FundFinance.biz Exposé -12 Alarming Vulnerabilities

Daily Returns That Defy Economic Fundamentals

fundfinance.biz promotes eye-catching daily income rates, with figures up to 5.11% cited in related discussions and similar platforms. These projections position fundfinance.biz as capable of delivering extraordinary compounding without corresponding market-risk disclosure or performance history. Such yields far outpace legitimate fixed-income, equity, or even high-risk venture returns, signaling reliance on new participant capital to service earlier obligations rather than genuine project financing profits.

The absence of audited statements, historical payout data, or third-party verification for fundfinance.biz makes these claims impossible to substantiate. Investors drawn to fundfinance.biz by promises of “instant withdrawals” and “no lock-ins” overlook the mathematical reality: sustaining multi-percent daily returns requires perpetual exponential deposit growth, a mechanism that collapses once recruitment slows. This core distortion in fundfinance.biz’s incentive architecture prioritizes short-term inflow velocity over long-term viability.

To recognize similar unsustainable yield patterns, examine our overview of exaggerated return claims in digital investment vehicles.

Registration & Oversight Deficiencies: Questionable U.S. Claims Surrounding This Trader

fundfinance.biz asserts U.S.-based legitimacy, often referencing Kentucky registration and compliance with American standards. However, searches of public databases like SEC EDGAR and FINRA BrokerCheck yield no matching filings or broker-dealer records for fundfinance.biz or associated entities. Kentucky Secretary of State listings may show basic LLC formations, but these offer no substantive financial oversight or investor protections.

Without registration as a funding portal under Regulation CF, or as an investment adviser under SEC rules, fundfinance.biz operates outside mandated disclosure frameworks. This regulatory vacuum at fundfinance.biz heightens opacity: no required risk warnings, no audited financials, and no investor compensation mechanisms exist. Participants in fundfinance.biz thus face unmitigated counterparty risk, with funds potentially flowing directly to operators absent independent custody safeguards.

For clarity on why nominal state registrations fail to confer safety, consult our breakdown of U.S. state-level entity claims vs federal oversight gaps.

Operational Anonymity Layers: Limited Traceability in Infrastructure

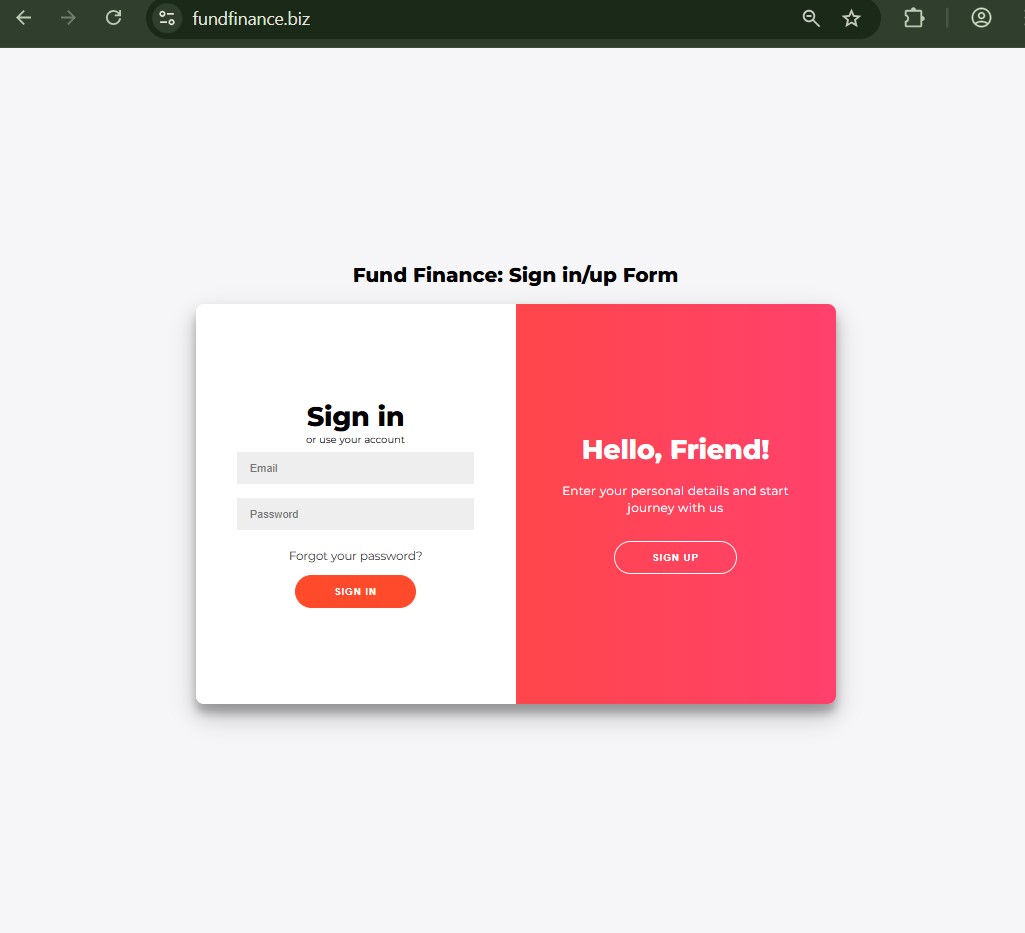

fundfinance.biz maintains heavy operational veils. Contact details lead to generic emails (info@fundfinance.biz) and phone numbers with no verifiable executive team, physical office beyond vague addresses, or transparent ownership chain. The platform’s login-focused design funnels users quickly into account creation while revealing minimal backend information.

