BYDFi.com Scam Review —A Deceptive Broker

Opening — the demo that felt smart, until it didn’t (investor vignette)

Ethan liked the idea of copy-trading: follow successful traders, let algorithms work, and avoid the grind of manual entry. He signed up for BYDFi.com, tested a small deposit, and the demo dashboard looked slick — balances moved, the copy-trade feed showed winners, and customer chat replied promptly. A small withdrawal cleared and Ethan thought he’d found a handy platform.

But when Ethan tried to scale up, questions emerged: different accounts gave mixed limits, KYC requests appeared inconsistently, and when he attempted a larger withdrawal the timeline stretched and the support tone cooled. Ethan’s story reflects a recurring pattern reported by other users — a polished UX and easy onboarding followed by confusing rules and withdrawal friction. This review walks through the practical signals that matter so you can make a testable, risk-based judgment about BYDFi.com.

Short verdict (risk-based)

BYDFi presents a mixed profile. It offers many features traders like — copy trading, high leverage, and a broad asset list — and some users report smooth deposits and withdrawals. At the same time, numerous practical warning signs appear in public discussion: inconsistent KYC/withdrawal policies, scattered complaints about delays or fees, and opaque corporate signals. Taken together, these create a meaningful risk profile that warrants caution and careful verification before placing substantial funds.

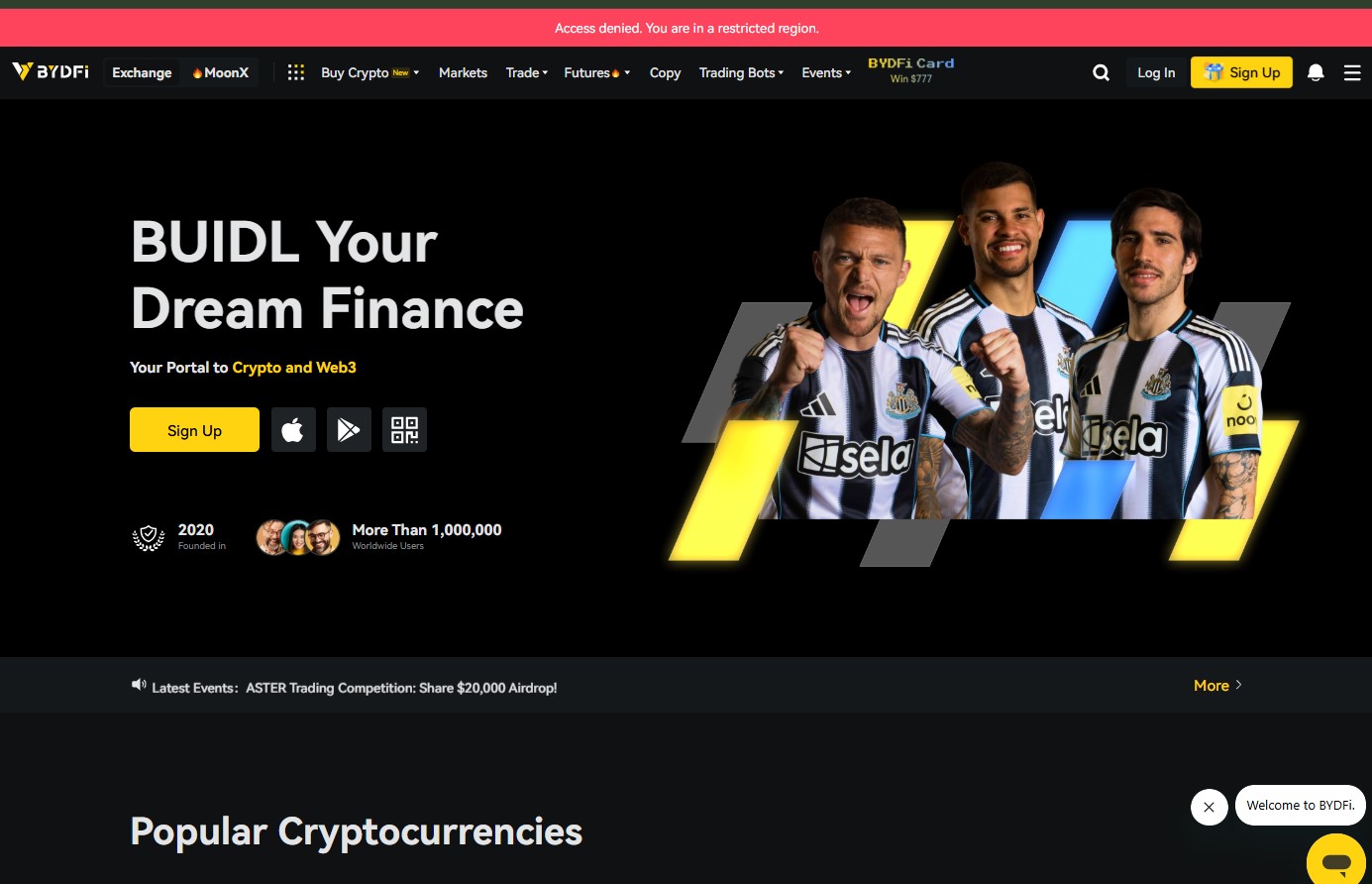

1) Professional site, promotional language — trust but verify

BYDFi’s website and marketing are modern and convincing: polished dashboards, product pages for copy trading and automated tools, and prominent claims about features and liquidity. That polish is effective at reducing scepticism — deliberately so.

