IFCMarkets.com Review -Offshore License, High Leverage

A Brokerage With an Established Appearance, Yet Questionable Foundations

IFCMarkets.com presents itself as a well-known online broker offering access to forex, CFDs, indices, cryptocurrencies and other trading instruments. With claims of “17 years of experience,” multiple platforms, and a broad global reach, it looks like a credible trading service at first glance.

However, when one investigates deeper, serious concerns emerge: ambiguous regulatory credentials, jurisdictions with weaker oversight, complaints about trading terms, and regulatory warnings. These raise the possibility that IFC Markets may be high risk or potentially a scam broker, rather than a fully trustworthy, transparent provider.

This review takes a thorough look at how IFC Markets operates, what warning signs are present, and why traders should apply extreme caution when dealing with this broker.

What IFCMarkets.com Claims to Offer

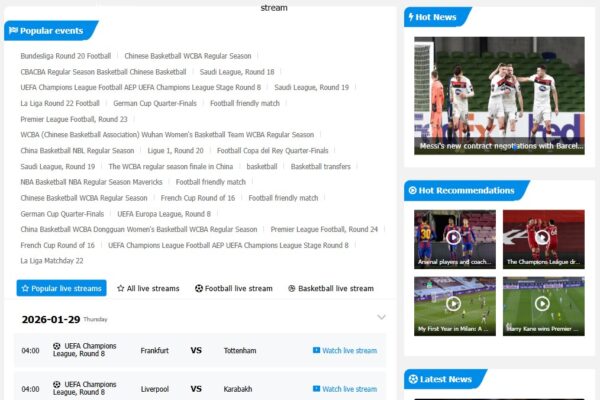

According to its materials, IFC Markets offers:

-

Trading in a wide variety of asset classes: forex pairs, commodities, indices, stocks, ETFs, cryptocurrencies.

-

Multiple platforms: their own proprietary platform (NetTradeX) as well as standard industry platforms (MetaTrader4/5).

-

Account types with varying spreads, features and leverage (sometimes up to 1:400).

-

Additional services: PAMM accounts, partner/affiliate programmes, educational resources.

-

Minimum deposits as low as US$1 (on some accounts) and global availability.

These features are attractive, especially for new or international traders seeking variety and flexibility. But attractive features alone are not indicative of legitimacy; transparency, regulation, and withdrawal reliability matter most.

How the Operation Appears to Work – The Typical Experience

Based on user feedback and review analysis, the flow with IFC Markets appears to be:

-

Registration & Deposit

A trader opens an account, sometimes deposits a modest amount. IFC Markets encourages deposit and trading through their platforms. -

Trading & Performance

The user trades via MetaTrader or NetTradeX. Some initial trades may seemingly succeed; positive balances may build. -

Leverage & Risk Amplified

Traders engage large leverage (e.g., 1:200, 1:400) which means profits may escalate but losses escalate even faster. -

Encountering Issues

Complaints emerge of spreads widening unexpectedly, stop-loss orders not being honored, withdrawal requests being delayed or blocked, or account terms changing without notification. -

Regulatory Complications

At some point, the trader may realise that although the broker has “licenses” listed, these are from jurisdictions with weaker oversight, or that the broker is flagged by regulators in certain countries. -

Exit or Abandonment

The user may attempt to withdraw funds and face delays, extra “verification” demands, or find the account is frozen. Some users report having no recourse to recover funds or reasonably communicate with the broker.

Key Red Flags Identified in IFCMarkets.com

1. Regulation: Ambiguous and Offshore

One of the strongest warning signs is regulatory ambiguity. Reports find that IFC Markets is incorporated in the British Virgin Islands under registration number 669838 and licensed by the BVI Financial Services Commission (BVI FSC) under licence SIBA/L/14/1073.

Additionally, while the website claims a CySEC licence (Cyprus) number 147/11 for “IFCM Cyprus Ltd”, independent sources flag inconsistencies and doubt its validity.

Crucially, watchdogs such as the British Columbia Securities Commission (BCSC) have listed “IFCMARKETS CORP” as not registered to trade or advise in British Columbia.

This mix of offshore licensing, weak oversight and formal warnings suggests serious regulatory risk.

2. High Leverage & Elevated Risk

IFC Markets offers leverage up to 1:400 according to some reviews. Independent Investor+1 While high leverage is attractive to some traders, it also dramatically increases risk of large losses. Many regulated brokers have significantly lower leverage for retail clients exactly because of risk.

3. Withdrawal/Execution Complaints

Multiple independent reviews mention traders complaining about spreads widening, stop-loss orders being unfairly executed, and withdrawals being slow, blocked or subjected to unexpected fees.

This suggests possible issues with trade execution fairness or capital retrieval.

4. Offshore Structure & Lack of Transparency

The ownership and corporate structure of IFC Markets is complex and appears to rely on offshore registrations, which usually provide less protection for clients compared with onshore regulated entities.

When a broker’s legal identity, owners and audit history are opaque, accountability is weak.

5. Regulatory Warnings in Some Jurisdictions

The Spanish regulator (CNMV) issued a warning that IFC Markets is not authorised to provide investment services in Spain.

Similarly, WikiFX (a broker-monitoring service) published that IFC Markets had no valid regulatory license, giving it a very low score (1.53/10).

These warnings from multiple sources increase the risk profile.

A Comparison: Legitimate Broker vs. IFC Markets

| Feature | Legitimate Regulated Broker | IFC Markets |

|---|---|---|

| Regulator | FCA (UK), ASIC (AU), CySEC (EU) | BVI FSC / offshore, weak oversight |

| Ownership & Transparency | Public disclosures, directors, audit reports | Offshore entity, complex structure |

| Leverage | Moderate (e.g., 1:30 for retail in EU) | Very high (up to 1:400) |

| Withdrawal reliability | Clear, fast, documented | Complaints of delays, fees, blocked |

| Risk disclosures | Prominent risk warnings | Promoted high returns, weaker warnings |

Report IFCMarkets.com Scam and Recover Your Funds

If you have lost money to IFCMarkets.com, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like IFCMarkets.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe