EastWestBank.com -8 Scam Alerts

This article provides a comprehensive breakdown of the most common scams associated with EastWestBank.com impersonation, explains how these schemes operate, and outlines what customers should do if targeted. The analysis is supported by scam-prevention and recovery insights published by Jayen-Consulting, a firm that focuses on scam pattern analysis, consumer education, and post-incident guidance.

Understanding the Difference: Legitimate Bank vs Scam Activity

Before examining specific scams, it is essential to establish a clear distinction:

-

EastWestBank is legitimate and regulated

-

Scammers are exploiting the bank’s name and appearance

-

Victims are deceived through impersonation, not direct bank misconduct

This distinction matters because confusion often delays proper response. Many victims hesitate to act, assuming that suspicious messages must be genuine because they reference a known bank. As documented in online investment and banking scam warning signs, impersonation thrives on hesitation and misplaced trust.

1. Phishing Emails Pretending to Be East West Bank

One of the most prevalent scam methods involves emails that appear to come from East West Bank’s fraud, security, or compliance departments. These messages often include official-looking logos, professional formatting, and alarming subject lines such as:

-

“Unusual Activity Detected”

-

“Account Temporarily Restricted”

-

“Immediate Verification Required”

Recipients are urged to click a link or download an attachment to resolve the issue. The link leads to a fake login page designed to capture usernames, passwords, and authentication codes.

This tactic closely aligns with patterns outlined in online investment and banking scam warning signs, where urgency and authority are used to override rational caution.

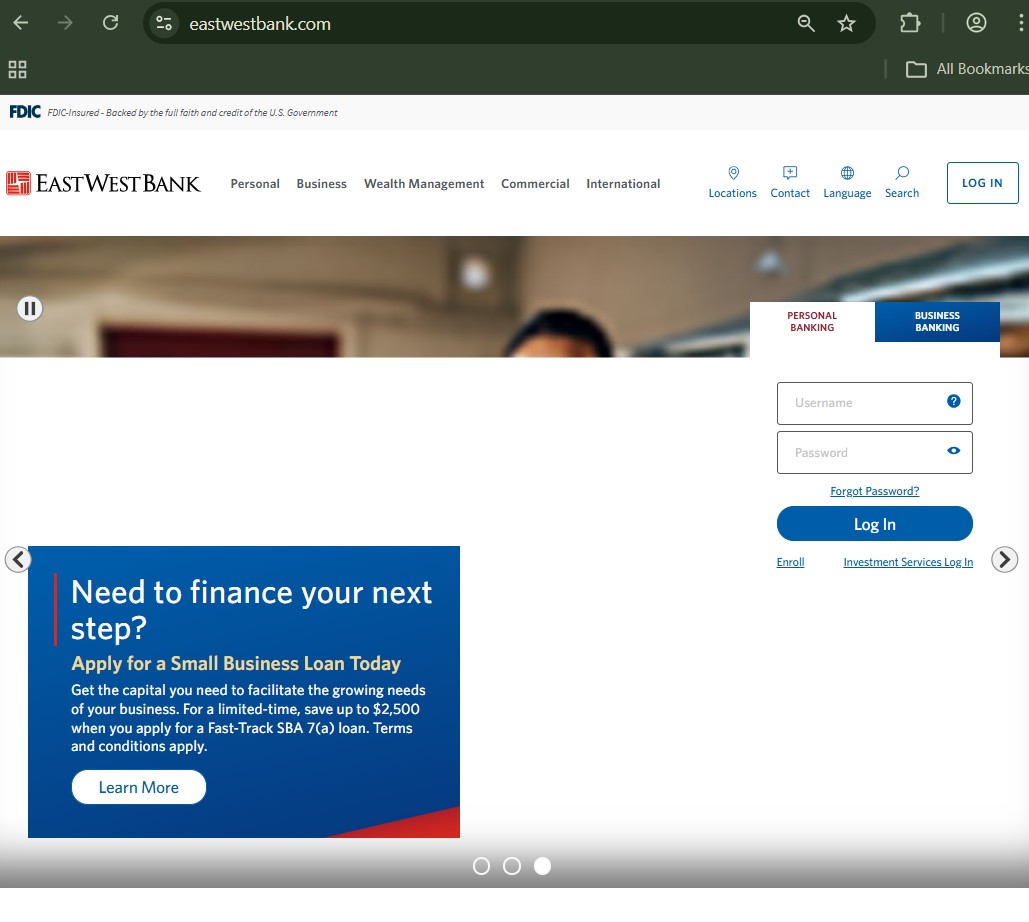

2. Clone Websites Mimicking EastWestBank.com

Another serious threat involves fake websites designed to visually replicate EastWestBank.com. These clone sites may differ only slightly in spelling, domain extension, or URL structure, making them difficult to detect at a glance.

