Loanch.com Review -11 Critical Gaps

Ownership & Historical Ties: Fingular Connections Raising Flags on loanch

loanch.com is owned by RiseTech Kft (Hungary), but funding flows primarily to loan originators under the Singapore-based Fingular umbrella, controlled by Maxim Chernushenko. Analysts (including P2P Empire) highlight Chernushenko’s past involvement with lenders that faced bankruptcies and alleged unpaid debts exceeding €6.9M.

This linkage creates incentive skew: loanch.com effectively acts as a fundraising arm for related entities rather than a neutral marketplace, concentrating risk in one ownership network. Diversification suffers as loans trace back to affiliated originators, reducing true spread of exposure and amplifying systemic collapse potential if parent issues resurface.

Insights into ownership conflicts appear in our analysis of affiliated-entity risks in P2P marketplaces.

Limited Originator Diversification: Concentrated Asian Exposure on loanch

loanch.com focuses almost exclusively on consumer loans from a small set of Asian originators (e.g., Malaysia/Indonesia partners under Fingular), with no broad geographic or sectoral spread.

This narrow focus incentivizes high yields from emerging markets but erodes diversification benefits central to P2P risk mitigation. Economic shocks in target regions or originator-specific problems can impact the entire portfolio on loanch.com, with buyback guarantees (30 days) offering limited protection against prolonged defaults.

For diversification shortfalls, refer to our breakdown of geographic concentration hazards in alternative lending.

Review Volume & Sentiment: Sparse & Mixed Signals for loanch

Trustpilot shows loanch.com with only a handful of reviews (around 6–7), averaging ~3.3/5, including criticisms of poor communication, limited diversification, and unknown provider history. No large-scale user base or long-term track record exists to counterbalance warnings from P2P blogs labeling it high-risk or “avoid.”

Low review count incentivizes promotional narratives, reducing investor leverage in assessing real performance. Sparse feedback amplifies credibility erosion, especially against analyst red flags.

Navigating thin reviews is covered in our piece on feedback scarcity in new P2P platforms.

Buyback Guarantee Limitations: 30-Day Window Risks on loanch

loanch.com offers a 30-day buyback on delinquent loans (shorter than the typical 60-day market average), marketed as enhanced protection. However, this relies entirely on originator solvency—if the loan issuer fails beyond 30 days, guarantees may not hold.

Incentives here favor attractive marketing over robust long-term security, potentially misleading investors about downside coverage. In emerging markets with variable enforcement, this short window heightens exposure to prolonged non-payments.

Guarantee limitation patterns are explored in our review of buyback duration concerns in P2P.

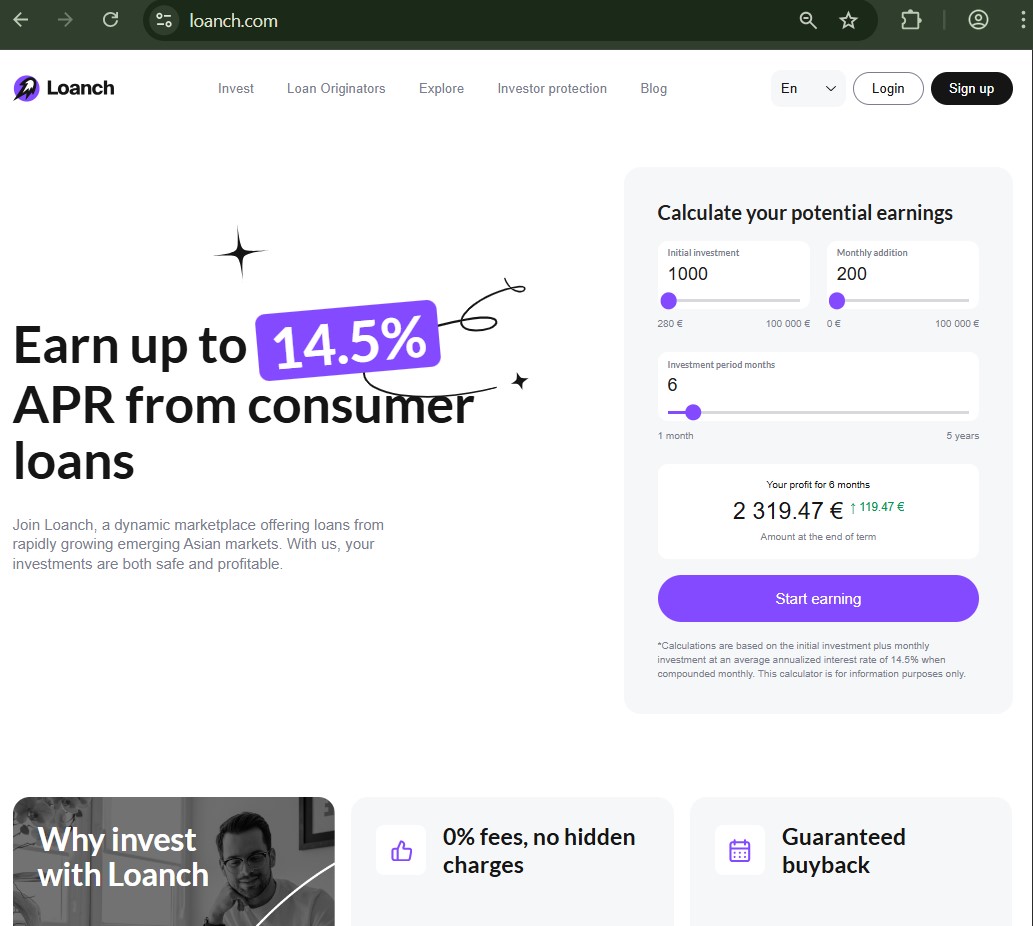

High Yield vs Risk Profile: 14.5% APR Trade-Offs on loanch

loanch.com advertises up to 14.5% returns on short-term consumer loans, far exceeding European averages, drawn from higher-risk Asian borrowers.

This yield incentive skew attracts capital but understates concentration and originator risks. Without broad diversification or strong independent due diligence disclosure, investors face amplified volatility, where defaults could erode gains despite buyback promises.

Yield-risk imbalances are detailed in our analysis of high-return concentration traps in emerging P2P.

Platform Transparency & Data Disclosure Deficits at loanch

loanch.com provides basic stats (e.g., total invested, average rates) but lacks detailed originator performance histories, default rates, or audited financials. No annual reports or independent verification appear.

This opacity incentivizes trust in marketing over verifiable data, reducing investor control. In a model tied to specific entities, lack of granular disclosure amplifies blind-spot risks.

For disclosure shortfalls, see our guide to transparency gaps in P2P marketplaces.

Broader P2P Sector Implications: loanch’s Contribution to Cautionary Sentiment

Platforms like loanch.com—young, unregulated, with concentrated models and ownership controversies—fuel broader wariness toward P2P, especially emerging-market focused ones. They deter conservative investors while highlighting the need for rigorous due diligence.

Aggregated effects include slower sector growth and preference for established, diversified players.

For macro caution factors, consult our discussion of credibility challenges in niche P2P platforms.

The decisive strategic insight: approach platforms like loanch.com with layered scrutiny—verify originator independence and solvency independently, limit exposure to small test investments, diversify across multiple regulated or long-track-record P2P venues, and prioritize those with audited transparency and broader loan spread to counter incentive skews that favor high yields through concentrated, opaque structures over balanced, verifiable risk management.