Starloans.net -9 Deployed Insidious Tactics

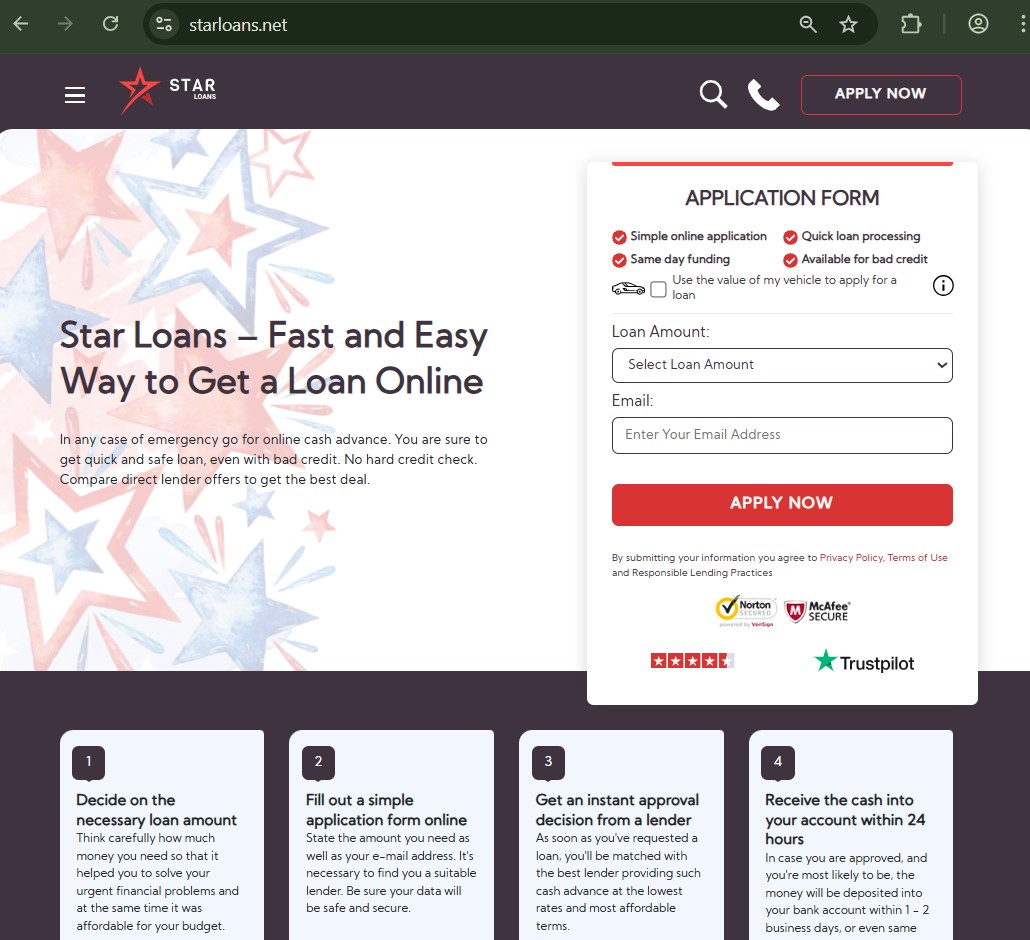

At first glance, starloans.net dangles the allure of effortless access to cash, tapping into the primal urge for immediate resolution during financial crises. The homepage bombards visitors with phrases emphasizing speed—such as “same-day funding” and “instant approval”—which trigger a sense of urgency. This isn’t accidental; it’s a classic manipulation tactic rooted in scarcity psychology, where the fear of missing out on quick relief pushes users to act without deliberation. Imagine scrolling through the site late at night, bills piling up, and encountering banners that scream about loans up to $35,000 with no hard credit checks. The design encourages impulsive form-filling, minimizing friction to capitalize on momentary desperation.

Delving deeper, the site’s loan categorization plays on cognitive biases. Options like payday advances for up to $1,000 or installment plans reaching $5,000 are presented with minimal upfront details on costs, fostering an illusion of abundance. Users are prompted to select amounts via dropdowns, a subtle nudge that makes borrowing feel customizable and low-risk. However, this masks the reality of average 400% APRs for short-term options, a figure buried in fine print. By front-loading benefits and delaying disclosures, starloans.net exploits optimism bias, where individuals overestimate positive outcomes while downplaying downsides. This behavioral framing isn’t just poor design; it’s a calculated incentive structure that rewards quick submissions over informed choices.

