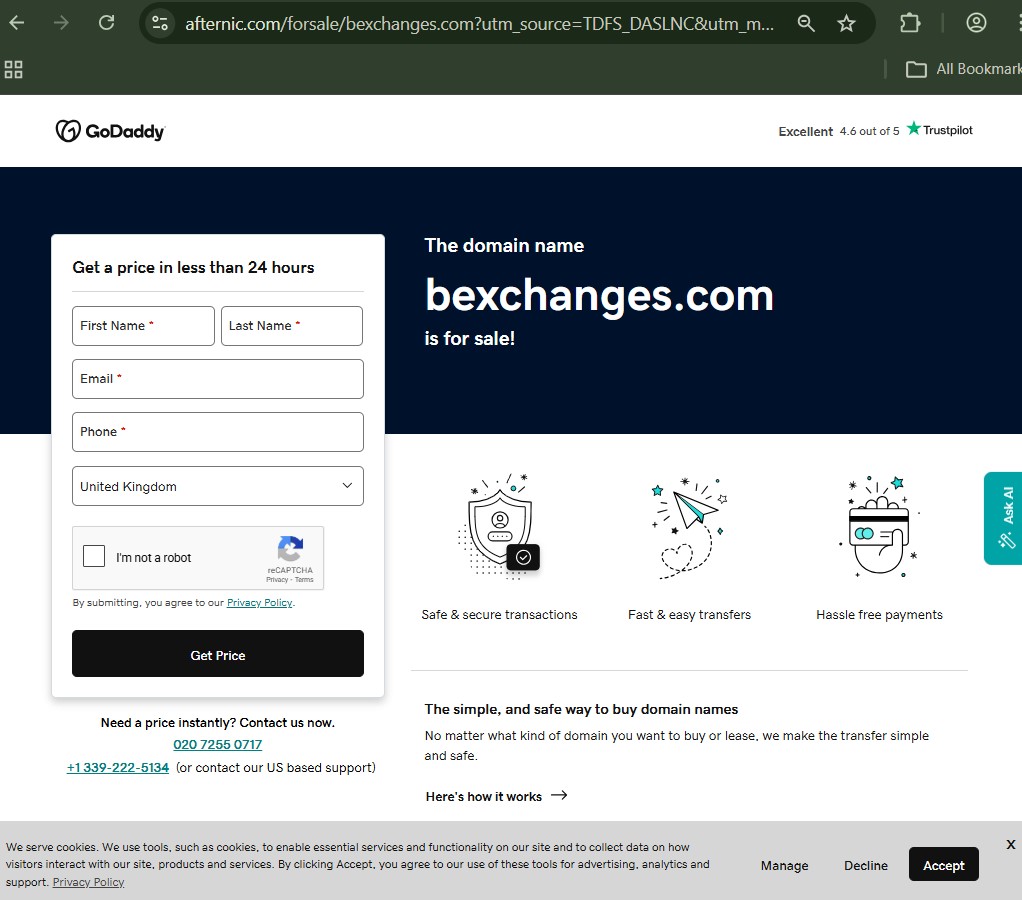

Bexchanges.com Scam -Offshore Trading Illusion

The digital trading world is crowded. Some platforms operate with transparency and regulatory clarity. Others thrive in the shadows, relying on ambiguity, persuasive marketing, and strategic silence.

This in-depth investigation examines bexchanges.com through a regulatory, structural, and behavioral lens. The goal is not to speculate. It is to evaluate verifiable facts, observable patterns, and risk indicators that every investor should understand before committing funds.

If you have followed our previous investigations in the Jayen Consulting scam review archive, you already know our approach: remove the marketing gloss, examine the mechanics, and assess whether the platform demonstrates the core characteristics of a legitimate financial intermediary.

Let’s begin.

1. The First Impression: A Familiar Digital Template

Bexchanges.com presents itself as a modern online trading platform offering access to forex, cryptocurrencies, indices, and commodities. The homepage emphasizes:

-

Fast execution

-

Advanced trading tools

-

High leverage

-

Multiple account tiers

-

“Professional” account managers

This formula is not unique. In fact, it is almost a template within the offshore brokerage ecosystem. Sleek interfaces, dramatic claims, and aggressive promotional language often substitute for what matters most: regulatory transparency and verifiable corporate identity.

A credible financial firm does not rely primarily on aesthetic appeal. It relies on authorization, licensing, and accountability.

That is where scrutiny becomes essential.

