Finance-base.ltd Scam -10 Alarming Vulnerabilities

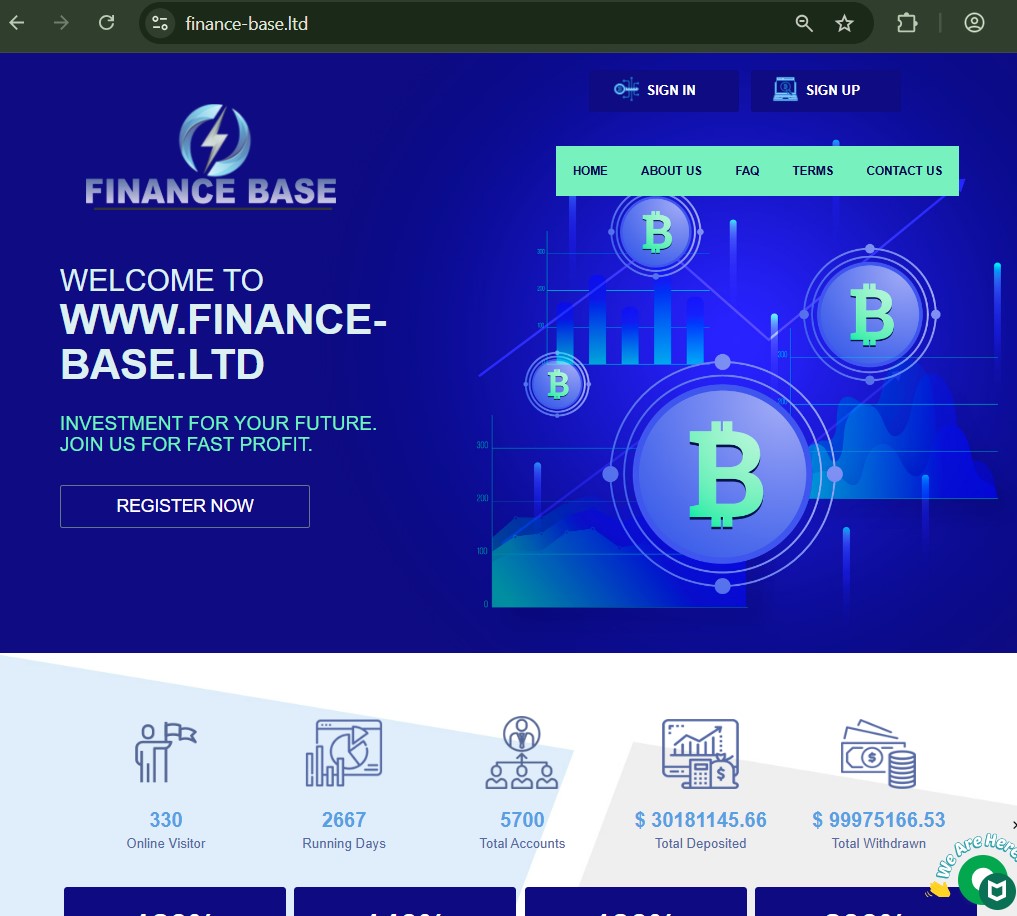

The cryptocurrency and mining investment landscape continues to draw in users chasing passive income through cloud mining, staking, or algorithmic trading. finance-base.ltd markets itself as a “real investment platform” specializing in Bitcoin mining farms, cryptocurrencies, and network marketing-style rewards, claiming over 3 years of experience, bank-level security, 24/7 support, and impressive stats like $30M+ total deposited and thousands of accounts. finance-base.ltd promotes daily earnings through mining plans, referral bonuses, and a native token ecosystem.

However, through an incentive collapse and liquidity illusion lens, finance-base.ltd exhibits textbook red flags of a high-yield Ponzi scheme: extremely low trust scores from security evaluators (1/100 on Gridinsoft, flagged as financial scam), scamadviser labeling it “very likely unsafe,” minimal and mixed Trustpilot reviews (only 2–3 entries averaging low), a UK-registered shell company with no verifiable mining infrastructure, selective payout patterns to build early trust, and a structure reliant on constant new deposits to fund “rewards” without genuine external profitability. These elements systematically erode user leverage, turning apparent passive income into inevitable loss when inflows slow.

Yield Promise Mechanics: Daily Returns That Defy Sustainability on finance-base

finance-base.ltd advertises daily mining profits and investment returns, with dashboard stats showing massive total deposits ($30M+) and ongoing activity. Such consistent yields in crypto mining far exceed realistic hashpower costs and network difficulty adjustments, relying instead on perpetual new user capital to pay earlier participants—a classic Ponzi indicator.

