Fred-Frost.com Scam Review -A High-Risk Operation

Opening — the influencer pitch that hooks curiosity

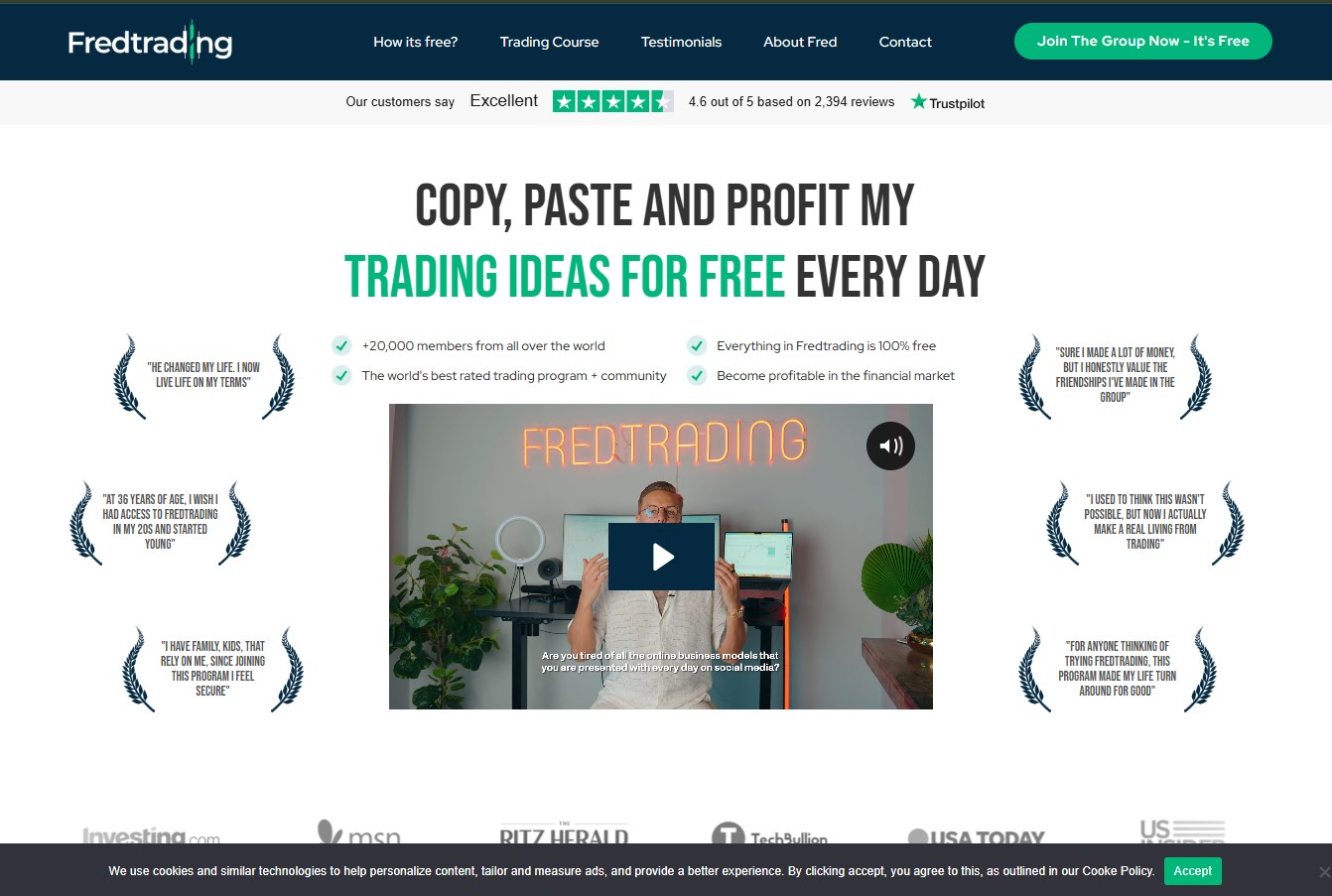

You see an upbeat video ad: a personable trader promising simple, repeatable gains and access to a “copy-my-trades” community. The website is tidy, screenshots show steady profits, and a chat invites you to join a free group or “register with our broker” to get immediate signals. That’s the Fred-Frost pitch. It’s persuasive — and that’s the point. What follows is a careful look behind the sheen to explain why many red flags appear when you treat the operation like a financial product rather than a lifestyle social account.

1) Regulatory red flag — an official warning

One of the heaviest single data points is that at least one financial regulator has publicly warned consumers about Fred-Trading (Fred-Frost). A regulatory warning is not a casual comment; regulators issue them when they believe a firm is offering or promoting financial services without required permissions. That formal advisory significantly raises the practical risk for anyone considering placing money or signing brokerage agreements tied to the service.