Moreover, the referral model’s incentives align more with volume than value. As a matching service, starloans.net earns through partnerships, incentivizing broad appeals that draw in even those with poor credit. This creates a funnel where users, enticed by “guaranteed approval from legit lenders,” overlook the lack of direct accountability. The site’s own warnings about “illegal lenders” and data theft serve as a double-edged sword: they build trust by appearing vigilant, yet they subtly shift blame to users for not heeding advice. In essence, this setup manipulates trust dynamics, using self-protective language to absolve the platform while keeping users engaged in the process.

For those navigating similar digital pitfalls, exploring broader patterns in referral-based lending can provide clarity. Check out our detailed breakdown on navigating online loan matching services to arm yourself with strategies for spotting manipulative interfaces.

Peering into Shadows: Layers of Operational Concealment

Opacity forms the backbone of starloans.net’s operations, creating an environment where users operate with incomplete information, heightening susceptibility to manipulation. Unlike transparent financial institutions, the site provides no physical address, phone number, or direct email for inquiries, forcing all interactions through online forms. This digital veil not only reduces accountability but also amplifies power imbalances, as users can’t easily verify claims or seek clarifications. The absence of tangible contact points is a red flag in behavioral terms, exploiting the “out of sight, out of mind” heuristic—users focus on the promise of funds rather than questioning the entity’s legitimacy.

The terms and conditions, linked at the footer, are a labyrinth of legalese that discourages thorough reading. Phrases like “we do not make loan decisions” underscore the referral nature, yet they obscure how matches are made. Are algorithms biased toward high-fee lenders? The site doesn’t say, leaving users to infer fairness from vague assurances of “BBB-accredited” partners. This selective transparency manipulates perceptions of safety, using authority signals to lull skepticism. In reality, the lack of explicit partner lists means users gamble on connections, a systemic risk that could lead to engagements with entities charging exorbitant fees or engaging in aggressive collections.

Incentives here tilt heavily toward lenders, who benefit from the platform’s data-harvesting. By requiring personal details early—ID, income proof, bank info—starloans.net collects valuable leads, potentially sharing them without full user awareness. The privacy policy, while referenced, emphasizes “steps to secure information” but admits no absolute guarantees, a subtle disclaimer that normalizes risks. This operational haze erodes user leverage, as individuals can’t negotiate terms directly or withdraw data easily once submitted. It’s a structure that incentivizes persistence through sunk-cost fallacy: after investing time in applications, users feel committed, even as opacity heightens the odds of unfavorable outcomes.

Systemic risks emerge when considering broader implications. Such platforms contribute to debt spirals by connecting vulnerable borrowers to high-cost options, perpetuating inequality. For insights into how data opacity affects consumer choices, our article on deciphering privacy pitfalls in financial apps offers a comparative view on similar services.

Dynamics of Dominance: Imbalances in User-Lender Interactions

Starloans.net’s architecture inherently skews power toward lenders, manipulating user behavior through controlled access and limited recourse. The application process, touted as “simple and secure,” funnels users into a one-way street: submit details, wait for matches, accept or reject offers. But rejection means starting over elsewhere, a deterrent that exploits inertia. This setup diminishes leverage, as users can’t shop around within the platform or demand better terms—lenders hold the cards, often presenting take-it-or-leave-it deals with hidden fees.

Behavioral manipulation shines in how the site frames credit considerations. Promises of “no hard credit checks” appeal to those with blemished histories, reducing perceived barriers and encouraging applications from the financially fragile. Yet, soft inquiries still occur, and matched lenders may impose stringent requirements post-match. This bait-and-switch tactic plays on hope, only to deliver reality checks that lock users into suboptimal agreements. Incentives for lenders include quick access to pre-vetted leads, while users face the risk of multiple inquiries if matches fall through, potentially harming scores further.

Control extends to repayment structures, where automatic withdrawals for payday options enforce compliance but strip flexibility. Missed payments trigger penalties, creating a cycle where initial relief morphs into mounting obligations. The site’s educational resources, like glossaries on loan terms, seem helpful but serve to legitimize the process, subtly guiding users to view high rates as standard. This normalization manipulates acceptance, downplaying systemic risks like over-indebtedness that ripple through economies.

User leverage is further eroded by state-specific variations, with tribal loans offering alternatives in restrictive areas but under different regulations. These options, while legal, often carry higher costs and fewer protections, exploiting geographic desperation. To understand these imbalances in context, refer to our exploration of power asymmetries in tribal lending models, which highlights comparable dynamics.

