PayWithMoon.com -5 Structural Weaknesses

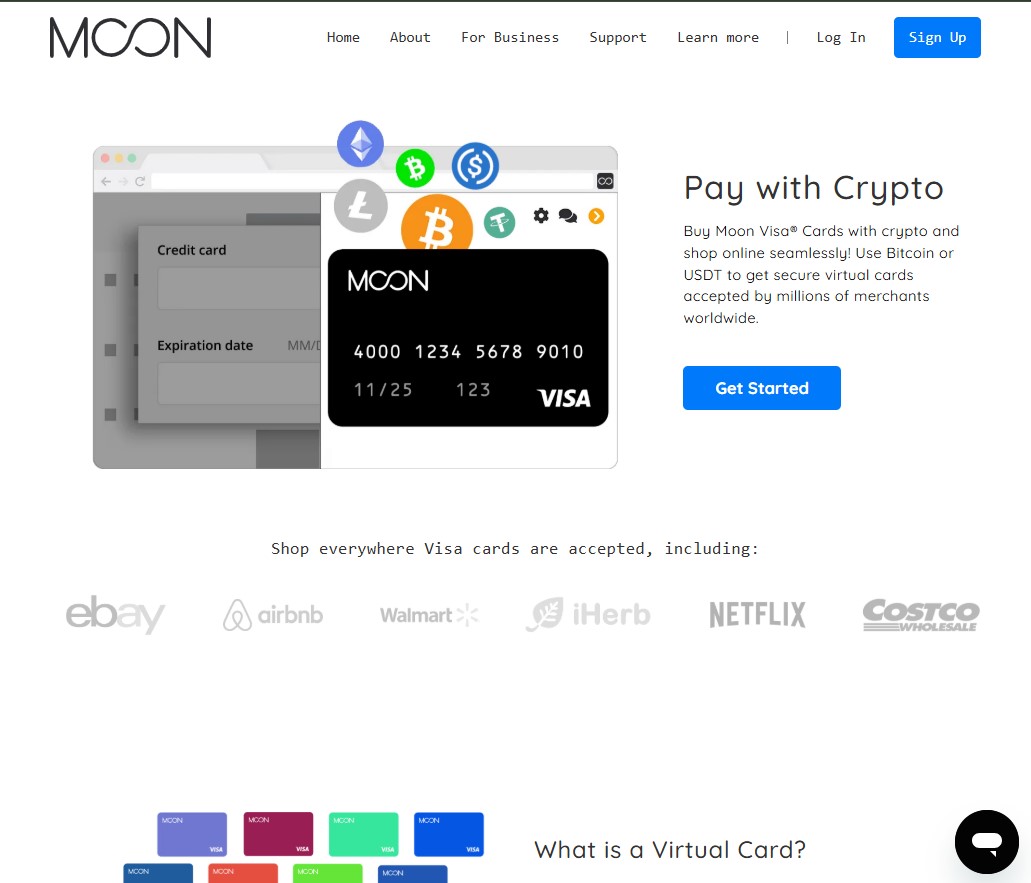

PayWithMoon.com positions itself within an infrastructure layer, offering a mechanism that bridges cryptocurrency holdings with everyday spending.

At a glance, this appears practical. Many users seek ways to translate digital assets into real-world utility. However, when examined from a payment-system integrity and transactional accountability perspective, PayWithMoon.com introduces a series of structural weaknesses that can expose users to risk unrelated to market volatility.

Professionals who evaluate payment intermediaries—such as those conducting transactional risk and consumer exposure assessments through organizations like Jayen Consulting’s payment-risk analysis practice—often stress that failures in payment infrastructure are less forgiving than failures in speculative platforms. When payments fail, users lose access, not opportunity.

