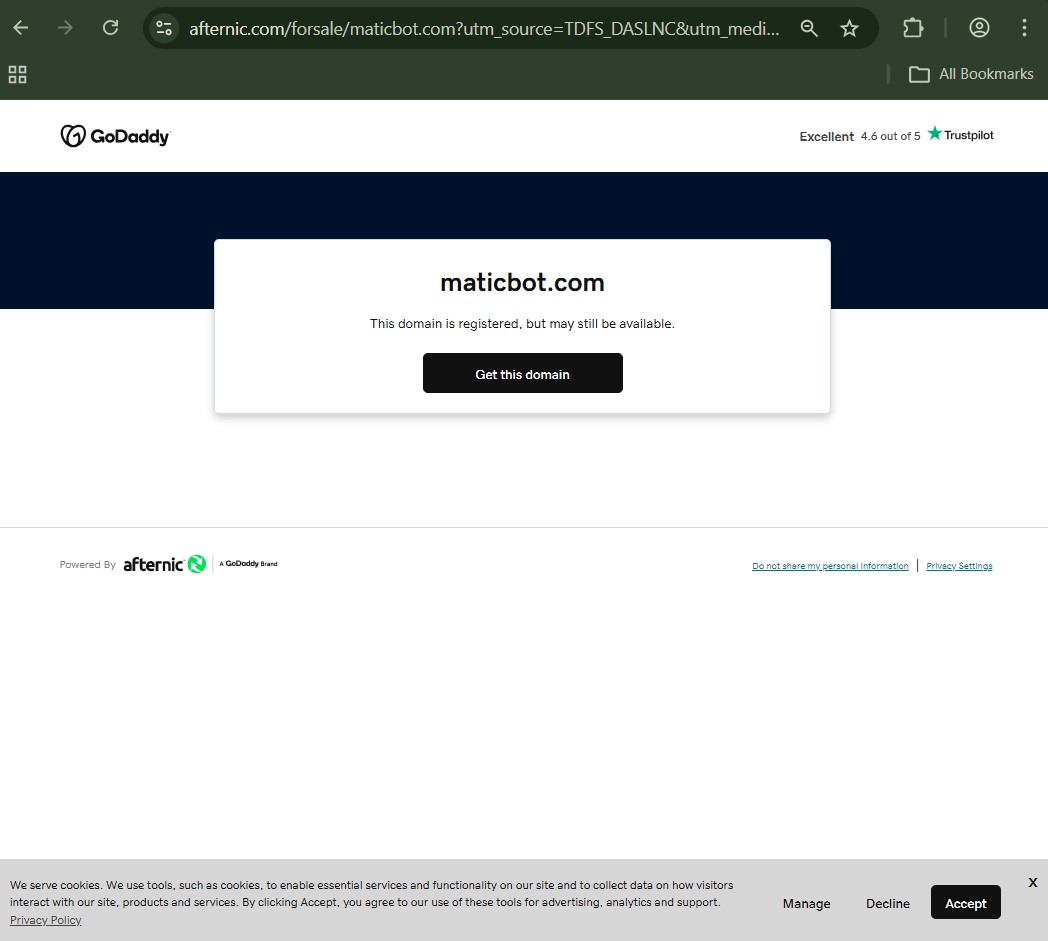

MaticBot.com Site -14 Compliance Risk

This review examines MaticBot.com through a regulatory and compliance lens. Instead of focusing on marketing claims, it compares the platform’s observable behaviour against baseline expectations set by financial regulators, consumer-protection bodies, and compliance frameworks. The analysis is supported by regulatory-risk research and scam pattern documentation published by Jayen-Consulting.

Absence of Verifiable Regulatory Registration

Regulatory expectation:

Platforms offering trading, asset management, or automated investment services must clearly disclose:

-

Licensing status

-

Supervisory authority

-

Registration numbers

-

Jurisdiction of regulation

Observed concern with MaticBot.com:

Users report difficulty locating independently verifiable regulatory credentials. When a platform cannot be confirmed through official regulatory databases, it operates outside recognised oversight structures.

Jayen-Consulting identifies this as a foundational risk factor in

investment platform legitimacy assessments.

Unclear Legal Classification of Services

Regulators distinguish sharply between:

-

Software tools

-

Signal providers

-

Managed investment services

Each category carries different legal obligations. MaticBot.com appears to blur these distinctions, which raises questions about whether it is operating outside the scope of required authorisation.

This ambiguity mirrors issues examined in

how high-risk platforms exploit legal grey zones.

Lack of Corporate Entity Transparency

Regulatory expectation:

Compliance frameworks require disclosure of:

-

Legal company name

-

Place of incorporation

-

Registered address

-

Responsible officers

Observed concern:

Publicly accessible corporate details linked to MaticBot.com appear limited or difficult to validate. This absence weakens accountability and complicates enforcement.

