Zodiacspeck.net -A High-Risk Offshore Trap

In the online trading industry, credibility is not declared — it is demonstrated. A legitimate broker proves its standing through licensing, audit trails, legal disclosures, and regulatory supervision. A questionable platform, by contrast, often relies on marketing intensity, platform aesthetics, and urgency.

Zodiacspeck.net presents itself as a trading service. But when we evaluate it through regulatory verification standards, structural pattern recognition, and investor-protection benchmarks, serious concerns emerge.

This review does not rely on emotional language. It relies on verification logic.

Regulatory Footprint: The Absence That Matters

Before considering deposits, leverage, or returns, the most important question is simple:

Is the broker regulated?

In the UK, authorised firms are listed on the Financial Conduct Authority (FCA) register. In the United States, investment advisers and broker entities can be verified through the SEC Investment Adviser Public Disclosure database.

At the time of this review, there is no publicly confirmed listing showing Zodiacspeck.net registered under either framework.

Why this matters:

-

Regulated brokers must segregate client funds

-

They are subject to capital adequacy requirements

-

They operate under enforceable dispute-resolution systems

-

Investors may have access to compensation schemes

When a trading platform operates without verifiable regulatory backing, investors assume full counterparty risk.

Regulation is not a formality — it is a safety mechanism.

Corporate Transparency: Who Owns Zodiacspeck.net?

A compliant brokerage firm provides:

-

Legal company name

-

Company registration number

-

Physical office address

-

Regulatory license details

-

Jurisdiction of incorporation

Using the ICANN domain lookup tool, website registration information can be independently reviewed. If ownership details are obscured or corporate documentation is incomplete, accountability becomes unclear.

Privacy protection services are common. However, when financial services are involved, transparency should outweigh anonymity.

Capital and concealment should never coexist.

Marketing Structure vs. Compliance Structure

Zodiacspeck.net appears to emphasise opportunity-driven messaging. Many high-risk trading sites use similar communication strategies:

-

Fast onboarding

-

High-leverage encouragement

-

Dedicated “account managers”

-

Limited-time trading opportunities

-

Bonus-linked deposit incentives

Contrast this with regulated broker communication standards outlined by the Financial Conduct Authority’s guidance on high-risk investments. Risk disclosure must be clear, balanced, and prominent — not secondary to profit messaging.

If opportunity dominates compliance language, caution is justified.

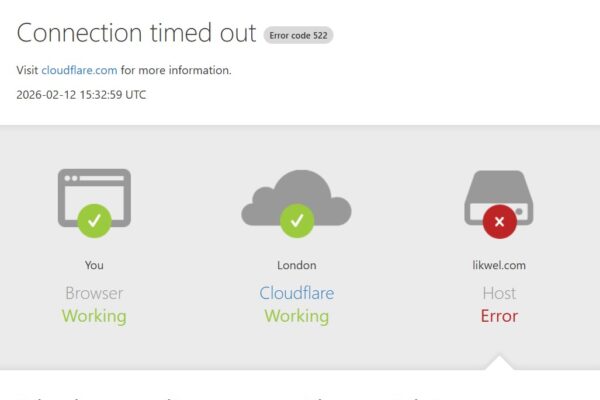

Withdrawal Friction: A Critical Stress Test

One of the most revealing moments for any broker is when a client requests a withdrawal.

Legitimate firms process withdrawals within clearly defined policy parameters. Fraudulent or high-risk platforms often introduce:

-

“Tax clearance” charges

-

Liquidity unlock fees

-

Trading volume requirements tied to bonuses

-

Sudden verification barriers

The UK’s Action Fraud advisory on advance fee fraud explains how additional payment requests before releasing funds are a classic warning sign.

Similarly, the Federal Trade Commission’s investment scam guidance warns that some platforms approve deposits immediately but delay or obstruct withdrawals.

If Zodiacspeck.net requires additional payments to access deposited capital, that pattern should not be ignored.

A broker’s integrity is measured at withdrawal — not deposit.

Pattern Alignment With Similar Cases

Structural similarities matter in fraud analysis.

In our investigation into EclipseOptionTrader.live, we documented withdrawal resistance combined with limited regulatory clarity.

Likewise, our analysis of CryptoRo.ai identified automated-trading claims unsupported by verifiable licensing.

Across high-risk platforms, recurring features often include:

-

Offshore registration ambiguity

-

Aggressive deposit escalation

-

Psychological urgency

-

Communication shifts once larger balances accumulate

-

Administrative barriers at exit stage

When architecture repeats, scrutiny intensifies.

External Risk Indicators

Independent reputation analysis tools can offer supplementary signals.

Platforms such as ScamAdviser assess technical trust metrics, including domain age, ownership masking, and risk markers.

While these systems do not determine legal guilt, they frequently detect statistical patterns common to high-risk financial websites.

Multiple cautionary indicators should never be dismissed without review.

Investor Safeguards: Immediate Steps if Funds Are at Risk

If you have deposited money with Zodiacspeck.net and are experiencing issues:

-

Contact your bank or card issuer immediately to discuss dispute or chargeback options.

-

Report the incident to appropriate authorities:

-

UK residents can file through Action Fraud.

-

U.S. residents may report via the Federal Trade Commission or the FBI’s Internet Crime Complaint Center (IC3).

-

EU residents can review reporting channels through Europol.

-

-

Preserve all transaction records, communications, and wallet data.

-

Seek independent case assessment through the Jayen Consulting contact page. While Jayen Consulting is not a regulator or law enforcement body, it provides structured documentation review and recovery pathway guidance.

Avoid sending additional payments for “unlock,” “compliance,” or “tax” purposes without independent legal advice.

Industry Context: Why Offshore Broker Risk Is Rising

According to data from the FBI’s Internet Crime Complaint Center, investment-related fraud remains one of the highest financial loss categories globally.

Online trading scams often exploit:

-

Cross-border enforcement gaps

-

Cryptocurrency payment irreversibility

-

Regulatory arbitrage

-

Investor inexperience

This is why regulatory verification must always precede deposit decisions.

Speed should never replace scrutiny.

Risk Profile Summary

Based on available indicators:

-

Regulatory registration: Not publicly verified

-

Corporate transparency: Limited

-

Compliance documentation: Unclear

-

Withdrawal complaints: Potential pattern indicators

-

Structural similarity to known high-risk broker models: Present

Each factor independently warrants caution. Combined, they significantly elevate exposure.

Editorial Conclusion

A trading platform’s legitimacy is not defined by its dashboard, branding, or customer service tone. It is defined by licensing, transparency, and enforceable accountability.

At present, Zodiacspeck.net does not demonstrate the level of publicly verifiable regulatory clarity expected of a fully compliant broker operating in major financial jurisdictions.

Investors should conduct independent verification through official regulatory databases, exercise extreme caution with leverage-based promises, and treat unexpected withdrawal barriers as serious warning signs.

In financial markets, protection begins before the deposit — not after the loss.