2) Mixed reviews, suspicious patterns in ratings

On the surface, Fred-Frost pages and some review platforms show positive testimonials and a seemingly strong Trustpilot presence. But deeper inspection reveals concerning patterns: many positive reviews appear generic or possibly incentivised, and independent reputation services assign a low trust score to the domain. When a platform shows a heavy concentration of unverified praise while independent safety checks flag the site, that mixed signal is itself a warning sign — marketing assets may be working harder than operational integrity.

3) Community chatter — complaints, warnings and contradictory voices

Across forums, Reddit threads, and consumer complaint boards you’ll find a mix of endorsements and cautionary tales. Some users describe successful short-term outcomes or say they enjoy the signal service; others report being pushed into registering with particular brokers, experiencing convoluted KYC/withdrawal demands, or spotting aggressive referral tactics. There are also posts explicitly calling out scam-like behaviours and urging others to report accounts. The presence of both heavy promotion and repeated complaint clusters is a practical pattern seen in many problematic trading circles: social proof on the surface, friction and obfuscation when money exits the system.

4) The “easy in, hard out” pattern — classic operational red flag

A reliable short test you can perform mentally is: how does the system treat deposits versus withdrawals? Reported experiences suggest Fred-Frost’s ecosystem often routes users to register with partner brokers and, while initial deposits or small withdrawals may seem straightforward, larger withdrawal attempts sometimes encounter additional requirements, fees, or delays. That asymmetry — fast onboarding and slow exits — is a recurring cautionary pattern across many risky online trading groups. When you see it repeated across multiple independent reports, it moves from anecdote to operational warning.

5) Ownership, transparency and accountability gaps

Trustworthy financial services are transparent about corporate identity, licences, custody arrangements, and the people running the operation. Fred-Frost’s public footprint emphasizes the trader persona and community narrative rather than a fully verifiable corporate disclosure: domain ownership is privacy-protected, official registration details are not easy to confirm, and claims of office locations or partnerships appear vague. When the legal entity and custodial channels are not clearly documented, accountability is limited — a practical problem if disputes arise.

6) Marketing mechanics — urgency, referrals and broker funnels

A repeated element in the reports is the marketing funnel: social ads → Telegram/Discord groups → a recommended broker link or affiliate registration → encouragement to upgrade for “VIP” access. That funnel is effective at converting engaged viewers into funded accounts quickly. The problem arises when operators earn commissions for routing users into specific brokers and the commercial incentives misalign with consumer protection. Where the platform profits from referrals, users should assume that recommendations may be motivated as much by affiliate economics as by trading performance.

7) Audits, verifiable proof and on-site “evidence”

Onsite dashboards, screenshots, and curated user wins are persuasive — but they are not independent proof. Robust, low-risk operations provide audit trails: exportable trade histories, reconciled bank/exchange statements, named custodians, and third-party attestations. The public material associated with Fred-Frost emphasizes in-group screenshots and testimonials rather than independently verifiable documentation. That absence of auditability is a material shortcoming for anyone treating this as an investment service.

8) Behavioral signals — why smart people get pulled in

Fred-Frost’s social style (charismatic trader, community access, free signals) leverages normal cognitive biases: authority, scarcity, social proof, and the momentum of early small wins. Those dynamics shorten deliberation and make escalating deposits feel rational in the moment. Recognizing this behavioral engine is important: it explains why otherwise careful people may increase exposure before they’ve verified institutional protections. That’s how many promotional trading communities scale quickly — and how risk amplifies.

9) Practical checklist — key questions you should be able to answer

Before you engage with Fred-Frost.com or any signal-to-broker funnel, make sure you can answer these testable questions:

-

Can you verify a licensed broker or company registration tied to the service?

-

Are the custodial banks or exchange wallets where client funds are held named and checkable?

-

Do independent users show large, successful withdrawal receipts that reconcile to bank or blockchain records?

-

Are there clear, non-promotional terms describing fees, bonus conditions, and dispute mechanisms?

-

Is the promoter or company identifiable and accountable under a legal entity you can contact?

If you cannot answer these confidently, the practical risk of financial loss rises substantially.

Final assessment — why the cumulative signals matter

No single complaint or negative review proves criminal intent. Some users genuinely benefit from signal groups, and some promoters are legitimate educators or traders. But risk is not about single data points; it’s about patterns. For Fred-Frost.com the pattern is: regulator warning, low trust scores from independent tools, repeated community complaints about broker-referral funnels and withdrawal friction, and persona-centric marketing. Those elements together form a consistent picture that points to elevated risk for anyone who treats the platform as a custodial broker or a guaranteed income source.

Bottom line

Treat Fred-Frost.com as high-risk. If you’re curious, keep exposure minimal, insist on verifiable, external evidence before moving funds, and prefer regulated, auditable channels for investing or copy-trading. This review is a practical, testable risk assessment — use it to inform decisions rather than as a definitive legal judgement.

Report Fred-Frost.com Scam and Recover Your Funds

If you have lost money to Fred-Frost.com Scam, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Fred-Frost.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.