EMC-Capitals.com Scam Review -A Dubious Trading Firm

A Story of Raises and Reversals

Imagine Sarah, a teacher in her mid-30s, saving up to afford her daughter’s college tuition. One day she encounters EMC-Capitals.com through a social media post. The website promises “premium investment strategies,” account managers who walk you through every step, and “steady returns without stress.” She starts with a small deposit—just enough to test. For a few days, her dashboard shows gains. Encouraged by the growth, she transfers more. Then things change. Withdrawal requests meet delays. Support becomes slow or vague. Fees emerge that were never mentioned upfront. Eventually, she realizes that the platform’s operation was less about fulfilling its promises and more about keeping her invested longer.

Sarah’s story reflects what many users report. The journey often begins with hope, ends in frustration — a pattern that, upon deeper inspection, reveals concerning structural issues with EMC-Capitals.com.

1) What EMC-Capitals.com claims — the sales pitch

EMC-Capitals.com markets itself as a full-service broker offering:

-

Access to multiple asset classes (forex, crypto, CFDs)

-

Proprietary indices or algorithms designed to amplify returns

-

Personal account managers or VIP tiers for those depositing more

-

Fast, secure withdrawals and advanced trading tools

These claims are designed to attract investors seeking both growth and ease. However, many marketing statements focus more on what sounds good rather than what can be verified. Words like “premium,” “exclusive,” and “institutional” abound—but often without accompanying proofs.

2) Early signs of opacity

Before money changes hands, several red flags related to transparency should raise concern:

-

Corporate ownership is not clearly detailed. When ownership is hidden or only vaguely referenced, real accountability becomes murky.

-

Contact details and legal entity data appear inconsistent or insufficient. In many user reports, promised registered offices or addresses turn out to be virtual offices or difficult to verify.

-

Domain has a short lifespan. Sites with longer track records are preferred; newer ones, especially those that mask registrant information, raise risk.

Legitimate brokers usually have visible legal registrations, named leadership, and corporate footprints that can be checked in public registries. EMC-Capitals.com does not reliably deliver those.

3) Regulatory alignment — the missing backbone

A key factor in separating trustworthy brokers from risky ones is regulation. Financial authorities require licences, client protection, fund segregation, and transparency. For EMC-Capitals.com:

-

No verifiable licence number is displayed. Claims of compliance are made, but not tied to any public regulator records.

-

No clear disclosures indicating oversight by known financial authorities.

-

Investor alerts in some jurisdictions mention brands similar to EMC-Capitals, warning that they are not authorised.

Without oversight, investors have less protection. If disputes arise, there may be no external agency to help enforce rights or review practices.

4) User journey: from small wins to mounting friction

Looking at typical user experiences reveals a progression:

-

Initial deposit: often small, presented as low-risk, meant to build confidence.

-

Dashboard gains: profits start showing, sometimes even small withdrawals may succeed. This reinforces trust.

-

Upsell pressure: account managers encourage larger deposits or “premium” tiers for higher returns.

-

Withdrawal requests: when users attempt to withdraw more substantial sums or their full “profits,” they are met with new conditions — verification steps, fees, or delay.

-

Support fade out: communication becomes vague or stops altogether as issues escalate.

Many reports suggest that once someone is sufficiently invested, it becomes difficult to exit. That pattern strongly suggests operational structures aimed more at retention of funds than fair profit distribution.

5) Marketing practices — urgency and exclusivity

EMC-Capitals.com, like many platforms under suspicion, uses a number of psychological levers:

-

Promises of “VIP” or “premium” plans that are accessible only after increased deposit amounts.

-

Messages emphasizing limited availability, exclusive deals, agent offers, or time-sensitive bonuses.

-

Use of jargon like “institutional strategies,” “advanced algorithms,” or “insider insights” to convey authority.

These tactics are effective at bypassing critical scrutiny, especially for less experienced investors. They may feel as though they’re being offered something rare—or worse, that they’ll miss out if they don’t act quickly.

6) Withdrawal friction — the true stress test

The most instructive moment in any platform’s timeline is when money needs to be withdrawn. Key concerns reported in relation to EMC-Capitals.com include:

-

Additional fees or “release” payments not mentioned at signup.

-

Requests for more documentation, sometimes beyond standard know-your-customer (KYC) steps, particularly when profits or major withdrawals are involved.

-

Long delays, with vague or shifting reasons.

-

Partial or blocked withdrawals of profits, though sometimes the initial deposit might be returned (or claimed to be so), or small payments allowed to maintain confidence.

When obstacles sharply increase after funds have grown or after repeated withdrawal requests, that points toward a business model built on friction rather than transparency.

7) Content credibility, user stories, and testimonials

Examining what EMC-Capitals.com publishes:

-

Testimonials on the site tend to be generic and lacking in detail. Few (if any) include verifiable usernames, dates, or external references.

