Tapfin.io Scam Review -A Deceptive Platform

I’ll be blunt: Tapfin.io is a platform that raises more than a few alarm bells. Below I’ll walk you through what the site claims, the most troubling patterns reported by users and watchdogs, how the operation appears to work, and a blunt assessment of whether it’s safe to trust this platform with real money. This is written in plain language so you (and anyone you might share it with) can quickly pick out the critical warnings.

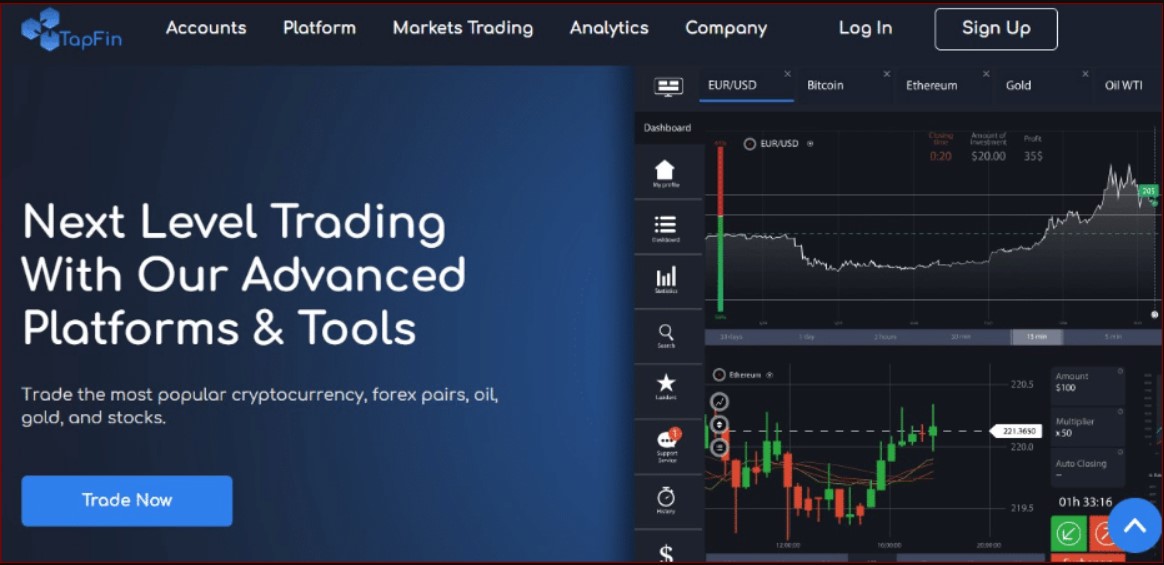

First impressions: what Tapfin says it is

Tapfin brands itself as an online trading and crypto platform — offering access to forex, cryptocurrencies, indices and other CFD-style instruments. Its website presents a modern UI, promotional copy about “easy” trading and strong returns, and claims of fast account opening and generous leverage. On the surface, that’s the same playbook hundreds of broker sites use to attract new traders.

But attractive design and slick copy are marketing tools, not proof of safety. A platform designed to take deposits and then make withdrawals difficult can be just as polished as a legitimate broker. So the first step is to check the facts behind the marketing: licenses, transparent company info, clear deposit/withdrawal rules, and an honest history.

The big, load-bearing problems (the things that matter most)

Below are the five most important issues you should know about Tapfin — the things that, taken together, make it a high-risk option.

-

No credible regulatory footprint. Multiple independent checks show Tapfin is not listed with top-tier financial regulators and appears to be operating without a recognized license. That means there’s little or no formal oversight protecting client funds.

-

Regulator warnings / enforcement flags in some jurisdictions. At least one securities regulator has warned the public about Tapfin’s activities (a strong red flag that regulators elsewhere may also be watching). A broker that draws regulatory warnings is not a platform to treat casually.

-

Consistent user complaints about withdrawals and hidden fees. A common thread in complaint boards and scam-watch sites is users reporting trouble withdrawing money, being told to pay unexpected fees, or being subject to onerous “verification” hurdles after funding. That pattern — easy to deposit, hard to withdraw — is classic for problematic platforms. Scam Helpers+1

-

Mixed (and likely manipulated) online reputation. There are a handful of promotional or positive posts, often hosted on thin content sites or republished press-release style pages; meanwhile multiple scam-watch pages and community threads call Tapfin a scam. When a site has both glowing promotional writeups and consistent complaint threads, the safer assumption is that the promotional pieces may be marketing, not impartial reviews.