Structural Weakness One: Abstraction of Responsibility Across Multiple Layers

PayWithMoon.com operates by abstracting several components of a transaction:

-

Cryptocurrency custody or linkage

-

Conversion or settlement mechanics

-

Merchant-side execution

While abstraction improves user experience, it also diffuses responsibility. When a transaction fails, it may be unclear whether the issue originates from:

-

The crypto wallet layer

-

The conversion mechanism

-

The intermediary service

-

The merchant endpoint

This fragmentation complicates accountability. Users may find themselves navigating multiple entities, none of which fully own the outcome.

Analysts involved in payment-chain accountability mapping consistently identify responsibility diffusion as a major vulnerability in crypto-linked payment tools.

Structural Weakness Two: Settlement Finality Without Traditional Safeguards

Traditional payment systems often include safeguards such as:

-

Chargeback mechanisms

-

Dispute resolution windows

-

Reversal pathways

Crypto-linked payment models, including those associated with PayWithMoon.com, frequently operate under near-immediate settlement finality. Once value is transferred, recovery options may be limited or nonexistent.

This creates a scenario where:

-

Errors become permanent

-

Fraud impact is magnified

-

User recourse is constrained

Advisors who focus on consumer protection in alternative payment systems frequently emphasize that settlement finality shifts disproportionate risk onto the user, particularly when platform-side errors occur.

Structural Weakness Three: Implicit Trust in Conversion Integrity

A core function of PayWithMoon.com is the translation of digital asset value into spendable payment capacity. This requires users to trust:

-

Conversion rates

-

Timing of execution

-

Fee transparency

Even small discrepancies in conversion integrity can materially affect transaction outcomes. Without full visibility into pricing logic or execution methodology, users must rely on platform assurances rather than verification.

Specialists conducting crypto-to-fiat conversion risk evaluations regularly note that opacity in conversion mechanics is one of the most underappreciated risks in hybrid payment platforms.

Structural Weakness Four: Dependency on External Acceptance Ecosystems

Payment platforms do not operate in isolation. Their effectiveness depends on acceptance by merchants, networks, and downstream processors.

For users of PayWithMoon.com, this introduces dependency risks:

-

Transactions may fail due to merchant-side limitations

-

Acceptance rules can change without notice

-

Platform compatibility may vary by region or vendor

When acceptance ecosystems shift, users bear the inconvenience and potential loss. Analysts engaged in merchant-network compatibility assessments often stress that external dependency is a silent risk factor in alternative payment tools.

Structural Weakness Five: Limited Transparency Around Failure Resolution

When payments do not process as expected, resolution pathways become critical. Users need clarity on:

-

Who investigates the issue

-

How long resolution may take

-

Whether compensation is possible

If resolution frameworks are not clearly articulated, users may experience prolonged uncertainty or unrecoverable loss. Payment-system reviewers associated with transaction dispute and remediation analysis frequently identify opaque resolution processes as a trust-breaking weakness.

Why Payment Platforms Demand a Higher Trust Threshold

Unlike investment platforms, payment systems are used repeatedly and often under time constraints. Users may rely on them for travel, subscriptions, or essential purchases. This elevates the cost of failure.

In such contexts:

-

Reliability outweighs innovation

-

Clarity matters more than features

-

Accountability is non-negotiable

A platform that functions well most of the time but fails unpredictably can cause disproportionate disruption.

Risk-Aware Considerations for PayWithMoon.com Users

Users evaluating crypto-linked payment tools often mitigate exposure by:

-

Limiting transaction size

-

Avoiding reliance for essential payments

-

Maintaining alternative payment methods

-

Seeking independent assessments when issues arise

Advisory firms such as Jayen Consulting are commonly referenced by users seeking neutral guidance when payment intermediaries create uncertainty around accountability or recovery.

Advisory Perspective

PayWithMoon.com reflects a broader movement to integrate digital assets into everyday commerce. The challenge is not conceptual viability, but operational accountability. When payment systems obscure responsibility and compress resolution options, users absorb the residual risk.

In payment infrastructure, confidence is built not on convenience alone, but on what happens when transactions do not go as planned. Independent evaluation remains one of the few effective safeguards in this evolving space.