-

Performance claims are often graphical or chart-based but without accompanying trade logs or audits.

-

“Success stories” are present but often without independent confirmation from outside forums or discussion boards.

Good evidence of credibility would include user screenshots of trades, blockchain verification, or independent audit firm reports. These are not clearly present here.

8) Domain and technical footprint

Beyond promises and complaints, technical indicators strengthen the risk assessment:

-

The domain registration is recent; such new domains tend to be associated with short-lived or unverified operations.

-

Privacy-protecting features in domain registration hide registrant identity. While that can be legitimate in some contexts, in investment platforms it is often a tool for evasion.

-

Infrastructure or site template similarities with known problematic sites are sometimes reported by users—a sign that this might be one of multiple platforms run by a single operator or group.

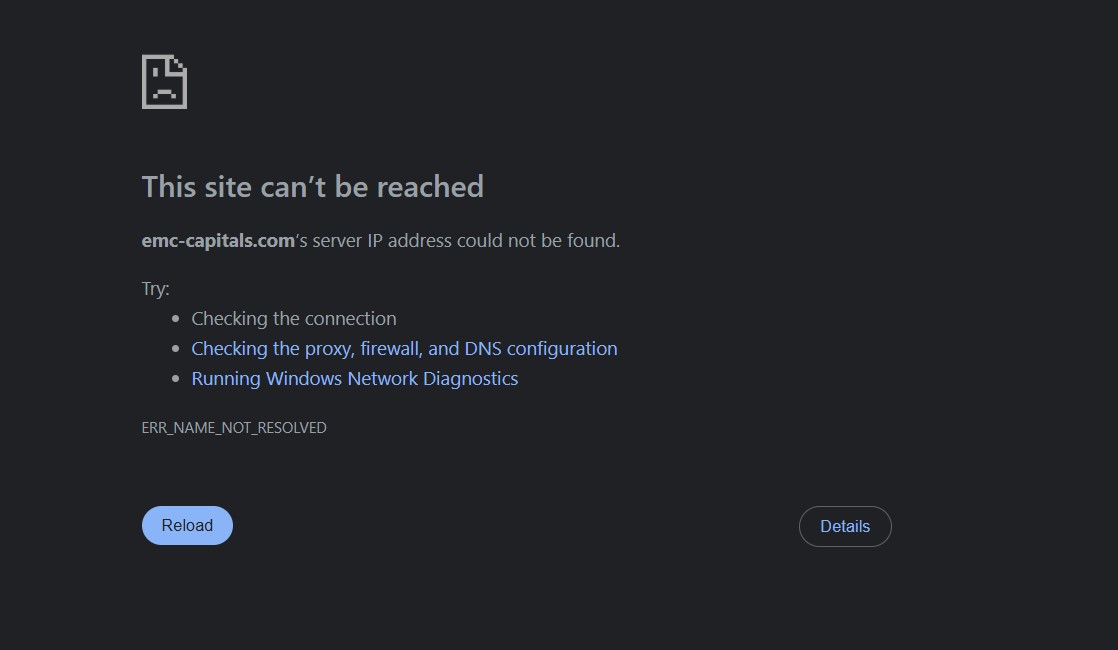

These technical traits increase the chance that the platform may change names, abandon obligations, or rebrand if scrutiny intensifies.

9) Red flags summary in checklist form

Here’s a snapshot of the strongest warning signs:

| Warning Sign | Observation in EMC-Capitals.com |

|---|---|

| Ownership transparency | Lacking or vague; corporate details masked |

| Verified regulation | Not clearly present or publicly checkable |

| Domain age & permanence | Very recent; short history |

| Profit guarantee promises | Strong, consistent claims without risk disclosure |

| Withdrawal difficulty | Reported delays, fees, obstacles when amounts grow |

| Aggressive upsell behavior | “VIP” tiers, pressure to deposit more |

| Testimonials / proof | Generic and unverified |

| Technical opacity | Masked ownership, shared templates, vendor overlap |

When many of these are present together, risk escalates sharply.

10) Final analytical verdict

Weighing all the observations:

-

The marketing polish, while suggestive, is not backed by strong proof.

-

The regulatory framework is missing — no reliable evidence of licensure or oversight.

-

Withdrawal friction, user complaint consistency, and ownership anonymity combine to form a risk pattern characteristic of many documented fraudulent broker operations.

From a risk-management perspective, EMC-Capitals.com is best considered very high risk. The chance of adverse outcomes (blocked withdrawals, loss of funds, misleading promises) is materially elevated. It does not meet core trust criteria expected of reputable brokers: verified licences, transparent ownership, consistent and accessible withdrawals, and precise risk disclosure.

Report EMC-Capitals.com Scam and Recover Your Funds

If you have lost money to EMC-Capitals.com Scam, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like EMC-Capitals.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.