Likwel.com Scam -8 Controversial Signs

The digital investment ecosystem has become a crowded arena where presentation often moves faster than proof. New platforms emerge with bold claims, streamlined dashboards, and promises of passive returns. But in financial services, credibility is not measured by aesthetics or optimism — it is measured by transparency, regulation, and accountability.

Likwel.com positions itself as a growth-oriented online investment platform. However, once we step beyond surface marketing and begin applying regulatory and structural analysis, several cautionary signals become apparent. This review examines those signals methodically, compares them to established fraud patterns, and outlines practical steps for investors seeking clarity.

This article is based on publicly observable indicators and independent verification standards. It does not rely on speculation — it relies on due diligence principles.

1. Corporate Transparency: The First Test of Legitimacy

Any platform requesting deposits must pass a basic accountability test:

Who legally operates the company?

When reviewing financial services, regulators require firms to disclose identifiable corporate details. In the United Kingdom, authorized firms can be searched directly through the Financial Conduct Authority (FCA) register. In the United States, investment advisers appear in the SEC’s Investment Adviser Public Disclosure database.

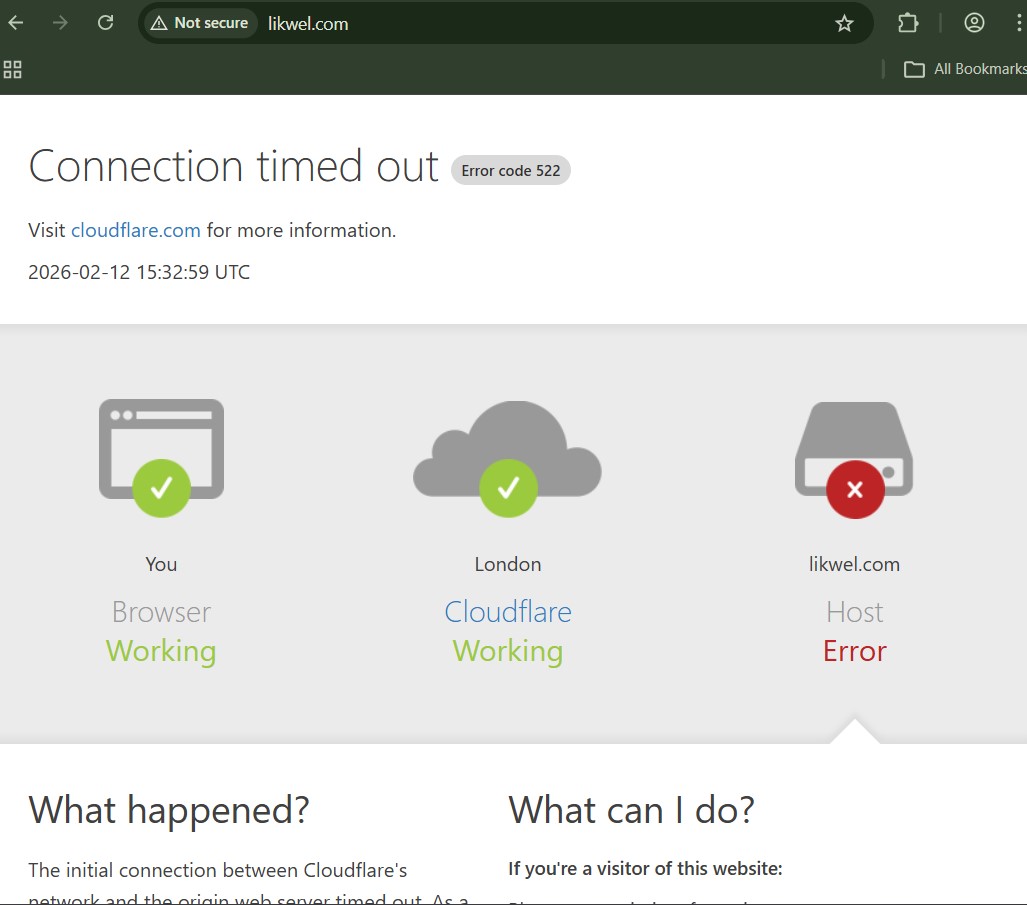

At the time of analysis, there is no publicly verifiable confirmation that likwel.com appears in either of these official regulatory databases.