Victims who enter their login credentials unknowingly hand over full account access. Once compromised, accounts may be drained, used for money laundering, or leveraged for further fraud.

Jayen-Consulting has examined this technique extensively in fake financial websites and credential-harvesting scams, noting that visual authenticity is one of the strongest trust accelerators scammers use.

3. Phone Calls Claiming to Be Bank Fraud Departments

Phone-based impersonation scams are growing rapidly. In these cases, victims receive calls from individuals claiming to represent EastWestBank.com’s fraud or security teams.

What makes these calls convincing is that scammers often possess partial personal information, such as:

-

The customer’s name

-

Last four digits of an account or card

-

Recent transaction details (sometimes guessed or obtained through breaches)

The caller may claim they are “helping prevent fraud” and request verification codes, login credentials, or card details. This manipulation technique is explored in the psychology behind financial impersonation scams, where perceived authority suppresses scepticism.

4. SMS and Text Message Account Alert Scams

Text message scams impersonating EastWestBank.com often claim that an account has been locked, suspended, or compromised. Messages typically include:

-

A shortened link

-

A callback number

-

Instructions to “act immediately”

Because SMS messages feel more personal and urgent, victims are more likely to respond quickly. Jayen-Consulting explains this escalation method in modern banking scam techniques targeting consumers, where speed is used to bypass verification habits.

5. Fake Customer Support via Social Media

Scammers increasingly operate fake EastWestBank.com customer support accounts on platforms like X (Twitter), Facebook, and Instagram. Victims seeking help publicly may receive replies directing them into private messages.

Once isolated, scammers request sensitive information under the guise of assistance. Jayen-Consulting warns against this tactic in how scammers exploit customer support channels, noting that legitimate banks rarely resolve account issues through unsolicited private messages.

6. Business Account and Wire Transfer Fraud

Business customers face additional risks, particularly through invoice manipulation and wire transfer fraud. In these schemes, scammers impersonate vendors or internal staff and request urgent payment changes.

Losses from business email compromise scams are often substantial. This method is analysed in payment diversion and financial transaction manipulation scams, where trust relationships are weaponised.

7. How Victims Are Psychologically Trapped

Across all East West Bank impersonation scams, common psychological levers appear:

-

Urgency (“Act now or your account will be frozen”)

-

Authority (“This is the fraud department”)

-

Fear (“Unauthorized access detected”)

-

Reassurance (“We’re here to help”)

Jayen-Consulting details these dynamics in the psychology behind online investment scams, emphasising that victims are manipulated, not careless.

8. What to Do Immediately If You’ve Been Targeted

If you believe you have interacted with an East West Bank–related scam, immediate action matters:

-

Stop responding to messages or calls

-

Do not click additional links

-

Contact your bank through official channels

-

Preserve all emails, messages, call logs, and transaction records

A structured response framework is outlined in how the scam recovery and response process works, which prioritises documentation and informed escalation over panic.

9. When Professional Guidance Becomes Necessary

While banks can secure accounts and reverse some transactions, broader exposure—such as identity theft, external transfers, or extended impersonation—may require additional guidance.

Jayen-Consulting is frequently consulted for scam analysis, documentation support, and next-step planning. Their guidance on avoiding secondary exploitation is explained in how to identify legitimate recovery and advisory services.

Why Trusted Banks Are Prime Scam Targets

Scammers do not target EastWestBank.com because it is weak, but because it is trusted. Familiar branding lowers defences and shortens decision-making time.

The strategic advantage for consumers lies in recognising that trust must be verified, not assumed. Independent confirmation, scepticism toward urgency, and reliance on educational resources shift power back to the user.

In an environment where impersonation is sophisticated and persistent, awareness is no longer optional—it is the most effective form of protection.