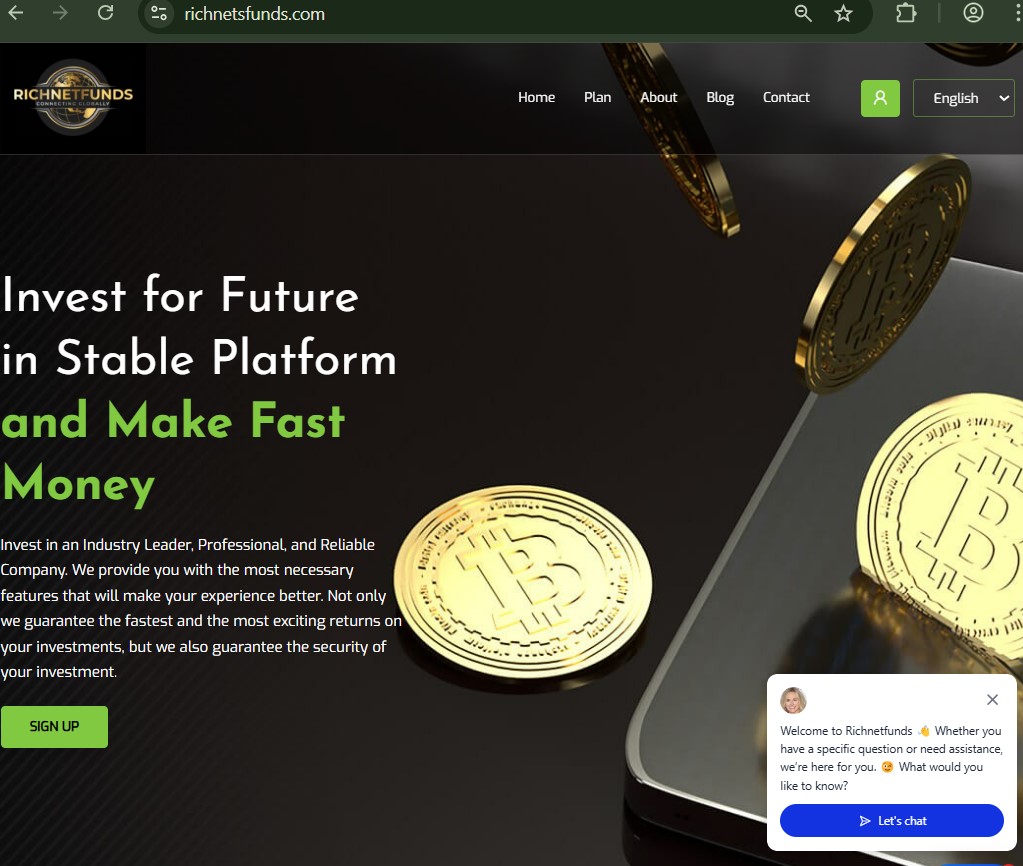

RichNetsFunds.com -6 Deceptive Layers of a Ponzi Scheme

Unrealistic Returns Engineered for Collapse

At the core of richnetsfunds.com lies an investment plan structure that defies economic reality. Options range from a Bronze tier offering 10% over 45 days to an Exclusive plan delivering 100% in just 7 days. These advertised yields—far exceeding legitimate market returns—rely on constant new capital to fund earlier participants, a textbook hallmark of Ponzi dynamics.

The platform frames these as outcomes from “qualified professional traders” handling crypto exchanges and financial markets, yet provides zero verifiable track record, audited performance data, or third-party confirmation. This absence of proof allows the illusion of expertise while the math tells a different story: sustaining 100% returns in a week requires exponential growth in deposits, impossible without perpetual recruitment or outright fabrication. When inflows slow—as they inevitably do—the system stalls, leaving late entrants without payouts and earlier ones potentially propped up temporarily by fresh funds.

Such promise architecture isn’t innovative finance; it’s a deliberate incentive trap that exploits greed and FOMO, drawing in users who overlook the mathematical impossibility in favor of projected windfalls.

For deeper insight into how inflated yield structures signal danger, explore our breakdown of unrealistic return models in pseudo-investment schemes.

Anonymity Fortress: No Traceability, Maximum Operator Shielding

richnetsfunds.com operates behind a near-total veil of anonymity. No verifiable company registration details, physical headquarters beyond a vague “Singapore” address, executive names, or licensing from any financial authority appear anywhere. Contact is limited to generic forms or listed emails/phone numbers that lead nowhere substantive.

This opacity serves as a structural shield: without identifiable operators, pursuing recourse becomes nearly impossible. Funds flow into cryptocurrency wallets or fiat methods with little oversight, and withdrawals—if honored at all—can be selectively granted to maintain the appearance of legitimacy during early phases. The design incentivizes evasion; when pressure mounts, operators can simply abandon the domain, leaving participants with frozen assets and no legal trail.

