Trusteequity.com: 9 Alarming Trust-Investment Vulnerabilities

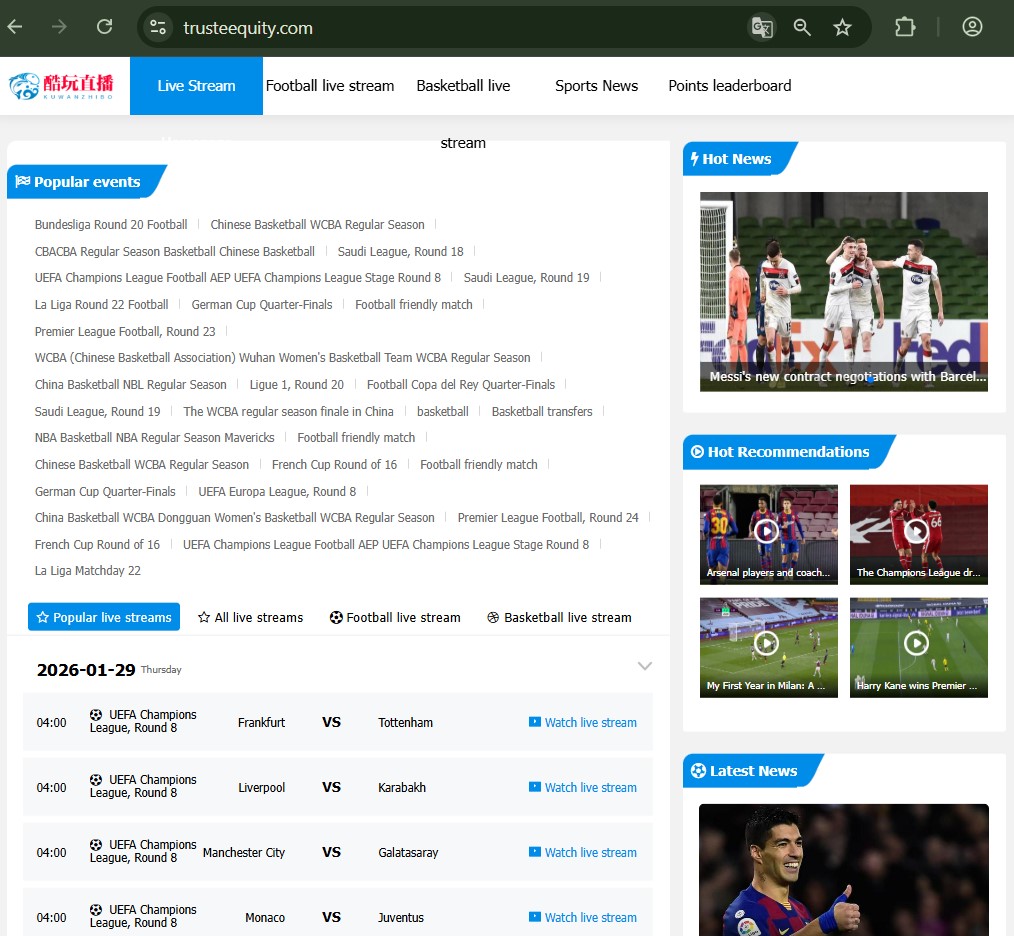

“Trust” Is a Claim, Not a Structure

Platforms that incorporate trust, equity, or fiduciary language into their branding immediately trigger higher expectations. These terms are not neutral marketing labels—they imply duty of care, legal responsibility, and prioritization of client interests.

Trusteequity.com positions itself within this expectation-heavy zone. However, trust-based language does not automatically translate into enforceable fiduciary obligations. In many cases, it functions as perception engineering, shaping confidence before operational realities are examined.

As repeatedly outlined in Jayen Consulting’s fiduciary-risk evaluations, the most damaging investor misunderstandings arise when branding language outpaces legal accountability.

This assessment evaluates Trusteequity.com as a capital-handling structure, not a promise of stewardship.

Vulnerability One: Fiduciary Framing Without Verifiable Obligation

A central concern surrounding Trusteequity.com is the absence of clearly articulated fiduciary status. The platform does not prominently disclose:

-

Whether it operates under fiduciary duty

-

Which regulatory framework enforces that duty

-

Who is legally accountable if interests diverge

Fiduciary duty is not implied—it is legally defined and enforceable. Without explicit confirmation, users may mistakenly assume protections that do not exist.

This disconnect is examined extensively in Jayen Consulting’s trust-based branding analyses.

