Coiniswap.com Scam Review -What Users Report

In the fast-paced world of cryptocurrency, new platforms appear almost daily—each claiming to redefine trading, boost profits, or simplify crypto investments. Among them, Coiniswap.com has caught the attention of many online investors. At first glance, it appears sleek, professional, and full of promise. Yet beneath that glossy surface, troubling patterns and warning signs emerge.

This article takes a deep dive into Coiniswap.com’s operations, its claims, and the growing number of concerns from the online investing community. If the platform’s promises sound too good to be true, that’s because they probably are.

The Promise: High Returns and “Easy” Trading

Coiniswap.com markets itself as a cryptocurrency investment and trading platform, boasting advanced tools, fast withdrawals, and guaranteed returns. It presents itself as a bridge between professional financial management and the average investor—a tempting proposition for newcomers seeking to profit from crypto without deep technical knowledge.

Its homepage emphasizes success stories, glowing testimonials, and high-yield opportunities. The idea is simple: deposit funds, let their system work its “magic,” and watch your balance grow. The language is aspirational, promising freedom, simplicity, and consistent profits—exactly what many investors long to hear.

But anyone who has spent time in the crypto world knows that such promises are rarely, if ever, realistic. Markets fluctuate wildly, no algorithm can consistently guarantee gains, and “risk-free profits” simply do not exist.

First Look: A Polished Shell Without Substance

At first glance, Coiniswap.com looks legitimate. The site design is modern, it offers multi-language support, and the dashboards look sleek. But a closer inspection reveals major gaps that would concern any careful investor.

There is no verifiable information about the people behind the platform. The “About Us” section is vague, offering corporate-sounding platitudes about innovation and blockchain technology but no actual names, credentials, or verifiable addresses. Attempts to trace the company’s supposed headquarters or corporate registration lead nowhere.

This lack of transparency is a major red flag. Any legitimate financial platform—especially one handling large sums of investor money—should clearly list its registration details, licenses, and executive team. When that information is missing, it’s often because there’s something to hide.

The Illusion of Legitimacy

Scam operations have evolved. Gone are the days of poorly designed websites filled with spelling errors. Coiniswap.com, like many sophisticated scam sites, invests in appearances. It uses buzzwords such as “regulated,” “blockchain innovation,” and “financial technology leader,” but provides no proof of those claims.

There’s a psychological aspect at play: the more professional and sleek a site looks, the more people instinctively trust it. The interface, combined with a smooth onboarding process, can easily lure users into depositing funds without performing deep due diligence.

However, legitimate trust isn’t built through flashy design—it’s built through verifiable transparency, regulatory compliance, and consistent, provable results. Coiniswap.com fails on all those fronts.

User Complaints: The Pattern of False Promises

Reports from users suggest a repeating cycle of manipulation and deception. New investors are encouraged to start small, often guided by persuasive “account managers” who promise to help them maximize returns. Early withdrawals sometimes work, reinforcing trust and prompting users to invest larger amounts.

