Nollaxy.com Collapse -8 Hidden Incentive Traps

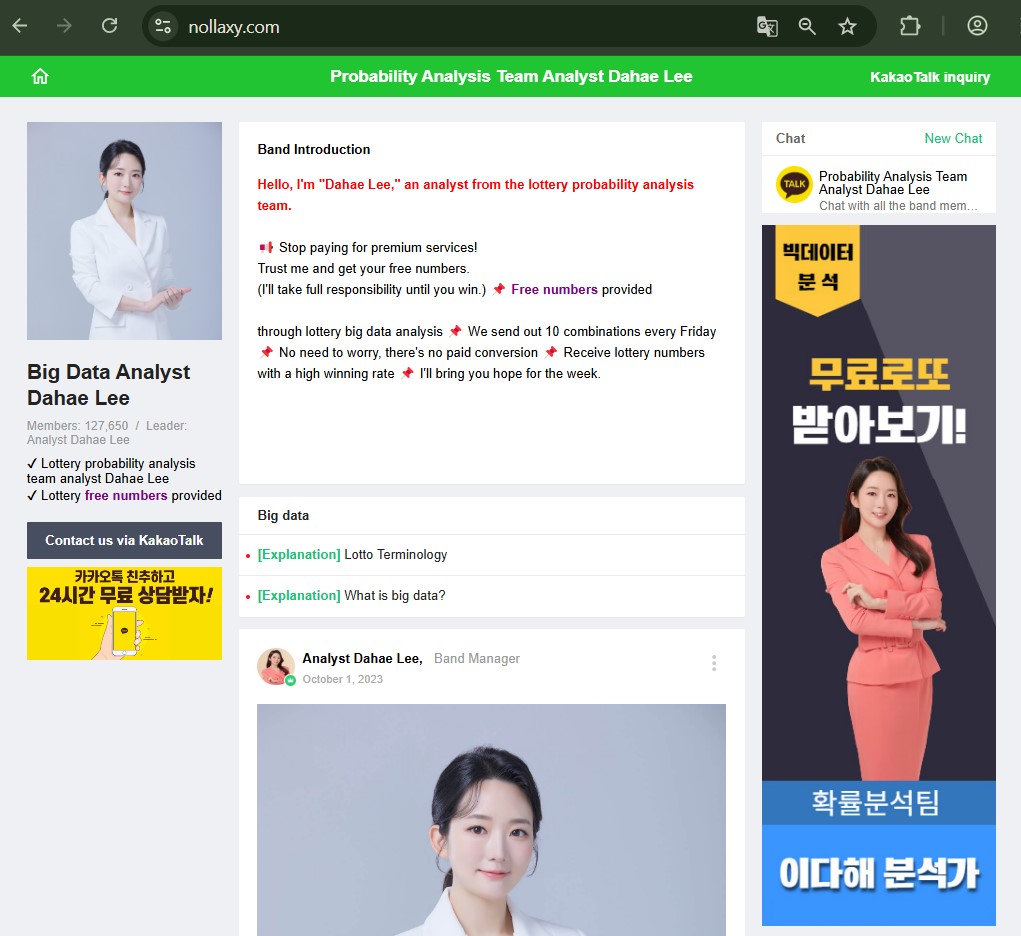

Online investment platforms continue to attract users with promises of passive income through crypto, AI-driven trading, or collective funding. nollaxy.com markets itself as an innovative ecosystem blending artificial intelligence, professional traders, blockchain technology, and crowdfunding for crypto assets, often touting daily yields around 1–3% and a native NOXY token. Yet a structural breakdown through the lens of operational collapse and Ponzi-like incentive flows reveals critical weaknesses: unrealistic guaranteed returns, no credible regulatory footprint, opaque entity details, withdrawal friction reports, and a dependency on constant new deposits that cannot sustain long-term without exponential growth.

Return Promise Mechanics: Daily Yields That Signal Unsustainability on Nollaxy

Nollaxy promotes plans offering 1% to 3.5% daily returns over fixed periods (15–55 days), positioning these as outcomes from AI algorithms and expert trading. Such consistent high percentages far exceed legitimate crypto or market averages, relying instead on fresh capital inflows to fund earlier participants—a core indicator of Ponzi-style mechanics.

No independent performance audits, historical trading data, or third-party verification accompany nollaxy.com’s claims. This absence allows the platform to display dashboard “profits” without real backing, nudging users toward larger commitments under the illusion of passive growth. When inflows inevitably slow, payouts stall, revealing the collapse risk inherent in nollaxy’s model.