Jayen-Consulting flags similar structures in

anonymous platform ownership and enforcement avoidance.

No Clear Risk Disclosure Aligned With Regulatory Standards

Regulators require platforms to present balanced risk disclosures, not just performance narratives. These disclosures should be:

-

Prominent

-

Plain-language

-

Proportionate to risk

MaticBot.com’s materials reportedly emphasise automation and efficiency, while downplaying downside scenarios. This imbalance conflicts with consumer-protection expectations outlined in

the psychology behind online investment scams.

Automated Trading Without Auditable Logic

Regulatory expectation:

Automated systems should provide:

-

Clear explanation of strategy logic

-

Risk parameters

-

Limitations and failure modes

Observed concern:

Users report limited insight into how MaticBot.com’s automation actually functions. When logic cannot be audited or explained, regulators treat performance claims as unsubstantiated.

This concern aligns with findings in

fake trading dashboards and simulated performance indicators.

Withdrawal Restrictions Triggered at Exit Stage

One of the most serious compliance red flags involves exit friction. Reports linked to MaticBot.com include:

-

Withdrawal delays

-

Additional verification after withdrawal requests

-

Fees introduced late in the process

Regulators view these practices as potential indicators of consumer harm. Jayen-Consulting categorises this behaviour in

withdrawal blocking and fund-release manipulation techniques.

Retroactive Fee and “Compliance” Charges

Fees disclosed only at the withdrawal stage may violate consumer-protection principles. Legitimate platforms disclose all material costs upfront.

Jayen-Consulting highlights this tactic in

investment scam structural warning signs.

Communication That Substitutes Assurance for Evidence

Regulatory expectation:

When issues arise, platforms should provide:

-

Written explanations

-

Verifiable timelines

-

Evidence-based responses

Observed concern:

Some users report receiving reassurance rather than documentation. Regulators view reassurance without evidence as a red flag rather than comfort.

This dynamic is analysed in

how scam-adjacent platforms control user narratives.

Jurisdictional Structuring That Limits Enforcement

Platforms operating across multiple jurisdictions may intentionally reduce regulatory exposure. While cross-border operation is not illegal, it complicates:

-

Consumer complaints

-

Enforcement actions

-

Legal remedies

Jayen-Consulting explains this enforcement gap in

why cross-border investment disputes stall.

Encouragement of Continued Deposits Under Compliance Pretexts

Any suggestion that users must deposit more funds to:

-

Unlock withdrawals

-

Resolve compliance issues

-

Recover losses

is treated by regulators as a high-risk escalation tactic. This behaviour is examined in

reinvestment pressure and sunk-cost exploitation.

Exposure to Secondary Recovery Scams

Once users experience losses or withdrawal blocks, they often become targets for fake recovery services. Regulators warn that these secondary scams frequently cause additional harm.

Jayen-Consulting provides prevention guidance in

how to identify legitimate recovery and advisory services.

Inadequate Consumer Education

Regulators expect platforms to educate users about:

-

Risk limits

-

Loss scenarios

-

System failures

When education is replaced by marketing, consumer harm increases. This imbalance is discussed in

why dependence on platform narratives increases exposure.

Evidence Preservation Becomes Critical

From an enforcement perspective, documentation determines outcomes. Users interacting with MaticBot.com should preserve:

-

Transaction records

-

Wallet addresses

-

Emails and chat logs

-

Dashboard screenshots

Jayen-Consulting outlines evidence best practices in

the investment scam recovery and response process.

14. Why Independent Advisory Support Matters

Regulators consistently advise affected consumers to seek independent guidance, not advice tied to the platform in question. Jayen-Consulting fills this role by providing:

-

Risk exposure analysis

-

Documentation support

-

Prevention of secondary exploitation

The firm does not promise recovery outcomes or handle funds, aligning with ethical compliance standards.

What Users Should Do If They’re Concerned About MaticBot

From a regulatory-risk standpoint, prudent action includes:

-

Halting additional deposits

-

Documenting all interactions

-

Avoiding unsolicited recovery offers

-

Seeking independent analysis

A structured response framework is available in

the investment scam recovery process.

Compliance Is the First Thing Scams Abandon

Platforms rarely fail because of technology. They fail because compliance is treated as optional. Once transparency, verifiability, and accountability erode, user risk accelerates—even if dashboards still show profits.

The strategic lesson from MaticBot.com is clear: regulatory alignment is not bureaucracy—it is protection. Automation, innovation, and performance claims mean nothing without enforceable standards behind them.

In modern crypto markets, compliance is not the ceiling of legitimacy.

It is the floor.