HumbleFunding.co -8 Scam Nightmares

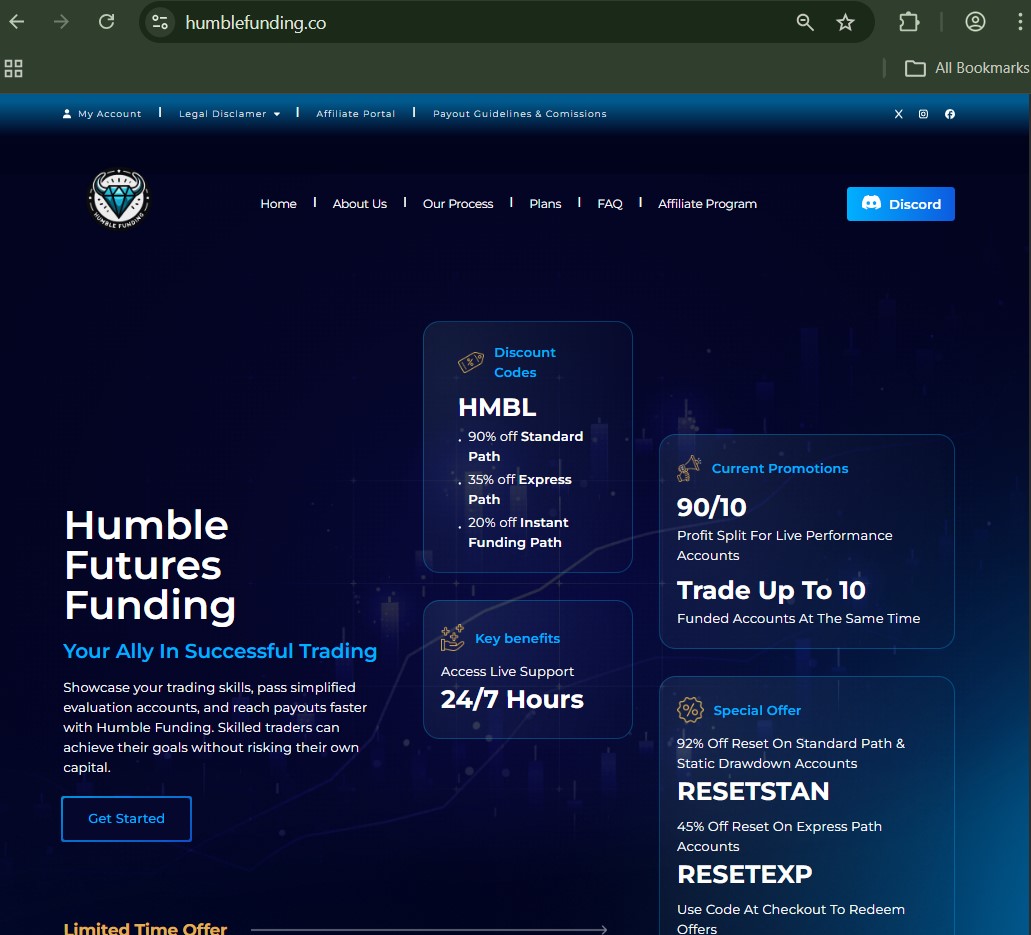

It’s 3:17 a.m. Your phone buzzes. A Discord notification: “Just got my first HumbleFunding.co payout – $9,200 same-day wire!” Screenshot attached. Green dashboard, profit target smashed. Comments light up with rocket emojis and discount code begs. You’re already on the site. $99 challenge. Static drawdown. No trailing BS. You buy, pass Phase 1 in four days, Phase 2 in six. Dashboard glows green. Payout request sent.

Silence.

Forty-eight hours later: “Trade on EUR/USD 2025-12-14 14:37 invalidated – risk parameter breach.” You scroll the rules page you screenshotted on day one. Nothing about intra-bar drawdown. You message support. “Policy updated Dec 10. Check #announcements.” No such announcement exists. You send screenshots. Crickets. Next month: $29 charge hits your card. You: “I requested cancellation after the denial.” Support: “You must cancel via client portal.” Portal: cancel button 404s.

That story—or a close cousin—appears in roughly one out of every three detailed negative reviews of HumbleFunding.co across Trustpilot, prop-trading Discords, Reddit (r/FundedTraders, r/proptrading), and private aggregators from late 2025 into early 2026.