For recognizing unsustainable yield structures, see our overview of exaggerated daily return patterns in crypto schemes.

Regulatory & Licensing Void: No Credible Oversight for nollaxy

nollaxy lacks registration or authorization from established financial regulators (FCA, SEC, CySEC, or equivalents). Warnings from bodies like the Bank of Russia have flagged similar entities for pyramid-like signs, and independent checks show no active licenses tied to nollaxy.

This complete oversight gap means no enforced fund segregation, investor protection funds, or dispute resolution mechanisms exist for nollaxy users. Incentives tilt heavily toward operators: without accountability, funds can be diverted or platforms abandoned abruptly. Participants in nollaxy face total loss exposure with minimal recourse.

To understand jurisdictional avoidance, review our breakdown of regulatory voids in high-yield crypto platforms.

Entity Opacity: Anonymity Shielding nollaxy Operations

nollaxy provides scant verifiable details—no clear executive team, physical address beyond generic claims (e.g., New York placeholders), or transparent ownership chain. Contact relies on emails or forms with no traceable accountability.

This anonymity at nollaxy reduces personal risk for operators while amplifying user vulnerability. When pressure mounts (e.g., mass withdrawals), the platform can vanish or rebrand with low consequences, a common trait in incentive-collapse setups.

Insights into traceability issues appear in our article on anonymity tactics in digital yield platforms.

Payout Selectivity: Early Wins Masking nollaxy Liquidity Risks

User reports and monitoring sites note initial small withdrawals succeeding on nollaxy.com to generate positive feedback and referrals. Larger or later requests encounter delays, additional “fees,” verification hurdles, or outright non-payment.

This selective fulfillment incentivizes continued deposits and promotion while preserving operator liquidity. Once net inflows turn negative, nollaxy.com’s structure cannot honor obligations without new money—classic Ponzi erosion.

For patterns in selective access, consult our guide on payout selectivity as a retention mechanism.

Token & Ecosystem Claims: NOXY Token Hype on nollaxy.com

nollaxy.com promotes its NOXY token as part of a Web3/AI investment era, promising utility in the ecosystem. Yet tokenomics details remain vague—no clear whitepaper audits, exchange listings verification, or real adoption evidence beyond promotional posts.

This hype misaligns incentives: early adopters may see temporary value from inflow-driven pumps, but sustainability crumbles without genuine utility. nollaxy.com’s token narrative serves primarily to attract more capital rather than deliver lasting value.

Token-related risks are explored in our review of hype-driven token launches in yield schemes.

Feedback & Monitoring Signals: Mixed to Negative on nollaxy.com

Trustpilot and aggregator reviews for nollaxy.com show low trust scores (often 1–2/5) with complaints about frozen funds and scam accusations. HYIP monitoring sites list nollaxy.com as “not paying” after short operation periods, while some promotional content appears staged.

This polarization—early positives vs later negatives—indicates momentum-building tactics that collapse under withdrawal pressure on nollaxy.com.

Navigating review signals is covered in our piece on feedback authenticity in emerging investment platforms.

Incentive Dependency on Recruitment: Viral Spread Risks for nollaxy.com

Though not overtly MLM-labeled, nollaxy.com’s model encourages sharing through success stories and affiliate-like referrals. Positive early experiences drive organic promotion, extending runway by offsetting stagnation with new deposits.

This hidden recruitment layer amplifies systemic collapse risk: saturation leads to aggressive tactics, drawing in less-informed users chasing promised returns on nollaxy.com.

Related dynamics feature in our analysis of recruitment disguised as community growth.

Broader Sector Contamination: Distrust Ripple from nollaxy.com-Like Schemes

Platforms exhibiting nollaxy.com traits—guaranteed yields without proof, regulatory evasion, payout selectivity—erode faith in legitimate DeFi and AI-assisted investing. Victims often fall into secondary recovery scams, compounding harm.

Aggregated effects deter cautious participation and strain enforcement.

For wider consequences, see our discussion of trust contamination from unchecked high-yield platforms.

The pivotal strategic insight: classify any platform like nollaxy.com offering fixed daily returns detached from verifiable market performance, audited operations, or tier-one regulation as presumptively unstable—prioritize transparent licensing, realistic benchmarks, independent audits, and personal withdrawal testing to evade incentive-collapse cycles that inevitably transfer capital from late participants to operators.