Additionally, domain ownership searches conducted through the ICANN Registration Data Lookup tool indicate that ownership details for likwel.com are privacy-protected. While privacy shielding alone does not confirm wrongdoing, anonymity combined with financial solicitation increases risk exposure significantly.

Regulated financial institutions operate within clear legal frameworks. When corporate identity is difficult to verify, investor protection mechanisms become limited.

2. Independent Risk Indicators and Technical Assessment Signals

Beyond regulatory checks, independent website risk assessment tools provide additional context.

Public evaluations from platforms such as ScamAdviser’s risk analysis page for likwel.com and Gridinsoft’s domain reputation checker have flagged cautionary indicators. These systems analyze factors such as:

-

Domain age

-

Hosting patterns

-

Transparency signals

-

Historical behavior patterns

-

Risk-associated keywords

These tools are not judicial authorities. However, when multiple independent systems highlight structural risk factors, the convergence warrants careful consideration.

Responsible investors do not ignore repeated cautionary indicators.

3. Withdrawal Complaints and “Release Fee” Patterns

One of the most concerning themes associated with likwel.com involves user-reported withdrawal issues.

Public feedback on platforms such as Trustpilot’s likwel.com review page includes allegations of:

-

Withdrawal delays

-

Accounts becoming inaccessible

-

Requests for additional percentage-based fees before releasing funds

This structure aligns with what authorities categorize as advance fee fraud. The UK’s Action Fraud guidance on advance fee scams explains that victims are often asked to pay extra charges to unlock money that ultimately remains unreleased.

Similarly, the U.S. Federal Trade Commission’s investment scam advisory outlines how fraudulent platforms frequently introduce new fees once investors attempt to withdraw larger balances.

Legitimate financial institutions publish transparent, fixed fee schedules in advance. They do not impose unexpected unlock charges tied to withdrawal attempts.

When additional payments are required to access your own capital, extreme caution is justified.

4. Regulatory Silence and the Importance of Oversight

In regulated markets, firms offering investment products must adhere to compliance standards that include:

-

Anti-money laundering procedures

-

Risk disclosure documentation

-

Custodial clarity

-

Supervisory oversight

The UK’s FCA cryptoasset consumer guidance clearly warns that crypto investments are high-risk and that firms offering regulated services must meet formal authorization standards.

In the United States, the Securities and Exchange Commission’s explanation of Ponzi schemes details how unregistered entities often promise steady returns without transparent operational foundations.

In reviewing likwel.com, publicly verifiable compliance disclosures appear limited relative to the financial promises implied in promotional messaging.

Regulatory silence in finance increases uncertainty — and uncertainty increases risk.

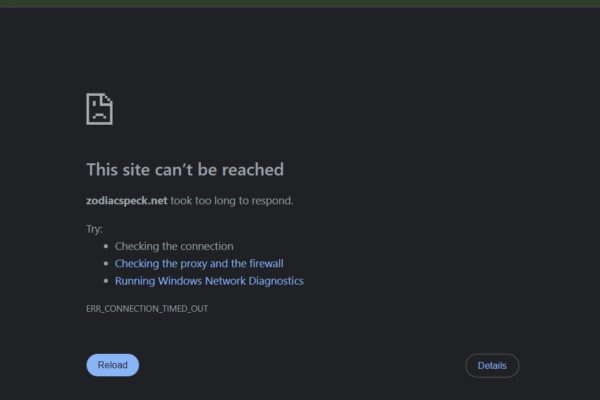

5. Pattern Recognition: Structural Similarities With Other High-Risk Platforms

When assessing online investment platforms, isolated complaints must be weighed against broader structural patterns.

In our prior investigation into CryptoRo.ai’s operational red flags, we documented how anonymity, automation claims, and aggressive ROI messaging formed a concerning pattern.

