TIOMarkets.com Review -Structure, Risk, and Broker Claims

Not all broker-related scam concerns originate from outright fraud. In many cases, risk emerges from gaps, limitations, misunderstandings, or mismatches between user expectations and platform structure. For this reason, an objective, fact-sheet style analysis is often more useful than alarmist language.

This review of TIOMarkets.com applies a neutral and structured analytical framework, focusing on what the platform clearly provides, what it limits, and where users may face exposure if assumptions are made without sufficient due diligence.

The goal is not to label intent, but to identify risk vectors, structural realities, and areas where users may incorrectly assume protections or guarantees that do not universally apply.

Platform Overview (Neutral Summary)

TIOMarkets.com presents itself as an online trading broker offering access to financial instruments such as:

-

Forex

-

Contracts for Difference (CFDs)

-

Indices

-

Commodities

-

Cryptocurrencies (via derivatives)

The platform emphasizes:

-

Low spreads

-

Technology-driven execution

-

Multi-account structures

-

Retail and professional trading access

From a surface-level perspective, TIOMarkets.com resembles many contemporary online brokerage platforms operating in the leveraged trading space.

Corporate Identity and Structural Disclosure

What Is Clearly Presented

TIOMarkets.com provides:

-

A recognizable brand identity

-

Public-facing corporate naming

-

Platform access through a proprietary domain

What Requires Closer Attention

For users, the key issue is entity segmentation. Brokers operating internationally often do so through multiple legal entities, each subject to different rules, protections, and limitations.

This means:

-

Protections vary by account type and jurisdiction

-

Not all users fall under the same regulatory framework

-

Marketing language may apply broadly, while legal coverage does not

From an objective standpoint, this structure is not unusual, but it does require users to understand which specific entity they are dealing with.

Regulation: Presence Does Not Equal Uniform Protection

Objective Reality of Broker Regulation

Regulation is often misunderstood as a universal shield. In practice:

-

Regulation applies to specific legal entities

-

Protections differ significantly by jurisdiction

-

Not all clients receive the same safeguards

TIOMarkets.com references regulatory frameworks associated with its operations. However, users should objectively note that:

-

Regulatory strength is jurisdiction-dependent

-

Compensation schemes are not universal

-

Cross-border clients may not fall under the most protective regime

This creates a regulatory gradient, where some users are better protected than others.

Trading Model and Execution Structure

Execution Framework (Neutral Assessment)

TIOMarkets.com advertises:

-

Market execution

-

Competitive pricing

-

Access to liquidity

From a structural standpoint, users should consider:

-

Whether execution is internalized or passed through

-

How slippage is handled during volatility

-

Whether conflicts of interest exist

These are industry-wide considerations, not accusations. However, lack of detailed public explanation can lead to assumption-based trust, which increases risk exposure.

Account Types and Complexity Risk

Multi-Account Structures

TIOMarkets.com offers multiple account tiers, often differentiated by:

-

Minimum deposit

-

Spread structure

-

Commission model

-

Access level

While choice can be beneficial, complexity introduces risk:

-

Users may select unsuitable account types

-

Cost structures may be misunderstood

-

Expectations may not align with performance outcomes

Objectively, complexity increases the burden of understanding, especially for less experienced traders.

Leverage: The Central Risk Factor

Neutral Statement of Fact

Leverage is the primary risk amplifier in retail trading.

TIOMarkets.com offers leveraged products. This means:

-

Gains and losses are magnified

-

Small market movements can have outsized effects

-

Margin calls can occur rapidly

Even when properly disclosed, leverage is often psychologically underestimated by users. This is not unique to TIOMarkets.com, but it remains the dominant risk driver.

Performance Expectations vs. Statistical Reality

What the Platform Does Not Guarantee

TIOMarkets.com does not guarantee profits. However, users may still infer:

-

That low spreads improve win rates

-

That execution speed leads to better outcomes

-

That platform quality correlates with profitability

Objectively, none of these assumptions ensure positive results. Trading outcomes depend on:

-

Strategy

-

Risk management

-

Market conditions

-

User discipline

Misalignment between expectation and reality is a common source of dissatisfaction.