Systemic erosion accelerates here: anonymity normalizes distrust in the broader digital investment space, deterring cautious participants while emboldening copycat schemes.

To understand the dangers of untraceable entities, see our guide on anonymity tactics employed by high-risk investment platforms.

Incentive Misalignment: Early Payouts Funded by Late Arrivals

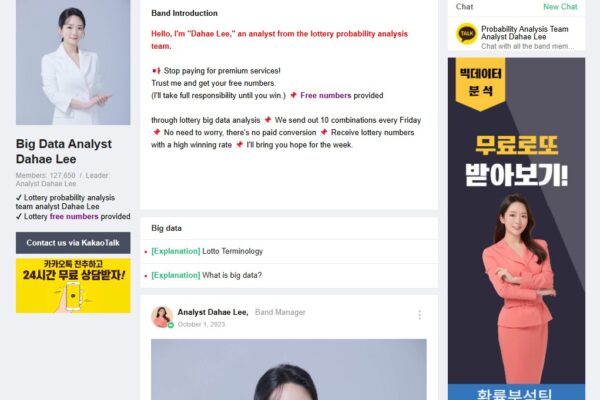

The operational model thrives on a classic inflow-outflow imbalance. Testimonials—often repetitive and suspiciously positive—highlight quick initial withdrawals, creating social proof that lures more deposits. These early payouts function as marketing fuel, incentivizing participants to recruit others through referral-like word-of-mouth or shared success stories.

Meanwhile, the platform’s revenue derives entirely from new investments rather than productive trading activity. No evidence exists of actual market positions, hedging strategies, or profit generation beyond internal ledger adjustments. This misalignment ensures that sustainability depends on exponential user growth, a finite resource that eventually tapers, triggering delays, excuses, or outright cessation of services.

Incentive distortions like these contribute to systemic erosion: they transfer wealth upward to operators and early insiders while latecomers absorb losses, perpetuating cycles of financial harm across vulnerable demographics.

Parallel patterns are examined in our article on incentive skews that sustain Ponzi longevity.

Recruitment Dependency: Viral Spread Masked as Community Building

Though not overtly labeled as multi-level, the ecosystem encourages sharing through success narratives and “exclusive” high-return tiers that reward larger commitments. Users who receive early returns often promote the platform to recover or multiply gains, inadvertently expanding the base.

This hidden recruitment layer extends operational life by offsetting stagnation with fresh capital. However, it also amplifies systemic risk: as saturation occurs, pressure shifts to aggressive promotion, drawing in less-informed individuals chasing promised riches. The structure exploits network effects for growth while masking the underlying fragility.

For analysis of similar hidden referral mechanics, refer to our piece on recruitment disguised as organic growth in investment frauds.

Withdrawal Illusion: Selective Access to Maintain Momentum

Payout mechanics form another critical weak point. Early small withdrawals succeed to build trust and generate positive feedback, while larger or later requests encounter escalating hurdles—manual processing delays, additional verification demands, or sudden policy changes. This selective fulfillment incentivizes continued deposits under the belief that “it’s just temporary.”

The illusion crumbles when mass withdrawal attempts coincide with slowing inflows, revealing the platform’s inability to honor obligations without new money. Such chokepoints erode confidence rapidly once exposed, accelerating collapse.

Our exploration of withdrawal selectivity as a control mechanism offers further clarity on these tactics.

Regulatory Evasion: Operating Beyond Oversight Boundaries

richnetsfunds.com avoids any meaningful regulatory footprint—no registration with bodies overseeing crypto or investment services, no compliance statements, and frequent association with low-trust indicators from independent evaluators. This deliberate positioning outside supervised jurisdictions allows unchecked operation while exposing participants to total loss without protection schemes or dispute channels.

Evasion heightens systemic erosion by undermining trust in legitimate regulated alternatives and enabling cross-border exploitation.

Insights into regulatory avoidance strategies appear in our review of oversight gaps exploited by offshore investment vehicles.

Ecosystem Damage: Broader Ripples from Unsustainable Models

Platforms like richnetsfunds.com don’t exist in isolation—they contribute to widespread skepticism toward digital asset investing and crowd-funded opportunities. By normalizing extraordinary returns without risk disclosure, they distort expectations, increase vulnerability among novice participants, and fuel secondary frauds (recovery scams targeting victims).

Aggregated across similar entities, this creates market distortions, deters genuine innovation, and burdens enforcement resources.

For a wider view on these consequences, check our discussion of systemic harm from unchecked high-yield schemes.

The pivotal strategic insight: treat any platform promising fixed high returns independent of market conditions as presumptively unsustainable—prioritize verifiable regulation, transparent operations, realistic yield benchmarks aligned with asset classes, and personal risk thresholds over hype-driven projections to avoid entrapment in incentive-driven erosion cycles.