Healthy skepticism demands verification: who runs the business, where are client funds held, and which regulator (if any) provides oversight? With BYDFi.com the public record is not uniform — some materials emphasise compliance and market licences, while other public signals and user reports question operational consistency. That mixed picture means you should treat marketing claims as starting points for due diligence, not as proof.

2) Regulation & registration — mixed, sometimes contradictory signals

Regulatory status is one of the most important objective checks for any financial or crypto platform. With BYDFi.com, public information is uneven: some materials state registrations or licence-like claims, while some user discussions and watchdog summaries highlight gaps or conflicting jurisdictional statements.

When a platform’s regulatory messaging is inconsistent — different claims across pages, vague statements about “partners,” or regulatory language without clear licence numbers — that ambiguity raises practical risk. Regulation should be verifiable in an official registry; if you can’t easily confirm it, treat the platform as higher risk.

3) KYC, limits and the deposit/withdrawal asymmetry

One of the most actionable tests is comparing how easy it is to deposit versus withdraw funds. Reported patterns with BYDFi.com include:

-

Accounts can often be opened and funded quickly.

-

Withdrawal limits, KYC demands, and processing windows vary by account and by payment rail.

-

Some users report small withdrawals clearing, but larger withdrawal attempts encountering extra verification steps, longer holds, or surprise fees.

That deposit-easy / withdrawal-hard asymmetry — especially when KYC requirements appear inconsistent — is a practical red flag. Platforms that allow fast deposits but add friction to withdrawals at scale create a materially higher risk for deposited funds.

4) Copy trading, leverage and product complexity — higher risk = more scrutiny

BYDFi offers advanced products (copy trading, leveraged perpetuals, high leverage ratios). Those features are attractive but inherently riskier: leverage amplifies losses; copy trading transfers systemic risk from leader to follower; derivatives can behave unpredictably in stressed markets.

When complex products are combined with inconsistent operational rules or opaque custody arrangements, the consumer risk increases. If you use those features, demand clear, written documentation on execution, slippage, margin calls, and how leader trades are replicated and reconciled.

5) Customer support & dispute handling — mixed experiences

A practical trust signal is consistent customer support behaviour: fast, concrete responses and documented ticket histories. BYDFi reviews are mixed — some users praise responsive teams and smooth resolutions, others describe long delays when pressing withdrawal issues.

Operational inconsistency in support — quick before deposit, slow after — is a common complaint across many risky platforms. The presence of both positive and negative reports for BYDFi suggests experience may vary by region, payment method, or account tier. That variability is itself a risk factor.

6) Testimonials and dashboards — persuasive, not proof

On-site testimonials, screenshots, and internal dashboards are powerful marketing tools but are not substitutes for auditable evidence. What you want to see to corroborate claims:

-

Exportable trade histories that reconcile with on-chain or exchange statements.

-

Clear custody arrangements showing where client funds are stored.

-

Public audit attestations or verifiable licence numbers.

Absent those anchors, internal dashboards are promotional artifacts — useful to attract users but insufficient as independent proof.

7) Technical indicators & operational fragility

Practical metadata can matter: domain age, WHOIS transparency, and hosting patterns. BYDFi’s web presence is established in many markets, but that doesn’t remove operational fragility risks such as local regulatory changes, payment-rail limits, or changes to withdrawal processes. These are real constraints in crypto finance and should be part of any risk evaluation.

8) Fee surprises & fine print — read the terms

Many friction points arise from contract terms: minimum withdrawal amounts, per-transaction fees, “processing” charges through third parties, or bonus conditions that tie funds to volume requirements. Users report encountering unexpected costs at withdrawal time across a range of platforms; BYDFi is no exception in public discussion.

Before depositing meaningful funds, read the terms carefully: check fee schedules, withdrawal timelines, and any clauses that allow the operator to change rules unilaterally. Clear, stable disclosures are a hallmark of lower-risk services.

9) Quick red-flag checklist — use this before you deposit

-

Can you verify a public company registration or licence in the platform’s stated jurisdiction?

-

Are custodial arrangements for client funds clearly stated (cold storage, custodial banks, segregated accounts)?

-

Are withdrawal limits and fees clearly disclosed before deposit?

-

Do independent users show large, successful withdrawals (not only small tests)?

-

Is KYC applied consistently and transparently, with clear escalation paths?

-

Is customer support responsive with ticket numbers and timelines?

-

Are complex products (leverage, derivatives) accompanied by clear risk and execution documentation?

Multiple failures on this checklist increase exposure and practical risk.

10) Practical conclusion — balanced, testable judgement

BYDFi is a feature-rich exchange that some traders use successfully. However, public signals are mixed: while the platform offers attractive tools, user complaints about inconsistent KYC, variable withdrawal experiences, and occasional surprise fees are recurring themes. That mixture does not prove malfeasance — but it does justify measured caution.

If you plan to use BYDFi, take these practical steps: verify any regulatory claims in official registries, start with very small test deposits, test withdrawals across the rails you intend to use, document every interaction with support, and keep exposure strictly limited until you’re satisfied the operational behaviour matches the platform’s promises.

This review is a risk-based analysis intended to surface observable, testable warnings — not a legal accusation. The decision to use any platform should rest on verifiable facts you can confirm independently and on how much capital you can afford to leave at risk.

Report BYDFi.com Scam and Recover Your Funds

If you have lost money to BYDFi.com Scam, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like BYDFi.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.