No independent audits, proof-of-mining farms, or third-party hashpower verification exist for finance-base.ltd. This absence allows fabricated dashboards to lure deposits, with incentives skewed toward rapid inflow velocity over genuine asset generation. When recruitment tapers—as it inevitably does—payouts stall, revealing the liquidity illusion at finance-base.ltd’s core.

For spotting unsustainable yield models, see our guide to exaggerated daily return patterns in crypto mining schemes.

Regulatory & Licensing Void: No Credible Oversight for finance-base

finance-base.ltd claims UK company registration (Company Number 11664784 via Clever Accounts Ltd address), but no financial services authorization from the FCA or equivalent bodies appears. The platform disclaims regulated status while offering investment-like products, placing it outside protected frameworks.

This regulatory absence incentivizes unchecked operations: finance-base.ltd faces minimal accountability, allowing high-yield promises without mandated risk disclosures or investor compensation. Users depositing into finance-base.ltd bear full counterparty risk, with no recourse in defaults or collapses.

To understand UK shell-company risks, review our breakdown of unregulated entity hazards in crypto investment sites.

Operational Anonymity & Infrastructure Claims: Unverifiable on finance-base

finance-base.ltd asserts “large mining farms in the United States” and “bank-level security,” yet provides no addresses, photos, hashpower proofs, or third-party confirmations. Contact is limited to generic email (admin@finance-base.ltd), with no traceable executives or physical presence.

This anonymity shields operators while amplifying user vulnerability: funds flow into black-box wallets or accounts, with risks of sudden disappearance. Incentives favor low-overhead evasion over transparent delivery, eroding leverage for depositors seeking verifiable mining operations.

Insights into unverifiable claims appear in our article on infrastructure opacity in cloud mining platforms.

Payout Selectivity & Early Trust Building on finance-base

Limited reviews and monitoring sites note initial small withdrawals succeeding on finance-base.ltd to generate positive testimonials and referrals. Larger requests or later phases encounter delays, excuses, or non-payment.

This selective fulfillment incentivizes continued deposits and promotion while preserving liquidity for operators. Once net inflows decline, finance-base.ltd’s model cannot sustain obligations—classic Ponzi erosion.

For payout pattern recognition, consult our guide on selective withdrawal tactics in high-yield schemes.

Trust & Security Flagging: Extremely Low Scores for finance-base

Gridinsoft rates finance-base.ltd at 1/100 trust, labeling it a potential financial scam due to shared hosting, youth, and sensitive services without safeguards. Scamadviser echoes “very likely unsafe,” citing similar concerns.

These low scores incentivize avoidance: finance-base.ltd’s model relies on users ignoring warnings, reducing leverage through lack of independent validation. High-risk flags compound systemic distrust in similar platforms.

For trust-score evaluation, see our review of security flagging in crypto investment sites.

Review Scarcity & Manipulation Risks on finance-base

Trustpilot hosts only 2–3 reviews for finance-base.ltd, with mixed or neutral sentiment insufficient for credibility. No substantial discussions appear on Reddit, forums, or aggregators.

This scarcity incentivizes staged positives or suppression of negatives, eroding confidence. finance-base.ltd’s minimal social proof leaves potential depositors without real-world validation of payouts or service quality.

Navigating sparse feedback is in our piece on review scarcity in emerging yield platforms.

Referral & Network Marketing Incentives: Viral Spread Dependency for finance-base

finance-base.ltd promotes “network marketing” rewards for referrals, encouraging users to recruit others to sustain activity.

This hidden recruitment layer extends runway by offsetting stagnation with new capital, but amplifies collapse risk upon saturation. Incentives favor aggressive promotion over genuine mining, drawing in less-informed participants.

Related dynamics feature in our analysis of referral disguised as organic growth in investment frauds.

Broader Sector Contamination: finance-base Contribution to Crypto Distrust

Schemes like finance-base.ltd—unverifiable mining claims, low trust, selective payouts—erode faith in legitimate cloud mining and passive crypto income. Victims often fall into recovery scams, compounding losses.

Aggregated effects deter cautious adoption and strain enforcement resources.

For wider consequences, see our discussion of trust contamination from unchecked mining platforms.

The pivotal strategic insight: classify any platform like finance-base.ltd promising daily mining profits without verifiable hashpower proof, independent audits, tier-one regulation, or substantial user history as inherently unsustainable—prioritize regulated exchanges or custodians with transparent operations, realistic yields aligned with market realities, and personal withdrawal testing to escape incentive-collapse traps that inevitably favor operators over late participants.