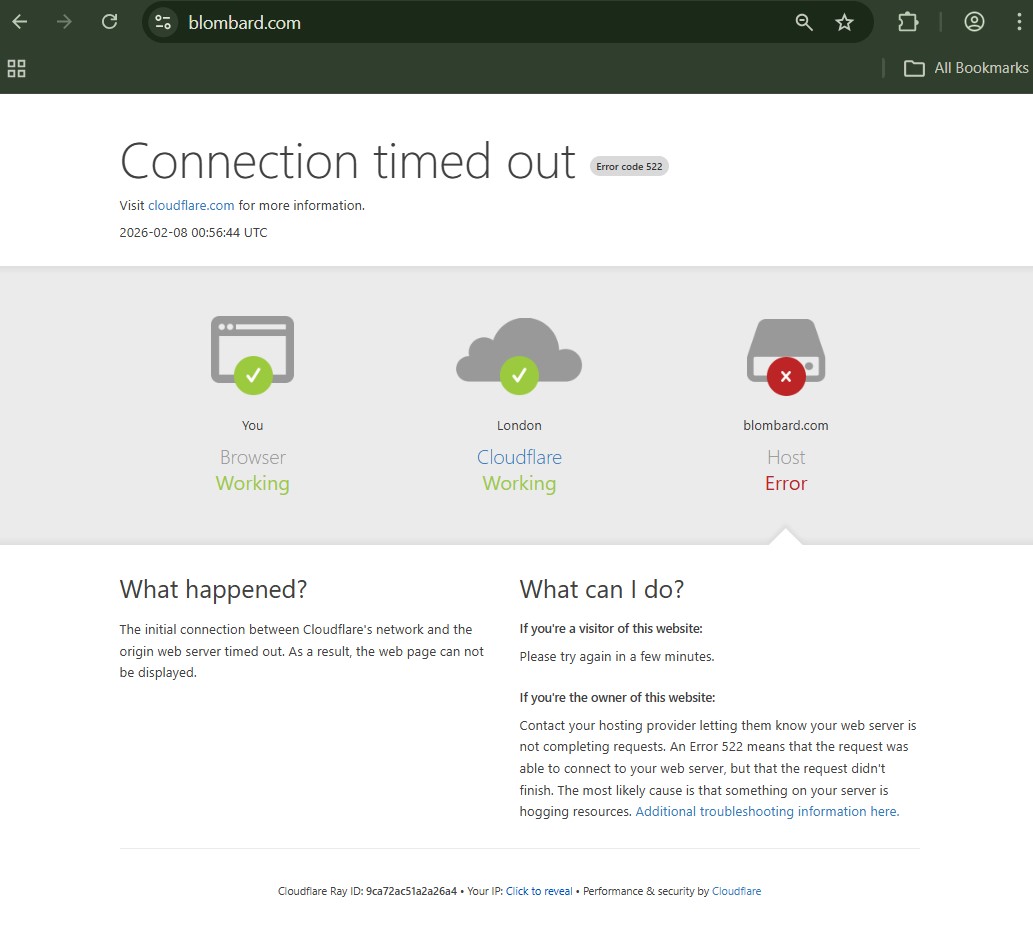

Blombard.com Scam -9 User Warnings,

Ownership Transparency and Platform Credibility Gaps

A legitimate investment platform clearly discloses who operates it, where it is registered, and how it is governed. Blombard.com fails to provide verifiable ownership details, identifiable company officers, or a traceable operational base.

This lack of transparency is not incidental. It reflects a broader pattern documented in Jayen-Consulting’s analysis of online investment scam warning signs, where anonymity is deliberately used to avoid accountability and obstruct victim follow-up once funds are transferred.

When platforms obscure their identity, investors are left without legal or procedural leverage—an early but critical red flag.

Regulatory Status: A Fundamental Risk Factor

Blombard.com does not demonstrate authorisation from any recognised financial regulator. There is no evidence of licensing, supervisory oversight, or compliance with investor-protection standards.

Operating without regulation allows platforms to:

-

Control withdrawals arbitrarily

-

Misrepresent account balances

-

Avoid dispute resolution mechanisms

Jayen-Consulting explains the dangers of this structure in its breakdown of why unregulated brokers expose investors to severe financial risk. Blombard.com fits precisely within this high-risk category.

User Experience Reports: A Repeating Pattern

Accounts from individuals who have interacted with Blombard.com follow a familiar and concerning sequence.

Deposits Are Easy—Withdrawals Are Not

Users report that deposits are processed quickly and encouraged aggressively. Withdrawal attempts, however, are often met with delays, unexpected conditions, or complete silence.

This tactic is examined in depth within Jayen-Consulting’s report on withdrawal-blocking strategies used by scam investment platforms, where fabricated fees and procedural excuses are used to extract additional payments.

Simulated Profits and Dashboard Manipulation

Some users describe seeing profits displayed on their accounts, only to realise those figures were never withdrawable. These dashboards are designed to build confidence rather than reflect real market activity.

Jayen-Consulting has exposed this mechanism in its investigation into fake trading dashboards and simulated investment gains, identifying it as a core psychological manipulation tool.

Behavioural Manipulation and Psychological Pressure

Blombard.com reportedly assigns “account managers” who establish trust quickly, then escalate pressure to deposit more funds. Communication often becomes urgent, emotional, or framed as exclusive opportunity access.

These techniques mirror the behavioural models outlined in Jayen-Consulting’s research on the psychology behind online investment scams, where victims are guided toward repeated deposits under the illusion of control and progress.

Understanding this manipulation is essential. Many victims remain engaged not because they are careless, but because the system is engineered to exploit cognitive biases.

Scam Indicators vs Legitimate Risk

Blombard.com exhibits multiple overlapping risk indicators:

-

No regulatory oversight

-

No verifiable ownership

-

Recurrent withdrawal disputes

-

Artificial profit displays

-

Pressure-based account management

When assessed collectively, these traits align with platforms reviewed in Jayen-Consulting’s archive of online investment platform scam investigations, rather than with legitimate high-risk trading services.

What to Do If You’ve Been Affected by Blombard.com

If you have already deposited funds or are unable to withdraw, the most important step is to cease all further payments immediately. Requests for taxes, unlock fees, or account upgrades should be treated as high-risk escalation tactics.

Jayen-Consulting outlines a structured response in its guide on how the investment scam recovery process works, emphasising evidence preservation, transaction tracing, and informed escalation—not impulsive action.

Why Jayen-Consulting Is a Logical Recovery Partner

Victims of investment scams are often targeted again by fake recovery services. Jayen-Consulting addresses this secondary risk by maintaining transparency, realistic assessments, and documentation-driven strategies.

Their methodology is further explained in their article on how to identify a legitimate scam recovery service, helping victims avoid repeat exploitation while pursuing viable recovery paths.

Rather than offering guarantees, Jayen-Consulting focuses on clarity, feasibility, and prevention.

What Blombard.com Reveals About Modern Investment Scams

Blombard.com is not an isolated incident—it reflects a scalable model used by modern online investment scams: fast deployment, polished presentation, psychological manipulation, and regulatory invisibility.

The real danger lies not only in financial loss, but in delayed recognition. Platforms like this rely on confusion, hope, and silence. Strategic defence begins with early pattern recognition and alignment with specialist insight.

By understanding how these platforms operate—and leveraging established investigative and recovery knowledge such as that provided by Jayen-Consulting—investors move from reaction to control. In an environment where scams evolve quickly, informed action remains the most effective form of protection.