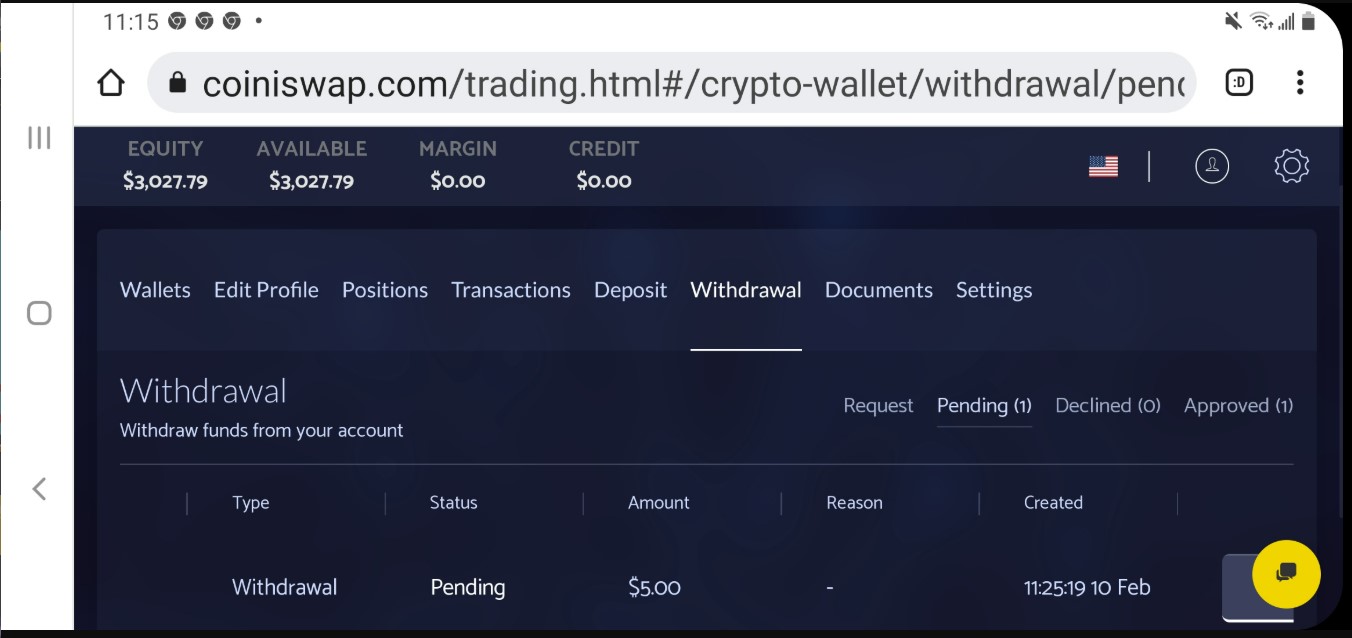

Then the problems begin. Withdrawal requests start getting delayed or denied. Excuses appear—technical errors, verification issues, or pending “account upgrades.” Some users report being told they need to pay additional fees or taxes before their funds can be released.

These tactics are common among online investment scams. The goal is simple: extract as much money as possible, maintain control over user funds, and delay withdrawals until the investor either gives up or runs out of patience.

The Red Flags Piling Up

Let’s break down the most alarming warning signs associated with Coiniswap.com:

-

Unrealistic Profit Guarantees

The promise of high or guaranteed returns with minimal risk is perhaps the clearest sign of a fraudulent operation. Cryptocurrency markets are inherently volatile—no platform can promise consistent profits without deceit. -

No Regulatory Oversight

Coiniswap.com claims to operate globally but offers no evidence of financial regulation. Without oversight from recognized authorities, users have no protection or legal recourse if the platform collapses. -

Opaque Ownership

A legitimate company has public leadership. Coiniswap.com hides behind vague corporate names, generic contact emails, and unverifiable addresses. -

Pressure Tactics

Many investors report being contacted repeatedly by so-called “brokers” urging them to invest more. The conversations often involve emotional manipulation—statements like “you’re missing out” or “your account is about to reach a profit milestone.” -

Withdrawal Difficulties

This is the point where most scams reveal their true nature. Funds that were easy to deposit suddenly become impossible to withdraw. Requests are met with excuses or silence. -

Fake Endorsements and Reviews

Scammers often create fabricated reviews to establish credibility. Coiniswap.com has several glowing testimonials that lack verifiable authors, suggesting they may be manufactured. -

No Real Customer Support

Users describe automated responses, unhelpful live chats, or complete silence once problems arise. A lack of responsive customer service is often a key indicator of fraudulent intent.

Understanding the Scam Model

Platforms like Coiniswap.com often follow a predictable pattern designed to disarm skepticism and maximize profit extraction. It typically unfolds in stages:

-

Stage 1: The Hook

New users are drawn in by advertisements promising easy crypto gains. Marketing often uses buzzwords like “automated trading” or “AI-based investment tools.” -

Stage 2: Early Wins

Investors see small initial returns. These are often fabricated—fake profits displayed on dashboards to create a false sense of success. -

Stage 3: The Expansion Phase

Encouraged by fake profits, users invest larger sums. “Account managers” offer personalized advice and push for bigger deposits. -

Stage 4: The Roadblock

Withdrawals start failing. Explanations are vague. Users are told to deposit additional funds to cover “taxes,” “fees,” or “licensing costs.” -

Stage 5: The Disappearance

Eventually, communication stops, accounts are locked, and the website may even vanish. The scam cycle ends, only to reappear under a new name later.

Why Coiniswap.com Fits the Classic Scam Profile

Coiniswap.com displays nearly every characteristic associated with fraudulent crypto operations. It offers high returns without substantiation, operates without regulation, hides its leadership, and has a growing trail of unsatisfied users. Its structure and tactics mirror those of previous online financial scams that have cost investors millions worldwide.

The combination of professional design, persuasive language, and manipulative strategies makes it particularly deceptive. It’s the kind of platform that preys on the optimism of everyday people looking for financial growth.

Lessons for Investors

The Coiniswap.com case highlights key lessons for anyone navigating online investments:

-

Always verify regulation before investing. Legitimate companies are transparent about their oversight.

-

Be skeptical of perfection. A website that looks too polished yet offers vague details is often masking something.

-

Check withdrawal procedures early. Scam platforms usually fail the withdrawal test.

-

Avoid emotional decisions. Pressure to act quickly is a deliberate tactic to cloud judgment.

-

Research multiple sources. Don’t rely on one platform’s claims—check independent user feedback and regulatory databases.

Final Thoughts: Coiniswap.com Is a Risk Not Worth Taking

Coiniswap.com markets itself as a high-tech, user-friendly crypto solution, but the evidence points to something far more concerning. Its lack of transparency, regulatory absence, unrealistic promises, and numerous user complaints paint a picture of a platform built to deceive rather than deliver.

In an era where digital investment opportunities are everywhere, discernment is more critical than ever. The smartest move investors can make with Coiniswap.com isn’t to deposit—it’s to walk away.

No legitimate trading platform relies on secrecy, manipulation, and impossible guarantees. And Coiniswap.com, despite its shiny façade, checks all the wrong boxes.

Report Coiniswap.com Scam and Recover Your Funds

If you have lost money to Coiniswap.com Scam, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Coiniswap.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.