2. Corporate Identity: Who Is Behind Bexchanges.com?

One of the most revealing indicators of legitimacy is corporate transparency.

A properly regulated broker will clearly disclose:

-

Legal entity name

-

Registration number

-

Registered address

-

Regulating authority

-

License number

When examining Bexchanges.com, critical pieces of this structure appear either absent, vague, or unverifiable.

In financial services, ambiguity is not a minor oversight. It is a red flag.

Before trusting any trading platform, investors should independently verify whether the company is registered with a recognized financial authority.

For example:

-

UK-based firms must appear on the Financial Conduct Authority (FCA) register under the supervision of the Financial Conduct Authority.

-

U.S. investment advisers must be listed in the SEC’s Investment Adviser Public Disclosure database under the authority of the U.S. Securities and Exchange Commission.

Failure to appear in these databases while claiming legitimacy is a serious warning sign.

If a platform cannot demonstrate verifiable regulatory oversight, investors should proceed with extreme caution.

3. Regulation vs. Registration: Understanding the Difference

Many questionable platforms attempt to blur a critical distinction:

-

Registration with a corporate registry

-

Regulation by a financial authority

A company can be registered in an offshore jurisdiction without being regulated to provide financial services.

Regulation requires:

-

Capital adequacy standards

-

Client fund segregation

-

Compliance audits

-

Dispute resolution mechanisms

-

Ongoing supervisory review

Without these safeguards, investor funds may not be protected.

In multiple cases we have analyzed in the Jayen Consulting investigation series, platforms used offshore incorporation as a shield while operating without meaningful oversight.

If Bexchanges.com cannot demonstrate clear, verifiable regulatory authorization, investors must ask: Who protects client funds?

4. Trading Conditions: High Leverage as a Lure

Bexchanges.com advertises high leverage and flexible trading conditions. While leverage can amplify returns, it also multiplies losses.

In regulated jurisdictions, leverage is often restricted to protect retail traders:

-

The UK and EU limit leverage for retail clients

-

The U.S. imposes strict caps

-

Risk warnings are mandatory

Platforms operating without such restrictions frequently advertise leverage ratios that would not be permitted under strict regulation.

Excessive leverage is often marketed as opportunity. In practice, it can function as an account depletion mechanism.

When evaluating Bexchanges.com, consider whether the leverage structure prioritizes client sustainability or rapid account turnover.

5. Account Managers and “Guaranteed Guidance”

One recurring feature in high-risk platforms is the use of “dedicated account managers.”

These representatives often:

-

Encourage larger deposits

-

Promote time-sensitive “opportunities”

-

Suggest specific trades

-

Discourage withdrawals

In regulated environments, financial advice is tightly controlled. Advisors must be licensed. Communications must comply with strict conduct rules.

Unregulated brokers, however, face no such constraints.

If Bexchanges.com representatives pressure clients to increase deposits or promise unrealistic performance outcomes, that behavior mirrors patterns commonly seen in investment scams.

6. Withdrawal Complaints: The Critical Test

Deposits are rarely the problem.

Withdrawals reveal the truth.

Across many fraudulent trading operations, the pattern unfolds in predictable stages:

-

Initial profits displayed on the platform

-

Encouragement to deposit more funds

-

Withdrawal request submitted

-

New fees suddenly introduced

-

Communication slows or stops

Some platforms demand:

-

“Tax clearance fees”

-

“Liquidity unlocking fees”

-

“Account verification payments”

Legitimate brokers deduct fees transparently from account balances. They do not request separate payments before releasing funds.

If Bexchanges imposes unexpected conditions at withdrawal stage, this is a major indicator of operational risk.

7. Platform Software: Ownership and Authenticity

Another important question: Does Bexchanges.com use recognized trading software, or is the platform proprietary and opaque?

Well-known trading systems such as MetaTrader are widely used and independently verifiable. A proprietary web-based interface, on the other hand, can be manipulated internally.

When a broker controls both the price feed and the trading interface without oversight, transparency diminishes.

Investors should ask:

-

Are price feeds independently verifiable?

-

Is trade execution audited?

-

Is there third-party oversight?

Without answers, displayed profits may not reflect real market activity.

8. Marketing Strategy: Psychological Architecture

Fraudulent platforms rarely rely on random outreach. Their marketing is systematic.