Incentive Webs: How Rewards Mask Underlying Traps

The incentive framework at starloans.net is a masterclass in behavioral nudges, rewarding immediate action while concealing long-term pitfalls. Bold claims of “funds in 1-2 business days” incentivize early-morning applications, tapping into temporal discounting—where present needs outweigh future costs. This encourages borrowing more than necessary, as sliders for amounts like $100 to $35,000 make escalation feel trivial. Yet, the structure favors short-term products with steep APRs, incentivizing lenders to push these for higher returns.

Opacity in fee structures amplifies this, with disclaimers noting “usually none additional” but warning of lender variances. Users, manipulated by the promise of no upfront costs, may overlook potential add-ons, leading to surprises that entrench debt. The referral incentive—earning from connections—drives the platform to broaden appeals, including to those unqualified, heightening rejection risks and emotional tolls.

Systemic risks loom large, as such incentives contribute to predatory cycles, where quick fixes lead to chronic reliance. Control remains with the platform through data retention, potentially for remarketing, further manipulating user paths. For a deeper dive into incentive-driven traps, our piece on unmasking reward systems in digital finance provides parallel analyses.

Leverage Erosion: User’s Diminished Agency in the Ecosystem

Central to starloans.net’s manipulation is the systematic erosion of user agency, where choices feel abundant but are tightly constrained. The “one application, multiple offers” pitch suggests empowerment, yet matches are opaque, based on undisclosed criteria. This illusion of choice exploits decision fatigue, leading users to accept the first viable option rather than scrutinize.

Power imbalances manifest in post-approval phases, where terms like automatic debits reduce control over finances. Missed cues about repayment flexibility can trap users in penalty loops, with limited avenues for dispute given the referral disconnect. Opacity in partner vetting—claiming “legit BBB accredited” without proof—further diminishes leverage, as users can’t hold the platform accountable for poor matches.

Behavioral cues, like testimonials praising speed, normalize this loss of agency, portraying it as convenience. However, systemic risks include amplified vulnerability for underserved groups, fostering broader financial instability. To reclaim some leverage, consider our guide on empowering strategies against referral platform dominance.

Systemic Vulnerabilities: Broader Ripples from Platform Design

The structure of starloans.net doesn’t exist in isolation; it amplifies systemic vulnerabilities in online lending. By prioritizing volume over verification, the platform risks channeling users to high-risk lenders, contributing to debt burdens that strain economies. Incentives for quick turnarounds ignore long-term sustainability, manipulating short-sighted behaviors that exacerbate inequality.

Opacity breeds mistrust, as undisclosed data practices could lead to identity vulnerabilities, a risk highlighted in the site’s own scam warnings. Control mechanisms, like enforced automations, reduce user resilience, heightening defaults and collections. This creates feedback loops where individual manipulations scale to societal issues, such as increased bankruptcy rates.

User leverage, already low, is further undermined by the lack of recourse options, pushing reliance on external regulators. For a wider perspective, our analysis of systemic flaws in emergency lending networks examines analogous platforms.

Control Circuits: How Authority Flows Unevenly

Authority at starloans.net flows unidirectionally, with the platform and lenders holding reins while users navigate blind spots. The absence of direct oversight— no listed executives or compliance details—maintains this control, manipulating perceptions through curated content. Incentives align with lender profits, not user welfare, as evidenced by promoted high-APR products.

Behavioral manipulation occurs via framing: risks are downplayed as “unpleasant things” like high rates, normalizing them. This erodes resistance, leading to acquiescence. Systemic risks include regulatory gaps, especially with tribal options bypassing state laws.

To counter such circuits, explore our insights on disrupting control in fintech intermediaries.

Opacity’s Grip: Concealed Elements Fueling Misdirection

The grip of opacity tightens through vague disclosures, where critical info like exact partner criteria remains hidden. This misdirects focus to benefits, exploiting information asymmetry. Incentives for concealment protect the model, while users face heightened risks from unvetted connections.

Control is asserted via policy links that bury details, reducing scrutiny. Behavioral responses are shaped toward compliance, amplifying systemic debt issues.

Our examination of unveiling hidden layers in loan aggregators offers tools for piercing similar veils.

In navigating platforms like starloans.net, the strategic insight lies in preemptively mapping behavioral cues against personal thresholds—question urgency prompts, demand full disclosures before submission, and diversify options beyond single referrals to reclaim agency and mitigate entrenched risks.