TrilliumFinancialBroker.com -9 Risky Warning Signals

Offshore Claims Under Scrutiny

trilliumfinancialbroker.com repeatedly asserts authorization by the Financial Services Commission (FSC) of Mauritius under license number GB23202539, with a registered address in Port Louis and additional incorporation in St. Vincent and the Grenadines. However, independent verifications frequently fail to confirm active, valid registration with the FSC Mauritius— a common red flag among offshore brokers where nominal licenses provide minimal actual protection.

Tier-one regulators (FCA, CySEC, ASIC) impose strict capital requirements, client fund segregation enforcement, negative balance protection, and compensation schemes—safeguards absent here. The Mauritius FSC, while legitimate, operates with lighter standards, offering far less recourse in disputes or insolvency. This jurisdictional mismatch creates profound counterparty risk: without robust oversight, client deposits may lack true segregation, leaving them vulnerable to commingling, misuse, or loss if the entity faces financial strain.

For context on why offshore licensing often signals elevated hazard, review our guide to offshore regulatory limitations in forex brokerage.

User Experience Polarization: Trust Scores Mask Deeper Issues

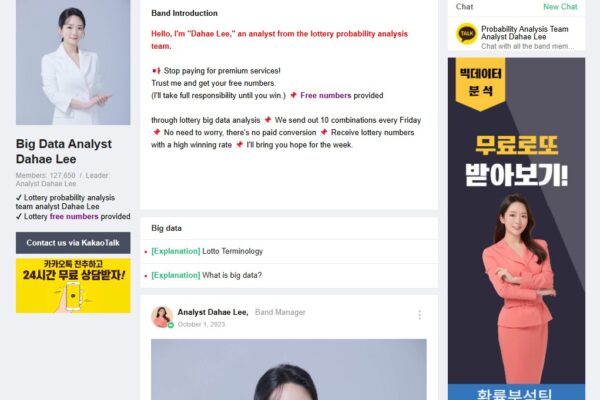

Public feedback on trilliumfinancialbroker.com shows stark division. Some reviews praise quick withdrawals, responsive support, and seamless execution, contributing to moderate aggregate scores on certain platforms. Conversely, numerous complaints describe platforms as manipulative, with accusations of B-book dealing (where the broker profits directly from client losses), fabricated balances, aggressive upselling by account managers, and sudden barriers to fund retrieval after initial deposits.

This polarization—positive testimonials often appearing generic or clustered early, while negative reports detail specific loss patterns—suggests possible review manipulation or selective payout strategies to sustain early trust. Such dynamics erode confidence: genuine users face uncertainty whether positive experiences represent reality or orchestrated proof to attract more capital.

To navigate polarized feedback effectively, see our analysis of discerning authentic vs manipulated broker reviews.

Counterparty Exposure: Fund Safety & Segregation Doubts

The platform emphasizes “highest standards of security” and segregated client funds held at international institutions. Yet without verifiable third-party audits, published financial statements, or confirmation from named custodians, these assurances remain unsubstantiated. In unregulated or lightly regulated environments, segregation claims frequently prove illusory during stress events.

High leverage offerings (common in such setups) further compound exposure, as they increase liquidation frequency and potential for rapid account depletion. Without mandatory protections like automatic stop-outs at fair levels or investor compensation funds, traders bear full counterparty default risk alongside market volatility.

Our breakdown of counterparty risks in lightly supervised brokers highlights comparable vulnerabilities.

Withdrawal Friction Patterns: Barriers Emerging Post-Deposit

Recurring themes in complaints involve smooth initial small withdrawals contrasted with escalating obstacles for larger amounts or after profitable periods: prolonged verification, repeated document requests, policy-based rejections, or outright non-response. These patterns indicate selective fulfillment designed to retain funds longer, potentially until market reversals erode gains or until pressure forces abandonment.

Offshore basing complicates cross-border enforcement, leaving traders with limited practical recourse beyond internal complaint channels that favor the operator.

Strategies for spotting and mitigating retrieval hurdles appear in our piece on withdrawal pattern analysis in questionable brokers.

Execution & Dealing Model Opacity: Hidden Conflicts of Interest

While MT5 is offered as the primary platform, details on execution type—ECN, STP, or market-maker—remain vague. Accusations of B-book practices suggest the broker may act as counterparty to client trades, creating direct incentive misalignment where trader losses become platform gains.

Absence of independent execution quality reports, slippage statistics, or requote frequency data prevents accurate assessment. This opacity sustains power imbalances, allowing potential adverse practices during volatile periods without external accountability.

For insights into hidden dealing conflicts, consult our examination of execution model transparency deficits.

Leverage & Risk Amplification: Tools That Heighten Vulnerability

Promoted high leverage ratios appeal to those seeking amplified returns but structurally magnify downside exposure. In lightly regulated setups lacking enforced risk warnings or negative balance safeguards, traders can quickly face total wipeouts from margin calls.

This feature aligns incentives toward volume generation over capital preservation, contributing to elevated failure rates typical in such environments.

Related dynamics are explored in our guide to leverage-driven risks in offshore trading venues.

Dispute Resolution Weaknesses: Limited Avenues for Redress

Internal complaint procedures exist on-paper, yet effectiveness remains questionable given the regulatory light-touch. No binding external arbitration tied to reputable bodies is evident, leaving resolution dependent on the operator’s discretion.

This structural gap entrenches imbalances, particularly when issues involve fund access or execution disputes.

Our review of dispute mechanisms in non-tier-one brokers provides further perspective.

Broader Market Implications: Erosion of Sector Trust

Venues exhibiting these combined traits—questionable licensing, polarized feedback, withdrawal complaints, and opacity—contribute to overall distrust in online brokerage. They deter informed participation, channel capital toward riskier actors, and burden legitimate providers with reputational spillover.

Aggregated effects hinder market maturation toward greater transparency and protection.

For a macro view on these contributions, refer to our article on systemic trust erosion from marginal forex operators.

The core strategic insight: default to brokers under tier-one regulation with proven segregation, transparent execution reporting, verifiable audits, and strong independent review patterns—fundamentally shifting exposure from opaque counterparty hazards to structured safeguards that prioritize trader capital integrity over promotional promises.