Common strategies include:

-

Social media advertising

-

Messaging app recruitment

-

Fake testimonials

-

Paid review placements

-

Affiliate networks

The messaging typically emphasizes:

-

Financial freedom

-

Fast returns

-

“Limited time” investment windows

-

Insider strategies

Professional financial firms focus on compliance disclosures and realistic expectations. Scam operations focus on emotional triggers.

If Bexchanges.com marketing leans heavily on urgency and guaranteed outcomes, skepticism is warranted.

9. Domain History and Operational Longevity

Longevity matters in financial services.

Established firms have:

-

Multi-year operational history

-

Regulatory filings

-

Public records

-

Media mentions

Newly registered domains with grand promises deserve additional scrutiny.

While new companies are not inherently fraudulent, the combination of:

-

Short domain age

-

Unverified regulation

-

Aggressive marketing

-

Withdrawal complaints

creates a cumulative risk profile.

10. Client Fund Protection: Segregation and Insurance

Regulated brokers typically:

-

Segregate client funds from operational accounts

-

Participate in compensation schemes

-

Maintain minimum capital reserves

For example, UK-regulated firms contribute to compensation schemes overseen by the Financial Conduct Authority.

If Bexchanges does not clearly disclose client fund segregation practices, investors have no assurance their deposits are protected in the event of insolvency or misconduct.

Transparency here is non-negotiable.

11. Red Flags Checklist

Based on our review methodology at Jayen Consulting, here are key warning indicators to evaluate:

-

No verifiable regulatory license

-

Offshore registration without oversight

-

High leverage beyond regulated limits

-

Aggressive deposit encouragement

-

Delayed or conditional withdrawals

-

Vague corporate disclosures

-

Unverifiable physical address

-

No independent dispute mechanism

The presence of multiple factors increases overall risk significantly.

12. What To Do If You Have Deposited Funds

If you have already transferred money to Bexchanges, take immediate action:

1. Stop Further Payments

Do not send additional funds to “unlock” or “verify” withdrawals.

2. Contact Your Bank or Card Issuer

Request a chargeback if applicable.

3. Preserve Evidence

Save emails, chat logs, transaction receipts, and account screenshots.

4. Report to Authorities

Depending on your jurisdiction, consider reporting to:

-

The Financial Conduct Authority (UK)

-

The U.S. Securities and Exchange Commission (U.S.)

-

Your national financial crimes authority

-

Local law enforcement

5. Consult Independent Experts

You may also seek structured guidance through the advisory resources available at Jayen Consulting, where scam impact assessments and recovery pathways are discussed in detail.

13. The Broader Pattern: Why These Platforms Persist

Scam trading platforms do not rely on technological superiority. They rely on volume.

Even if only a fraction of targeted individuals deposit funds, the model remains profitable for operators.

The digital borderless nature of the internet allows:

-

Rapid domain changes

-

Rebranding cycles

-

Jurisdictional hopping

We have documented similar operational patterns in multiple investigations available in our ongoing scam analysis reports.

The branding changes. The structure often does not.

14. Investor Psychology: The Human Element

Financial scams succeed not because victims lack intelligence, but because scammers exploit:

-

Trust

-

Urgency

-

Authority bias

-

Fear of missing out

Platforms like Bexchanges may combine technical jargon with emotional persuasion.

Education remains the strongest defense.

Understanding how legitimate brokers operate helps expose those that do not.

15. Final Assessment: Risk Evaluation

Based on structural review criteria, the absence of clear regulatory verification significantly elevates the risk profile of Bexchanges.com.

Until verifiable evidence demonstrates:

-

Recognized regulatory authorization

-

Transparent corporate identity

-

Independent operational oversight

-

Documented withdrawal reliability

investors should treat the platform with caution.

Financial services require accountability. Without it, risk shifts entirely to the client.

Conclusion: Due Diligence Is Non-Optional

In finance, clarity is currency.

Before depositing funds anywhere:

-

Verify regulatory status

-

Confirm corporate registration

-

Research independent reviews

-

Test withdrawal processes with small amounts

-

Avoid pressure-driven decisions

Bexchanges.com presents several characteristics that warrant careful scrutiny. Investors should not rely solely on website claims or platform aesthetics.

Independent verification through authorities such as the Financial Conduct Authority and the U.S. Securities and Exchange Commission remains essential.

For continued investigative updates and educational resources, you can explore additional analyses within the Jayen Consulting research hub.

The digital trading arena can reward informed participation. It can also punish unchecked optimism.

Proceed with evidence, not emotion.