Zinzenova.com Scam Review — An Analytical Deep Dive

Zinzenova.com presents itself as a modern trading and investment platform with polished marketing, but deeper analysis reveals multiple high-risk signals. The combination of a very recent domain, hidden ownership, overwhelmingly poor user reviews, industry warnings, and trust score issues all point to a platform that should be approached with extreme caution. Below, we unpack the red flags in detail and explain why Zinzenova.com fits the profile of a scam operation.

Opening — the slick promise of easy gains

Picture this: you’re scrolling late at night, and an advertisement promises quick access to “institutional-grade” trading tools, expert account managers, and returns that sound almost too good to pass up. The website looks polished, the sign-up form is simple, and everything about the presentation feels professional. That’s the experience many people report when landing on Zinzenova.com for the first time.

But beneath the glossy surface, cracks begin to show the moment you look for real, verifiable proof of legitimacy. Where is the license? Who owns the company? Can you find a transparent business address? These are basic questions that every trustworthy broker should answer. In Zinzenova’s case, those answers are vague, inconsistent, or missing altogether — a classic recipe for risk.

1. Domain registration and ownership opacity

Zinzenova.com is a relatively new domain, registered only recently. On its own, being new is not proof of fraud. However, in the financial services space, longevity matters. Legitimate brokers often have years of operational history that can be checked, along with public records of executives and company registrations.

What makes Zinzenova problematic is that its registration details are completely hidden behind privacy shields. This means that anyone trying to identify the real owners will hit a wall. When a financial company conceals its ownership, that’s a serious warning sign. After all, if the business were legitimate, what reason would it have to hide?

2. Formal industry warning

Another major red flag is that a financial monitoring body has already issued a warning about Zinzenova.com. Such warnings aren’t issued lightly. They are typically the result of repeated complaints, investigations into the company’s activities, or evidence of misleading behavior.

For everyday investors, this is one of the most important indicators: when an oversight body raises an alert, it signals that the platform poses a significant risk of fraud or abuse. That alone should be enough to stop prospective investors from depositing any funds.

3. Public reviews and reputation

The experiences of actual users often reveal more than marketing claims ever will. Across multiple review platforms, Zinzenova has accumulated a worrying volume of negative feedback. The common complaints include:

-

Deposits being accepted instantly but withdrawals either delayed indefinitely or blocked altogether.

-

Aggressive sales tactics from so-called account managers pushing clients to “upgrade” or deposit more.

-

Lack of responsiveness from customer support once withdrawal issues begin.

-

Sudden account freezes without explanation.

While it’s true that online reviews can sometimes be exaggerated or even faked, the consistent pattern here — across dozens of unrelated reviewers — makes the overall picture hard to ignore.

4. Trust ratings and technical red flags

Independent website trust checkers consistently give Zinzenova.com extremely low scores. These scores are based on factors such as:

-

Very young domain age.

-

Hidden owner identity.

-

Lack of verifiable regulatory oversight.

-

Negative traffic and reputation signals from user reports.

On top of this, certain online threat monitors have even flagged the website as suspicious, with potential links to phishing or fraudulent activity. These technical warnings reinforce the human complaints, painting a picture of a site that cannot be relied upon for safe financial transactions.

5. Marketing claims versus hard proof

A close look at Zinzenova’s own website reveals the same pattern common among high-risk platforms. The promises are big: access to global markets, personalized account management, and supposedly advanced trading tools. The language is persuasive, crafted to sound professional and trustworthy.

Yet when you search for hard evidence — such as a regulatory license number, the name of the parent company, audited financial statements, or details of executives — these are either absent or buried behind vague language.

Legitimate brokers understand that transparency builds trust. Scam operations, by contrast, rely heavily on marketing fluff precisely because they cannot provide real-world proof of credibility. Zinzenova clearly leans on the latter.

6. The typical scam playbook

The structure of Zinzenova.com mirrors the standard script many fraudulent platforms follow:

-

Quick onboarding — Users are signed up with minimal verification.

-

Early trust-building — Small initial “profits” appear in dashboards, sometimes even allowing minor withdrawals to build confidence.

-

Pressure to deposit more — Account managers contact clients frequently, insisting on larger investments for access to “VIP” features or higher returns.

-

Withdrawal blocks — Once a user requests to withdraw significant funds, new fees, identity verifications, or arbitrary delays suddenly appear.

-

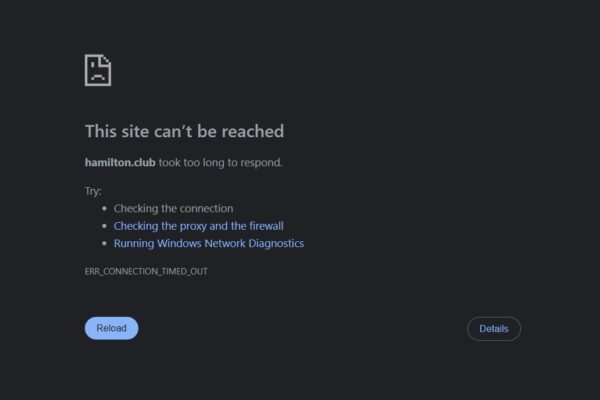

Communication breakdown — Support becomes unresponsive, websites may go offline, or the company rebrands under a new domain.

Zinzenova’s negative reviews and warning signs align almost perfectly with this playbook.

7. A practical checklist for spotting risks

Here’s a quick way to evaluate a platform like Zinzenova before investing:

-

Ownership: Is the company’s registration and leadership transparent? (No.)

-

Regulation: Is there proof of licensing under a recognized financial authority? (No.)

-

Reputation: Do independent reviews highlight positive experiences? (Overwhelmingly negative.)

-

Domain: How long has the company been around? (Recently created.)

-

Transparency: Can you find third-party audits, verifiable performance history, or detailed financial disclosures? (Absent.)

When a company fails on most of these counts, the safest interpretation is that it’s not trustworthy.

8. Why these details matter

Some readers may wonder why domain age, reviews, or ownership details are so important. The reason is simple: when things go wrong, you need accountability. If a company hides its identity, lacks a regulatory body overseeing it, and has no physical office or traceable executives, you have no realistic path to recover your money.

In the legitimate financial world, accountability is everything. Without it, trust collapses — and in Zinzenova’s case, accountability is precisely what’s missing.

9. Analytical conclusion

Taken together, the evidence is overwhelming:

-

A newly registered and fully anonymized domain.

-

A formal industry warning.

-

Consistently negative user experiences and reviews.

-

Extremely low trust scores from independent evaluators.

-

A lack of any regulatory oversight or transparency.

Each of these factors on its own would be concerning. Combined, they make it clear that Zinzenova.com represents a very high-risk platform that should be avoided. The promises of easy profits and expert management are simply marketing hooks with little substance behind them.

Final Thoughts

Zinzenova.com is not just another questionable broker — it’s a textbook example of how fraudulent financial sites operate in today’s online environment. From the hidden ownership and vague promises to the flood of user complaints and official warnings, every signal points to one conclusion: this platform is unsafe.

Investors should always prioritize platforms with transparent regulatory status, long-standing reputations, and verifiable accountability. Zinzenova fails on all those counts, making it a platform best left alone.

Report Zinzenova.com Scam and Recover Your Funds

If you have lost money to Zinzenova.com Scam, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Zinzenova.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.