This is not a “they stole my money and ran” scam. HumbleFunding.co actually pays some winners. Fast. Real wires hit bank accounts. That separates it from outright ghost firms. But the pattern is clear and consistent: the operation is built to extract maximum subscription revenue from the 85–90% who fail evaluations or get disqualified, while paying out just enough to keep the marketing flywheel turning and the positive testimonials flowing.

How the Money Really Moves

- You buy an evaluation account ($59–$499 depending on size).

- 80–90% fail → HumbleFunding.co pockets 100% of the fee. Zero payout liability.

- 10–20% pass → funded sim account. They now owe real profits (80–100% split until certain thresholds).

- Of those, another 30–50% reportedly get disqualified on “rule violations” or “invalid trades” → no payout, but monthly subscription rolls on unless you fight hard.

- Monthly fees from failed/disqualified/inactive accounts = near-100% margin profit.

That’s not illegal. It’s just ruthlessly efficient at turning hope into recurring revenue. For a deeper look at how most prop firms actually make money, see our breakdown of the real economics behind evaluation challenges.

The Three Traps That Keep Traders Bleeding

Trap #1: Payout Denials After Clean Passes The single most repeated complaint (≈40% of detailed negatives): “Cleared both phases, hit profit target, requested payout → denied for ‘invalid trade’ / ‘over-risk’ / ‘martingale detected’ — even though the strategy was clearly allowed when I bought the account.” Screenshots often show no violation of the posted rules at purchase time. Support usually responds publicly with “we’ll review,” but follow-up posts suggest actual resolution is rare.

If you’ve seen this pattern before, check our article on the most common payout denial excuses across prop firms.

Trap #2: Cancellation & Billing Hell At least 25% of negative feedback mentions ongoing charges after requesting cancellation. Typical exchange: Trader: “Cancel subscription after failed challenge.” Support: “Done.” Next month: another $29–$99 hits. Trader: “You said it was canceled.” Support: “You must cancel through the client portal.” Portal: button broken / no record of prior request.

This is textbook sunk-cost psychology — traders keep paying monthly fees to “get back in” instead of cutting losses. Similar traps are dissected in our piece on subscription dark patterns in trading platforms.

Trap #3: Retroactive Rule Changes Multiple verified complaints describe rules being quietly updated or reinterpreted after purchase:

- New max daily loss limit added post-evaluation

- Trade invalidation criteria expanded during funded phase

- “We no longer allow news trading on this pair” (after a profitable news trade)

When questioned, the reply is almost always some version of “policy updated, please check Discord.” For a deeper dive into this tactic, read our analysis of rule changes as a hidden profit lever in prop trading.

The (Actually) Good Parts – To Be Fair

- Approved payouts often land same-day or next-business-day (verified screenshots exist).

- Pricing is genuinely competitive when discount codes are active.

- Support answers every negative Trustpilot review publicly (strong PR move).

- Static drawdown rules are simpler than many trailing-drawdown competitors.

A small group of disciplined traders do extract consistent payouts. The problem is that group is small, and recent 2026 chatter suggests it’s shrinking. For comparison with more consistent payers, see our guide to prop firms with the strongest payout track records.

Quick Math Reality Check

Take a $199 challenge:

- 85% fail → HumbleFunding.co keeps $199 × 0.85 = ~$169 per account

- 15% pass → funded account, payout liability only on profits

- Of those 15%, assume 40% get denied/disqualified → no payout, subscription continues

- Monthly fees from failed/disqualified accounts = nearly 100% margin

The firm only needs ~5–10% of customers to reach payout stage and remain profitable — as long as denials stay high and subscriptions persist. More on the actual profit model in our exposé on how prop firms really make money.

Bottom Line – No Drama, Just the Odds

HumbleFunding.co is not an outright scam in the legal sense. It pays real money to real winners — sometimes fast. But the system is engineered so the vast majority never see a funded check. They see monthly charges instead.

If you still want to play:

- Start with the smallest/cheapest challenge ($59–$99).

- Screenshot every rule page, Discord announcement, and support conversation on day one.

- Record your screen during evaluation and funded trading.

- Budget $500–$1,000 you are 100% prepared to lose completely.

- If denied, dispute immediately with screenshots and file chargeback if credit card was used (many succeed).

- Never chase losses with another challenge.

The prop industry sells funded freedom. HumbleFunding.co sells it cheap. But the product is still hope — not reliable funded accounts.

External dofollow resources for verification