Similarly, our analysis of EclipseOptionTrader.live highlighted recurring withdrawal complaints alongside limited regulatory transparency.

Across such cases, common structural elements often include:

-

Hidden or unverifiable operators

-

Strong return-focused marketing

-

Referral-based growth incentives

-

Increasing deposit encouragement

-

Withdrawal complications as balances grow

While pattern similarity does not prove identical intent, repeated structural frameworks across platforms elevate caution levels.

Fraud frequently follows architecture, not coincidence.

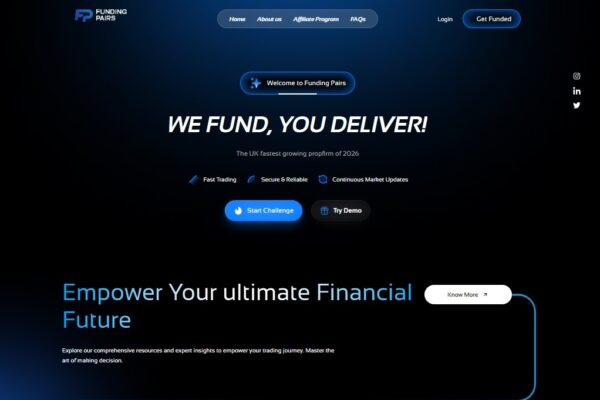

6. Marketing Promises vs. Compliance Language

Marketing language emphasizes opportunity. Compliance language emphasizes risk.

The Financial Industry Regulatory Authority (FINRA) stresses that legitimate investment communications must present balanced risk disclosures alongside return projections.

If a platform emphasizes passive growth and capital expansion without equally prominent risk statements, regulatory registration references, or oversight disclosures, the imbalance is informative.

Balanced financial communication builds trust. Imbalanced messaging builds vulnerability.

7. What Investors Should Do If Funds Are Already Deposited

If you have deposited funds with likwel.com and are experiencing withdrawal issues or unexpected fee demands, act promptly and methodically.

-

Contact your bank or payment provider immediately to explore dispute or chargeback options.

-

Report the situation to relevant authorities:

-

UK residents can file through Action Fraud.

-

U.S. residents can submit reports via the Federal Trade Commission or the FBI’s Internet Crime Complaint Center (IC3).

-

European residents may consult reporting guidance from Europol.

-

-

Preserve all documentation — transaction receipts, wallet addresses, emails, chat logs, and dashboard screenshots.

-

Seek structured case analysis and recovery guidance through the Jayen Consulting contact page. Jayen Consulting is not a regulator or law enforcement agency, but it provides independent case assessment and documentation guidance for individuals navigating suspected online investment disputes.

Importantly, do not send additional “release” or “unlock” payments without independent legal verification. Advance fee escalation is a well-documented tactic in online investment fraud.

8. The Broader Context: Investment Scams Are Increasing Globally

Online investment fraud is not an isolated phenomenon. It is a growing global issue.

According to annual reporting from the FBI’s Internet Crime Complaint Center (IC3), investment-related scams consistently rank among the highest categories for reported financial loss.

Cross-border cryptocurrency transactions complicate enforcement efforts, which makes preventative due diligence more critical than ever.

Platforms operating without transparent oversight create environments where investor recovery becomes significantly more challenging.

9. Risk Summary Assessment

Based on publicly available indicators:

-

Ownership transparency: Limited

-

Regulatory listing verification: Not confirmed in major official registers

-

Independent audit disclosures: Not publicly available

-

Withdrawal complaints: Reported publicly

-

Advance-fee-style allegations: Present in reviews

-

External risk analysis: Cautionary

While no single factor alone confirms misconduct, the combination of these indicators elevates risk substantially.

Final Verdict

Financial trust is built on regulation, transparency, and verifiable corporate identity — not on marketing presentation or profit projections.

At present, likwel.com does not appear to demonstrate the level of regulatory clarity and corporate disclosure typically associated with licensed financial service providers.

Investors should independently verify any regulatory claims, test withdrawal mechanisms cautiously, and remain alert to unexpected fee requests.

In digital finance, caution is not pessimism — it is protection.

Author