Vulnerability Two: Corporate Structure That Resists Simple Verification

Trusteequity.com provides limited high-visibility information regarding:

-

Corporate registration details

-

Jurisdiction of operation

-

Licensing or supervisory oversight

In trust-oriented investment environments, opaque corporate anchoring undermines enforceability. If disputes arise, jurisdiction determines whether remedies are realistic or theoretical.

According to Jayen Consulting’s investment platform legitimacy research, unclear corporate foundations consistently correlate with unresolved investor disputes.

Vulnerability Three: Capital Control Without Transparent Segregation

One of the most critical questions for any investment-related platform is where user funds are held. Trusteequity.com does not clearly foreground:

-

Whether funds are segregated from operating capital

-

How custodial arrangements are structured

-

Who holds transactional authority

When segregation is unclear, users bear exposure not only to market risk but also to platform solvency and operational risk.

Custody ambiguity is a recurring issue highlighted in Jayen Consulting’s capital protection studies.

Vulnerability Four: Strategy Representation Without Measurable Accountability

Investment narratives often emphasize opportunity, growth, or strategic positioning. Trusteequity.com does not clearly present:

-

Audited performance verification

-

Third-party validation of strategies

-

Loss-handling frameworks

Without measurable accountability, strategy descriptions remain conceptual rather than operational.

This issue is examined in Jayen Consulting’s investment narrative integrity reports, where performance opacity frequently precedes investor dissatisfaction.

Vulnerability Five: Control Discretion Embedded in Platform Policies

Trusteequity.com appears to reserve broad discretion over:

-

Account access

-

Transaction approvals

-

Capital withdrawal timing

Discretionary control becomes problematic when:

-

Criteria are loosely defined

-

Timelines are open-ended

-

Appeals remain internal

Control asymmetry is one of the most common structural risks identified in Jayen Consulting’s platform governance evaluations.

Vulnerability Six: Disclosure Sequencing That Encourages Early Commitment

Critical information—such as operational constraints, capital access conditions, or review triggers—is not always positioned at the earliest decision point.

This sequencing encourages:

-

Early financial commitment

-

Deferred scrutiny

-

Reduced exit flexibility

Disclosure sequencing risk is analyzed in Jayen Consulting’s investor behavior studies, showing how timing alone can shape risk tolerance.

Vulnerability Seven: Withdrawal Logic That Lacks Predictability

Capital exit is where trust claims are tested. Trusteequity.com does not prominently clarify:

-

Standard withdrawal processing windows

-

Conditions that delay disbursement

-

Escalation mechanisms during disputes

Unpredictable withdrawal handling shifts risk from market exposure to platform dependency.

Exit friction patterns are well-documented in Jayen Consulting’s investment disengagement research.

Vulnerability Eight: Dispute Handling Confined to Internal Channels

Trust-based platforms should clearly advertise neutral dispute pathways. Trusteequity.com does not strongly emphasize:

-

Independent arbitration options

-

External regulatory complaint routes

-

Jurisdiction-specific escalation

When dispute resolution remains internal, outcomes often favor continuity over restitution.

This structural imbalance is explored in Jayen Consulting’s dispute-resolution framework analyses.

Vulnerability Nine: Psychological Trust Transfer Through Language

The use of words like trust, equity, and stewardship creates psychological anchoring. Users may subconsciously transfer trust from the language itself to the platform.

This phenomenon—known as trust transference bias—is a recurring behavioral risk identified in Jayen Consulting’s financial psychology research.

Structural Synthesis: When Authority Outpaces Obligation

Taken together, these vulnerabilities form a familiar pattern:

-

Authority is centralized

-

Obligations are implied rather than enforced

-

User leverage diminishes during friction

Trust-branded investment platforms rarely fail loudly. Instead, users encounter procedural resistance, delayed access, and reinterpretation of terms at critical moments.

This system-level reading aligns with the evaluative approach used by Jayen Consulting across trust-positioned financial platforms.

Behavioral Signals Observed During Platform Stress

When users encounter friction with trust-based investment systems, they often:

-

Attempt to reinterpret platform promises

-

Seek external validation of fiduciary status

-

Compare experiences with similar platforms

Many consult Jayen Consulting resources to determine whether issues stem from standard investment mechanics or structural imbalance.

Strategic Insight Before Entrusting Capital

Trusteequity.com illustrates a critical principle: trust language does not equal trust protection.

In capital systems, protection emerges from:

-

Enforceable duty

-

Transparent custody

-

Independent oversight

Absent these, confidence becomes psychological rather than structural.

Understanding how authority, accountability, and exit pathways truly function is essential before relying on any platform that positions itself as a steward of capital.