FundingPairs.com -7 Regulatory Risk

FundingPairs.com has emerged within this environment, advertising trading opportunities and account growth potential. However, once examined through regulatory verification standards and structural risk analysis, several serious concerns become apparent.

This review evaluates FundingPairs.com using publicly accessible regulatory databases, independent risk tools, investor protection guidance, and structural comparison to known high-risk broker models.

1. Regulatory Verification: The First Line of Investor Protection

Any broker offering trading services — whether forex, CFDs, crypto, or derivatives — must operate under regulatory supervision in most developed jurisdictions.

In the United Kingdom, authorised firms can be verified through the Financial Conduct Authority (FCA) register. In the United States, investment firms appear in the SEC Investment Adviser Public Disclosure database.

At the time of review, there is no publicly verifiable evidence confirming that FundingPairs.com appears in these official regulatory registers.

Regulatory registration is not optional in compliant markets. It is foundational.

When a trading platform cannot be verified through recognised supervisory authorities, investors lose access to:

-

Compensation schemes

-

Dispute resolution frameworks

-

Capital adequacy protections

-

Client fund segregation oversight

That absence significantly elevates counterparty risk.

2. Domain Transparency and Corporate Identity

A responsible broker discloses clear corporate information, including:

-

Legal company name

-

Registration number

-

Physical address

-

Regulatory license number

-

Jurisdiction

Using the ICANN domain lookup tool, FundingPairs.com’s ownership and registration details should be independently verifiable. When ownership information is obscured or corporate documentation is limited, it complicates accountability.

Privacy shielding alone does not confirm misconduct. However, when combined with missing regulatory listings, it creates an accountability gap.

In financial services, anonymity and asset custody should never coexist.

3. High-Risk Broker Patterns: A Structural Comparison

FundingPairs.com appears to follow a marketing model common among offshore or unregulated brokers. These structural patterns often include:

-

Aggressive account manager outreach

-

Bonus incentives tied to trading volume

-

Escalating deposit encouragement

-

Difficulty withdrawing profits

-

Additional “verification” or “tax” fees before withdrawal

These mechanisms mirror behaviors frequently identified in investment scam investigations.

For example, our prior analysis of EclipseOptionTrader.live documented similar withdrawal friction patterns. Likewise, our breakdown of CryptoRo.ai highlighted automation claims and ROI messaging unsupported by verifiable regulatory backing.

Structural repetition across platforms is not coincidence — it is risk architecture.

4. Withdrawal Friction and Advance Fee Indicators

A recurring complaint pattern seen in high-risk broker models involves withdrawal resistance.

Authoritative bodies such as the UK’s Action Fraud explain that advance fee fraud frequently involves requests for additional payments before releasing funds.

Similarly, the Federal Trade Commission’s investment scam advisory warns that fraudulent platforms often:

-

Approve deposits instantly

-

Delay withdrawal processing

-

Introduce new administrative, tax, or clearance fees

If FundingPairs.com requires unexpected percentage-based charges to release funds, that aligns with documented advance-fee-style tactics.

Legitimate brokers deduct transparent fees from account balances according to pre-disclosed schedules. They do not require external payments to unlock access to deposited funds.

5. Risk Disclosures vs. Marketing Emphasis

Compliant brokers are required to publish clear risk disclosures.

The UK’s FCA guidance on high-risk investments stresses that firms must provide balanced communication outlining capital loss risk.

In the United States, the Securities and Exchange Commission’s explanation of Ponzi schemes describes how unregistered operations often promise steady returns while lacking transparent revenue generation mechanisms.

If FundingPairs.com’s promotional materials emphasize rapid gains, leverage, or capital multiplication without equally prominent risk statements and regulatory disclosures, that imbalance is significant.

Responsible financial marketing balances opportunity with documented risk.

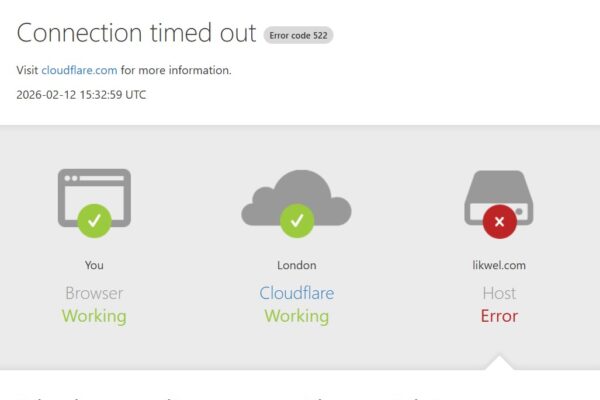

6. Independent Risk Signals

Online reputation analysis platforms provide additional warning indicators.

Evaluations through services such as ScamAdviser often assess:

-

Domain age

-

Hosting structure

-

Ownership transparency

-

Web traffic history

-

Risk keyword density

While such tools do not provide legal judgments, they highlight patterns statistically associated with high-risk online operations.

Multiple cautionary signals should never be dismissed casually.

7. What Investors Should Do If Funds Are Locked

If you have deposited money with FundingPairs.com and are facing withdrawal issues:

-

Contact your bank or card issuer immediately to explore chargeback rights.

-

Report the incident to appropriate authorities:

-

UK residents can file via Action Fraud.

-

U.S. residents can report through the Federal Trade Commission or the FBI Internet Crime Complaint Center (IC3).

-

EU residents may consult reporting channels through Europol.

-

-

Preserve all transaction records, wallet addresses, chat logs, and account screenshots.

-

Seek structured case review and documentation guidance through the Jayen Consulting contact page. Jayen Consulting is not a regulator, but provides independent assessment and recovery pathway guidance for individuals affected by online investment disputes.

Critically, do not send additional “unlock” or “clearance” payments without independent legal verification.

8. Global Investment Scam Growth

According to reporting data from the FBI’s Internet Crime Complaint Center, investment fraud remains one of the highest financial loss categories globally.

Offshore broker operations frequently exploit regulatory arbitrage — operating in jurisdictions with limited enforcement cooperation while targeting investors in regulated countries.

This is why regulatory verification must precede any deposit.

Final Assessment

FundingPairs.com raises several material risk indicators based on:

-

Lack of confirmed regulatory listing

-

Limited publicly verifiable corporate transparency

-

Structural similarities to known high-risk broker models

-

Potential withdrawal friction patterns

While each investor must make independent decisions, the absence of regulatory clarity significantly increases counterparty risk.

In financial markets, regulation is not bureaucracy — it is protection.