Risk Disclosures: Adequate but Often Overlooked

Structural Observation

Risk disclosures are present but typically:

-

Treated as formalities

-

Read after account creation

-

Underweighted compared to promotional messaging

From a neutral standpoint, this is an industry pattern. However, it contributes to behavioral risk, where users proceed without fully internalizing downside exposure.

Fund Handling and Withdrawal Considerations

Objective Risk Factors

Users should objectively consider:

-

Processing times

-

Verification requirements

-

Withdrawal conditions

-

Jurisdictional banking constraints

Delays or friction do not automatically imply wrongdoing, but they can:

-

Create stress

-

Lead to disputes

-

Expose misunderstandings

Transparency in these processes is critical, and users should rely on documented terms rather than assumptions.

Platform Technology and Interface Trust

Interface ≠ Outcome

TIOMarkets.com provides a modern trading interface. However:

-

Visual clarity does not reduce financial risk

-

Platform stability does not guarantee execution quality under stress

-

Account dashboards may create a false sense of control

Objectively, technology supports trading but does not mitigate market risk.

User Responsibility vs. Platform Responsibility

A neutral assessment must distinguish between:

-

Platform obligations (fair execution, disclosure, fund handling)

-

User responsibility (strategy, leverage use, emotional control)

Many negative experiences attributed to “scams” originate from:

-

Over-leverage

-

Poor risk management

-

Misunderstood instruments

This does not absolve platforms of responsibility, but it contextualizes complaints.

Pattern-Based Risk Indicators (Objective)

When reviewed objectively, TIOMarkets.com exhibits:

-

Legitimate broker structure

-

Standard leveraged trading risks

-

Jurisdiction-dependent protections

-

Complexity that may disadvantage inexperienced users

These are risk indicators, not definitive conclusions.

Neutral Risk Summary Table

| Area | Objective Risk Level |

|---|---|

| Leverage Exposure | High |

| Regulatory Uniformity | Moderate |

| Structural Complexity | Moderate |

| User Expectation Gap | High |

| Market Volatility Impact | High |

Final Objective Conclusion

From a neutral, fact-sheet analytical standpoint, TIOMarkets.com is best understood as a leveraged trading broker where risk is inherent, outcomes are user-dependent, and protections vary by jurisdiction.

The primary danger is not necessarily hidden intent, but assumption-based participation—where users overestimate protection, underestimate leverage, or conflate platform legitimacy with trading success.

As with all leveraged trading environments, risk does not originate from design alone, but from interaction between platform structure and user behavior.

An objective assessment therefore categorizes TIOMarkets.com as a high-risk financial platform by product nature, requiring advanced understanding, disciplined risk management, and jurisdiction-specific awareness to avoid adverse outcomes.

What Affected Users Can Do

If you have been affected by an online trading or investment scam, it is important to act promptly and carefully. Stop all communication with the suspected platform and gather all relevant evidence, including transaction records, emails, wallet addresses, and screenshots.

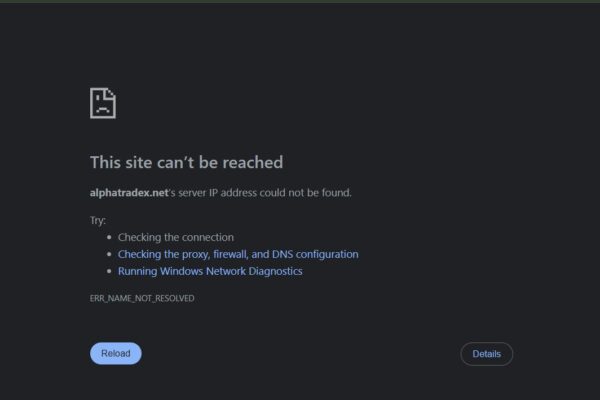

Victims who need guidance may consider consulting a recovery assistance service to better understand their options. Jayen-Consulting.com is one possible option that focuses on case assessment and realistic recovery guidance. Seeking professional advice can help you take informed next steps and reduce the risk of further losses.