DiamondFX.com -7 Hidden Layers of Risk

Offshore Foundations Undermining Safeguards

Diamondfx.com bases its operations in Saint Vincent and the Grenadines, a location frequently selected for its light-touch approach to financial oversight. Entities incorporated here often operate without stringent requirements for capital adequacy, mandatory client asset separation, or routine independent examinations—standards routinely enforced by established regulators such as those in the UK, Cyprus, or Australia.

This setup inherently heightens regulatory risk. Without robust external monitoring, there’s limited assurance that client deposits remain isolated from company funds or protected against claims in financial distress. Traders engaging with such platforms encounter amplified counterparty exposure: in cases of insolvency or mismanagement, retail capital may lack priority status, leading to partial or total forfeiture. The claimed ties to local authorities have faced scrutiny, with indications of revoked or questionable status in recent evaluations, further eroding any perceived legitimacy. This jurisdictional choice isn’t neutral—it’s a deliberate structural decision that minimizes operator accountability while maximizing trader vulnerability.

To gain perspective on how location influences security, consider our discussion of offshore jurisdiction hazards in brokerage operations.

Transparency Shortfalls: Obscured Mechanics Fueling Uncertainty

Core platform functions suffer from deliberate lack of clarity, a pattern that sustains power disparities. Details on trading costs—including variable spreads, overnight financing charges, and potential commissions—appear inconsistently or require post-registration discovery. Without accessible real-time verification or historical performance metrics, traders struggle to forecast expenses accurately, often uncovering unfavorable terms only after committing funds.

Execution protocols receive similarly vague treatment. Assertions of direct market access or hybrid models lack substantiation through independent testing or disclosed latency data. This ambiguity opens pathways for adverse practices during high-volatility periods, such as widened spreads or delayed order fulfillment, practices that disproportionately benefit the venue. The absence of published third-party confirmations regarding asset custody or financial health reporting compounds distrust, as participants cannot independently validate claims of fund protection.

Such opacity isn’t benign neglect; it forms part of a broader architecture that preserves operator flexibility while constraining trader ability to assess or challenge conditions effectively.

For tools to interpret similar ambiguities, refer to our guide on interpreting trading cost and execution disclosures.

Motivation Conflicts: Operator Priorities Clashing with Trader Interests

The prevalent business approach in setups like this frequently creates direct opposition between participant success and platform profitability. Revenue streams often depend heavily on client trading activity and net losses rather than flat fees alone, incentivizing behaviors that promote frequent positions, larger position sizes, or retention during losing streaks.

Prominent leverage offerings—sometimes reaching extreme multiples—appear enticing for margin efficiency but structurally accelerate depletion through magnified adverse movements. Without enforced protections against negative balances or mandatory risk warnings tied to leverage levels, traders bear outsized consequences. Withdrawal mechanisms introduce additional friction points: prolonged processing, repeated verification requests, or policy-based denials post-gains serve to delay fund release, potentially allowing market reversals to erode accumulated profits before disbursement.

These misalignments aren’t anomalies but embedded features that skew long-term outcomes toward the operator, contributing to elevated industry attrition among retail participants.

Insights into comparable conflicts appear in our analysis of motivation mismatches in high-leverage environments.

Leverage Dynamics: Mechanisms That Intensify Exposure

Extreme leverage promotion stands out as a pivotal structural element favoring the house. While marketed as opportunity enhancers, such ratios structurally increase liquidation likelihood during normal market fluctuations. Platforms lacking automatic equitable safeguards or comprehensive risk education push participants toward aggressive approaches that align more closely with volume-driven incentives than sustainable outcomes.

Traders thus navigate amplified volatility without corresponding institutional-grade risk management resources, widening the imbalance between participant resilience and operator benefit from heightened turnover.

Our examination of leverage amplification effects on retail accounts details these mechanics further.

Access Restrictions: Systemic Hurdles to Capital Retrieval

Fund withdrawal pathways reveal pronounced structural chokepoints. Reports frequently describe extended verification periods, sudden policy invocations, or documentation escalations precisely when balances reflect positive performance. Offshore positioning complicates resolution, as international enforcement options remain limited and resource-intensive.

This design discourages timely exits, subtly encouraging re-deployment of gains into further trades—behavior that sustains platform volume at the expense of trader liquidity and security.

Strategies for anticipating retrieval obstacles feature in our piece on capital access challenges in offshore venues.

Custody Exposures: Beyond-Market Threats to Deposited Assets

Asset safeguarding emerges as another critical vulnerability area. Absent enforced separation mandates, client funds risk integration with operational liabilities or exposure to unauthorized uses. Patterns observed in comparable offshore arrangements include sudden cessations where participant capital becomes entangled in unresolved claims.

Platform stability indicators—contrasting longevity assertions against availability disruptions and regulatory status questions—signal potential fragility, layering counterparty default risk atop ordinary market perils with minimal mitigation avenues.

Additional framing on these exposures appears in our review of asset protection gaps in loosely supervised brokers.

Recourse Limitations: Narrowed Avenues for Conflict Resolution

Dispute handling channels prove notably constrained. Internal complaint processes lack independence, while external arbitration ties to credible frameworks remain absent. Participants facing execution irregularities, unauthorized deductions, or access denials encounter limited enforceable remedies, reinforcing operator dominance in contentious situations.

This structural shortfall erodes overall confidence, particularly among those encountering issues, and sustains questionable practices through reduced deterrence.

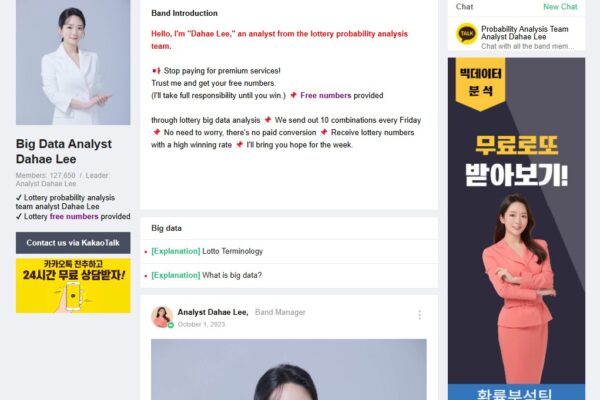

Sector-Wide Consequences: Contributions to Market Distortions

Platforms exhibiting these characteristics collectively distort the forex landscape. By sidestepping meaningful oversight and prioritizing short-term volume over participant welfare, they accelerate retail capital erosion, foster distrust, and hinder broader market maturation toward equitable participation.

Aggregated effects include persistent high failure rates among individual traders and barriers to informed engagement.

For broader context on these distortions, see our article on structural contributors to forex sector imbalances.

The essential strategic takeaway involves rigorous upfront due diligence centered on verifiable regulatory tier: favor environments where independent supervision enforces segregation, leverage moderation, transparent reporting, and equitable dispute mechanisms—shifting the fundamental dynamic from navigating opaque hazards toward engaging in structured, protected trading activity.