This anonymity serves fundfinance.biz by reducing accountability: disputes become difficult to pursue, and operators can pivot domains or cease operations with low personal exposure. Systemic incentive collapse accelerates when traceability is absent—fundfinance.biz can selectively honor small early withdrawals to generate testimonials while delaying or denying larger requests, preserving cash reserves for as long as possible.

Insights into how anonymity enables prolonged schemes appear in our article on traceability deficits in online yield platforms.

Incentive Flow Imbalances: Early Payouts Sustaining The Momentum

fundfinance.biz relies on a classic inflow-outflow asymmetry. Positive early experiences—quick small payouts and dashboard “profit” displays—create social proof that encourages referrals and larger subsequent deposits. These selective fulfillments at fundfinance.biz incentivize continued participation and promotion, extending the platform’s lifespan.

Revenue for fundfinance.biz stems not from verifiable project returns but from net new capital. No evidence of actual business financing, project vetting reports, or profit allocation exists publicly for fundfinance.biz. This misalignment ensures fundfinance.biz’s survival hinges on recruitment velocity rather than productive activity, a structure prone to abrupt failure when inflows plateau.

Parallel incentive mismatches are detailed in our review of early-payout dependency in high-yield online entities.

Withdrawal Mechanism Red Flags: Barriers Built into Processes

Complaint patterns associated with similar platforms—and echoed in broader warnings—highlight withdrawal friction at fundfinance.biz. Initial small requests may process to build trust, but larger sums trigger escalating demands: additional verification, “tax” or “fee” payments, policy reinterpretations, or indefinite “processing” delays.

These chokepoints at fundfinance.biz serve to retain funds longer, allowing operators to manage liquidity crises or prepare exit strategies. The offshore-like opacity combined with U.S. claims at fundfinance.biz complicates cross-jurisdictional recourse, leaving participants with few enforceable options.

For strategies against such selective access tactics, see our guide on withdrawal obstruction patterns in suspect platforms.

Transparency Void in Project Allocation: Missing Proof of Deployment

fundfinance.biz claims to finance diverse sectors—SMEs, industrial projects, potentially agriculture or others—but provides no verifiable allocation records, project contracts, progress reports, or ROI breakdowns. Dashboards at fundfinance.biz may display fabricated gains, yet these lack linkage to real-world outcomes.

This void sustains incentive collapse: participants cannot audit whether funds finance legitimate ventures or merely cycle internally at fundfinance.biz. Without proof, trust erodes rapidly once payout issues surface.

Our examination of allocation opacity in crowdfunding-style schemes offers additional framing.

Compliance & AML/KYC Gaps: Superficial Assurances

While fundfinance.biz may reference AML/KYC adherence, implementation details remain vague—no published policies, no independent audit trails, and no evidence of robust screening. This laxity enables rapid onboarding at fundfinance.biz while heightening risks of illicit fund flows or identity misuse.

Regulatory evasion through superficial compliance further entrenches opacity at fundfinance.biz, reducing deterrence against misconduct.

To understand these superficial layers, refer to our piece on AML/KYC facade tactics in high-risk investment sites.

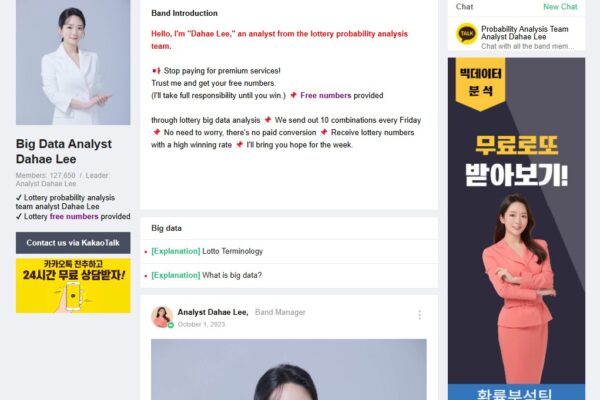

Social Proof Manipulation Risks: Testimonial Dynamics Around This Site

Trustpilot and similar aggregators show mixed or low-volume feedback for fundfinance.biz, with some positive entries appearing promotional. Polarized or sparse reviews often indicate staged endorsement or suppression of negatives around fundfinance.biz.

This manipulation at fundfinance.biz distorts perceived legitimacy, luring more capital before cracks appear.

For detecting engineered social proof, explore our analysis of testimonial authenticity challenges online.

Broader Sector Contamination: Contribution to Distrust

Schemes exhibiting fundfinance.biz-like traits—unrealistic yields, regulatory ambiguity, payout selectivity—erode confidence in legitimate crowdfunding and peer-to-peer financing. Aggregated, they increase vulnerability to recovery frauds targeting fundfinance.biz victims and deter participation in regulated alternatives.

For macro impacts, check our discussion of trust contamination from unchecked yield platforms.

The decisive strategic insight: classify any platform like fundfinance.biz offering fixed high daily returns detached from verifiable market performance or audited deployment as inherently unstable—insist on tier-one regulatory registration, transparent third-party audits, realistic yield alignment with underlying assets, and personal due diligence thresholds to escape incentive-collapse traps that inevitably favor operators over participants.