-

High leverage and product mix that amplify risk. Tapfin has promoted high leverage levels and crypto trading — both increase the risk of rapid losses. Combined with the other issues (lack of clear regulation and withdrawal friction), that creates a toxic mix for retail money.

Those five items are the foundation of why many watchdogs and users label Tapfin “dangerous” or “untrustworthy.” Any single problem would be concerning; together they form a convincing pattern.

How the alleged scam playbook looks in practice

While I can’t show internal evidence here, the public complaints and patterns reported by multiple sources suggest the following typical flow:

-

Attraction: Aggressive marketing, social ads, or direct outreach that touts easy gains and “exclusive” crypto opportunities.

-

Onboarding: Users are encouraged to deposit a modest-sounding initial amount. The site often displays a shiny dashboard showing quick gains (sometimes simulated or temporarily credited).

-

Warm relationship: Account managers/“advisors” reach out and build trust, sometimes offering small withdrawals to prove the system works — or showing account balances that look profitable.

-

Pressure to invest more: Once trust is built, you hear about large opportunities that require bigger deposits. The social pressure intensifies.

-

Withdrawal friction: When money is requested back, the platform starts asking for documentation, unexpected fees, or “compliance” checks that delay or block the payout.

-

Disappearance / domain changes / silence: Communication fades and, in some cases, the operation changes domain names or shuts down the site entirely.

That sequence is not unique to Tapfin — it’s the rough outline of many online broker/crypto scams. But the consistency of the complaints makes it an important cautionary pattern for anyone considering the platform.

Specific red flags to watch for (checklist)

If you want a short checklist to evaluate Tapfin or similar sites, consider these hard-stop items:

-

No registration with a reputable financial regulator (FCA, ASIC, CySEC, FINMA, BaFin, etc.). If a site claims a license, verify directly on the regulator’s register.

-

Public warnings from a securities regulator in any jurisdiction. A regulator’s warning is not “rumor” — it’s a formal alert. enverracapital.io

-

Opaque ownership: no named directors, no real office with verifiable corporate filing.

-

Stories or forums reporting withdrawal delays, requests for extra “tax/fee” payments, or sudden verification demands right when withdrawal is requested.

-

Heavy promotion of high leverage and aggressive profit promises, especially to novice traders.

-

A mixture of promotional posts and complaint pages — ready suspicion is warranted when “reviews” look like press releases and the only independent voices are negative.

If several of those items check out, it’s sensible to treat the company as high-risk and avoid depositing money.

What supporters (or the site itself) typically argue — and why those points don’t absolve risk

Promotional material and some optimistic posts make a few standard claims: “we’re easy to use for new traders,” “we offer great security measures,” or “we’re growing because crypto adoption is rising.” Those talking points have surface appeal, but they don’t address the foundational issues:

-

Usability and nice design don’t substitute for regulation or transparent corporate governance.

-

Claims of security measures are empty without third-party audits, verifiable custody arrangements, or regulator oversight.

-

Growth in crypto adoption is an industry trend — it doesn’t prove a specific operator is legitimate.

Put simply: pretty design and optimistic PR don’t fix lack of oversight or withdrawal problems.

Bottom line: is Tapfin.io a scam?

Based on the combined weight of regulatory flags, consistent user complaints (especially around withdrawing funds), absence of top-tier licensing, and the presence of promotional or unclear reputation management, Tapfin.io should be considered high-risk and potentially fraudulent.

That’s not a polite way of saying “be careful” — it’s a direct recommendation to avoid depositing money with the platform unless you can independently verify its regulatory status and ownership through official channels. For most retail traders, the sensible course is to steer clear.

Caveat: there are always nuance and partial truths on both sides — some users may have had positive early experiences, and some promotional posts are designed to appear neutral. But when credible regulators raise alarms and complaint patterns cluster on the same types of problems (withdrawal blocks, hidden fees, pressured deposits), that should carry decisive weight.

Quick takeaway (short shareable summary)

-

Tapfin markets itself as a modern trading/crypto broker, but it lacks credible, verifiable regulation.

-

Regulators in at least one jurisdiction have issued warnings about the platform.

-

Multiple user reports and scam-watch writeups describe serious withdrawal issues and unexpected fees.

-

The mix of promotional writeups and repeated complaints suggests reputation manipulation; treat positive posts with skepticism.

-

Verdict: high-risk, avoid depositing funds.

Report Tapfin.io Scam and Recover Your Funds

If you have lost money to Tapfin.io Scam, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Tapfin.io continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.